Tips & Tricks

SQL Accounting Linking

There are four methods to integrate or link with SQL Accounting

- Restful API (Recommended - For two way communication & SQL Public Connect User)

- Clipboard Excel Import (Easy for non-savvy users)

- SQL Acc XLS n MDB Import - XLS, XLSX, Json & CSV/TXT File (Format 2 - Bar(|),Comma(,),Semi Comma(;),Tilde(~))

- SQL XML Import - XML File

- SQL Text Import - CSV/TXT File (Format 1 - Semi Comma (;) Only)

Choosing Method

SQL Accounting has three environment setups. Below are the available method options:

-

Public Cloud (SQL Public Connect)

Data is hosted on our public server.

-

On Premise Cloud (SQL Private Connect)

Data is hosted at the user's office.

-

On Premise (Offline)

Data is hosted at the user's office.

SQL Accounting & Firebird Program

Sample DB

Empty DB

- At the Login Screen Click 2 dot Button

- Click Create New Database

- Follow the wizard

Default username and password is ADMIN

Things To Consider Before Import/Post

Before wanted to Import/Post to SQL Accounting Database, below information/setting must set in the SQL Accounting

-

Click Menu: View

Untick(UnSelect) the option

- Command Navigator

- Tabbed Docking

- Allow Multiple Windows

- Enable Windows Task Bar

-

Click _Menu:

Tools | Options... | CustomerTick(Select) the option

- Use Cash Sales No. for Payment Received

Untick(UnSelect) the option

- Perform Tax / Local Amount Rounding

- 5 Cents Rounding (Sales Invoice)

- 5 Cents Rounding (Cash Sales)

-

Click _Menu:

Tools | Options... | MiscellaneousUntick(UnSelect) the option

- Prompt Negative Stock Quantity Dialog Box

- Prompt Duplicate Cheque Number

-

Click _Menu:

Tools | Maintain User... | NewCreate New User (eg POS)

-

Click _Menu:

Tools | Maintain User... | Access RightTick (Select) the option

- Override Customer Credit Control under the Group : Customer

- Override Sales Min/Max Price under the Group : Sales

- Override Acceptable Transaction Date under the Group : Tools

- Save on Negative Quantity under the Group : Stock

Untick (UnSelect) the option

Under the Group : Sales

- Prompt Replace Unit Price Dialog

- Show Payment / Change Dialog in Cash Sales

-

The following must exist and be valid in SQL Accounting

Field In SQL Accounting Customer Code Customer => Maintain Customer Supplier Code Supplier => Maintain Supplier Terms Code Tools => Maintain Terms Project Code Tools => Maintain Project Sales/Purchase Account Code GL => Maintain Account Sales/Purchase Return Account Code GL => Maintain Account Cash/Bank Account Code Tools => Maintain Payment Method (Created from Maintain Account) Agent Code Tools => Maintain Agent Area Code Tools => Maintain Area Currency Code Tools => Maintain Currency Tax Code Tools => Maintain Tax (if had SST / GST) -

Below is Optional (i.e. if had post/import item code to SQL Accounting)

| Field | Location/Form |

|---|---|

| Item Code | Stock => Maintain Stock Item |

| Location Code | Stock => Maintain Location |

| Batch Code | Stock => Maintain Batch |

**ALWAYS do backup the database First before Import/Post to SQL Accounting

Table/Fields Detail

- Updated 15 Jan 2025

- DetailSpec

Normal Used Table/Biz Object Name

Sales Side

| Biz Object | Description |

|---|---|

AR_Customer | Maintain Customer |

SL_IV | Sales Invoice |

SL_CS | Cash Sales |

SL_CN | Sales Credit Note |

SL_DN | Sales Debit Note |

AR_PM | Customer Payment |

AR_IV | Customer Invoice |

AR_DN | Customer Debit Note |

AR_CN | Customer Credit Note |

Purchase Side

| Biz Object | Description |

|---|---|

AP_Supplier | Maintain Supplier |

PH_PI | Purchase Invoice |

PH_CP | Cash Purchase |

PH_SC | Purchase Return |

PH_SD | Purchase Debit Note |

AP_SP | Supplier Payment |

AP_PI | Supplier Invoice |

AP_SD | Supplier Debit Note |

AP_SC | Supplier Credit Note |

Posting Information

-

Detail Data should Group by Stock Group/Category & TaxType (ZRL or SR) & Itemcode (if wanted import itemcode)

-

Eg. Cafe can be group by

- Food - SR

- Food - ZRL

- Beverage

- Service Charges

- Rounding

-

Detail Data should Group by Stock Group/Category & TaxType (ZRL or SR) & Itemcode (if wanted import itemcode)

-

Eg. Cafe can be group by

- Food - SR

- Food - ZRL

- Beverage

- Service Charges

- Rounding

For example, if there are 10 transactions today:

- 8 are Simplified Invoices, grouped as one Doc No: POS-00001

- 2 are Full Tax Invoices/Credit Sales Invoices, each with its own Doc No: POS-00002, POS-00003

All can be posted to SL_CS and AR_PM.

Below is an example: Today's total Simplified Invoice sales is RM1000.

Method 1 (Recommended)

This will result in four transactions

-

RM1000 - Post to

SL_CS& (P_DocNo,P_PaymentMethodfield is empty &P_Amount,P_PaidAmountfield is 0) -

RM700 by Cash - Post to

AR_PM -

RM200 by MasterCard - Post to

AR_PM -

RM100 by CreditCard - Post to

AR_PM

Pros : Easy to Edit or Delete the transactions

Cons : Many Posting document

Method 2

This approach results in three transactions:

- RM700 by Cash — Post to

SL_CSand set theP_PaymentMethodfield - RM200 by MasterCard — Post to

AR_PM - RM100 by CreditCard — Post to

AR_PM

Pros: Fewer posting documents

Cons :

- Not Easy to Edit or Delete the transactions

- Cash Sales OR number unable to override (i.e. System Auto set/assign)

Extra Notes

-

Both Full Tax & Simplified IV can use same Debtor Code as Not mention required Customer GST ID

-

Government 5 cents Rounding Mechanism - NO Tax/GST Code

-

Deposit for Non Refundable can use Customer Payment

AR_PM& set NONREFUNDABLE field to 1- Default is

SR - Will auto reverse once it being Knock-Off

- Default is

-

Document discounts should be apportioned by subtotal amounts when mixing tax codes (see Cash Sales POS-DocDisc).

Example (10% document discount):

- Subtotal for SR = 150.24 → Discount = 150.24 * 10% = 15.02

- Subtotal for ZR = 988.88 → Discount = 988.88 * 10% = 98.89

Or

- Doc Discount = 113.91

- Sub Total for SR = 150.24 => Disc ((150.24/1139.12) * 113.91) = 15.02

- Sub Total for ZR = 988.88 => Disc ((988.88/1139.12) * 113.91) = 98.89

-

Mixed supplies tax codes include:

- ES

- TX-ES (replaces TX-N43)

- TX-RE

-

Realise Bad Debts Use CN as Normal

- System will contra the provision bad debts done at GST-03 by 6 mth bad debts

- Make sure Knock the actual Bad debts Invoice

-

For Purchase Invoice(PI) MUST 1 by 1 post in (i.e. can't Group multi PI in 1 PI)

Prompt Invalid class string, ProdID: "SQLAcc.BizApp" error while try to link to SQL Accounting.

- Login SQL Accounting

- Click

Tools | Options | General - Click Register & follow wizard

- Exit SQL Accounting

- Login SQL Accounting

- Try run you application to link again

If still prompt after above steps

- Uninstall SQL Accounting

- Stop Anti Virus

- Reinstall SQL Accounting

- Run the above steps again

Prompt Access Violation when importing

This can happen due to:

The fieldname is not match with SQL Accounting (eg, SQLAcc fieldname UDF_Width, but you had call for UDF_Weight)

- Old version of SQL Acc Import program, try update the SQL Acc Import program

- The fieldname had the empty space at the beginning and/or end (norm happen if import from Excel) eg 'DocNo ' or ' DocNo' instead of 'DocNo'

SQL Accounting Linking FAQ

Prompt Invalid class string, ProdID: "SQLAcc.BizApp" error while try to link to SQL Accounting

- Login SQL Accounting

- Click Tools | Options | General

- Click Register & follow wizard

- Exit SQL Accounting

- Login SQL Accounting

- Try run you application to link again

If still prompt after above steps

- Uninstall SQL Accounting

- Stop Anti Virus

- Reinstall SQL Accounting

- Run the above steps again

Prompt Access Violation when importing

This can happen due to:

This happen due to

The fieldname is not match with SQL Accounting (eg SQLAcc fieldname UDF_Width yr had call for UDF_Weight)

- Old version of SQL Acc Import program, try update the SQL Acc Import program

- The fieldname had the empty space at the beginning and/or end (norm happen if import from Excel) eg 'DocNo ' or ' DocNo' instead of 'DocNo'

Why after import the DO still had outstanding even the Invoice had imported?

Yes all import will loss the Transfer status (i.e. if import DO & IV will treat as different) except using SDK import with condition

Which field should I map/insert to for Credit Note & Debit Note for Invoice Number, Invoice Date & Reason?

In Generally(Recommended) you can use below field (All in Header Field)

| SQL Accounting Field | Mapping Field | Description |

|---|---|---|

| DocNoEx | Invoice Number | Field Size : 20 |

| DocRef1 | Invoice Date | Field Size : 25 |

| Description | Reason | Field Size : 200 |

If you wanted posted in Detail Field also can

| SQL Accounting Field | Mapping Field | Description |

|---|---|---|

| Remark1 | Invoice Number | Field Size : 200 |

| Remark2 | Invoice Date | Field Size : 200 |

| Description2 | Reason | Field Size : 200 |

Can I post/import to SQL Accounting on a monthly basis?

No. For the GST/SST era, we recommend posting/importing on a daily basis so users have time to verify and correct any errors.

Below is the proper steps to perform posting/importing

- Backup

- Post/Import to SQL Accounting

- Compare listings in SQL Accounting with your POS/external program

I have multiple levels of document discounts — how do I post to SQL Accounting?

You can insert two or more rows (depending on the number of discount levels) with negative unit prices.

As mentioned above in Extra Notes, proportion the discount by subtotal amount when mixing tax codes.

Can I do like this, DR Bank/Cash In hand/Debtor & CR Sales Account using Journal?

No. The correct Double Entry is as following

-

Invoice/Cash Sales

- DR - Debtor

- CR - Sales Account

-

Payment Received

- DR - Bank/Cash In Hand

- CR - Debtor

Can I use the ADMIN ID for importing/posting?

No. ADMIN has full access rights; if a problem occurs it can be difficult to trace who performed the import. We recommend creating a separate user with limited access rights for importing/posting.

It adviceable to create Another ID with less Access Right

Can SQL Accounting & External Program(eg POS) Import/Posting doing Stock Control in same time?

Yes, but we Recommended External Program(eg POS) to do all the Stock Control if the External Program(eg POS) able to do all the report Required by the User.

Reason :

-

Faster import time

-

Timing issue as in SQL Acc the Qty is ALWAYS outdated cause real Stock In/Out is from the External Program(eg POS)

-

Data redundancy when two systems store the same data

-

Avoid wasting time on Sync correctness stock data between 2 system

Related Ref : Can I control my Stock when I link with other Application?

Can SQL Acc accept negative amounts?

Yes, for item row amounts.

No all document amount(DocAmt field) must not below 0

Is there any setting for transactions without tax?

No, there is no special setting. Set the following fields:

| Field | Value |

|---|---|

| Tax | '' |

| TaxInclusive | 0 |

| TaxAmt | 0 |

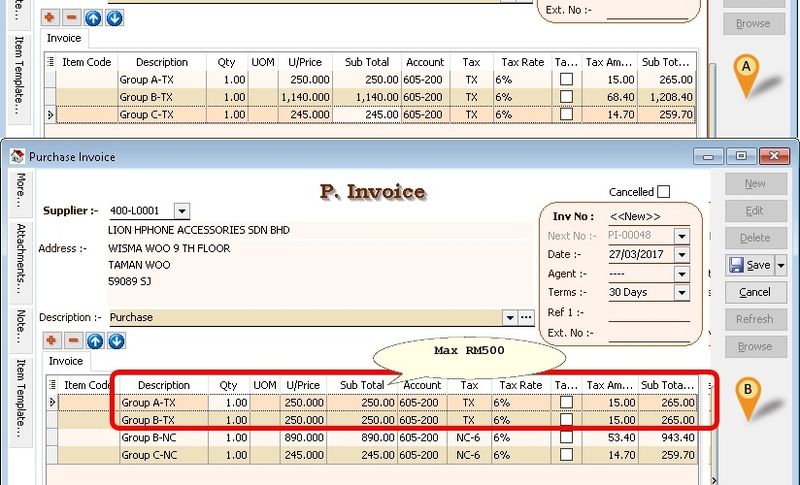

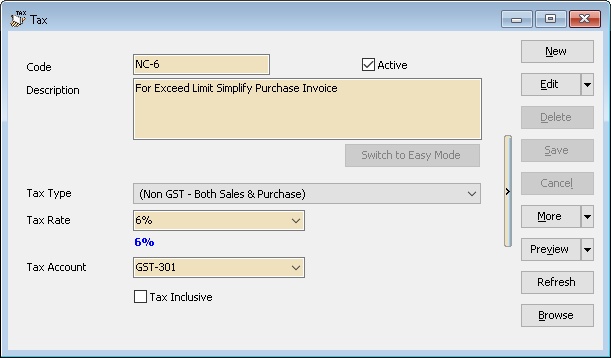

How to post when a supplier issues a simplified invoice but it exceeds RM500?

It advisable to ask the user to Request Full Tax Invoice from their supplier as user might pay double Tax due to add back for non claimable amount to the company profit by their Audit/Accountant.

Below is a suggested example of how to post a simplified supplier invoice.

Prompt could not convert variant of type (Null) into type (Integer) error while try to post (eg Invoice)

Ensure the database you are logged into has GST started/enabled.

How to post SR with 6% for documents issued after 01 Jun 2018?

There are two solutions:

Solution 1

Add a TaxRate field script/code.

Solution 2

Create a new SR tax code with 6% (e.g., SR6) in SQL Accounting.

Is there any change in linking for SST?

- GST to No SST

May follow Non GST

-

GST to SST

There are not many changes — treat it like normal GST; only the tax codes differ.

| Tax Code | Description | Rate | Required Tariff Code |

|---|---|---|---|

| ST5 | Sales Tax | 5% | Y |

| ST | Sales Tax | 10% | Y |

| SV | Service Tax | 6% (8% From 01 Mar 2024) | Y |

| STE | Sales Tax Exempted | N | |

| SVE | Service Tax Exempted | N |

New field added:

| Field Name | Field Type | Field Size | Mandatory | Default Value | Remarks |

|---|---|---|---|---|---|

| TARIFF | String | 20 | C | Tariff or HS Code Mandatory – If posting to: - GL Payment Voucher & GL Official Receipt - Customer Invoice, Debit Note & Credit Note - Supplier Invoice, Debit Note & Credit Note - All Sales & Purchase Module without Item Code Not Required – If posting Sales & Purchase with Item Code |

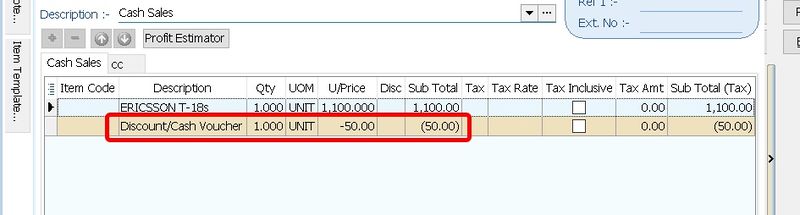

How to SQL Accounting handle if had Discount/Cash Voucher?

You can treat the Discount/Cash Voucher as Part of item row but is in Negative UnitPrice

Begin 11 Oct 2019 the Company ROC/BRN will increase to 12 digit characters. Any changes in Linking?

Yes if user is upgrade to Version 875.782 & above.

Table Affected

-

SY_PROFILE=> File | Company Profile -

AR_CUSTOMER=> Customer | Maintain Customer -

AP_SUPPLIER=> Supplier | Maintain Supplier

Field Changes

-

Original Name REGISTERNO change to BRN

-

New Field BRN2

-

New Field Size for both Fields 30

Is there any changes in Linking for the E-Invoicing?

New Field Added Available in Version 5.2024.983.848 & above

Maintain Customer & Maintain Supplier

| Field Name | Field Type | Field Size | Remarks |

|---|---|---|---|

| TIN | String | 14 | Company Tax Register Number |

| IDTYPE | Integer | 0 - Empty 1 - Reg No 2 - NRIC (New) 3 - Passport 4 - ARMY 5 - NRIC (Old) | |

| IDNO | String | 20 | This field will depend on the ID Type selected |

| TOURISMNO | String | 17 | This is only applicable to tourism tax registrant, which may consist of hotel operators and online travel operators |

| SIC | String | 10 | Malaysia Standard Industrial Classification (MSIC) Codes https://sdk.myinvois.hasil.gov.my/codes/#msic-codes Available in Version (TBA) Maintain Supplier Only |

| SUBMISSIONTYPE | Integer | 0 | Available in Version 5.2024.992.854 & above 0 = None 17 = E-Invoice/Self Billing (for Maintain Supplier) 18 = Consolidate |

| IRBM_CLASSIFICATION | String | 3 | Maintain Supplier Only Category of products or services being billed as a result of a commercial transaction. More than 1 classification code can be added for goods / services included in the e-Invoice. https://sdk.myinvois.hasil.gov.my/codes/classification-codes/ Available in Version 5.2024.990.852 & above |

| POSTCODE | String | 10 | The identifier for an addressable group of properties according to the relevant postal service |

| CITY | String | 50 | The common name of the city, town, or village, where the Customer/Supplier address is located. |

| STATE | String | 50 | The state of a country. https://sdk.myinvois.hasil.gov.my/codes/state-codes/ |

| COUNTRY | String | 2 | A code that identifies the country. May refer to Country List |

Maintain Stock Item

| Field Name | Field Type | Field Size | Remarks |

|---|---|---|---|

| IRBM_CLASSIFICATION | String | 3 | Category of products or services being billed as a result of a commercial transaction. More than 1 classification code can be added for goods / services included in the e-Invoice. https://sdk.myinvois.hasil.gov.my/codes/classification-codes/ |

Available in Version 5.2024.990.852 & above

Sales & Purchase Data Entry - Header

| Field Name | Field Type | Field Size | Remarks |

|---|---|---|---|

| EIVDATETIME | DateTime | 0 | For below version 5.2024.1001.858 E-Invoicing Submitted Date time in the UTC timezone e.g. 19/07/2024 7:17:43 AM |

| EIV_UTC | DateTime | 0 | For version 5.2024.1001.858 & Above E-Invoicing Submitted Date time in the UTC timezone e.g. 19/07/2024 7:17:43 AM |

| IRBM_UUID | String | 26 | E-Invoicing Submitted response UUID e.g. FSEP22A4Y5BFGGWAX95N943811 |

| IRBM_LONGID | String | 50 | E-Invoicing Submitted response Long UUID e.g. TM9AFNQ0M76T07BTX95NX43J10CzvSE31712365482 |

| IRBM_STATUS | Integer | 0 | E-Invoicing Submitted Status https://sdk.myinvois.hasil.gov.my/faq/ e.g. 2 |

| POSTCODE | String | 10 | The identifier for an addressable group of properties according to the relevant postal service |

| CITY | String | 50 | The common name of the city, town, or village where the Customer/Supplier address is located. |

| STATE | String | 50 | The state of a country. https://sdk.myinvois.hasil.gov.my/codes/state-codes/ |

| COUNTRY | String | 2 | A code that identifies the country. May refer to Country List Here |

| DPOSTCODE | String | 10 | The identifier for an addressable group of properties according to the relevant postal service |

| DCITY | String | 50 | The common name of the city, town, or village where the Customer/Supplier address is located. |

| DSTATE | String | 50 | The state of a country. https://sdk.myinvois.hasil.gov.my/codes/state-codes/ |

| DCOUNTRY | String | 2 | A code that identifies the country. May refer to Country List Here |

| SALESTAXNO | String | 25 | |

| SERVICETAXNO | String | 25 | |

| TIN | String | 14 | Company Tax Register Number |

| IDTYPE | Integer | 0 - Empty 1 - Reg No 2 - NRIC (New) 3 - Passport 4 - ARMY 5 - NRIC (Old) | |

| IDNO | String | 20 | This field will depend on the ID Type selected |

| TOURISMNO | String | 17 | This is only applicable to tourism tax registrant, which may consist of hotel operators and online travel operators |

| SIC | String | 10 | Malaysia Standard Industrial Classification (MSIC) Codes https://sdk.myinvois.hasil.gov.my/codes/#msic-codes Maintain Supplier Only |

| INCOTERMS | String | 20 | A set of international trade rules that define the responsibilities of buyers and suppliers. The input of special characters is not allowed. |

| SUBMISSIONTYPE | Integer | 0 | Available in Version 5.2024.992.854 & above 0 = None 17 = E-Invoice/Self Billing (for Purchase Only) 18 = Consolidate |

Sales & Purchase Data Entry - Detail

| Field Name | Field Type | Field Size | Remarks |

|---|---|---|---|

| TAXEXEMPTIONREASON | String | 300 | Available in Version 5.2024.992.854 & above For Tax Exemption Code use only |

| IRBM_CLASSIFICATION | String | 3 | Category of products or services being billed as a result of a commercial transaction. More than 1 classification code can be added for goods / services included in the e-Invoice. https://sdk.myinvois.hasil.gov.my/codes/classification-codes/ |

Available in Version 5.2024.990.852 & above

Maintain Currency

| Field Name | Field Type | Field Size | Remarks |

|---|---|---|---|

| ISOCODE | String | 3 | https://sdk.myinvois.hasil.gov.my/codes/countries/ |

Available in Version 5.2024.995.855 & above

GL Cash Book - Payment Voucher & Office Receipt - Header

| Field Name | Field Type | Field Size | Remarks |

|---|---|---|---|

| EIV_UTC | DateTime | 0 | E-Invoicing Submitted Date time in the UTC timezone e.g. 19/07/2024 7:17:43 AM |

| COMPANYNAME | String | 100 | |

| ADDRESS1 | String | 60 | |

| ADDRESS2 | String | 60 | |

| ADDRESS3 | String | 60 | |

| ADDRESS4 | String | 60 | |

| POSTCODE | String | 10 | The identifier for an addressable group of properties according to the relevant postal service |

| CITY | String | 50 | The common name of the city, town, or village where the Customer/Supplier address is located. |

| STATE | String | 50 | The state of a country. https://sdk.myinvois.hasil.gov.my/codes/state-codes/ |

| COUNTRY | String | 2 | A code that identifies the country. May refer to Country List Here |

| PHONE1 | String | 200 | |

| SALESTAXNO | String | 25 | |

| SERVICETAXNO | String | 25 | |

| TIN | String | 14 | Company Tax Register Number |

| IDTYPE | Integer | 0 - Empty 1 - Reg No 2 - NRIC (New) 3 - Passport 4 - ARMY 5 - NRIC (Old) | |

| IDNO | String | 20 | This field will depend on the ID Type selected |

| TOURISMNO | String | 17 | This is only applicable to tourism tax registrant, which may consist of hotel operators and online travel operators |

| SIC | String | 10 | Malaysia Standard Industrial Classification (MSIC) Codes https://sdk.myinvois.hasil.gov.my/codes/#msic-codes Maintain Supplier Only |

| SUBMISSIONTYPE | Integer | 0 | 0 = None 17 = Self Billing 18 = Consolidate 19 = E-Invoice Refund |

| IRBM_UUID | String | 26 | E-Invoicing Submitted response UUID e.g. FSEP22A4Y5BFGGWAX95N943811 |

| IRBM_LONGID | String | 50 | E-Invoicing Submitted response Long UUID e.g. TM9AFNQ0M76T07BTX95NX43J10CzvSE31712365482 |

| IRBM_STATUS | Integer | 0 | E-Invoicing Submitted Status https://sdk.myinvois.hasil.gov.my/faq/ e.g. 2 |

GL Cash Book - Payment Voucher & Office Receipt - Detail

| Field Name | Field Type | Field Size | Remarks |

|---|---|---|---|

| IRBM_CLASSIFICATION | String | 3 | Category of products or services being billed as a result of a commercial transaction. More than 1 classification code can be added for goods / services included in the e-Invoice. https://sdk.myinvois.hasil.gov.my/codes/classification-codes/ |

Change to Boolean Type

Begin from SQL Acc Version 5.2024.1007.860 & above the follow field type will change to Boolean Type (True/False)

| For Version 859 & Below | For Version 860 & Above |

|---|---|

| - T - 1 | True |

| - F - 0 | False |

| FieldName | True Value | False Value |

|---|---|---|

| TaxInclusive | 1 | 0 |

| SerialNumber | T | F |

| Cancelled | T | F |

| Cancelled | 1 | 0 |

| AddPDCToCRLimit | T | F |

| Transferable | T | F |

| IsActive | T | F |

| IsActive | 1 | 0 |

| NonRefundable | 1 | 0 |

| AllowExceedCreditLimit | T | F |

| Printable | T | F |

| StockControl | T | F |

| IsBase | 1 | 0 |

| IsDefault | 1 | 0 |

| IsDefault | T | F |

| Programming | Before (For Version 859 & below) | After (For Version 860 & Above) |

|---|---|---|

| C# | lDetail.FindField("TaxInclusive").value = 1; lDetail.FindField("Printable").AsString = "T"; | lDetail.FindField("TaxInclusive").value = True; lDetail.FindField("Printable").value = True; |

| PHP | $lDetail->FindField("TaxInclusive")->value = 0; $lDetail->FindField("Printable")->AsString = "T"; | $lDetail->FindField("TaxInclusive")->value = False; $lDetail->FindField("Printable")->value = True; |

| Python | lDetail.FindField("TaxInclusive").value = 1 lDetail.FindField("Printable").AsString = "T" | lDetail.FindField("TaxInclusive").value = True lDetail.FindField("Printable").value = True |

| Query SQL | SELECT CODE, DESCRIPTION FROM AGENT WHERE ISACTIVE='T' or SELECT CODE, DESCRIPTION FROM SHIPPER WHERE ISACTIVE=1 | SELECT CODE, DESCRIPTION FROM AGENT WHERE ISACTIVE or SELECT CODE, DESCRIPTION FROM SHIPPER WHERE ISACTIVE |

| Query SQL | SELECT CODE, DESCRIPTION FROM AGENT WHERE ISACTIVE='F' or SELECT CODE, DESCRIPTION FROM SHIPPER WHERE ISACTIVE=0 | SELECT CODE, DESCRIPTION FROM AGENT WHERE NOT ISACTIVE or SELECT CODE, DESCRIPTION FROM SHIPPER WHERE NOT ISACTIVE |