GST

GST Setup and Information

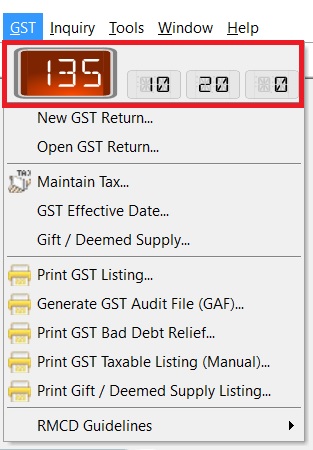

GST Count Down Timer

This is a countdown timer for the submission of the GST Return. It is generally displayed 7 days before the GST Return due date.

Example GST Count Down Timer:

Formula

Visible := (Return Due - Today Date - 1) < 7

Example

Frequently : Monthly

Next Submission : Nov 2016

Count Down begin shown : 24 Dec 2016

Today date : 27 Dec 2016

Count Down Shown : 3 Days+++

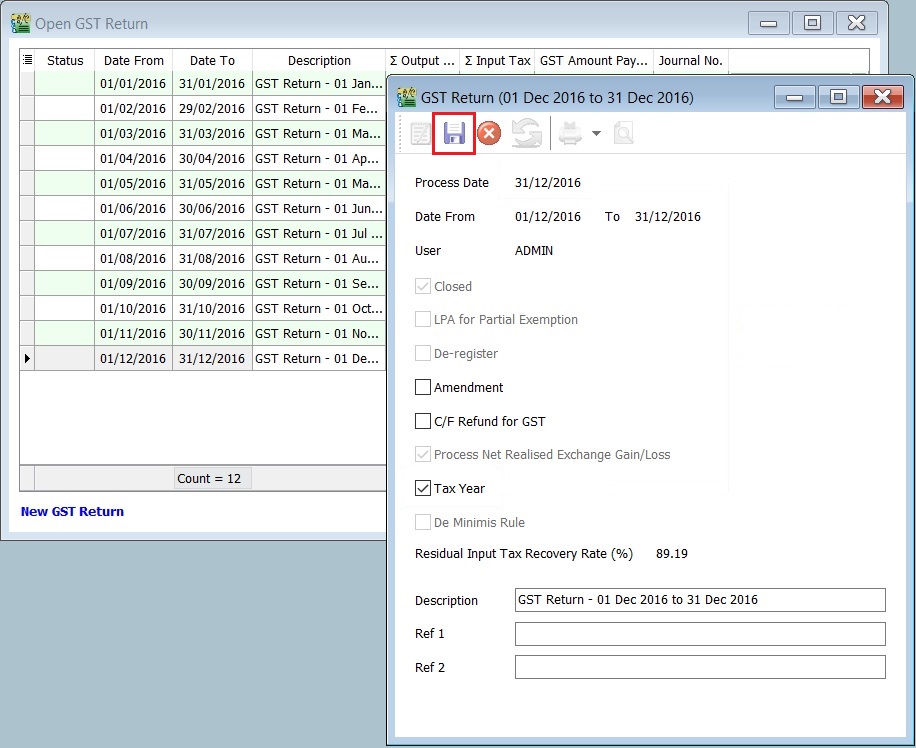

GST Return

To process and close the GST Returns period. You can generate the GST-03 and GAF.

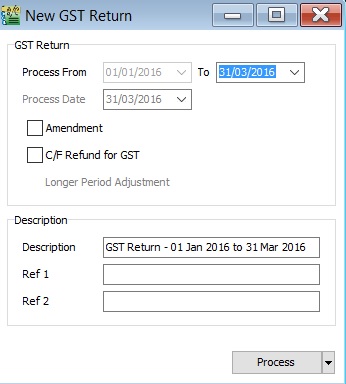

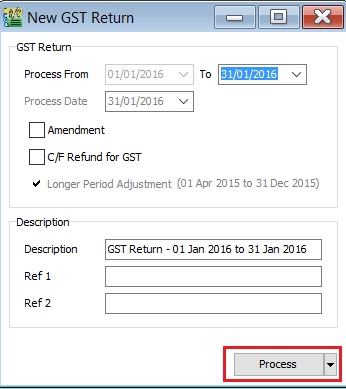

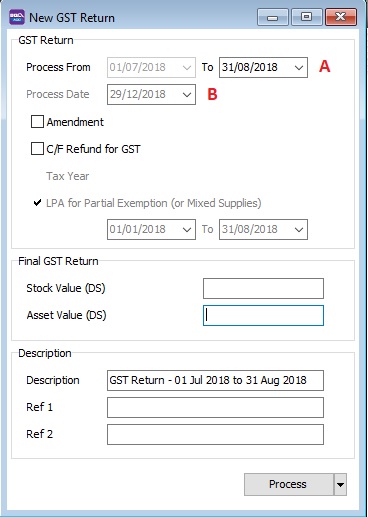

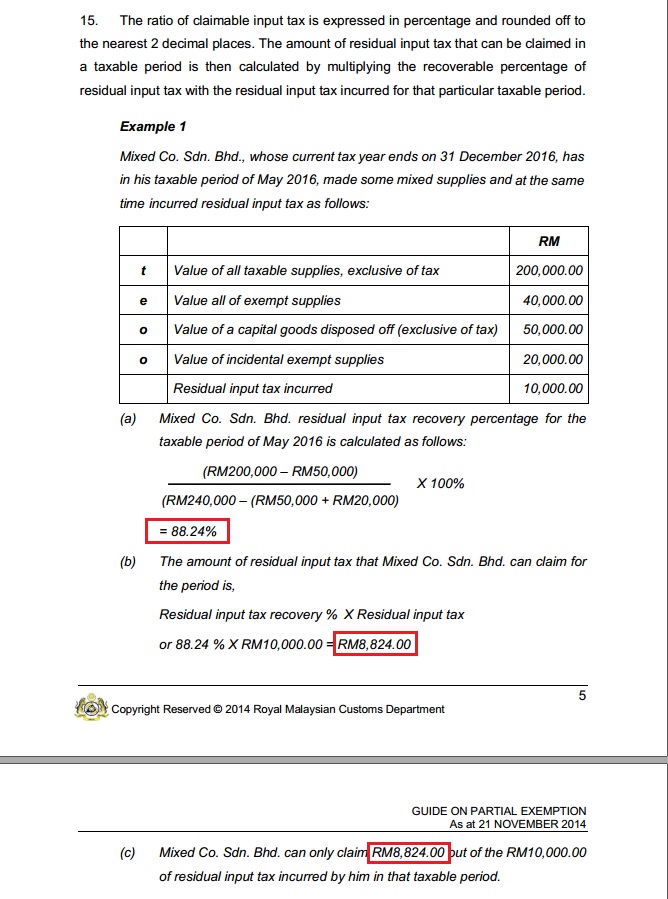

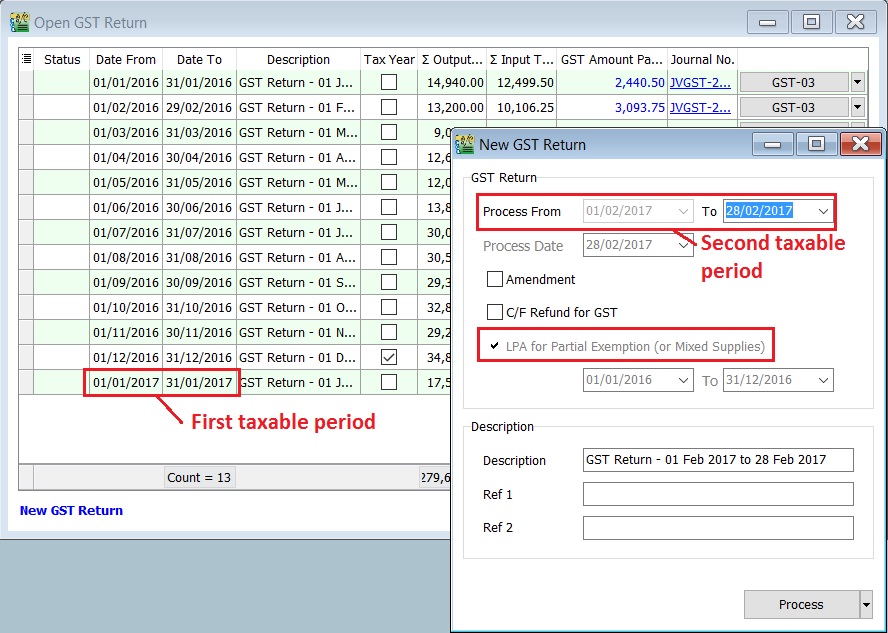

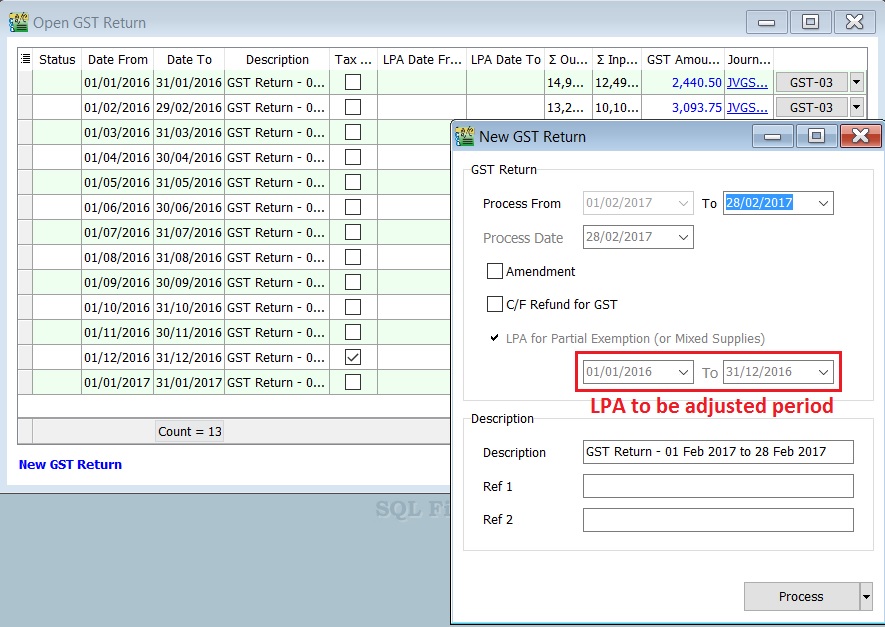

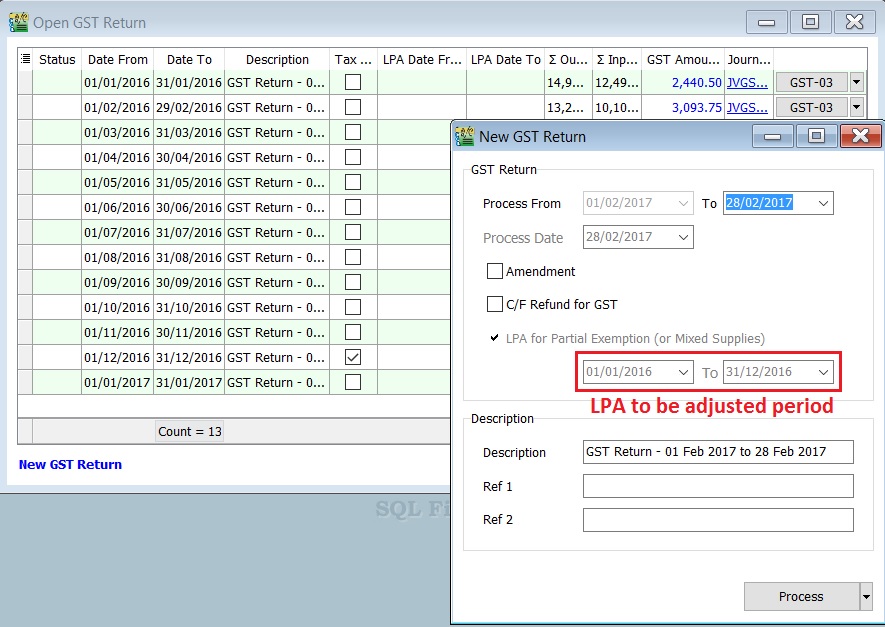

New GST Return

| Field Name | Field Type | Explanation |

|---|---|---|

| Process From to | Date | GST Taxable Period, e.g., either monthly or quarterly. |

| Process Date | Date | Date to process the GST Return. |

| Amendment | Boolean | Ticked. In GST-03, the "Amendment" checkbox will be marked X. |

| C/F Refund for GST | Boolean | Ticked. In GST-03, Item 9 "Do you choose to carry forward refund for GST?" will be marked X in Yes checkbox. |

| Longer Period Adjustment (LPA) | Boolean | Auto ticked according to the first tax year adjustment. |

| Description | String | GST Return - Process From Date to Date (by default). |

| Ref 1 | String | Key-in any reference no. |

| Ref 2 | String | Key-in any reference no. |

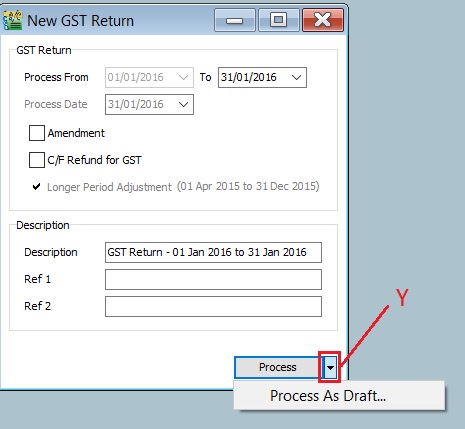

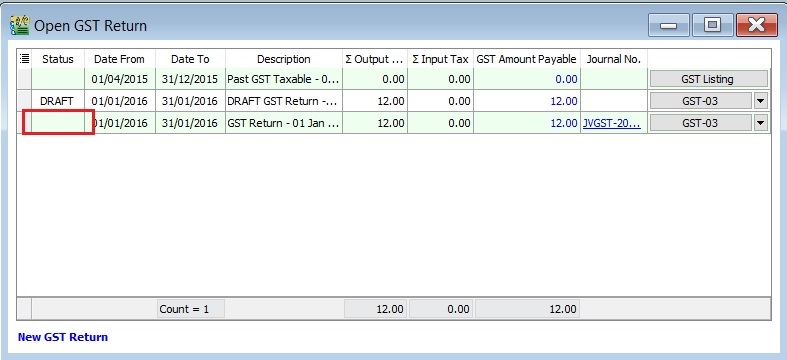

Draft GST Return

You can draft the GST-03 before the final GST-03 submission by processing it as a draft.

-

Click the dropdown arrow nect to the Process button (Y).

-

Refer to the screenshot below.

-

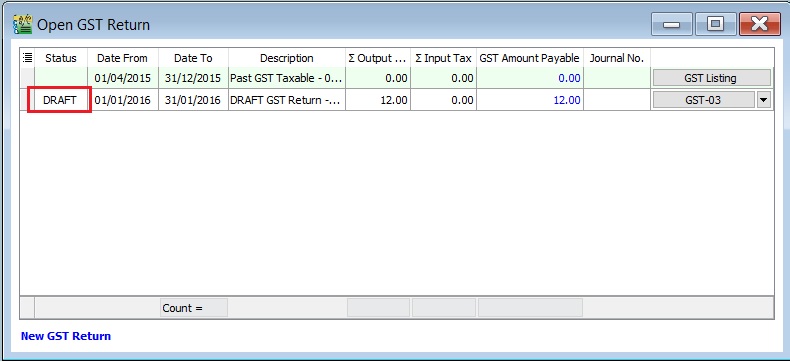

DRAFT Status showed for the GST Returns period.

You can still amend documents while the GST return is in DRAFT status. Multiple drafts can be created before FINAL process the GST Returns for the period.

Final GST Return

-

Click the Process button.

-

Refer to the screenshot below.

-

The finalized GST Return will no longer display "DRAFT" in the status column.

You cannot amend the documents anymore where the FINAL GST return has generated.

Extra

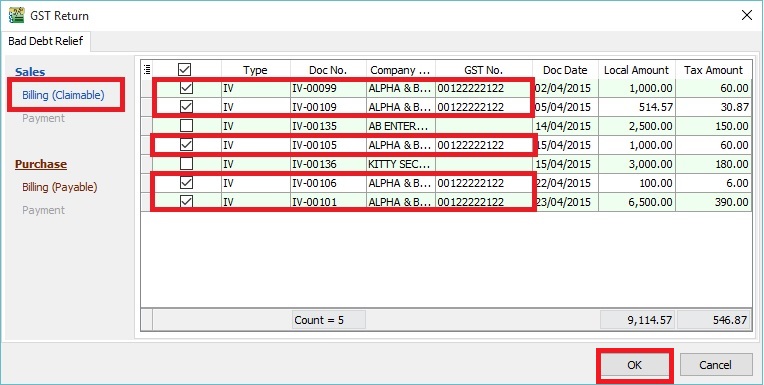

AR & AP Bad Debt Relief

-

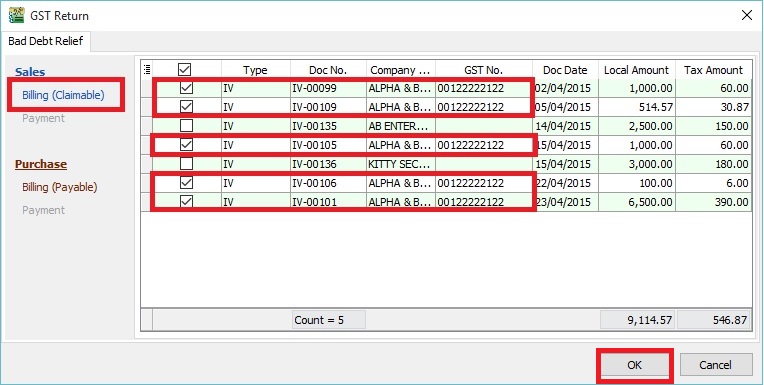

Bad Debt Relief screen will appear (see the screenshot below) if the system detects outstanding Tax Invoices that have expired for 6 months.

-

Sales documents from the company without GST No. will be un-ticked. You can tick the documents if you believe the company is GST-Registered.

Tips:

Tips:To avoid to tick the documents manually for GST Registered company, please go to update the GST no at Maintain Customer.

-

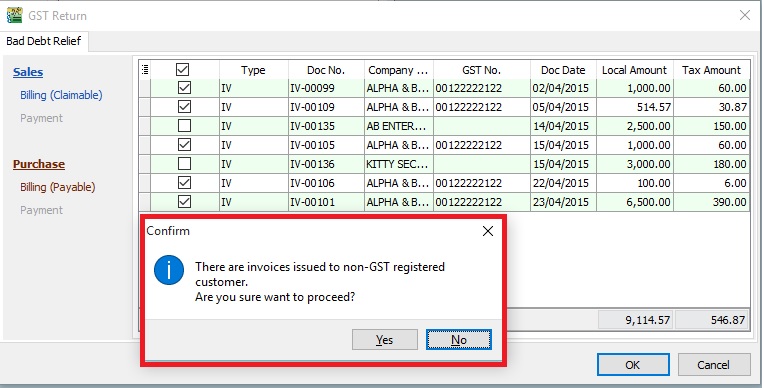

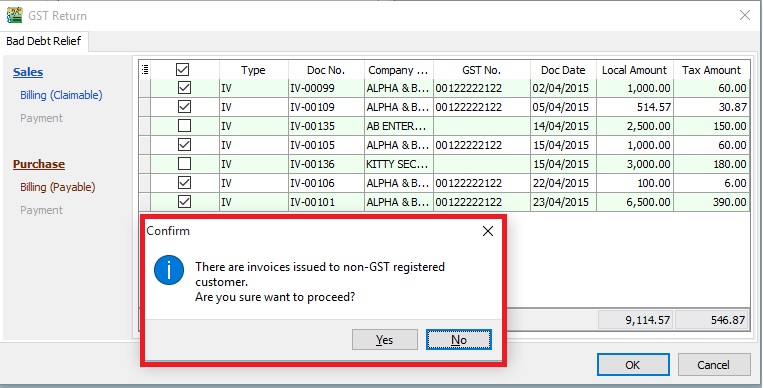

Press OK if a "confirm" message is prompted (see the screenshot below), This indicates that some companies do not have a GST No.

-

If you confirmed that the company is Non-GST Registered, press YES to proceed.

-

Otherwise, press NO and update the GST No. in Maintain Customer to confirm the company is GST-registered before processing the GST Return.

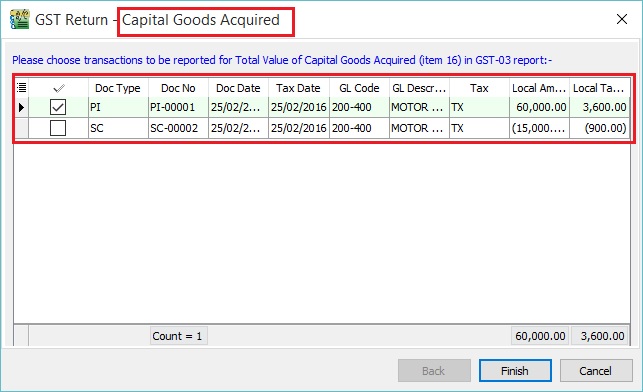

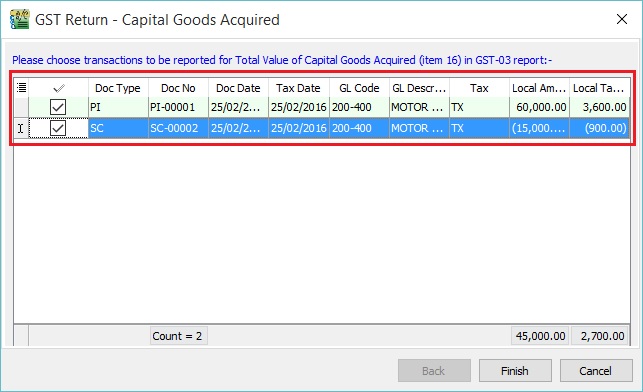

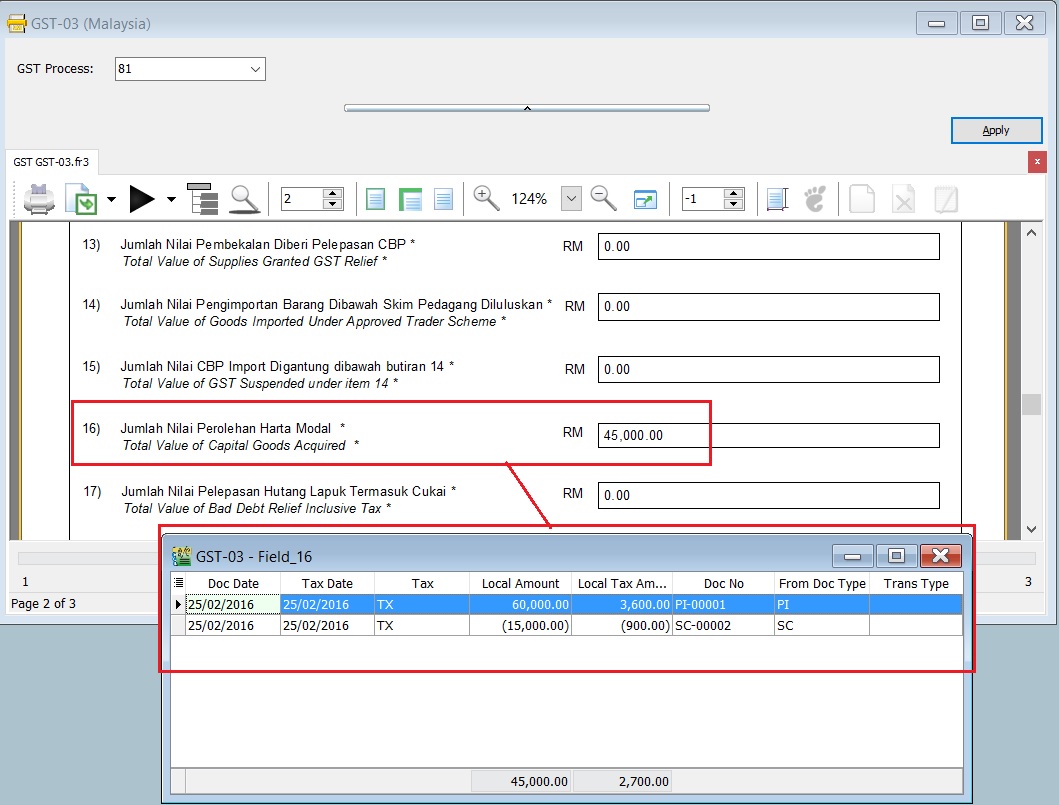

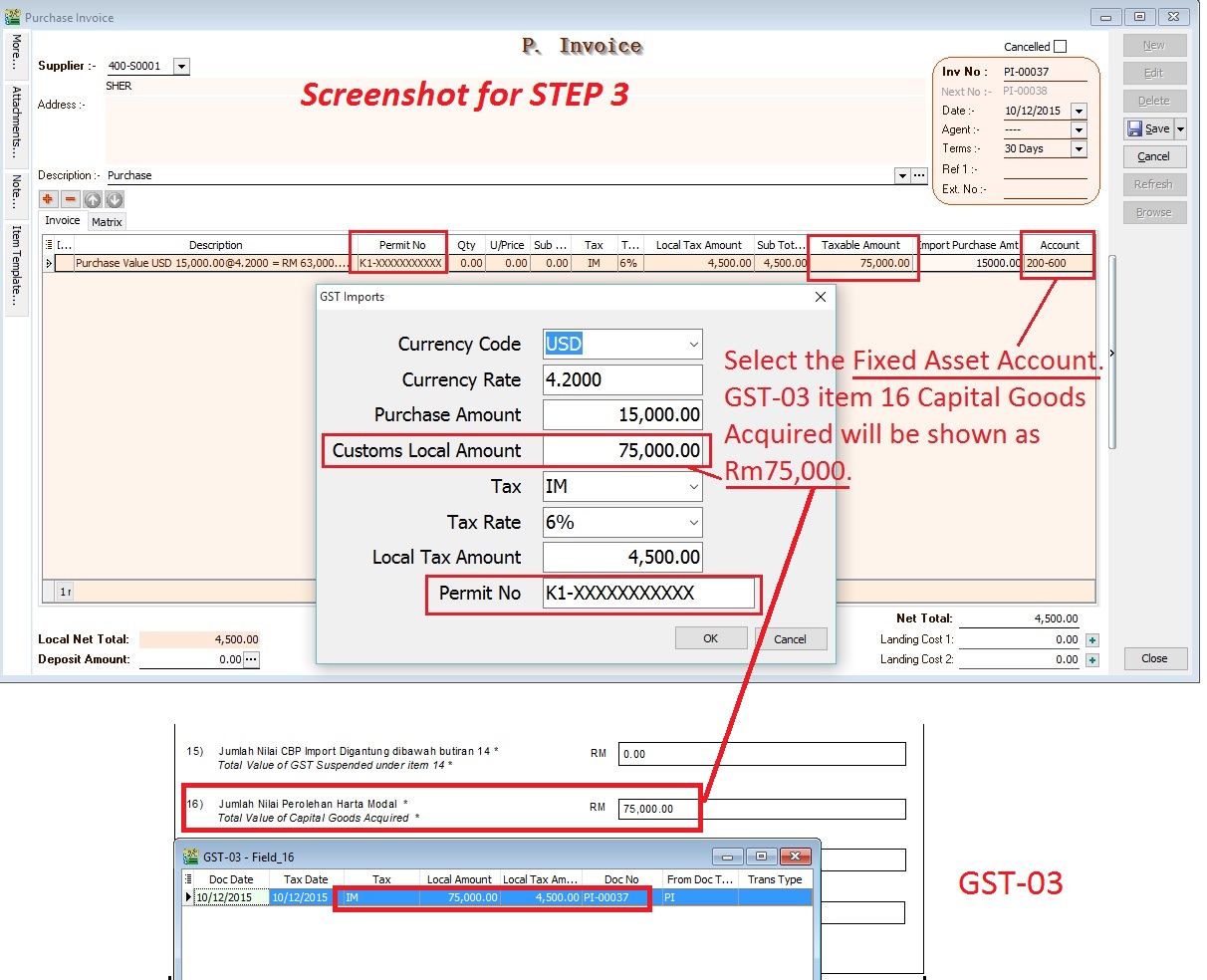

Capital Goods Acquired

-

If you receive a prompt for GST Return - Capital Goods Acquired, it indicates that there are credit adjustment transactions for Fixed Asset Account. See below screenshot.

-

Select the transactions line to include the credit adjustment (eg. Rm15,000.00). Otherwise, the system will capture the value of Rm60,000.00 in GST-03 item 16. See the screenshot below.

-

It will capture the net capital goods acquired value in GST-03 item 16.

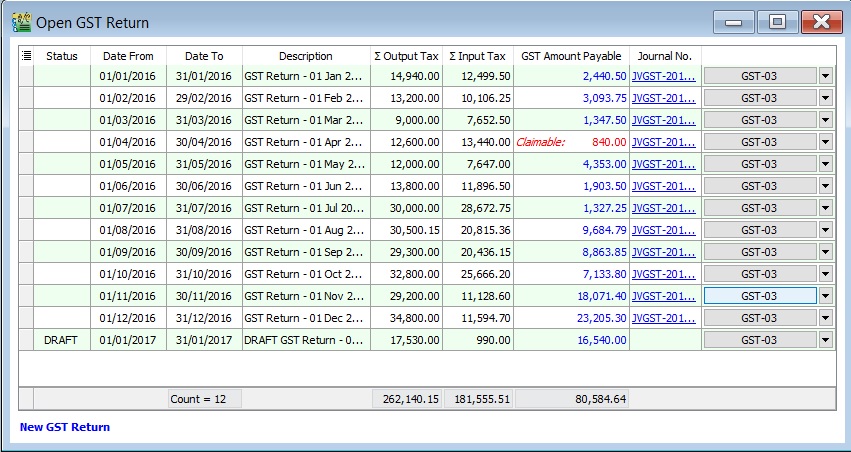

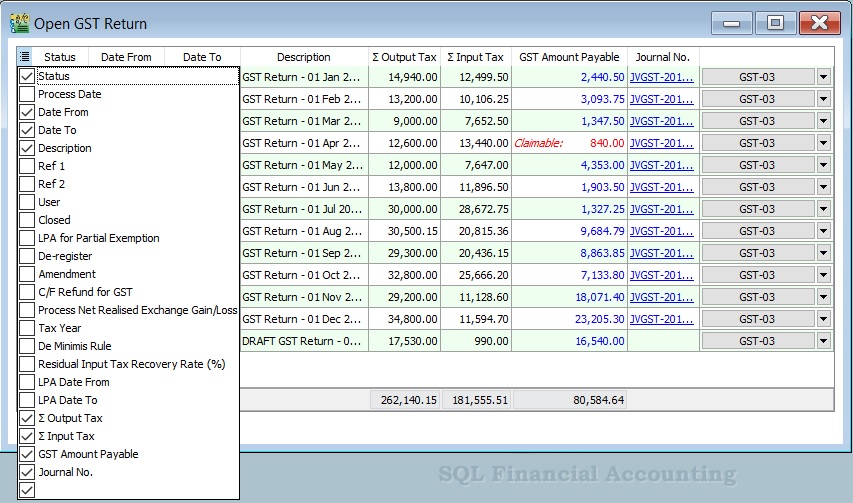

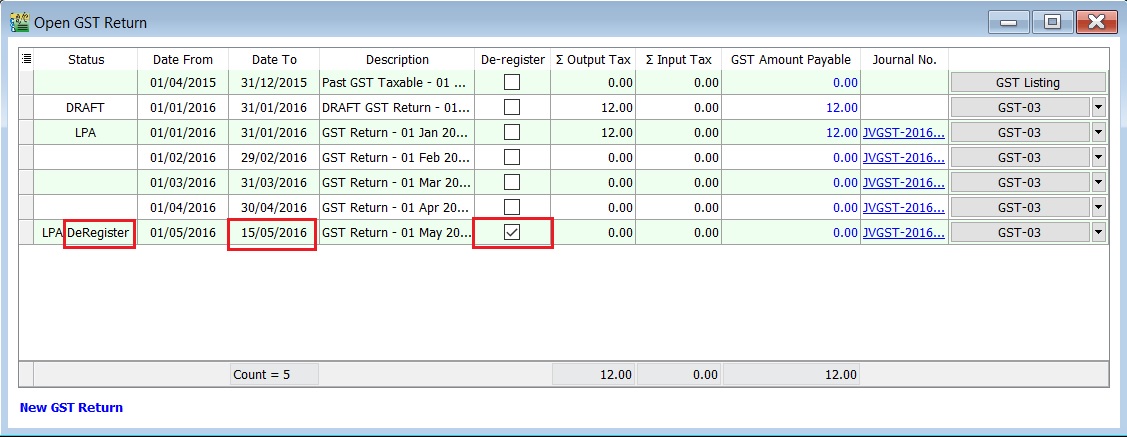

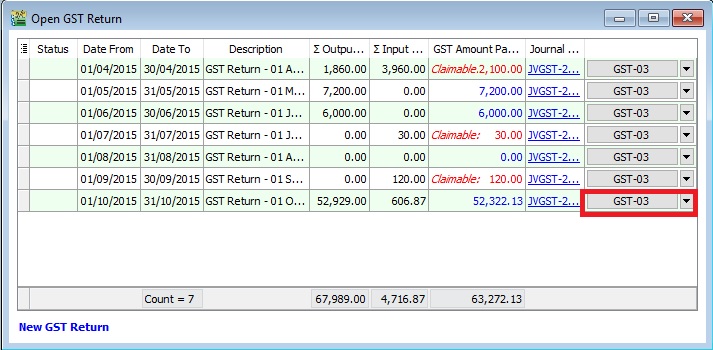

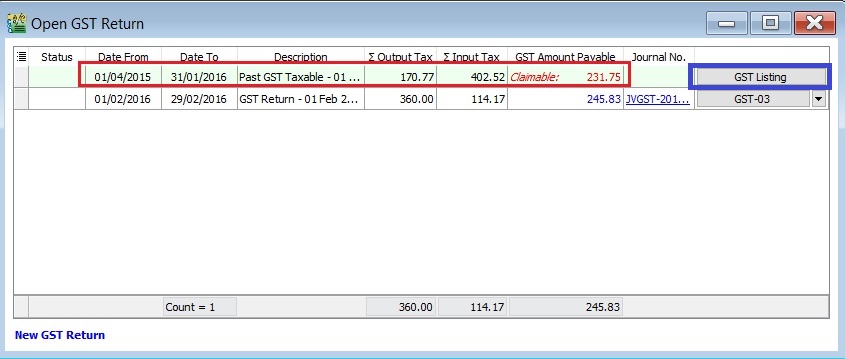

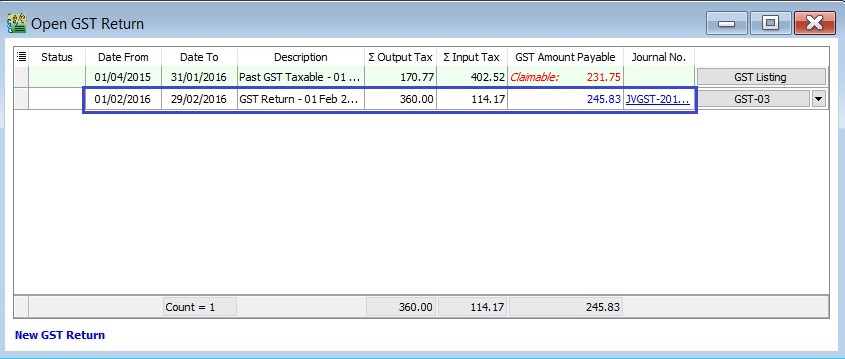

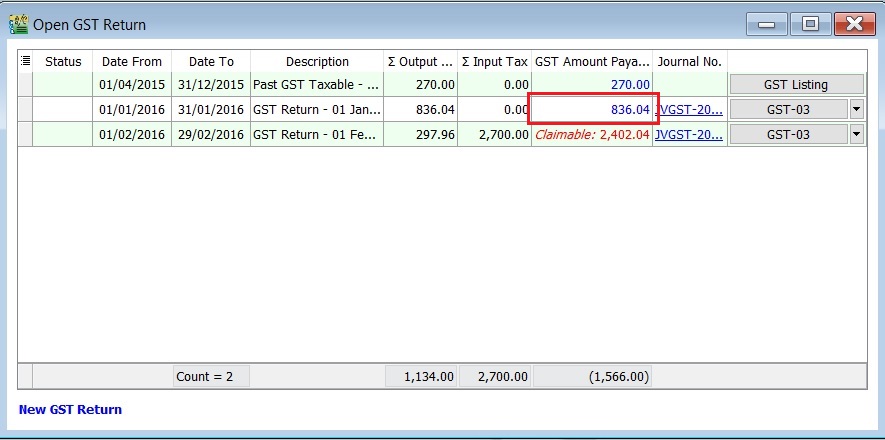

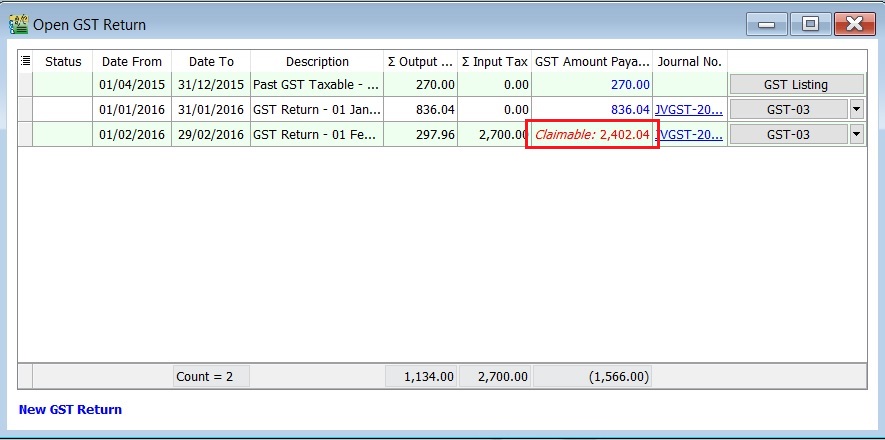

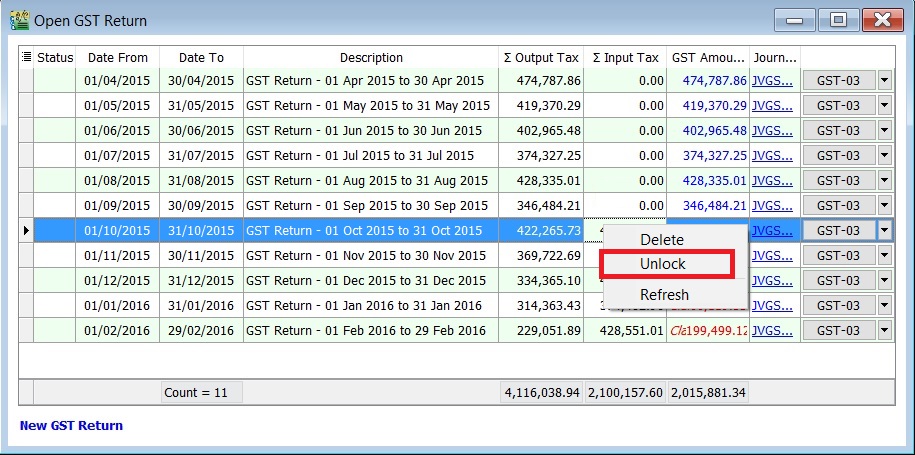

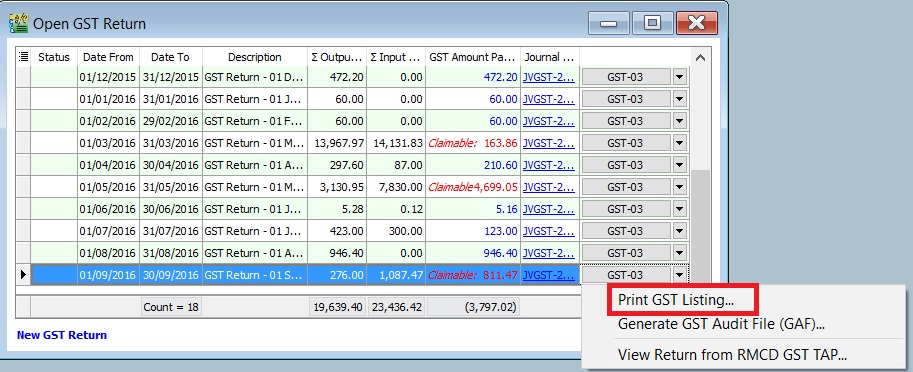

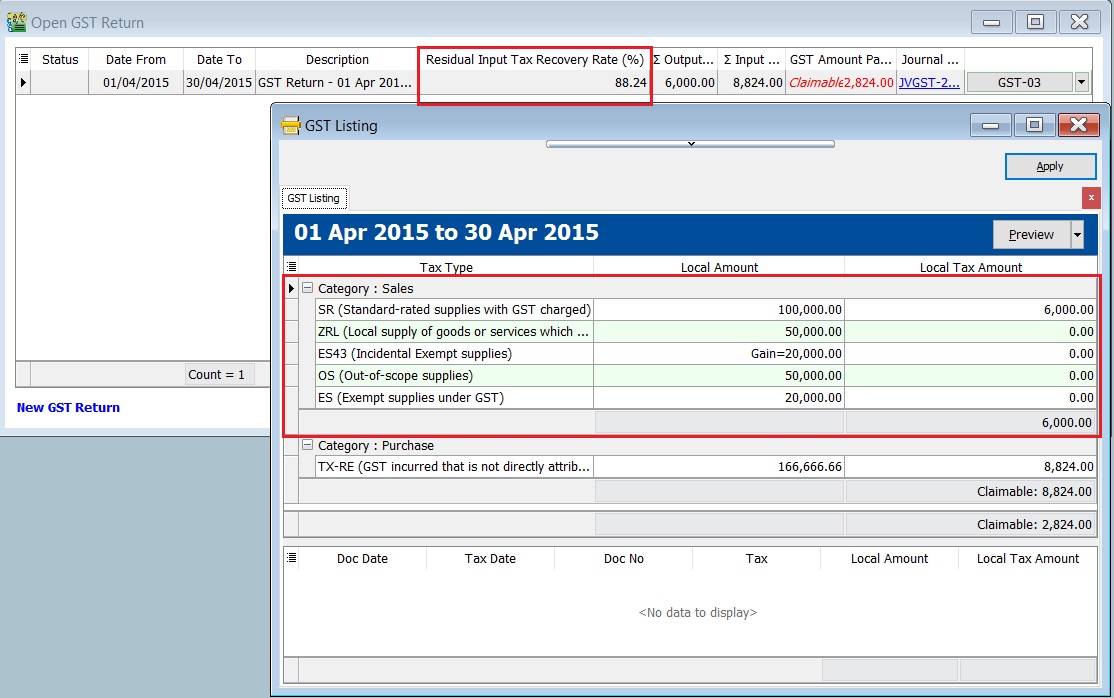

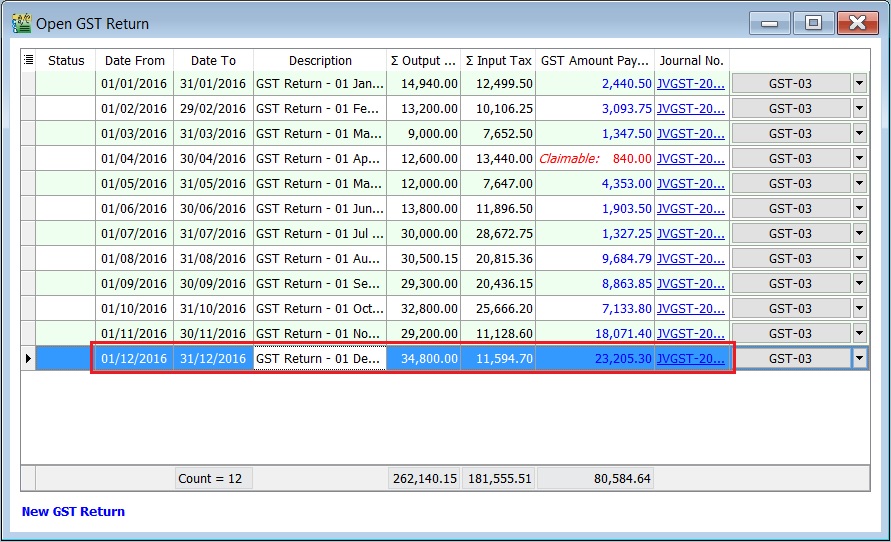

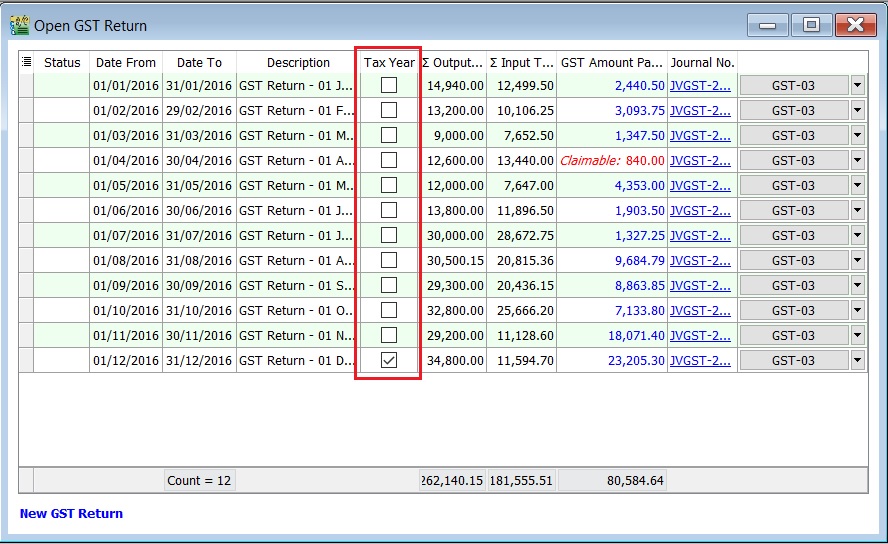

Open GST Return

-

See the screenshot below:

-

You can insert more available fields.

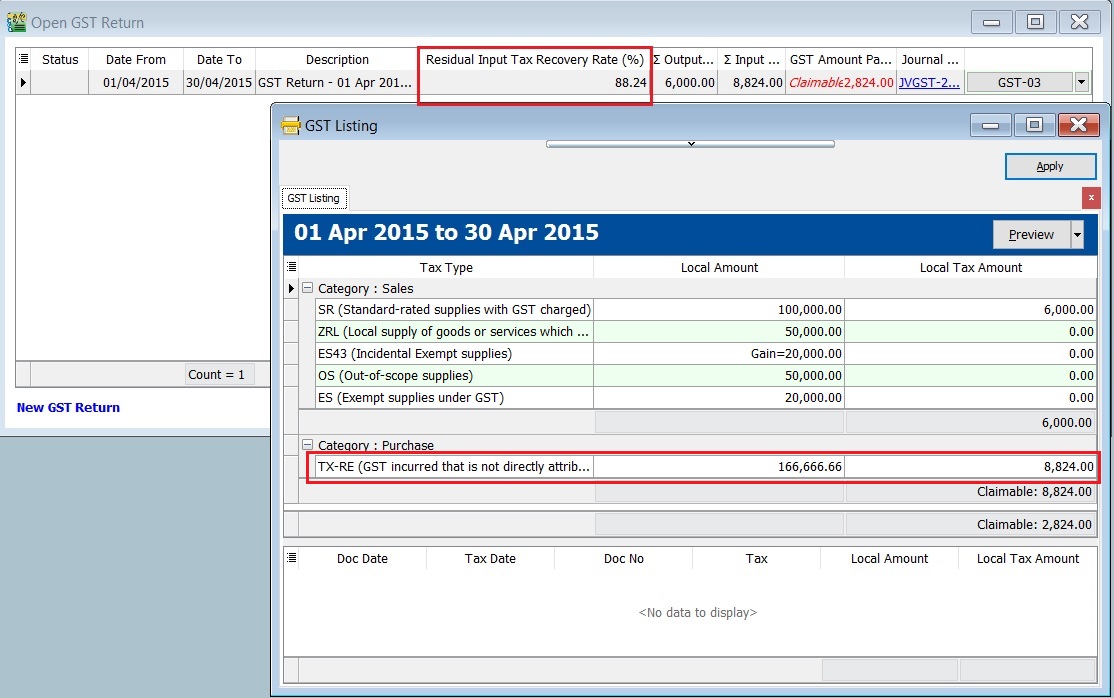

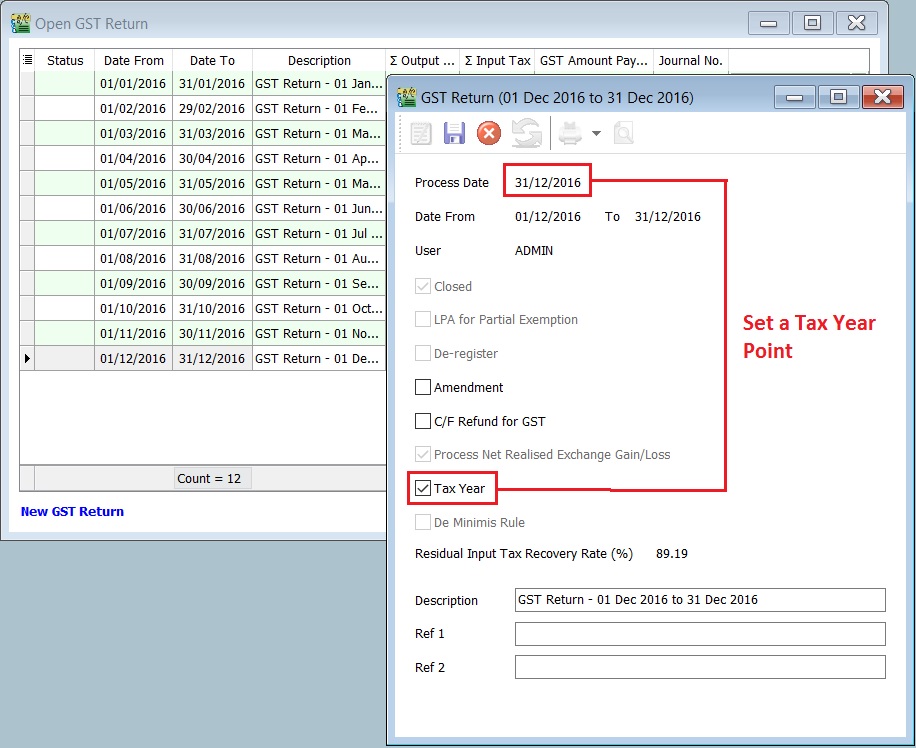

Field Name Field Type Explanation Status String To show the GST Return status, i.e., DRAFT, DE-REGISTER. Process Date Date To show process date. Date From Date To show date from. Date To Date To show date to. Description String To show the description entered. Ref 1 String To show the ref 1 entered. Ref 2 String To show the ref 2 entered. User String To display the User process the GST Return. Closed Boolean Always ticked to close. LPA for Partial Exemption Boolean Longer period adjustment (LPA) for partial exemption (Mixed Supplies). De-register Boolean Ticked if the taxable period has de-register date. Amendment Boolean To show the GST Return has ticked this option. Refer to :GST GUIDE ON AMENDMENT RETURN (GST-03) C/F Refund for GST Boolean To show the GST Return has ticked this option. Process Net Realized Exchange Gain/Loss Boolean No longer use because system auto handles this option. Tax Year Boolean Tax Year point. De Minimis Rule Boolean - Ticked = Pass - Un-ticked = Not Pass Residual Input Tax Recovery Rate (%) Float To display the IRR %. LPA Date From Date LPA date from. LPA Date To Float LPA date to. ∑ Output Tax Float To show the total output tax value. ∑ Input Tax Float To show the total input tax value. GST Amount Payable Float Net GST Payable or Claimable. Journal No. String Auto post the JVGST-XXXXX to reconcile the GST Payable and GST Claimable accounts. Button Options button: GST-03, Print GST Listing, Generate GST Audit File (GAF). Tips:You can click New GST Return in Open GST Return screen. See below the screenshot.

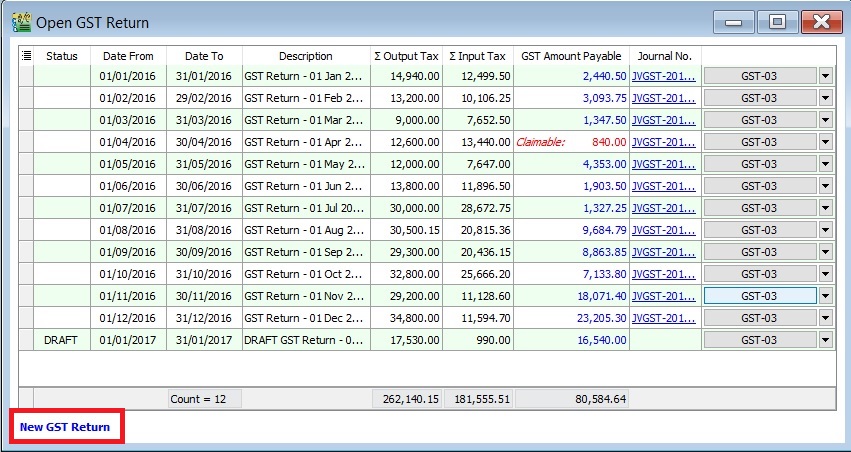

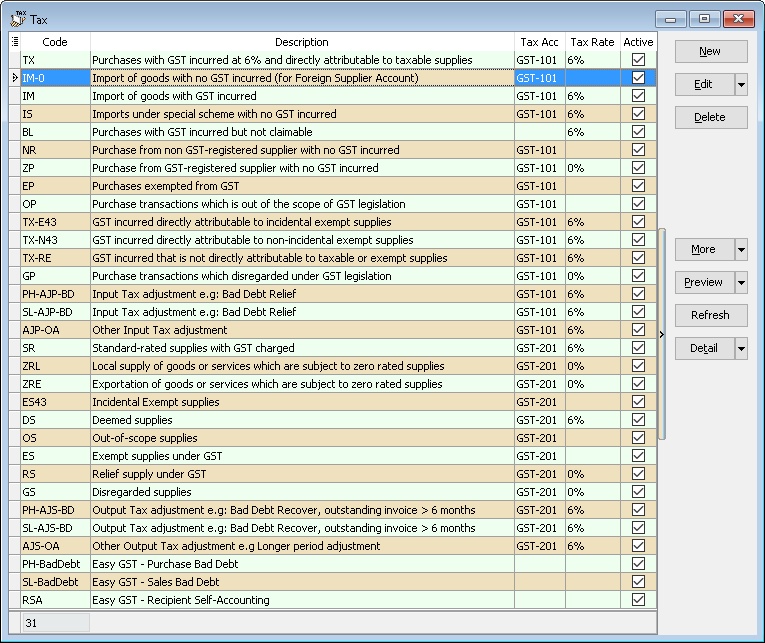

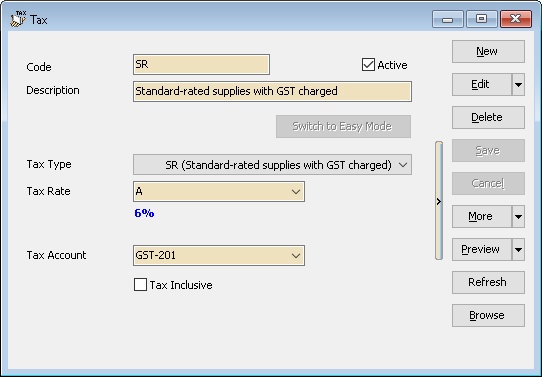

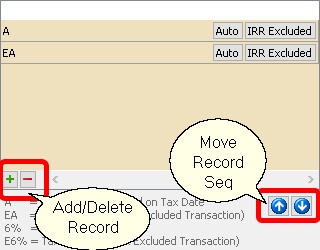

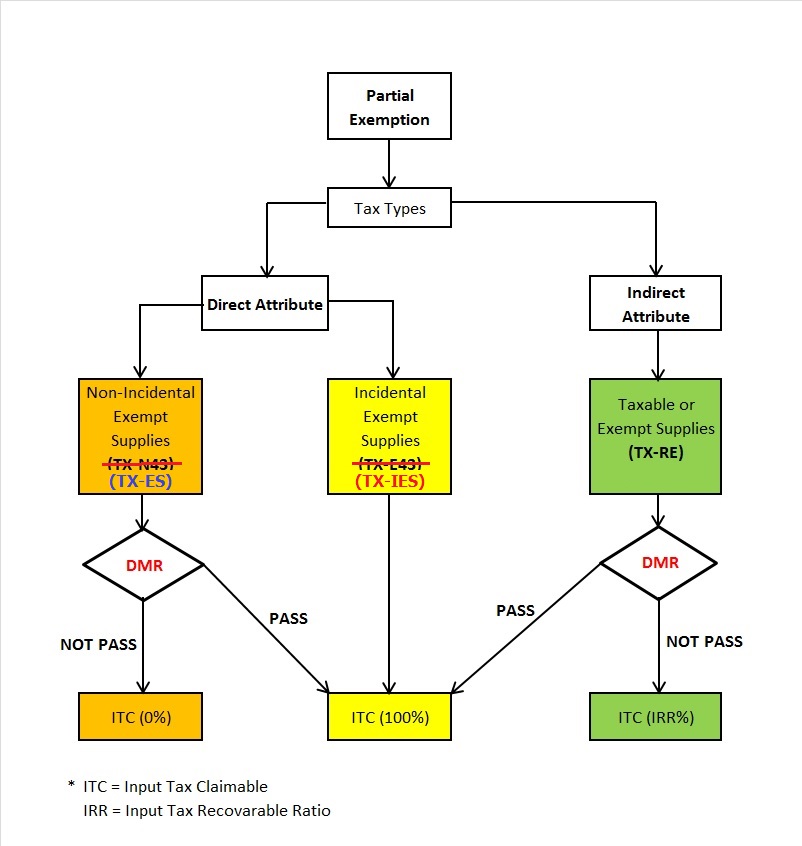

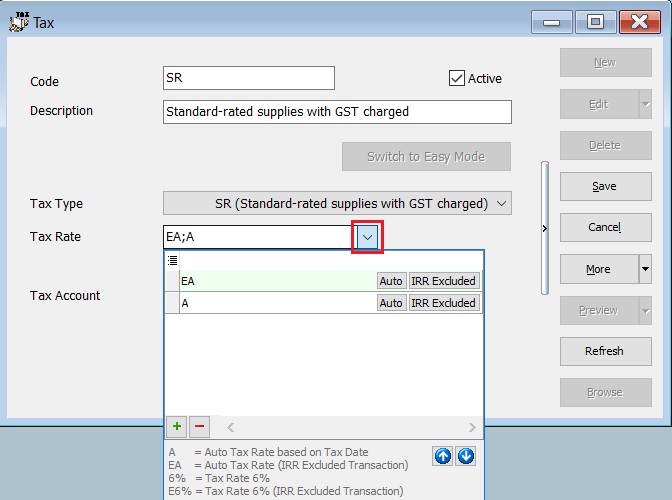

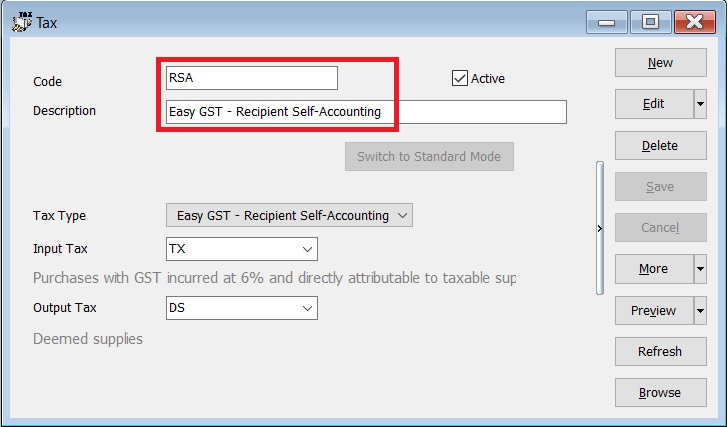

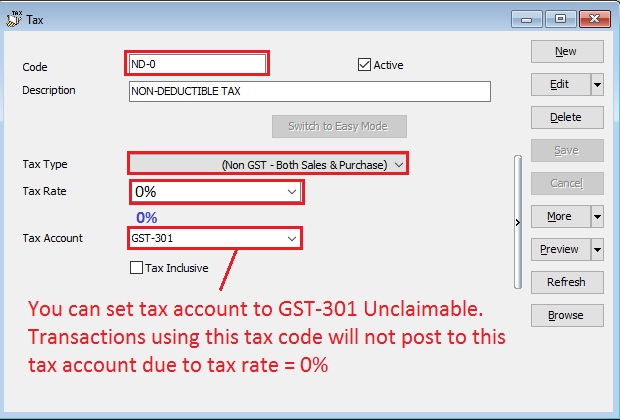

Maintain Tax

- This to Maintain all the available tax given by Government or user can self add or modified

Create New Tax

- Screenshot below is the Maintain Tax entry form.

| Field Name | Explanation & Properties |

|---|---|

| Code | Enter the tax code to be shown in report. |

| Active | - Checked: Active & able to select from the Tax List in data entry. |

| - UnChecked: InActive & unable to select from the Tax List in data entry. | |

| Description | Enter the tax description. |

| Tax Type | Select the Tax Type for the Tax Code to be created. |

| Tax Rate | User can self-determine the rate or set Auto: |

| - A: Auto Tax Rate. System will auto change to new rate if there is update in GST Rate (must update SQL Accounting). | |

| - E: Excluded from IRR calculation (useful for OS Tax Code & Mixed Supplies Industry). | |

| - EA: Combination of A & E. | |

| - 6%: User-defined fixed rate (e.g., 6%). | |

| - E6%: Fixed rate excluded from IRR calculation. | |

| Default 1st row is the Default selection in data entry. | |

| Tax Account | Select an appropriate GL Account from Maintain Account. |

| Tax Inclusive | - Checked: Default is Tax Inclusive. |

| - UnChecked: Default is Tax Exclusive. |

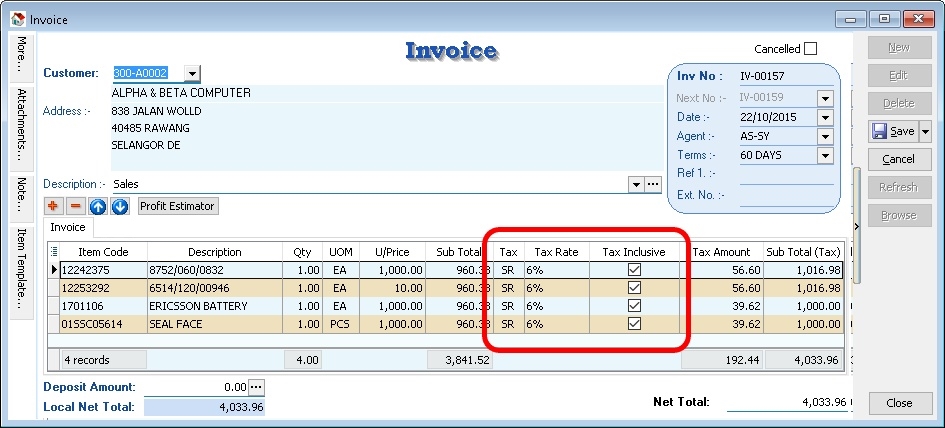

Use of Tax

- You can set the tax as default at the following

- GL | Maintain Account...

- Customer | Maintain Customer... | Tax

- Supplier | Maintain Supplier... | Tax

- Stock | Maintain Stock Item... | Output Tax/Input Tax

- Tools | Options | Customer | Default Output Tax

- Tools | Options | Supplier | Default Input Tax

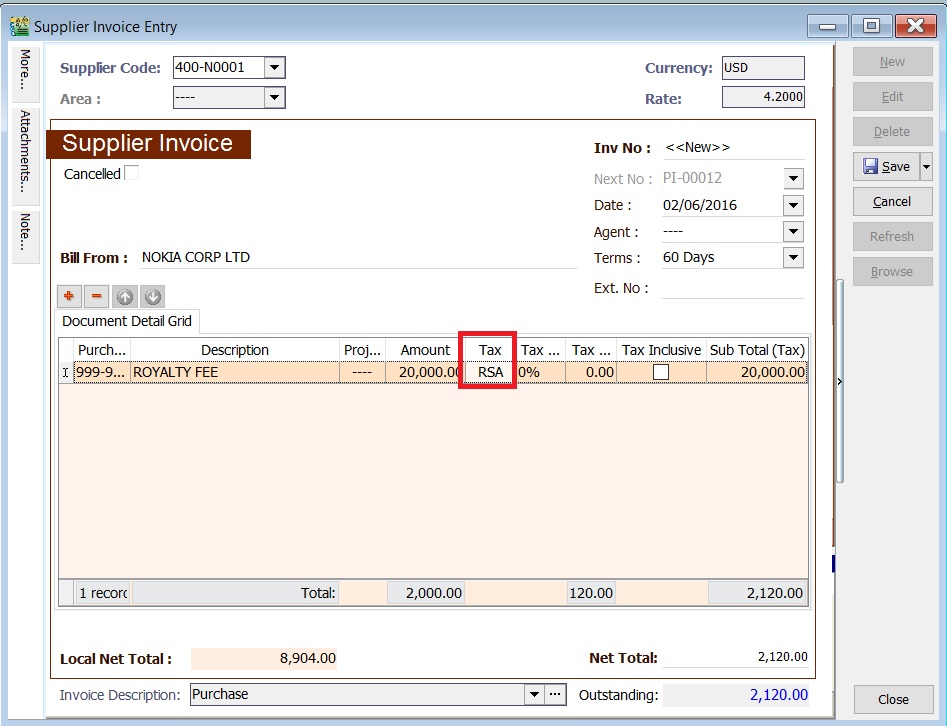

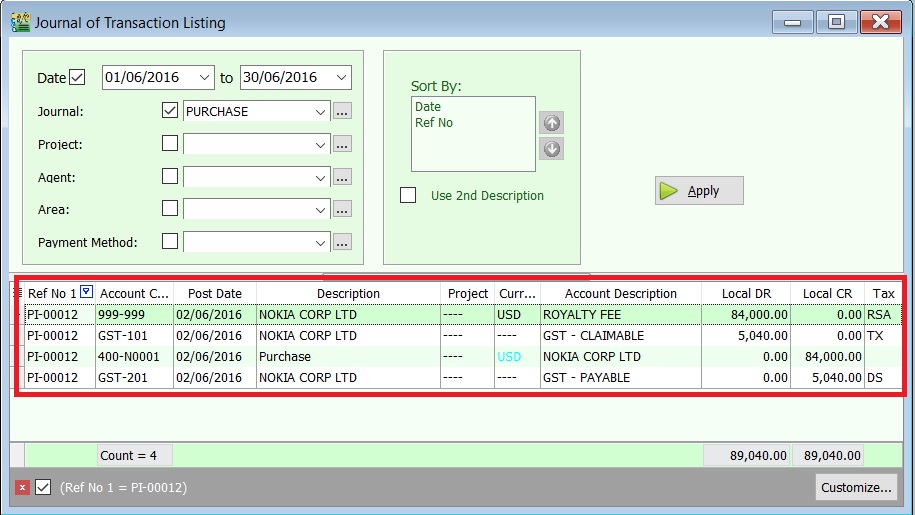

- Therefore, item inserted will be automatically calculate the tax amount based on the subtotal. See below screenshot.

Default System Tax Seq

Default System Tax Seq are as follow

For Sales & Purchase

- Maintain Customer/Supplier

- Maintain Item Code

- Tools | Options | Customer/Supplier => For Version 836.761 & below

- Maintain Tax with IsDefault is Tick => For Version 837.762 & above

For AR & AP

- Maintain Customer/Supplier

- Maintain Account

- Tools | Options | Customer/Supplier => For Version 836.761 & below

- Maintain Tax with IsDefault is Tick => For Version 837.762 & above

For GL

- Maintain Account

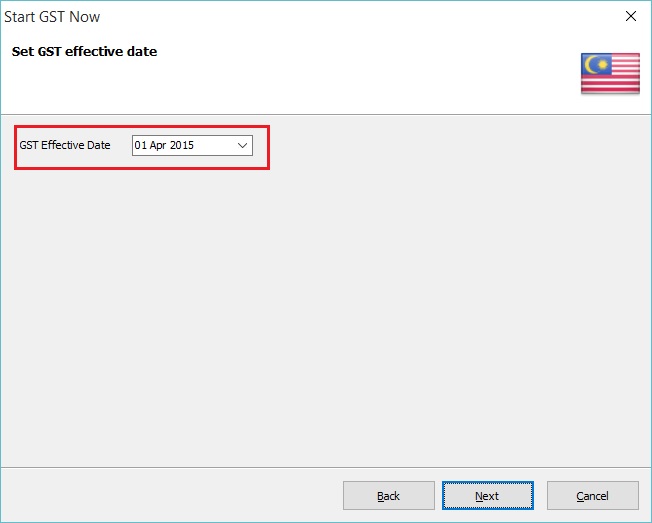

GST Effective Date

Enable to set the GST start date (register) and end date (de-register).

-

Below the screenshot is the Start GST wizard, you are required to set the GST Effective Date.

-

You can check the GST Effective Date under the menu GST | GST Effective Date...

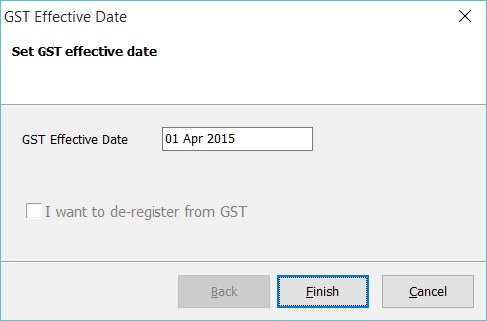

Field Name Field Type Explanation GST Effective Date Date GST start date. I want to de-register from GST Boolean To set de-register date from GST.

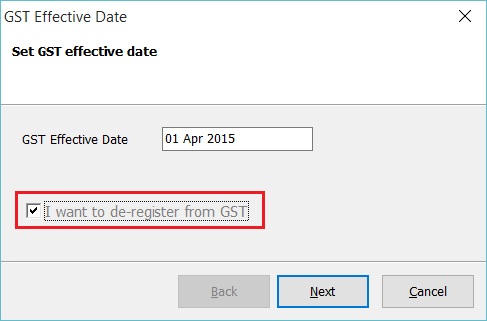

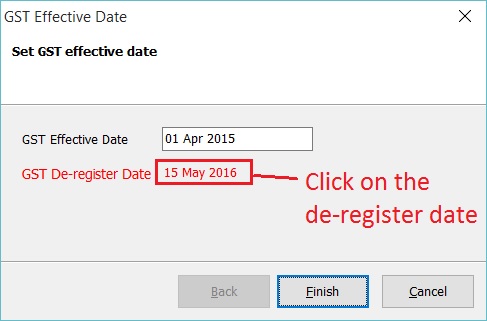

How to set De-register

-

At the GST effective date screen, tick on I want to de-register from GST.

-

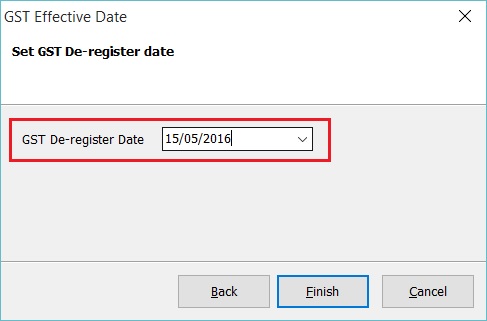

Next', type-in the de-register date. Let's assume ABC Sdn Bhd ceased to be a registered person on 15 May 2016.

-

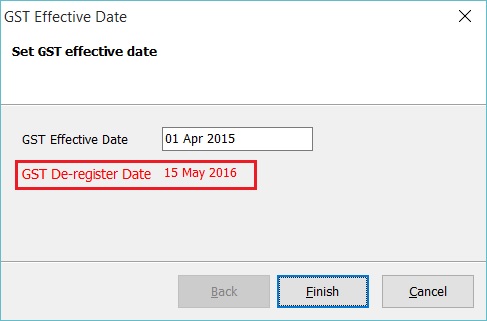

Click Finish to confirm the de-register date.

-

GST De-register Date : 15 May 2016 will displayed below the GST effective date. See the screenshot below.

-

Click Finish to exit.

You can found the De-Register markings in the GST Returns. See the screenshot below.

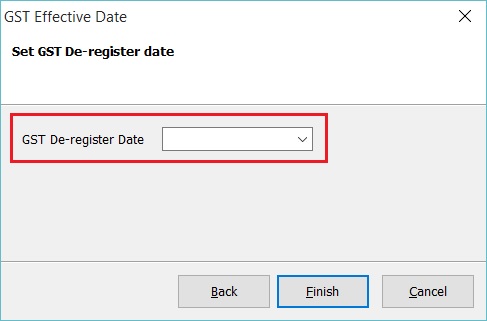

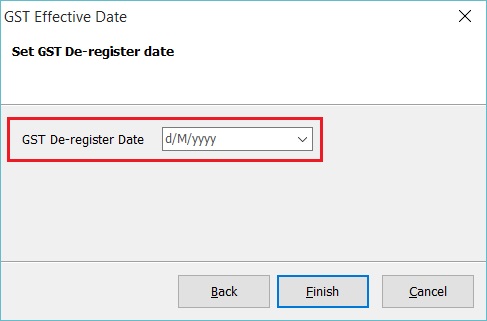

How to cancel De-Register Date?

-

At the GST effective date screen, click on the De-Register Date.

-

Leave the De-Register date blank or become d/M/yyyy. See the screenshot below.

-

Click Finish to confirm remove the de-register date.

Gift / Deemed Supply

This guide will teach you to enter the gift and deemed supply in SQL Financial Accounting.

Gift

Gift Rules

Goods worth not more than RM500 given FREE to the same person in the same year. The word ‘year’ in paragraph 5(2) (a) of the First Schedule of GSTA 2014 refers to ‘tax year ‘(financial year).

- not a supply

- not subject to GST

- input tax is claimable

What it means year as Tax Year (Financial Year)? For example.... GST Effective Date: 01 Apr 2015 Financial Start Period: 01 July 2014

First tax year will be: 01 Apr 2015 - 30 Jun 2016 (15 months) - Gift rule Rm500 per person per tax year Second tax year will be: 01 Jul 2016 - 30 Jun 2017 (12 months) - Gift rule Rm500 per person per tax year

Example 1: Company XY Sdn Bhd purchased 15 hampers worth RM200/hamper to be given to each of his employees.

- every employee will get one hamper FOC.

- no need to account for output tax.

- input tax on 15 hampers = RM180.00 (6% x RM3,000.00) is claimable.

Example 2: Company CX Sdn Bhd has purchased a watch worth RM400.00 and gave it to one of the director’s son.

- The gift is not subject to GST because its value is less than RM500.00 (gift rule).

- input tax incurred on the purchase is claimable.

Example 3: A Company purchased a laptop worth RM1,500.00 and gave the laptop to a director’s son as a gift.

- GST on the laptop must be accounted for by the company as output tax.

- the value of the goods is more than RM500.00.

Example 4: A company purchased a laptop worth RM1,500.00 three years ago. Currently the company has given the laptop to one of his business partners. For the purpose of accounting GST, the company has to use open market value of the goods now where the value of the goods is RM450.00, i.e. the value of the goods has depreciated.

- no need to account for output tax on the gift

- the value of the goods is less than RM500.00. (Gift rule applicable)

Example 5: Company C rewarded RM5,000.00 to his best employee of the year.

- not subject to GST

- money is neither goods nor services

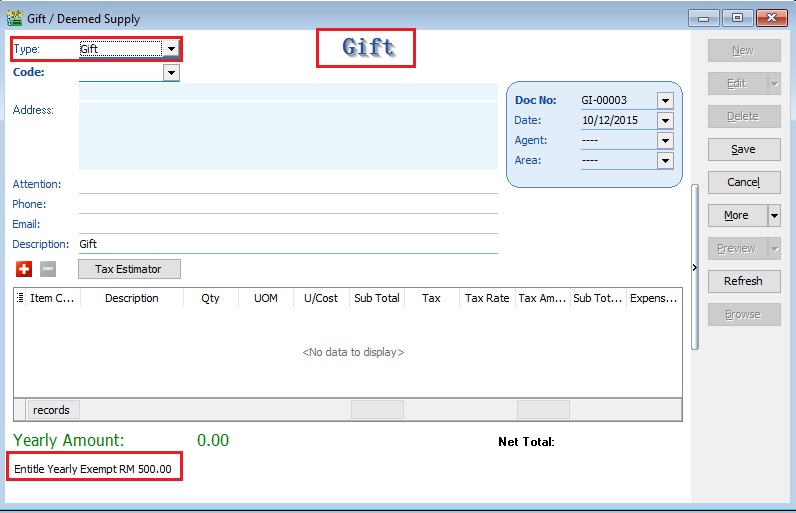

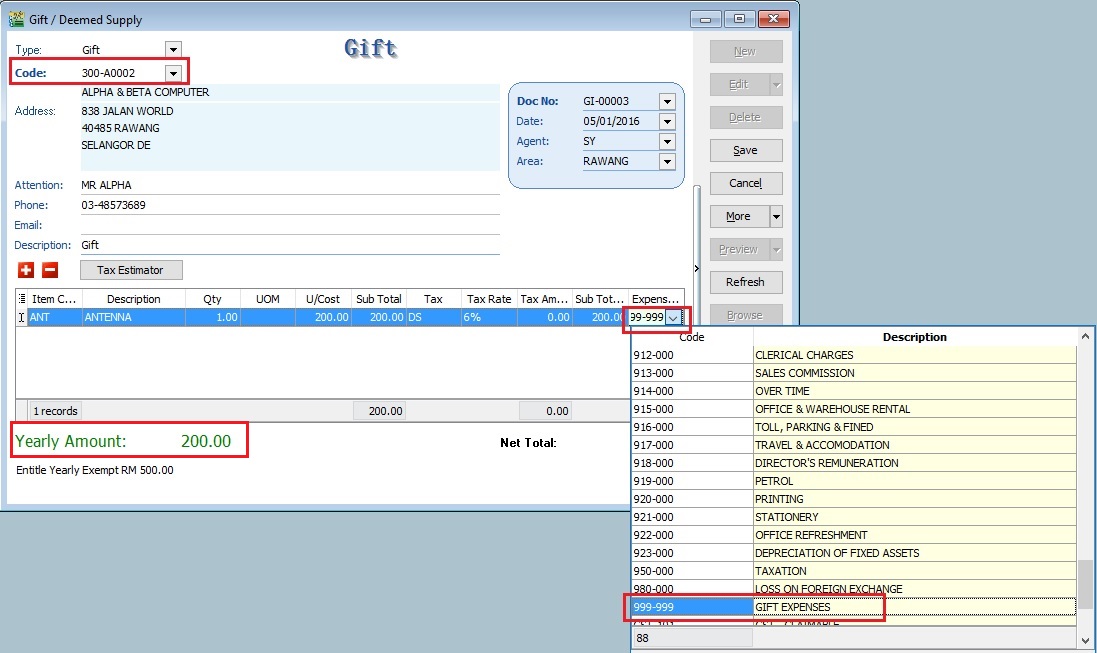

Gift Document Entry

-

Click on New.

-

Select Type : Gift.

Note:

Note:You will see this note "Entitle Yearly Exempt RM500.00" at the bottom.

-

For Gift, you must select Code : Customer Code.

-

Select Item Code: Item Code.

-

Select a preferred Expenses GL Account. User has to create a GL Account in Maintain Account.

For example,

Item Code Description Qty UOM U/Cost Sub Total Tax Tax Rate Tax Amount SubTotal (Tax) Expenses GL Account ANT ANTENA 1.00 UNIT 350.00 350.00 DS 6% 0.00 350.00 999-999 GST Gift/Deemed Supply

-

Yearly Amount will immediately updated together with the current Gift document amount.

Yearly Amount = Cumulative gift amount in the same year + current gift document amount

-

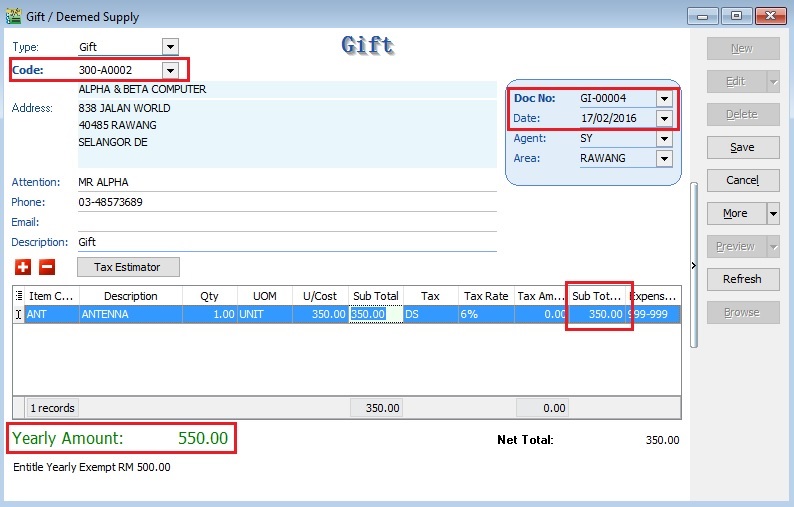

Below screenshot is the 2nd gift document created for same company/person in the same year. The word ‘year’ in paragraph 5(2) (a) of the First Schedule of GSTA 2014 refers to ‘tax year ‘(financial year).

-

System will auto calculate tax amount once exceed RM500.00

Gift Date Gift Cost Tax Amount Calculation 05/01/2016 ANTENA 200.00 0.00 17/02/2016 ANTENA 350.00 33.00 RM550 × 6% Note:The calculation of the gift is based on the Total value of the gift once exceed RM500.

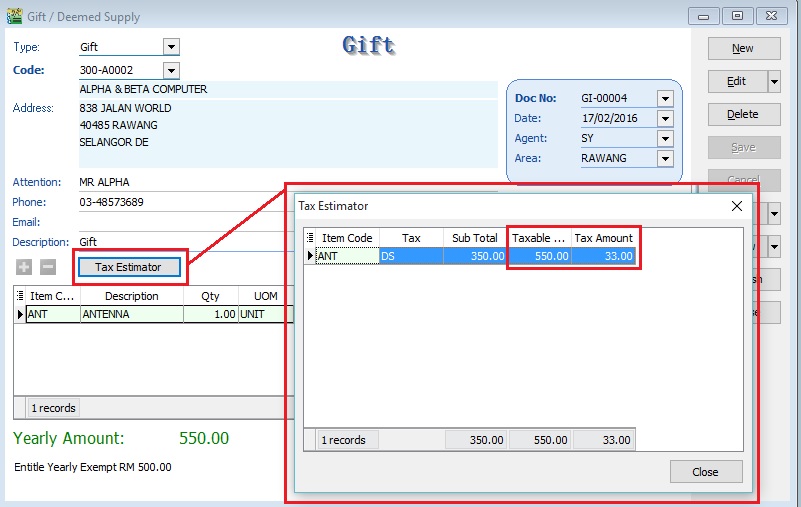

-

Click on Tax Estimator. You can see the GST Amount to be process to the gift.

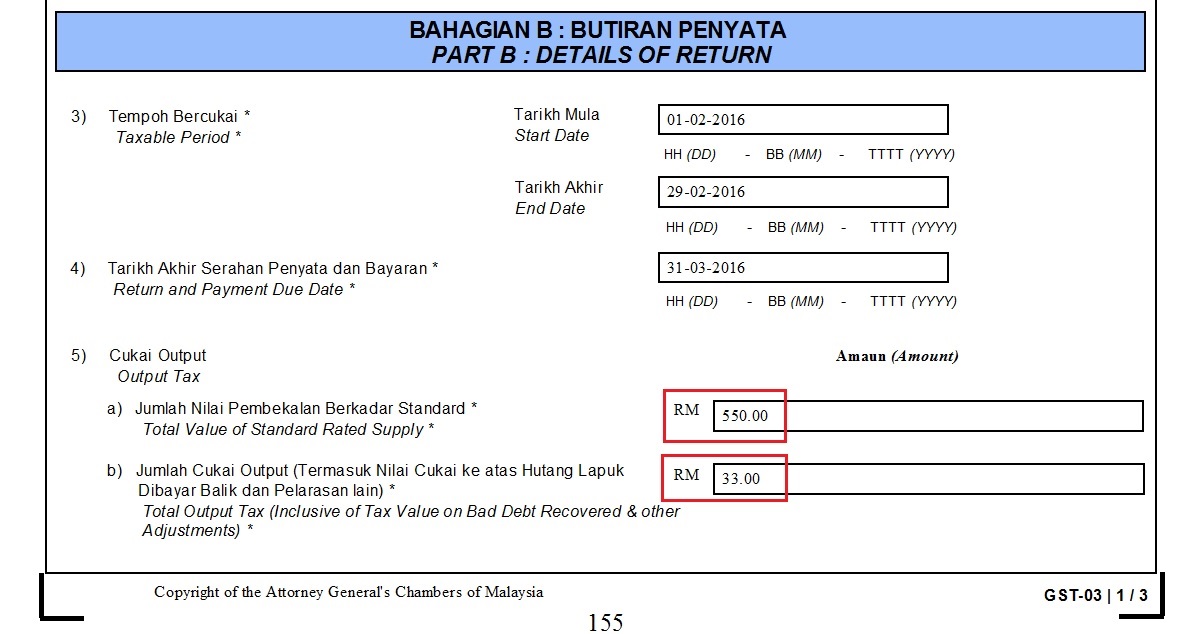

Process GST Return

During process of GST-03 Return, if the system detects there are deemed supplies (DS) under gift, it will add this GST Tax under DS as output Tax.

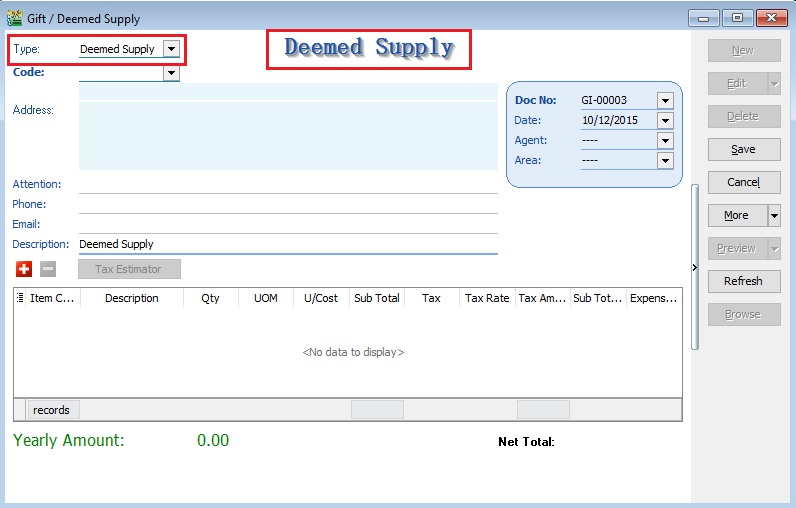

Deemed Supply

-

Click on New.

-

Select Type : Deemed Supply.

-

For Deemed Supply, you can leave the Code

<<EMPTY>> -

Select Item Code: Item Code.

-

Select a preferred Expenses GL Account. User has to create a GL Account in Maintain Account.

For example,

Item Code Description Qty UOM U/Cost Sub Total Tax Tax Rate Tax Amount SubTotal (Tax) Expenses GL Account ANT ANTENA 1.00 UNIT 350.00 350.00 DS 6% 21.00 371.00 999-999 GST Gift/Deemed Supply -

System will calculate tax amount instantly when you save the Deemed Supply, ie. Taxable Amount x 6%.

-

Yearly Amount always shown 0.00, because it is Deemed Supply.

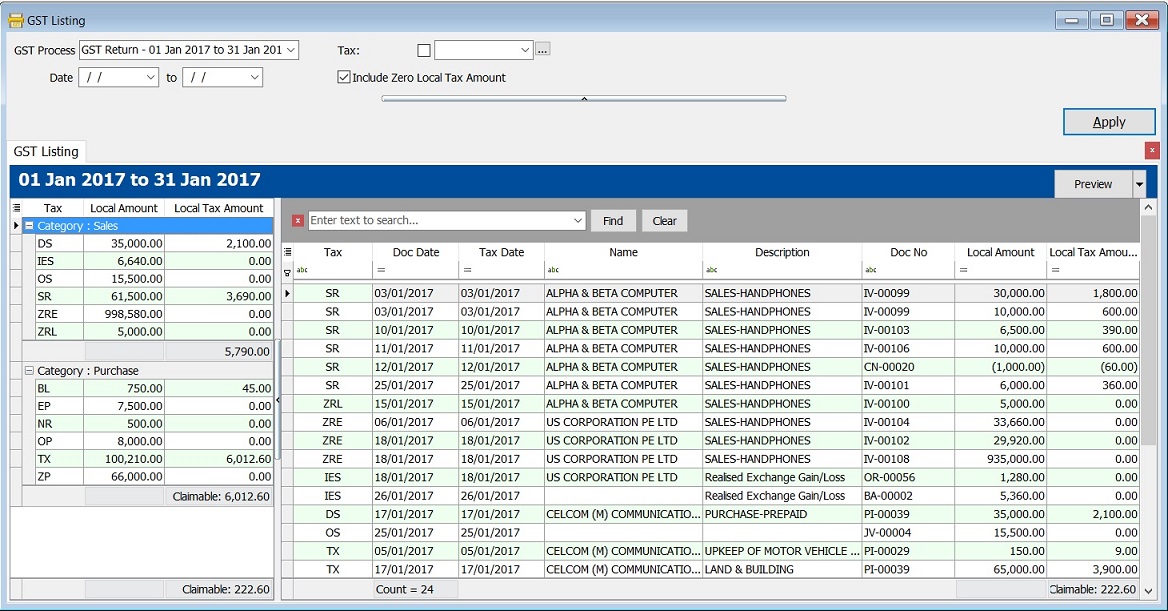

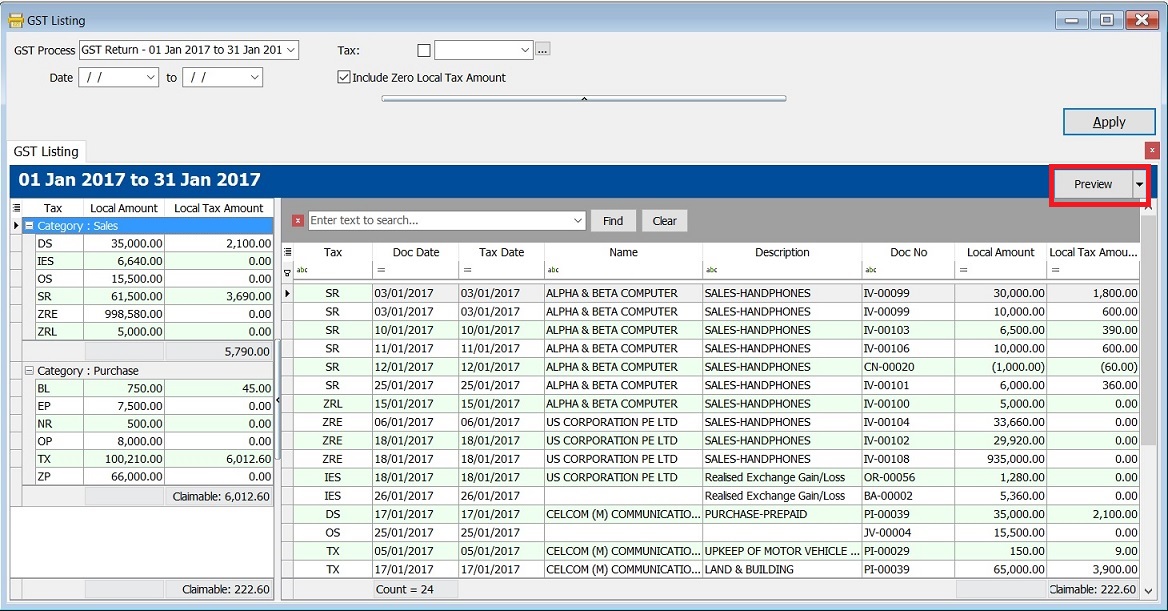

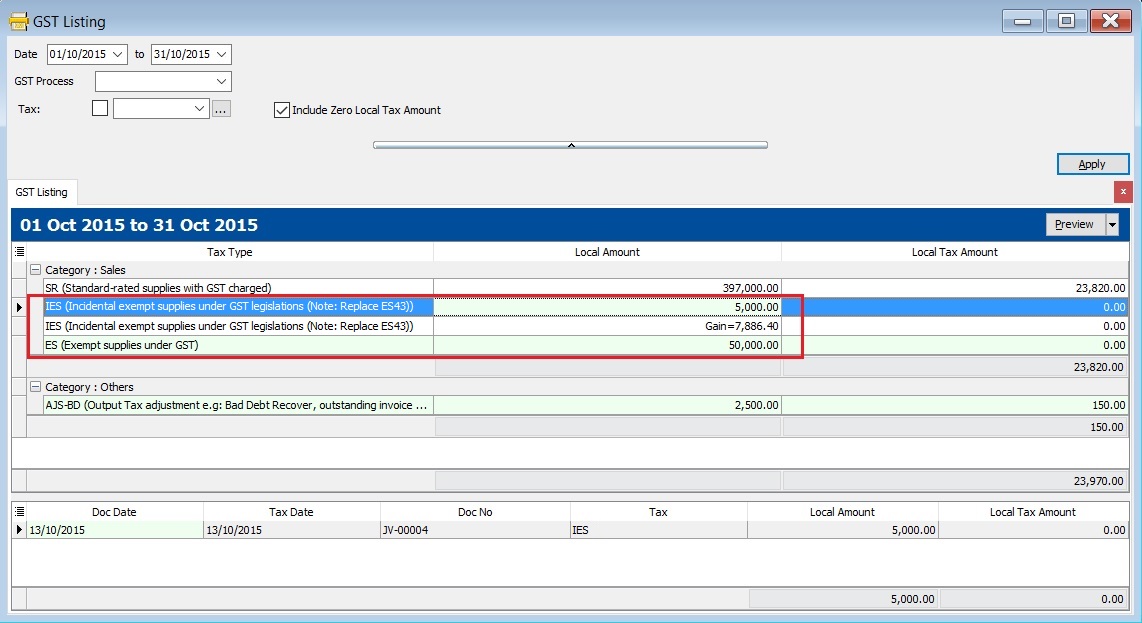

Print GST Listing

To generate a summary and details of the GST transactions after process the GST Returns. It is easy to cross check against with GST-03.

GST Listing

GST Listing - Parameter

| Parameter | Type | Explanation |

|---|---|---|

| GST Process | Lookup | To select the GST Process period. |

| Date | Date | To range the date to retrieve the data after apply it. |

| Tax | Lookup | To select the tax code. |

| Include Zero Local Tax Amount | Boolean | To show the zero local tax amount. |

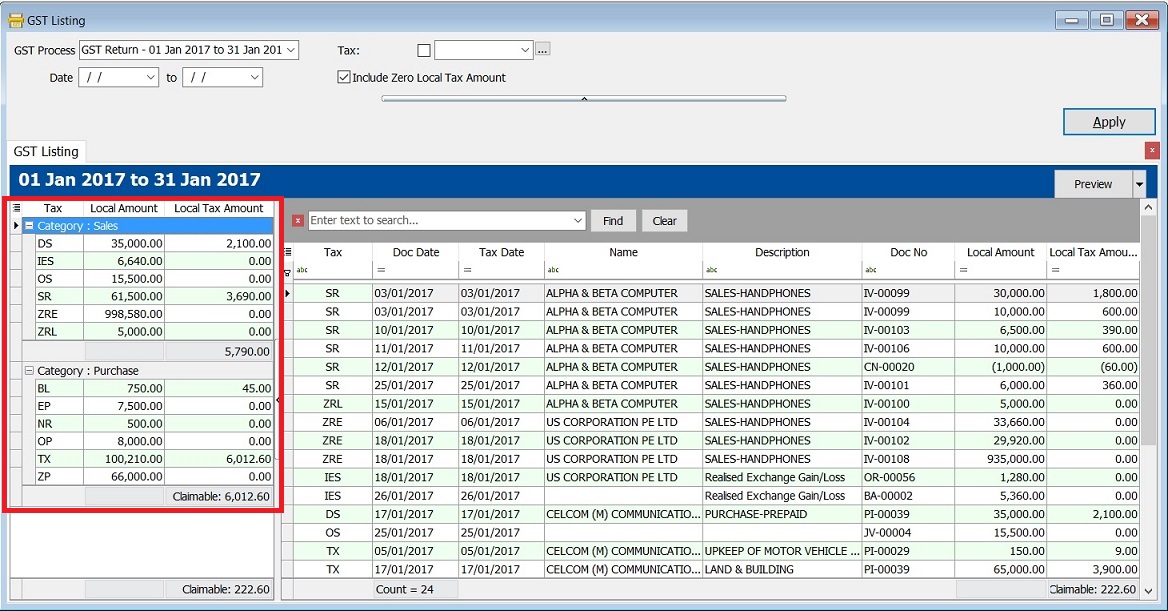

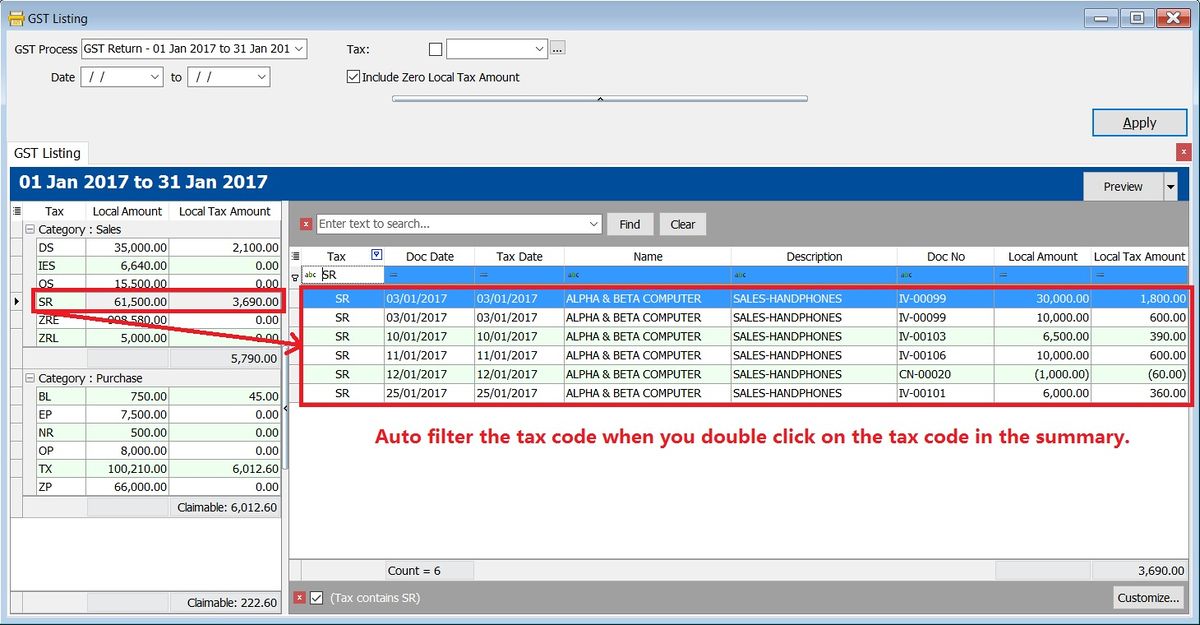

GST Listing - Summary

-

Double click on the tax code (eg. SR) in the Summary.

-

It will auto filter the GST transactions by tax code (SR) in the Details.

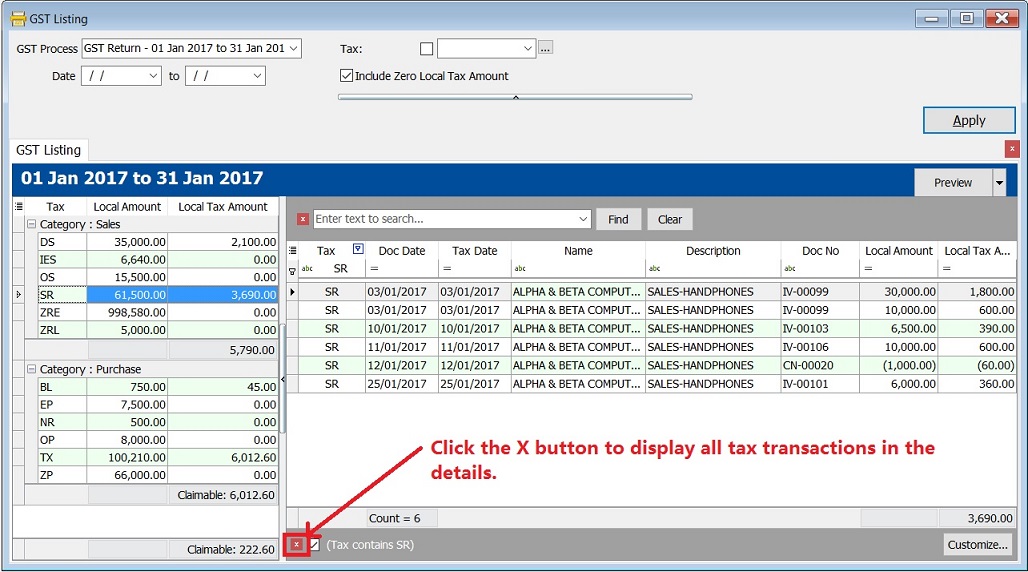

-

Deselect the tax code (SR), click on the X button. See the screenshot below.

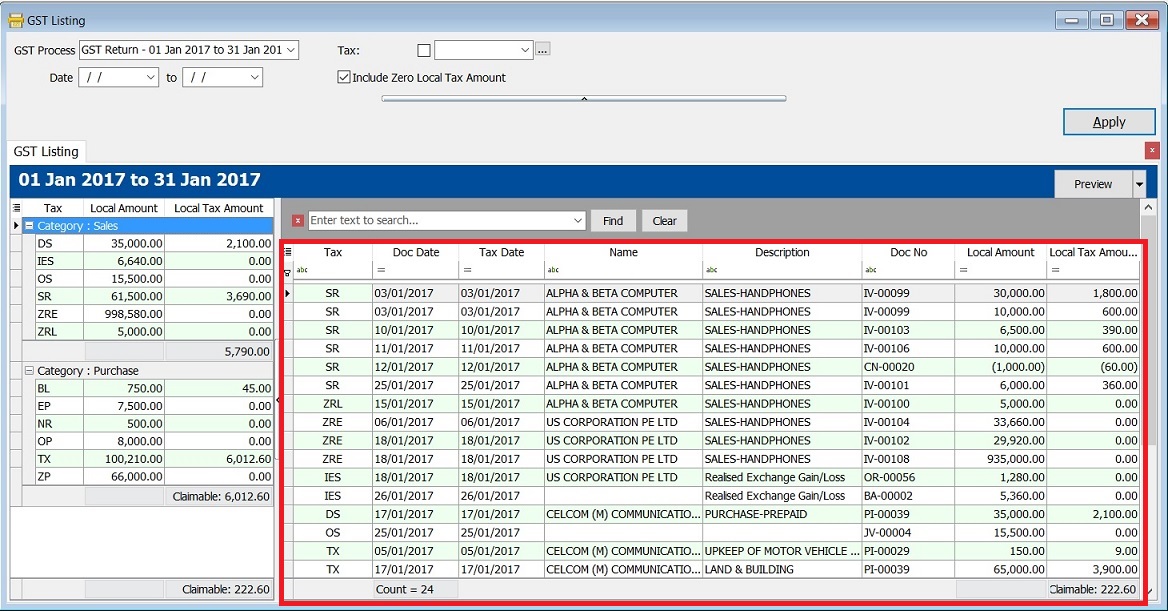

GST Listing - Detail

-

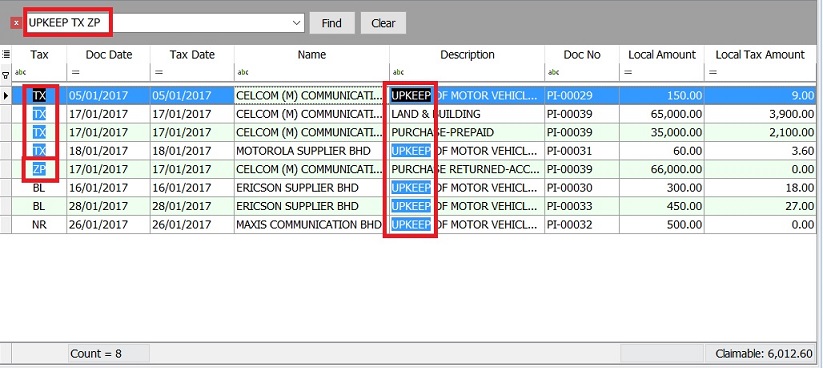

Find Panel is very useful to search in any columns by the keywords entered by you.

-

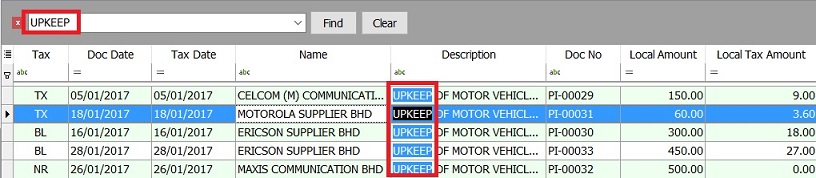

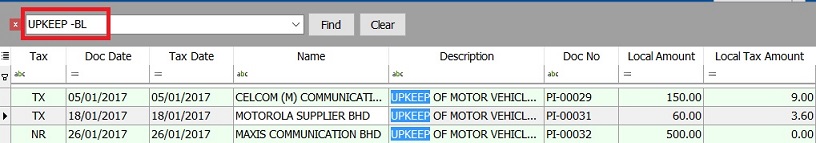

It helps to search the transactions contain the keywords, eg. "UPKEEP", "TX" or "ZP". You just need to enter the keywords directly with a space in between each keywords. See the screenshot below.

Find Panel Helper

-

With this function, you can easily narrow down the search to identify the errors before the GST Returns submission.

-

Let say I wish to find the word UPKEEP.

-

Type the UPKEEP in the find panel.

-

If you want to exclude the BL tax code, then you have to enter as UPKEEP -BL in the find panel.

Explanation of Extended Search Syntax :

| Example Search Syntax | Filter Operator | Explanation |

|---|---|---|

| apple pineapple mango | OR | Any transaction lines containing apple, pineapple, OR mango will be searched. |

| apple +pineapple | AND | Transaction lines with a combination of apple AND pineapple will be searched. |

| apple -mango | EXCLUDE | Transaction lines with the word apple but EXCLUDE mango. Result: apple and pineapple will be searched. |

| "pineapple apple" | EXACT WORD | Search for the exact words "pineapple apple". |

Spacing is very important to make your search more accurate.

Reports

-

Click on Preview.

-

Select a report to preview or print or export.

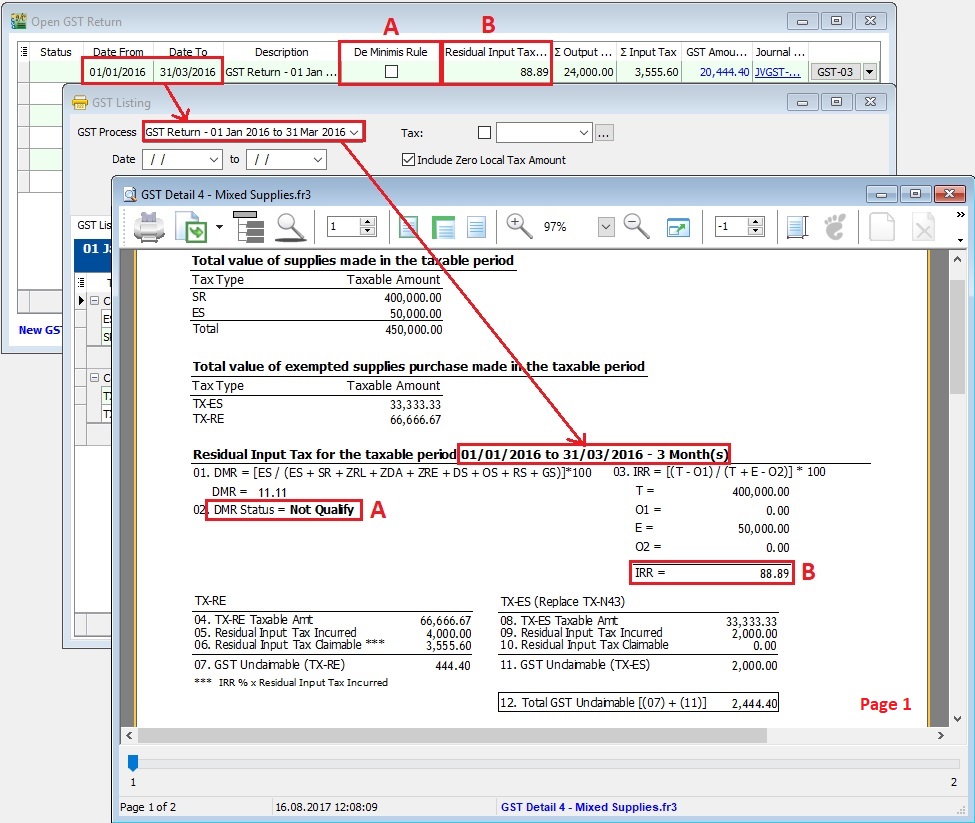

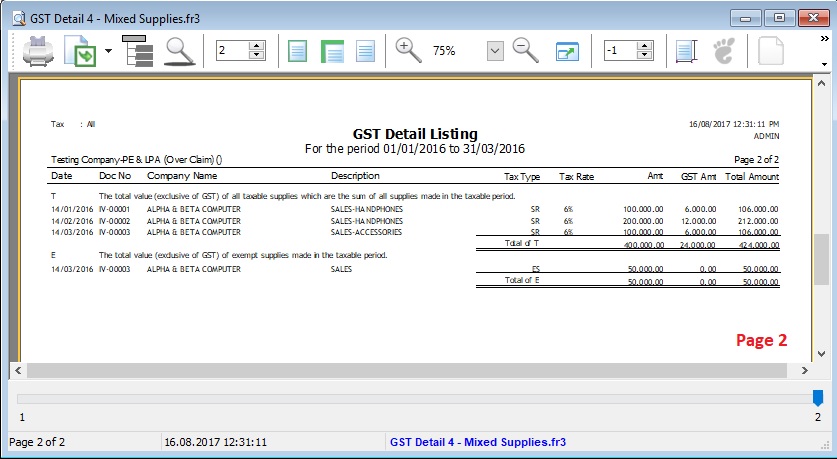

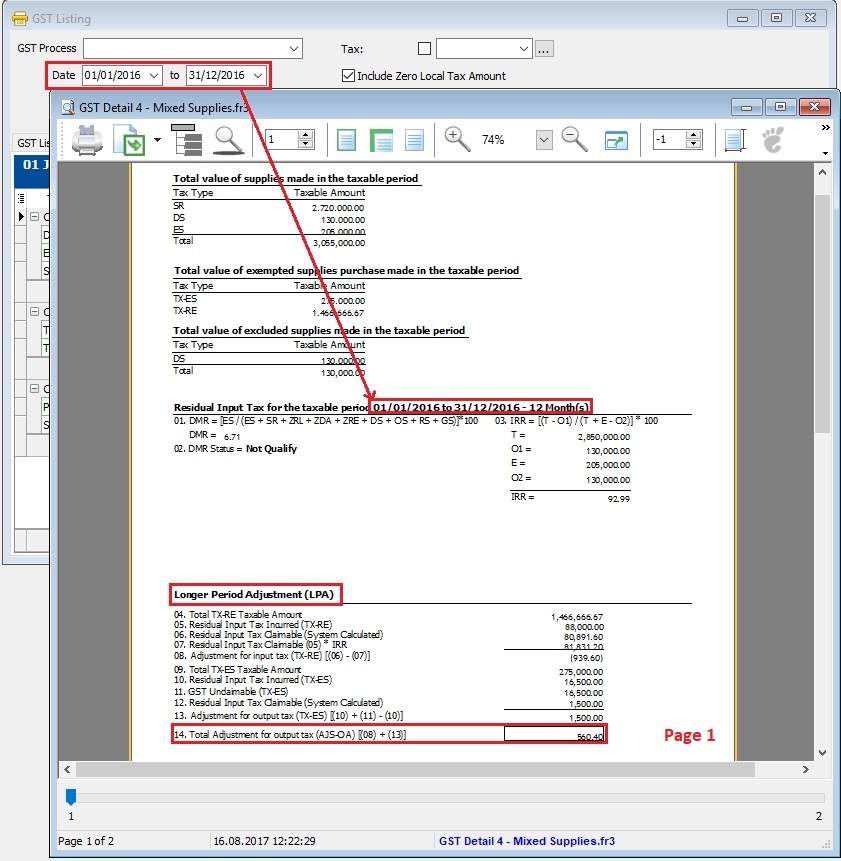

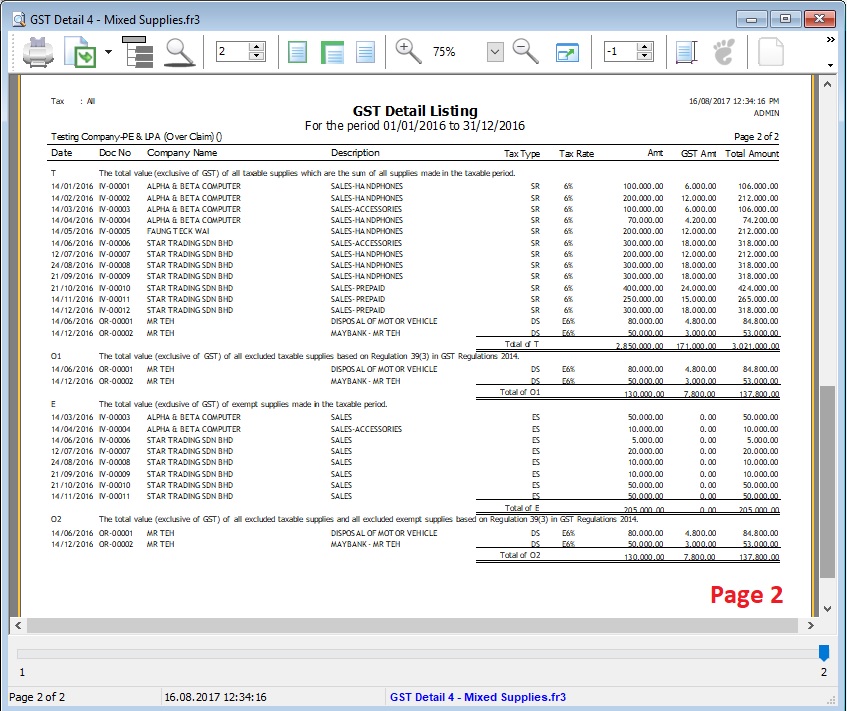

No. Report Name Purpose 01 GST Detail 1 To show the document description in GST Listing. 02 GST Detail 2 To show the document item details description in GST Listing. 03 GST Detail 3 - GST F5-(SG) For Singapore GST, to show the GST-03 details in GST Listing. 04 GST Detail 3 - GST-03 For Malaysia GST, to show the GST-03 details in GST Listing. 05 GST Detail 4 - Mixed Supplies Applicable to Mixed Supplies. To show the calculations for DmR and Longer Period Adjustment. 06 GST Lampiran 2 GST detail listing for standard rated. It is upon request by RMCD. 07 GST Lampiran 2-with ZR Another GST detail listing for the standard rated and zero rated separately. 08 GST Lampiran 4 - Ringkasan Maklumat Permohanan Tuntutan Pelepasan Hutang Lapuk Lampiran 4 as requested by Kastam Officer. 09 GST Listing - Yearly GST Analysis To analyze the yearly tax amount and taxable amount. 10 GST Summary Sheet - MY GST Summary Sheet format. 11 GST-Lampiran B-0 PT GST Bil 2B (ATS) (IS) A special GST detail listing for Approved Trader Scheme (Refer to GST-03 item 14 & 15). 12 GST-Penyata Eksport (ZRE) A special GST detail listing for Zero Rated Export supply (Refer to GST-03 item 11). 13 GST-Penyata Pembekalan Dikecualikan (ES & IES) A special GST detail listing for Exempted Supplies (Refer to GST-03 item 12). 14 GST-Penyata Pembekalan Tempatan Berkadar Sifar (ZRL) A special GST detail listing for Zero Rated Local supply (Refer to GST-03 item 10). NOTE:From Doc Types in GST Listing Detail are consists of:

- _A = Un-claimable Non-Incidental Exempt Supplies (TX-N43)

- _B = Un-claimable TX-RE

- _C = Annual Adjustment Non-Incidental Exempt Supplies (TX-N43)

- _D = Annual Adjustment TX-RE

- _X = Realized Gain Loss

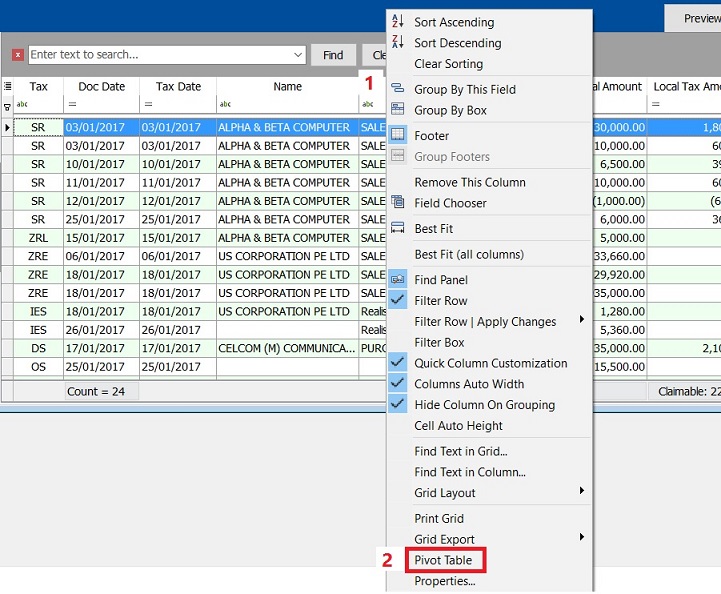

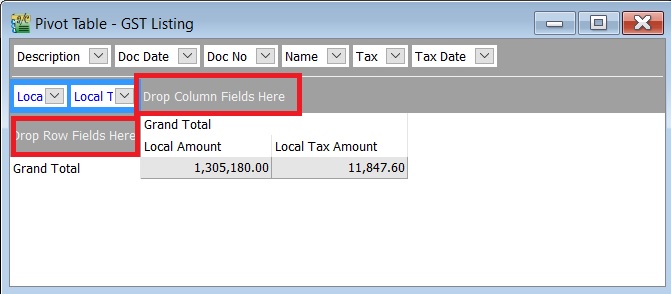

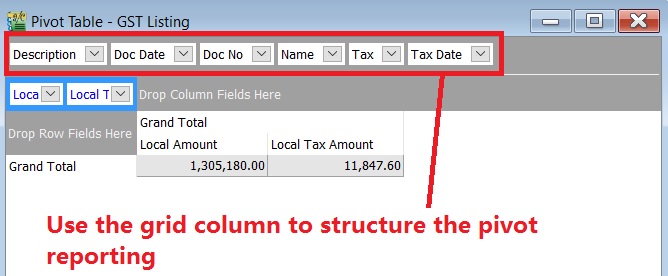

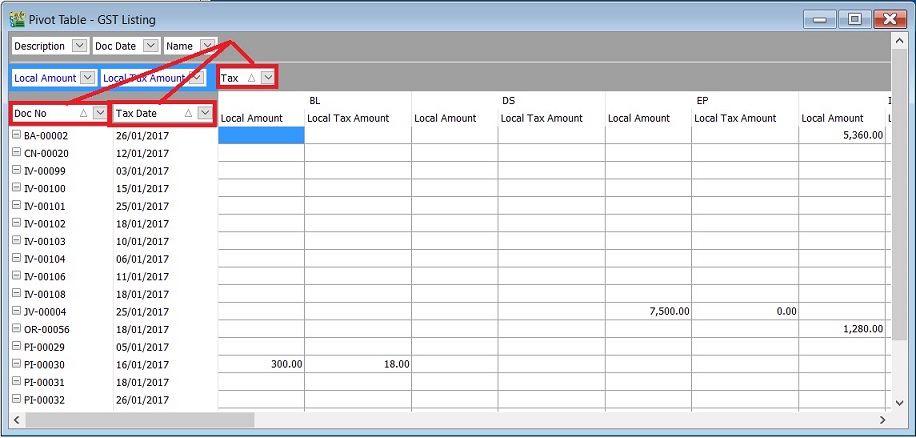

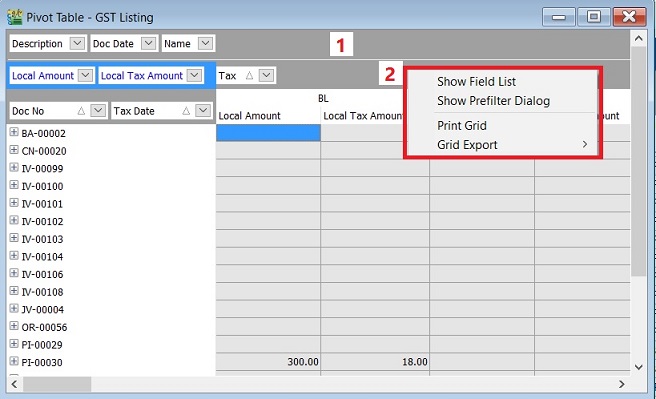

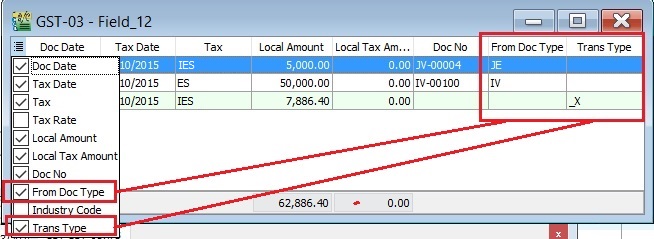

Pivot Table

-

Right click on any of the grid columns.

-

From the menu, select Pivot Table.

-

At Pivot Table, there are 3 sections as below:

a. Data Fields – Data field will auto inserted when you launch the pivot table.

b. Row Fields – To structure the grouping for Rows.

c. Column Fields – To structure the grouping for Columns.

-

Use the grid columns to structure the pivot format. See the screenshot below.

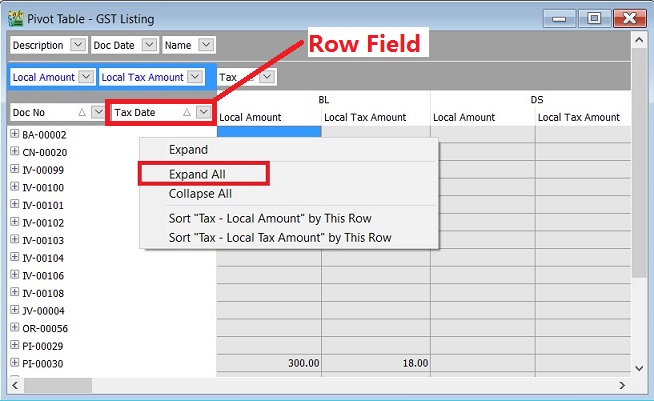

-

Drag the grid column into Row fields or Column fields.

- Right click on the Row Field

- Select Expand All.

- Right click on the grey area.

- A small menu pop out.

- Show Field List - Not really use to it.

- Show Pre-filter Dialog - Insert filter conditions.

- Print Grid - To print the grid.

- Grid Export - To export the grid data into EXCEL, TEXT, HTML and XML.

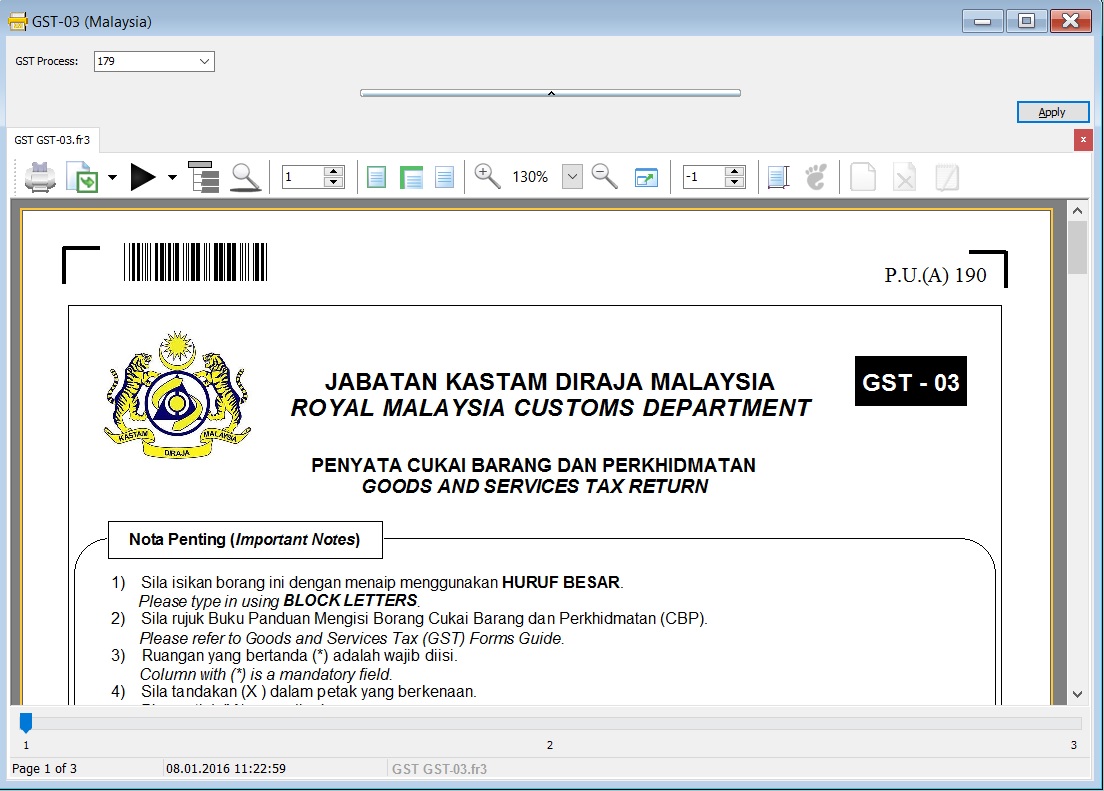

Print GST - 03

To generate the GST-03 data for submission via TAP.

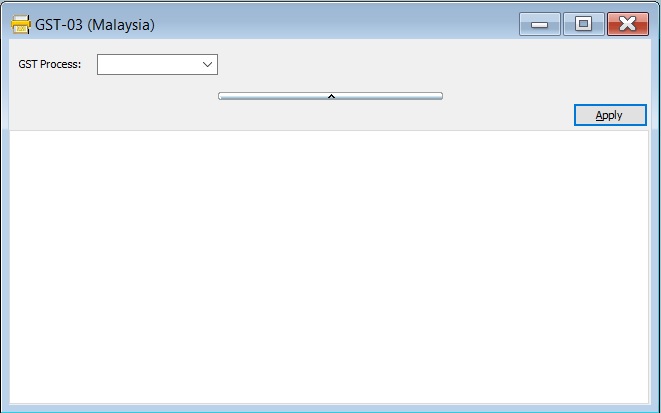

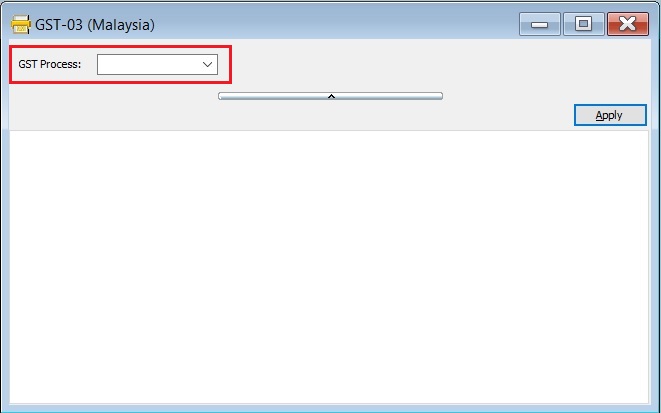

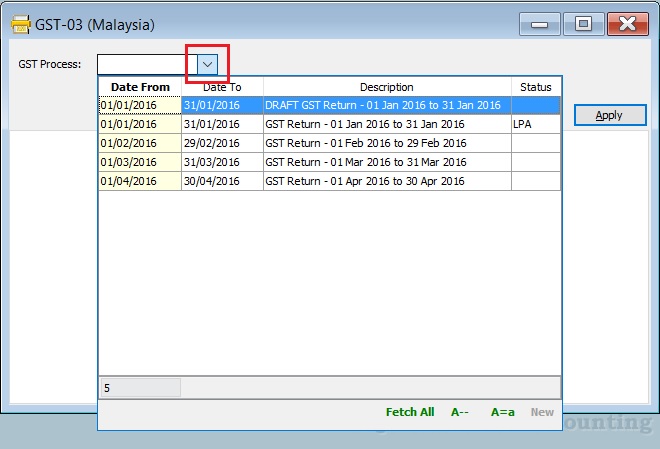

GST - 03

GST-03-Parameter

| Parameter | Type | Explanation |

|---|---|---|

| GST Process | Lookup | To select the GST Process Period. |

See example of the GST Process Lookup screenshot below.

GST-03 Form

-

After select the GST Process parameter, click on APPLY.

-

See the below screenshot.

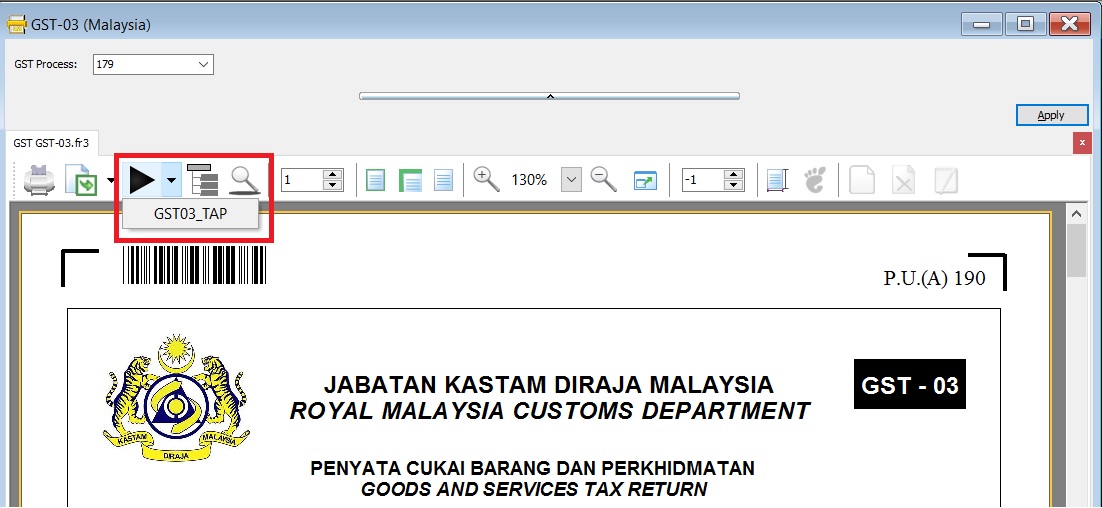

GST-03 TAP Upload File

-

At the GST-03 on the screen, click on the PLAY button.

-

Click on GST03_TAP. See the below screenshot.

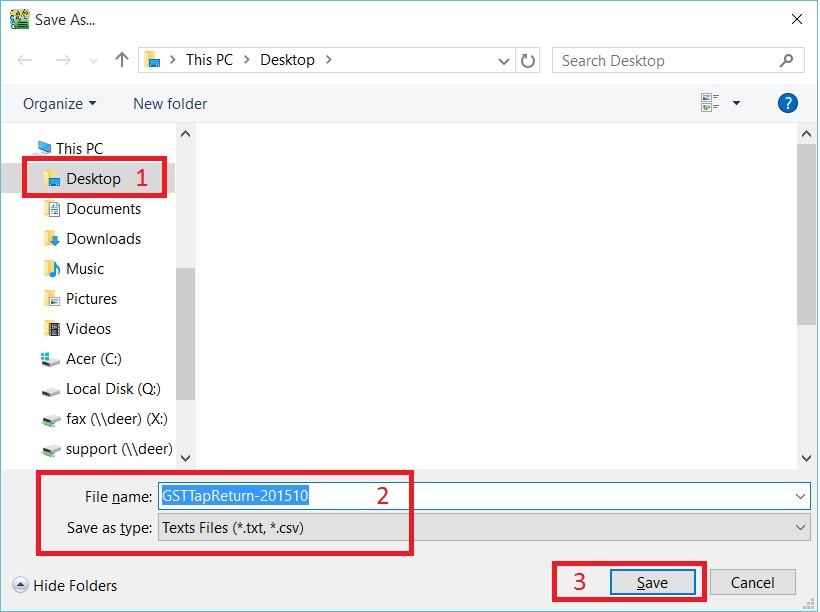

-

Select the destination directory to save the TAP-Upload text file, eg. GST Tap Return for Oct 2015 the filename: GSTTapReturn-201510.

-

Click on SAVE.

-

See the below screenshot.

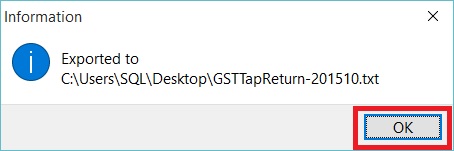

-

Prompt the below message. Press OK to proceed to upload the file via TAP website.

GST - 03 Item Details

Original source from RMCD website: GST-03 Guidelines from RMCD website

PART A : DETAILS OF REGISTERED PERSON

| Item No. | Description | Guidelines |

|---|---|---|

| 01 | GST No.* | GST No from File → Company Profile... |

| 02 | Name of Business* | Company Name from File → Company Profile... |

PART B : DETAILS OF RETURN

| Item No. | Description | Guidelines |

|---|---|---|

| 03 | Taxable Period* | GST Returns – Process date range. |

| 04 | Return and Payment Due Date* | Follow the RMCD due date. |

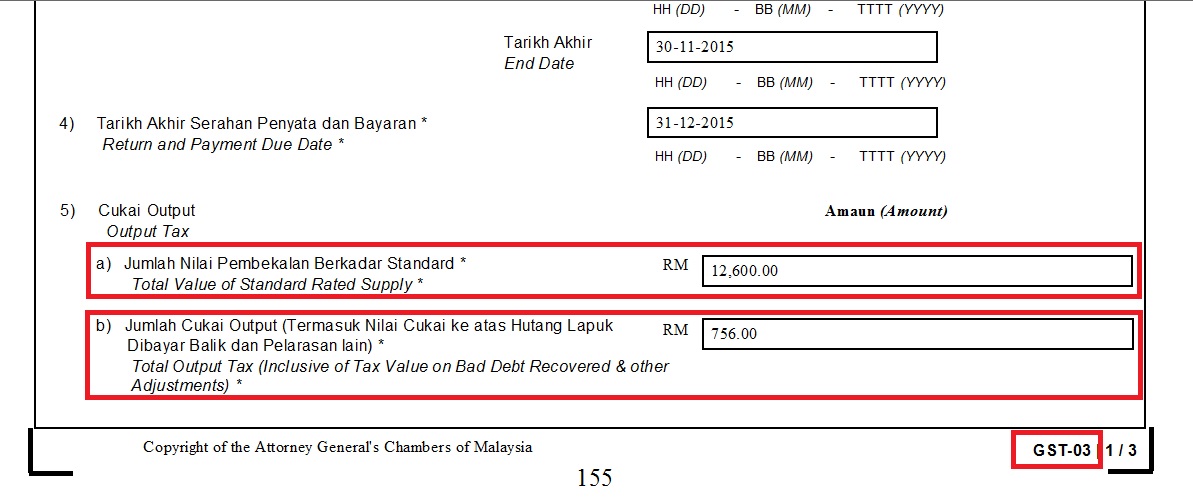

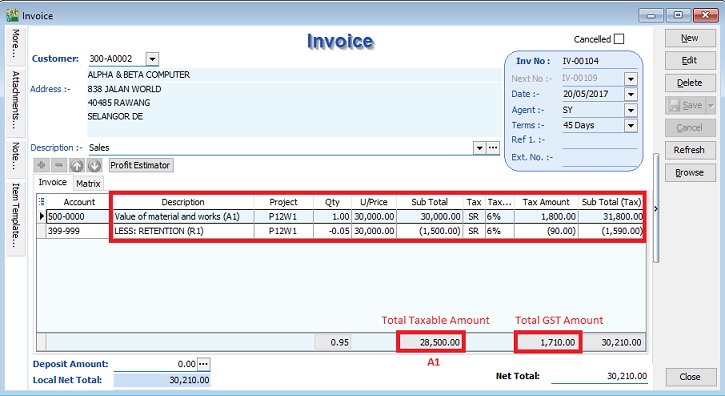

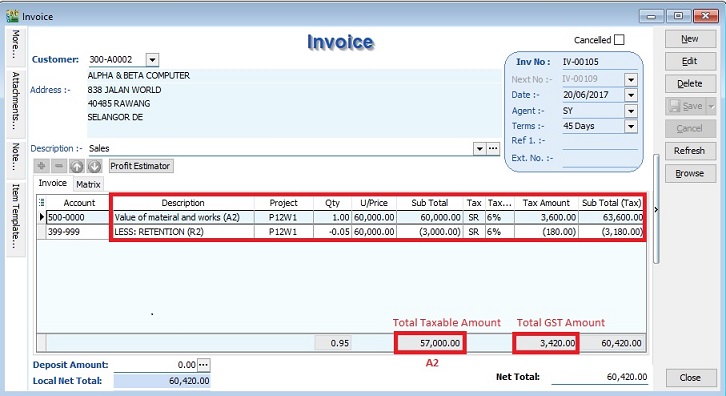

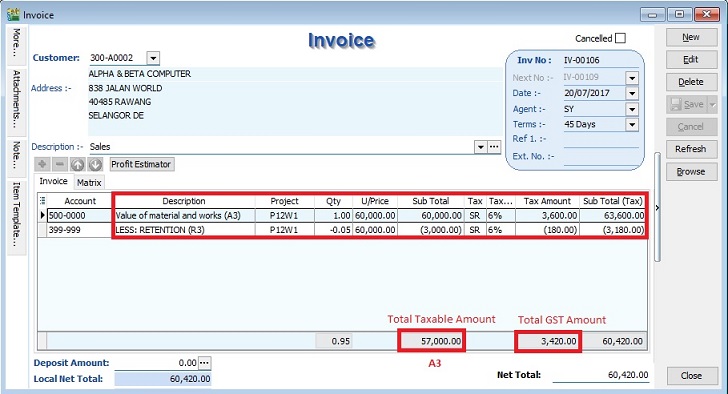

| 05a | Output Tax – Total Value of Standard Rated Supply* | SR + DS (Taxable Amount) |

| 05b | Output Tax – Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments)* | SR + DS + AJS (Tax Amount) |

| 06a | Input Tax – Total Value of Standard Rate and Flat Rate Acquisitions* | TX + IM + TX-E43 + TX-RE |

| 06b | Input Tax – Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments)* | TX + IM + TX-E43 + TX-RE + AJP (Tax Amount) |

| 07 | GST Amount Payable (Item 5b – Item 6b)* | Output Tax Value > Input Tax Value |

| 08 | GST Amount Claimable (Item 6b – Item 5b)* | Input Tax Value > Output Tax Value |

| 09 | Do you choose to carry forward refund for GST? | Mark X on YES if you have ticked C/F Refund for GST. |

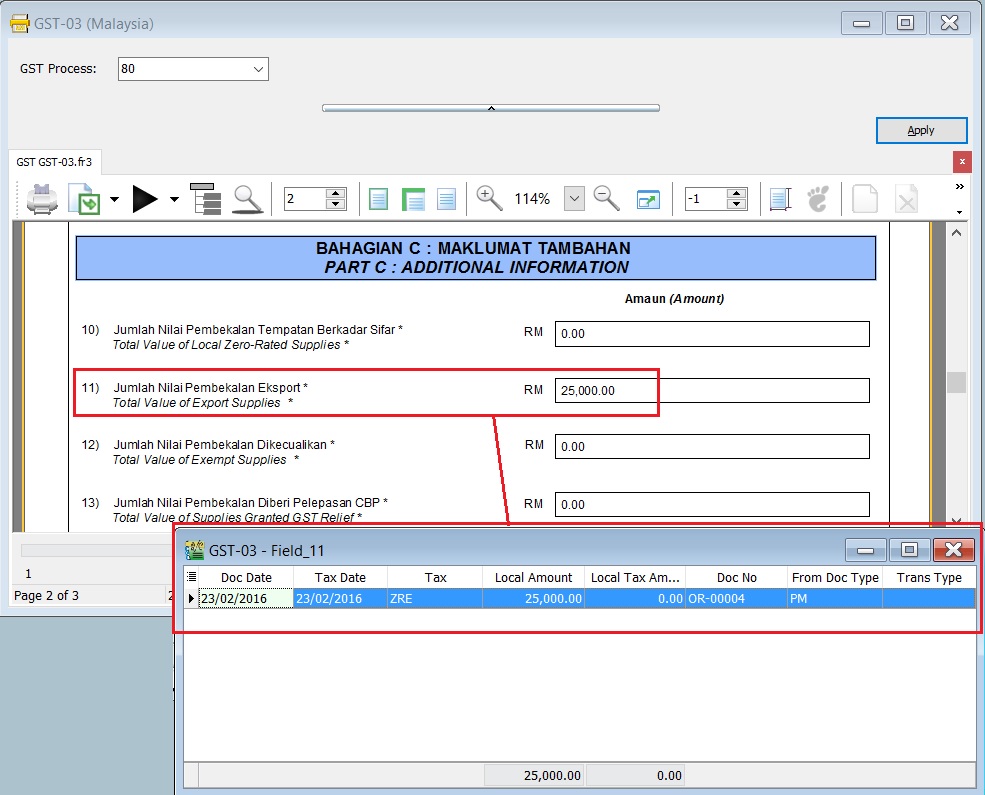

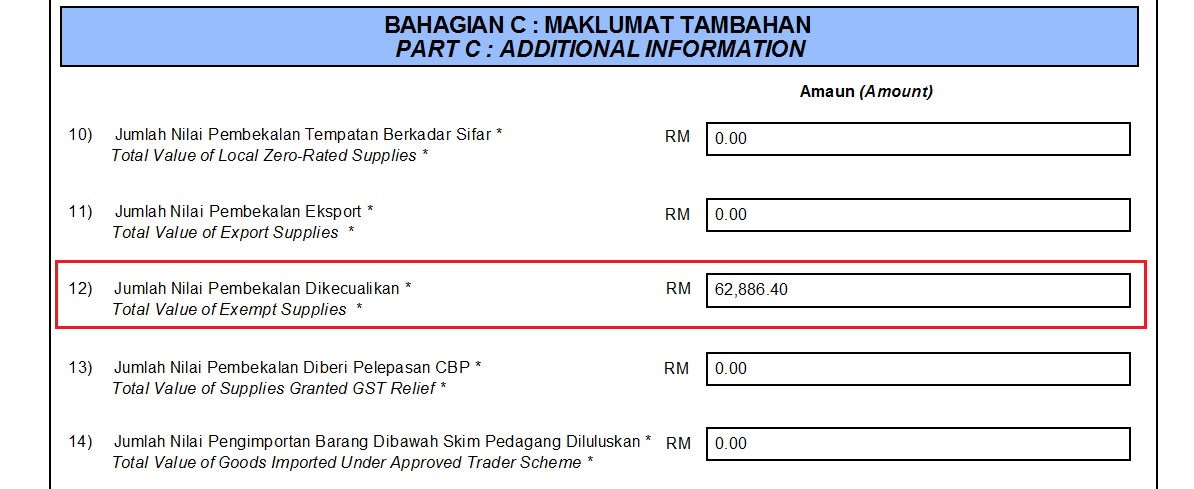

PART C : ADDITIONAL INFORMATION

| Item No. | Description | Guidelines |

|---|---|---|

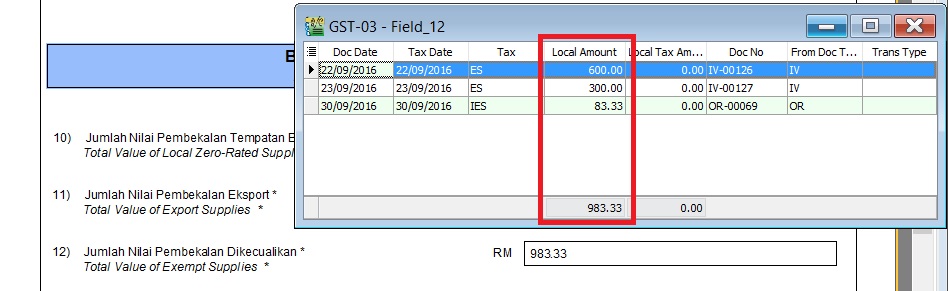

| 10 | Total Value of Local Zero-Rated Supplies* | ZRL + NTX (Taxable Amount) |

| 11 | Total Value of Export Supplies* | ZRE + ZDA (Taxable Amount) |

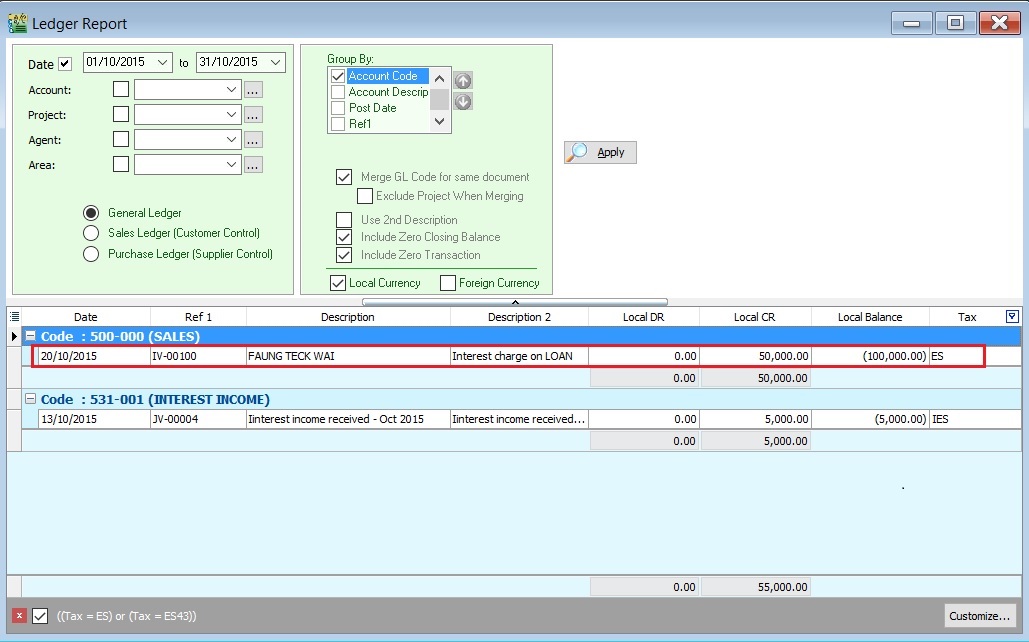

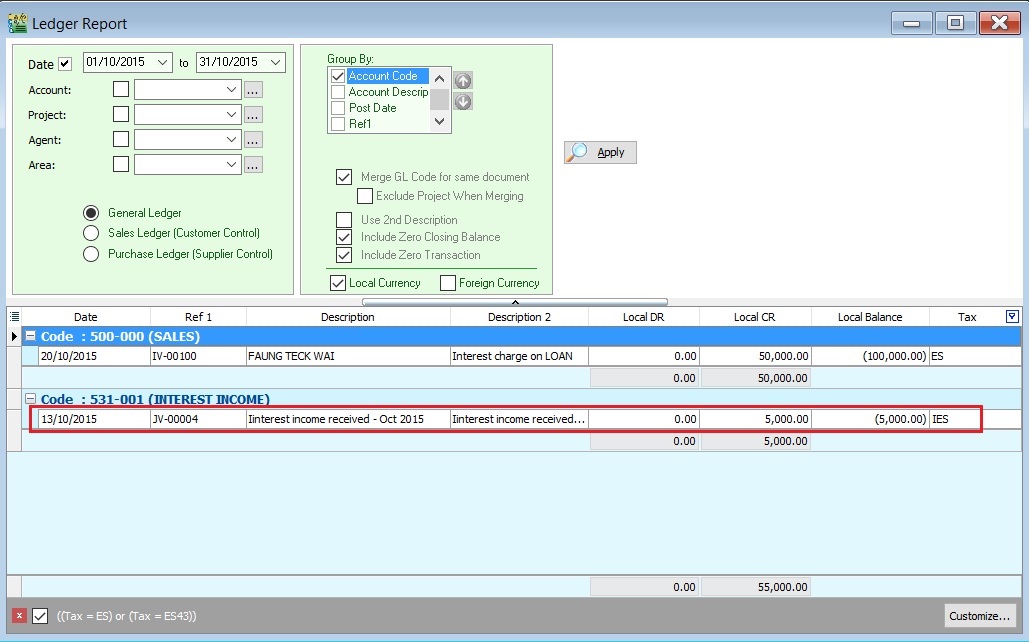

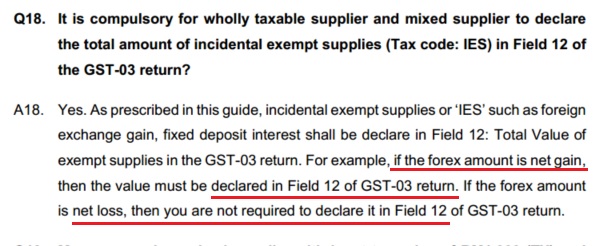

| 12 | Total Value of Exempt Supplies* | IES + ES (Taxable Amount) |

| Note: Net Loss in Forex (IES) = 0.00 | ||

| 13 | Total Value of Supplies Granted GST Relief* | RS (Taxable Amount) |

| 14 | Total Value of Goods Imported Under Approved Trader Scheme* | IS (value excluding tax) |

| 15 | Total Value of GST Suspended under item 14* | IS x 6% (value of tax) |

| 16 | Total Value of Capital Goods Acquired* | TX + TX-CG + IM (value excluding tax) |

| Note: Regardless of purchase asset value. Purchase doc/Cash Book PV/ JV using "Fixed Asset" GL Account (exclude Block Tax). | ||

| 17 | Total Value of Bad Debt Relief Inclusive Tax* | AJP (value including tax) – Only Debtor (106 x AJP Input Tax / 6) |

| 18 | Total Value of Bad Debt Recovered Inclusive Tax* | AJS (value including tax) – Only Debtor (106 x AJS Input Tax / 6) |

| 19 | Breakdown Value of Output Tax in accordance with the Major Industries Code | Picks from GL Accounts that need MSIC Code: Sales Account, Cash Sales Account, Return Inwards, etc. |

| MSIC Code is a 5-digit code representing your business nature. | ||

| Used in Form GST-03 (Item 19). | ||

| The total GST amount of the respective MSIC Codes will be shown. | ||

| Others will be filled automatically if exceeding 5 MSIC codes. | ||

| Refer to list of MSIC 2008. |

PART D : DECLARATION

| Item No. | Description | Guidelines |

|---|---|---|

| 20 | Name of Authorized Person* | User name from Tools -> Maintain User... |

| 21 | Identity Card No.* | IC (New) from Tools -> Maintain User... (Misc tab) |

| 22 | Passport No.* | Passport from Tools -> Maintain User... (Misc tab) |

| 23 | Nationality* | Nationality from Tools -> Maintain User... (Misc tab) |

| 24 | Date | Process Date |

| 25 | Signature | Sign on GST-03 print copy. |

Column with (*) is a mandatory field.

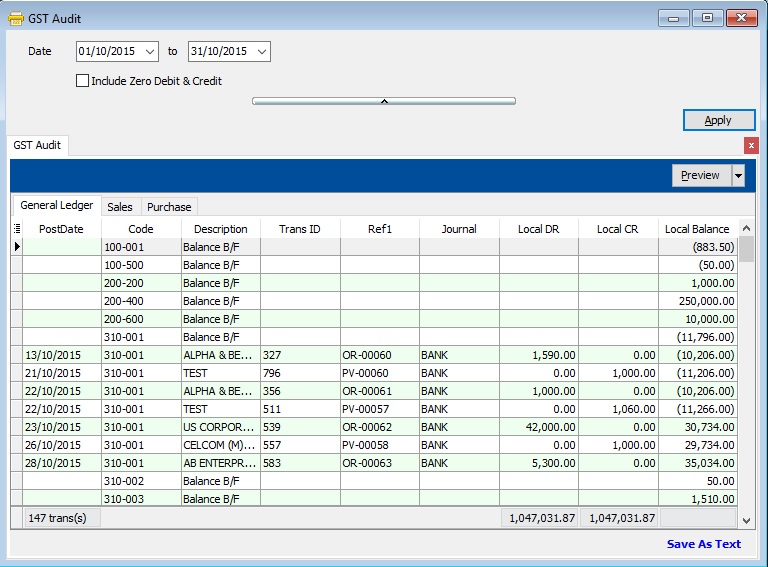

Generate GST Audit File (GAF)

To generate the GST Audit File (GAF) upon RMCD request. Source from: RMCD - GAF Guilde

GST Audit File (GAF)

GST Audit File (GAF) has break into 3 parts:

- General Ledger

- Sales

- Purchase

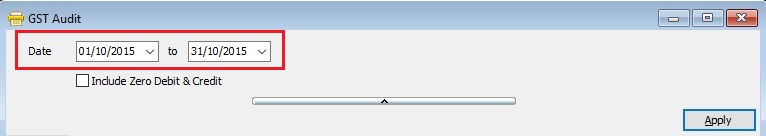

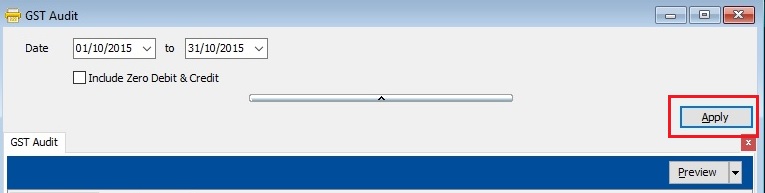

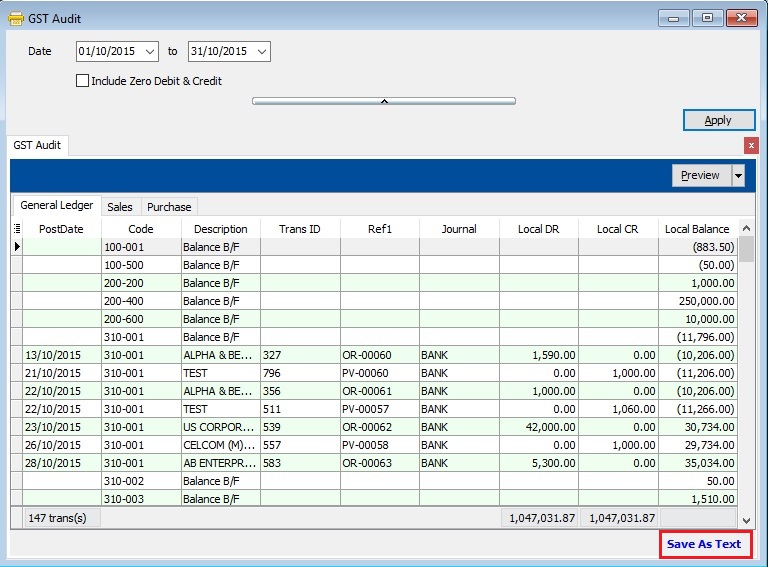

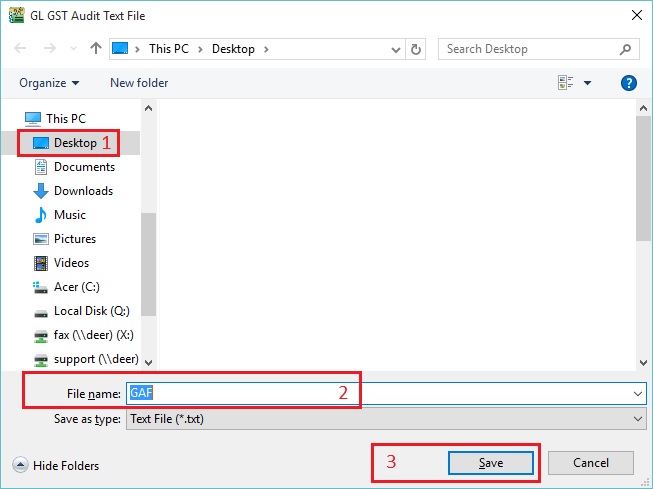

How to Export the GAF File

-

Select the date range.

-

Click on APPLY.

-

Click on Save As Text.

-

Select the destination directory to save the GAF file. See the below screenshot.

-

File generated successfully. Press OK to exit the below message.

Print GST Bad Debt Relief

A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec.58 of the GSTA 2014 and the person has not received any payment or part of the payment in respect of the taxable supply from the debtor after the sixth month from the date of supply.

The bad debt relief may be claimed if - (amended on 28 Oct 2015 from DG Decision) (a) requirements under s.58 GSTA and Part X of GST Regulations 2014 are fulfilled; and (b) the supply is made by a GST registered person to another GST registered person

The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply. If the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month, then the taxable person has to notify the Director General (DG) within 30 days after the expiry of the sixth month on his intention to claim at a later date.

A GST registered person who has made the input tax claim but fails to pay his supplier within six months from the date of supply shall account for output tax immediately after the expiry of the sixth month (s.38(9) GSTA).

The word ‘month’ in sec.58 refers to calendar month or complete month – Example: Invoice issued at 15 th January 2017. For monthly taxable period, the sixth month expires at the end of June and the bad debt relief shall be claimed in July taxable period.

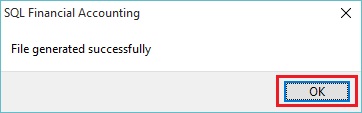

See below the overview of GST Bad Debt Relief system flow:

Check List Related to Bad Debt Relief

Maintain Tax (Bad Debt Relief)

Below tax code will be AUTO used for Bad Debt Relief matter when process GST Return:

| Tax Code | Description | Tax Acc Entry | Explanation |

|---|---|---|---|

| SL-AJP-BD | Input Tax adjustment e.g: Bad Debt Relief | DR GST-Claimable | For customer bad debt relief claim |

| CR GST-Sales Deferred Tax | |||

| SL-AJS-BD | Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months | DR Sales Deferred Tax | For customer bad debt relief recovered |

| CR GST-Payable | |||

| PH-AJP-BD | Input Tax adjustment e.g: Bad Debt Relief | DR GST-Claimable | For supplier bad debt relief recovered |

| CR GST-Purchase Deferred Tax | |||

| PH-AJS-BD | Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months | DR GST-Purchase Deferred Tax | For supplier bad debt relief payable |

| CR GST-Payable |

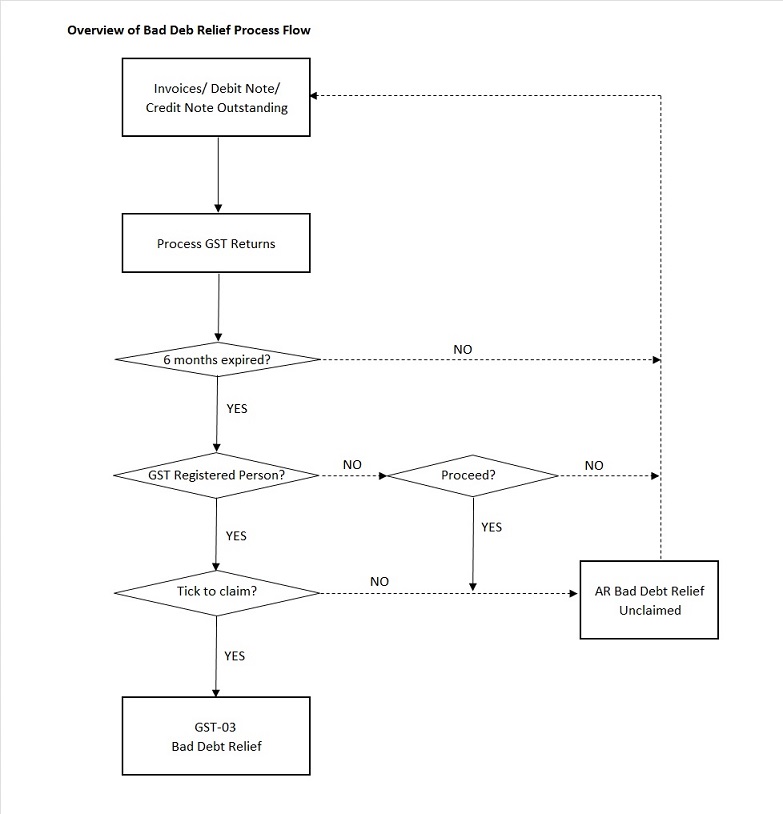

Maintain Customer

-

There is one condition to determine the bad debt relief can be claimed if -

- requirements under s.58 GSTA and Part X of GST Regulations 2014 are fulfilled; and

- the supply is made by a GST registered person to another GST registered person

-

Therefore, you need to update the GST No for your customer who is GST registered person. See the screenshot below.

-

Under the Tax tab in Maintain Customer,

Process GST Returns

-

Process GST Return. For example, process from 01/10/2015 to 31/10/2015.

-

Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months.

-

Sales documents from the company has empty GST No will be un-ticked. You can tick the documents if you think this company is a GST Registered person.

TIPS:

TIPS:To avoid to tick the documents manually for GST Registered company, please go to update the GST no at Maintain Customer.

-

Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No.

-

If you have confirmed that the company is Non-GST Registered person then you can press YES to proceed.

-

Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a GST Registered person before process the GST Return.

GST Listing (Bad Debt Relief)

Category Others will appeared in GST Listing if there is found bad debt relief (eg. AJS-BD, AJP-BD):

| Category | Description | Local Amount | Local Tax Amount |

|---|---|---|---|

| AJS-BD | Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months | 17,000.00 | 1,020.00 |

| AJP-BD | Input Tax adjustment e.g: Bad Debt Relief | 9,114.57 | 546.87 |

GST - 03 (Bad Debt Relief)

-

At GST Return screen, you can direct preview the GST-03 by click on the GST-03 button (see the screenshot below).

-

GST-03 result from the above sample data:

GST-03 # Description Amount 5a Total Value of Standard Rated Supply 0.00 5b Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) 1,020.00 6a Total Value of Standard Rate and Flat Rate Acquisitions 0.00 6b Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments) 546.87 17 Total Value of Bad Debt Relief Inclusive Tax 9,661.44 18 Total Value of Bad Debt Relief Recovered Inclusive Tax 0.00

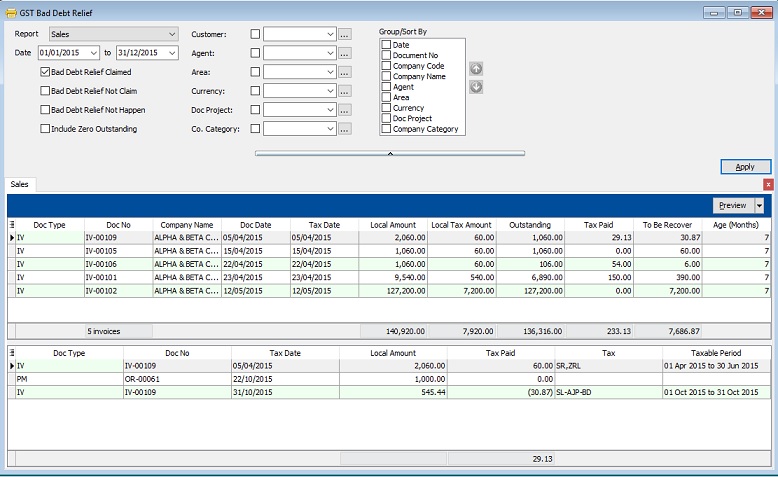

Print GST Bad Debt Relief Report

-

This report is to help you to analyze the GST Bad Debt Relief happenings on each invoices.

-

Let's say the IV-00109 has the following details:-

Seq Description Amount Tax Tax Amount Amount with Tax 1 Sales of coconut can drinks 1,000.00 SR 60.00 1,060.00 2 Sales of coconut 1,000.00 ZRL 0.00 1,000.00 -

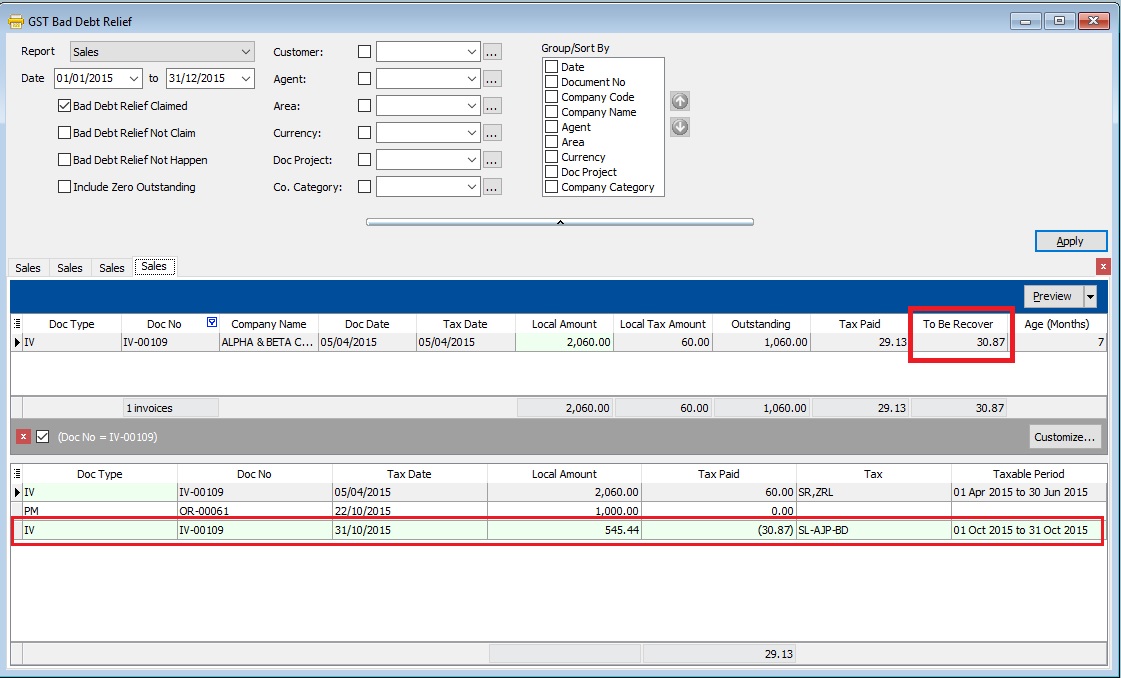

From the below report, it tells you that the bad debt relief claimed and to be recover at Rm30.87 for IV-00109. You can found at the detail that the bad debt relief claimed at Taxable Period 01 Oct 2015 to 31 Oct 2015.

-

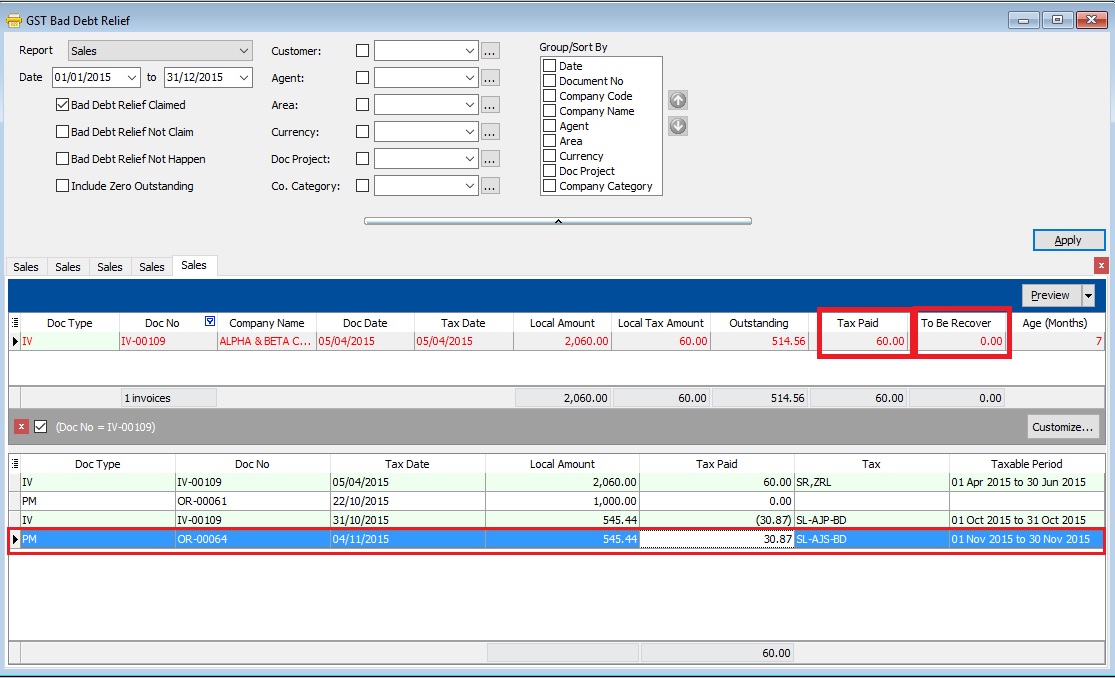

After the IV-00109 has been full settlement in month Nov 2015, you will found the full tax paid Rm60.00 and to be recover will be shown as 0. You can found at the detail that the bad debt relief recovered at Taxable Period 01 Nov 2015 to 30 Nov 2015.

-

There are some option can choose to apply the GST Bad Debt Relief for further checking:

Sales

Checkbox Explanation Bad Debt Relief Claimed GST bad debt relief that you HAVE TICKED to claim on outstanding invoices when process your GST returns. Bad Debt Relief Not Claim GST bad debt relief that you DO NOT TICKED to claim on outstanding invoices when process your GST returns. Bad Debt Relief Not Happen Outstanding invoices the GST Amount not expired at 6 months GST bad debt relief. Include Zero Outstanding To include the outstanding invoices are zero. Purchase

Checkbox Explanation Bad Debt Relief Paid GST bad debt relief have paid on the outstanding supplier invoices when process your GST returns. Bad Debt Relief Not Pay GST bad debt relief not pay yet on the outstanding supplier invoices. It could be due to late receive the supplier invoice. Bad Debt Relief Not Happen Outstanding invoices the GST Amount not expired at 6 months GST bad debt relief. Include Zero Outstanding To include the outstanding invoices are zero. -

Click Preview button. You can found the following report list.

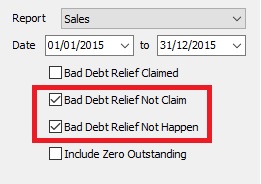

# Report Name Usage 1 GST Bad Debt Relief - Sales GST Bad Debt Relief Listing with detail based on the checkbox ticked. 2 GST-BM Bad Debt Relief-Unclaimed Letter 1 Bahasa Malaysia bad debt relief unclaimed letter format 1 to Director General 3 GST-BM Bad Debt Relief-Unclaimed Letter 2 Bahasa Malaysia bad debt relief unclaimed letter format 2 to Director General 4 GST-EN Bad Debt Relief-Unclaimed Letter 1 English version bad debt relief unclaimed letter format 1 to Director General 5 GST-EN Bad Debt Relief-Unclaimed Letter 2 English version bad debt relief unclaimed letter format 2 to Director General TIPS 1 : To print the bad debt relief unclaimed letter.-

Select the Date Parameter as the GST effective date onwards.

-

Tick both Bad Debt Relief Not Claim and Bad Debt Relief Not Happen to apply follow by preview.

-

This letter applicable to customer has maintained GST No in Maintain Customer only.

-

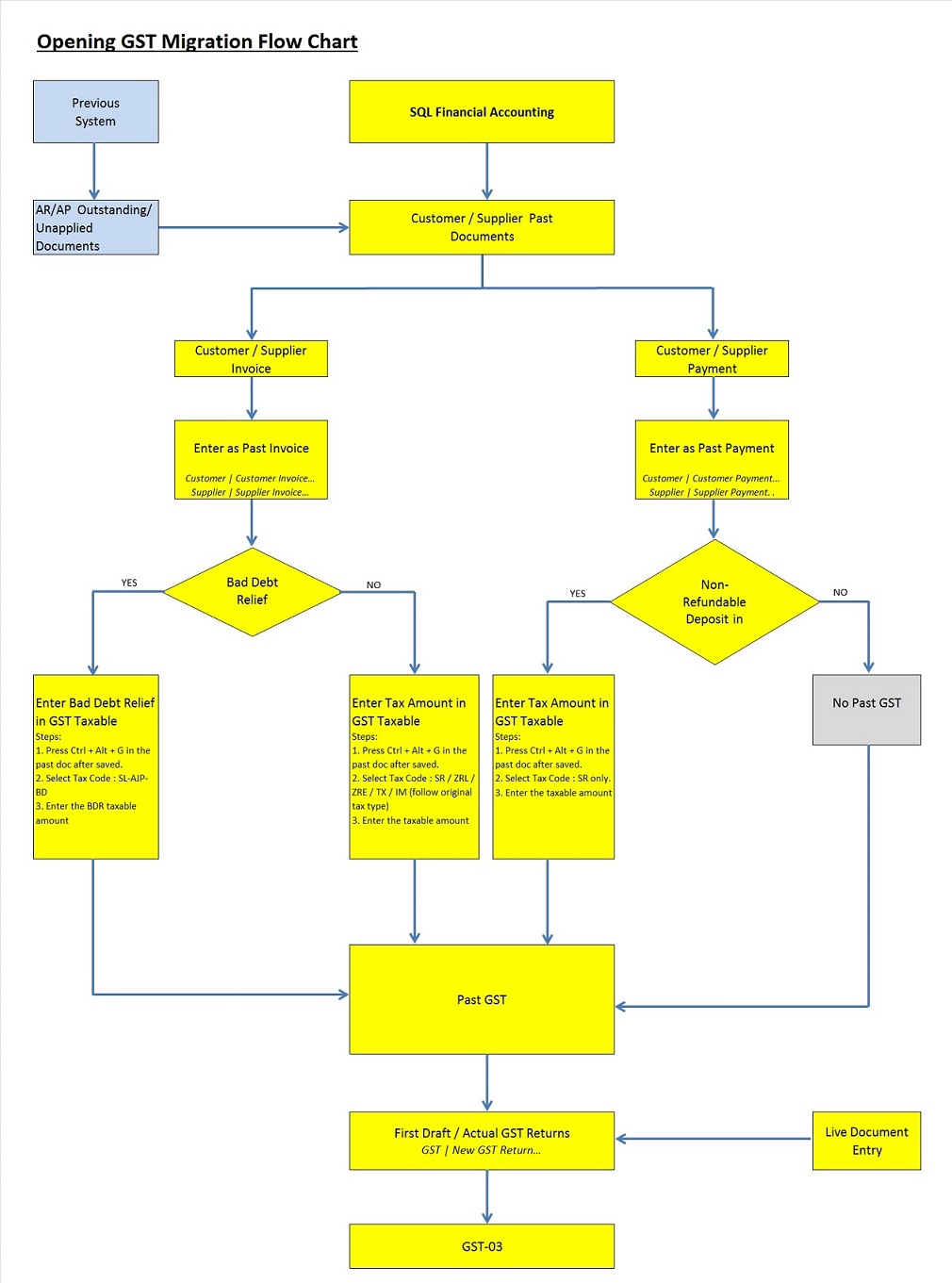

Migration System Features-How to handle the GST Past Documents Opening Balance for Customer and Supplier

How to handle the GST Past Documents Opening Balance for Customer and Supplier?

This guide will teach you the way to handle the past outstanding documents for Customer and Supplier from previous accounting system. We are ensure that the data migration part go smooth with GST matters happened in previous system likes bad debt relief and non-refundable deposit.

Overview of the GST Past Documents for Customer and Supplier:

How to enter GST Past Documents

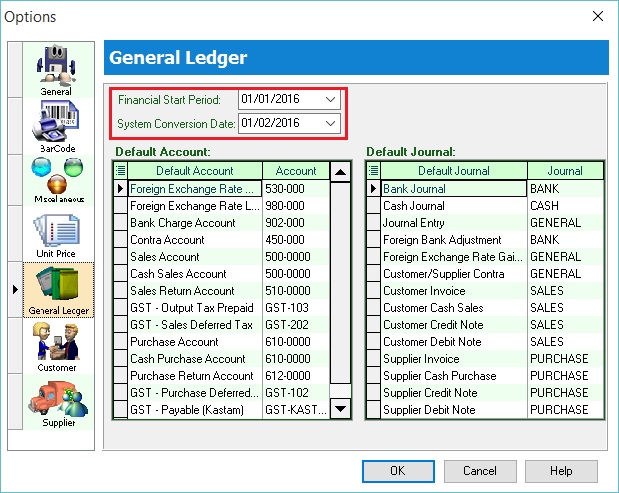

Financial Start Period and System Conversion Date

-

Let's say the company GST reporting period is Monthly. Under the Tools | Options... set the following:- Financial Start Period : 01 Jan 2016 System Conversion Date : 01 Feb 2016 (Cut-off Date for Opening Entry)

NOTE:It is not recommended to set the System Conversion Date fall within the quarterly GST reporting period. Let's say the company GST reporting period is Quarterly.

GST effective date : 01 April 2015

You should set the System Conversion Date: 01 April 2016 or next quarter start date (ie. 01 July 2016).

-

See below screenshot:

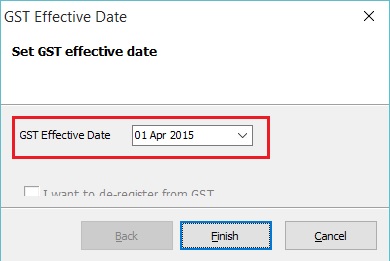

GST Effective Date (Bad Debt Relief)

-

Let's assume the company is GST registered at 01 April 2015.

-

See below screenshot:

Important:

Important:It is very important to set the GST Effective Date where the GST commerce date started. Bad debt relief will based on the GST Effective date.

For example, GST effective date set on 1 April 2015 and system conversion date is 1 Jan 2016. Pass document dated in 15 July 2015 (it is after the GST effective date). Therefore, the Bad Debt Relief will be process in GST Returns-Jan 2016 automatically.

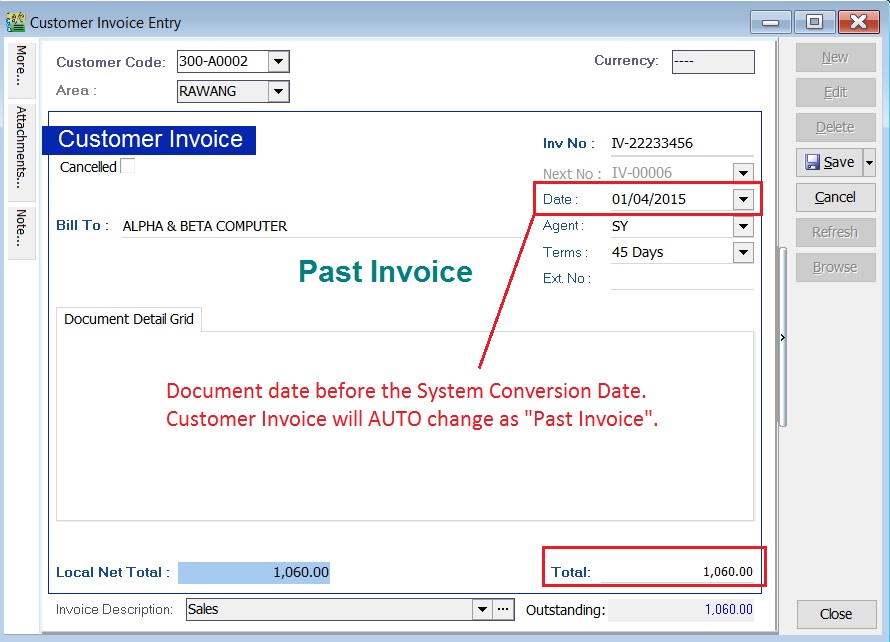

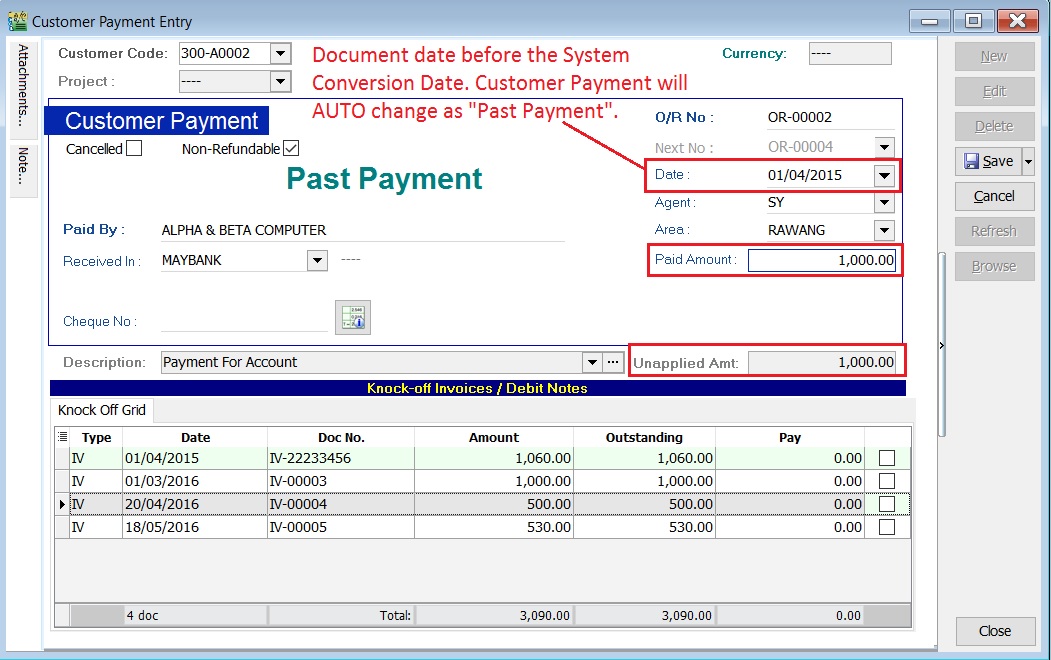

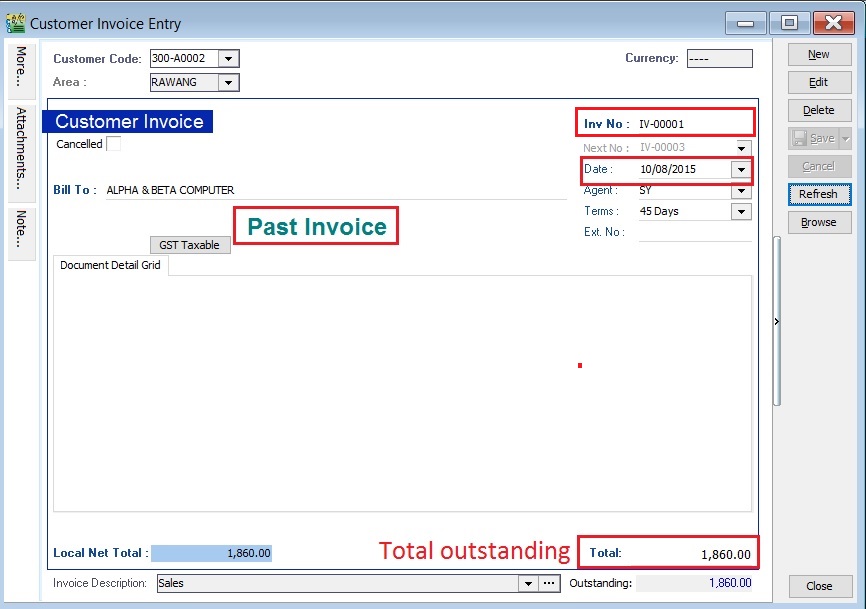

Enter the Past Documents (AR & AP)

-

Create new customer/supplier invoice.

-

Enter the Invoice No.

-

Enter the Original Invoice Date. Date before the system conversion date, the document will converted to "Past Invoice" automatically.

-

Enter the Outstanding Invoice Balance into Total.

-

Save it.

-

See screenshots below.

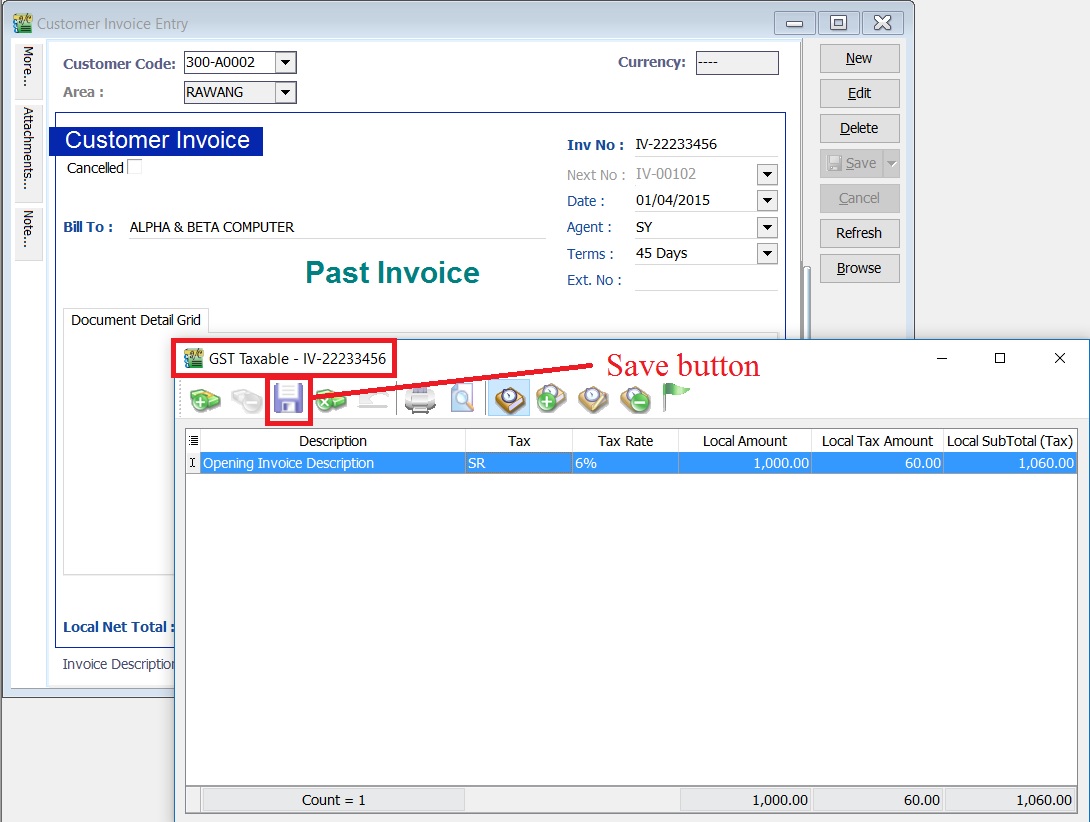

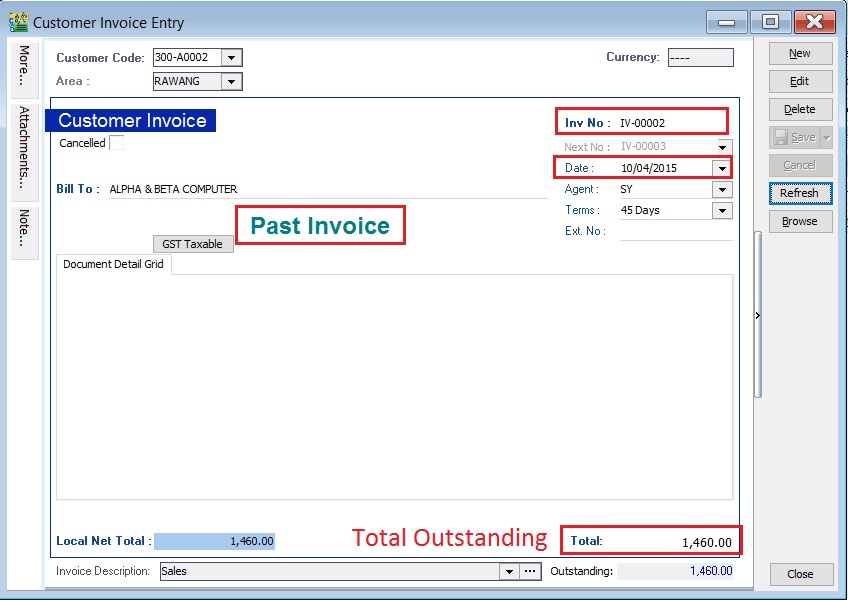

Screenshot 1: Past Invoice:

Screenshot 2: Past Payment:

-

Take note to the below table.

Action Where to Enter? To enter the Customer Past Tax Invoice a. Go to Customer / Customer Invoice... b. Refer the above step 1. To enter the Supplier Past Tax Invoice a. Go to Supplier / Supplier Invoice... b. Refer the above step 1. To enter the Customer Past Non-Refundable Deposit (for SR, ZRL, ZRE) a. Customer / Customer Payment... b. Refer the above step 1. c. Tick the Non-Refundable checkbox (for SR only). d. Un-tick the Non-Refundable checkbox (for ZRL & ZRE).

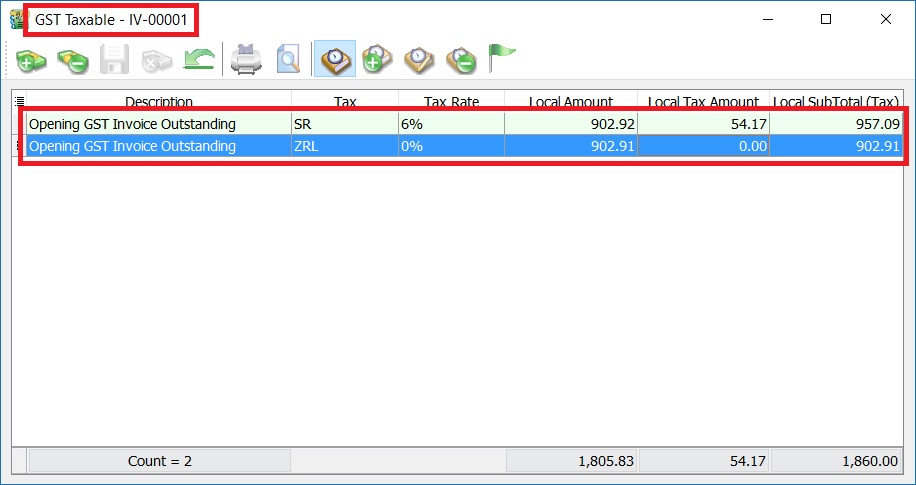

Enter the GST Taxable for Past Documents (AR & AP)

-

Open the past tax invoice document.

-

Press CTRL + ALT + G.... You able to assign the tax code (SR / ZRL / ZRE / TX / IM...etc), the taxable amount (eg. Rm 1,000.00) and the tax amount (eg. Rm 60.00) for past document.

Note:Document must be saved before press CTRL + ALT + G.

-

Save it.

-

See screenshot below.

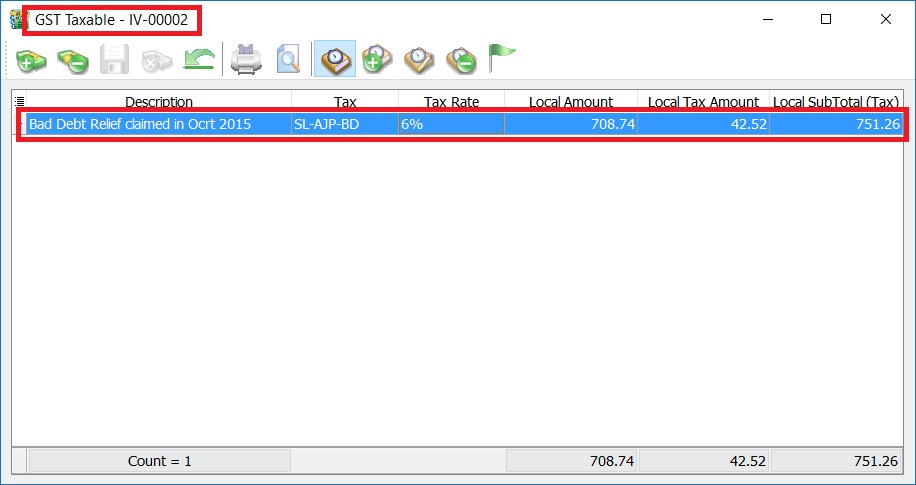

Screenshot 3: GST Taxable:

-

Take note to the below table.

Action Where to Enter? To enter GST Taxable for the Customer Past Tax Invoice a. Go to Customer / Customer Invoice... b. Refer the above step 1. c. Tax code commonly apply to this matter is SR / ZRL / ZRE / SL_AJP-BD (for bad debt relief claimed as input tax in old system). To enter GST Taxable for the Supplier Past Tax Invoice a. Go to Supplier / Supplier Invoice... b. Refer the above step 1. c. Tax code commonly apply to this matter is TX / IM / PH_AJS-BD (for bad debt relief paid as output tax in old system). To enter GST Taxable for the Customer Past Non-Refundable Deposit a. Go to Customer / Customer Payment... b. Refer the above step 1. c. Tax code commonly apply to this matter is SR.

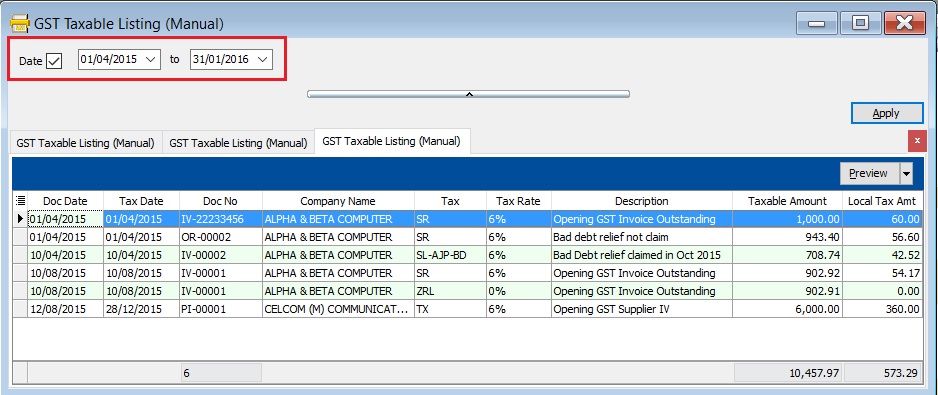

Past Documents GST Taxable Listing

-

Select the date range to apply.

date from (GST effective date) and date to (before the system conversion date).

-

See screenshot below.

Screenshot 4: GST Taxable Listing:

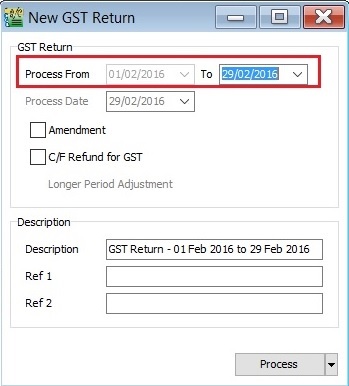

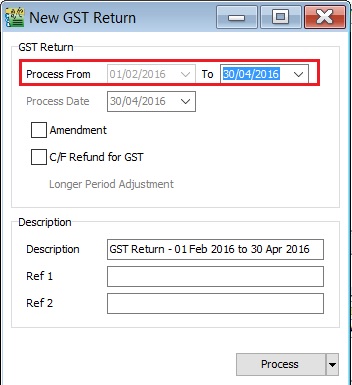

GST Returns

-

Select the date range. See screenshot below.

-

Monthly (eg. 01/02/2016 - 29/02/2016)

-

Quarterly (eg. 01/02/2016 - 30/04/2016)

-

-

Click to Process.

-

Past GST transactions will generated automatically after click Process. See below screenshot.

Tips:

Tips:To check the past GST listing, click on GST Listing button.

-

Current GST Returns will be processed at the same times. See below screenshot.

Special Cases

Case 1: Claim bad debt relief based on the outstanding in SQL Accounting

-

Old System

-

invoice Invoice No: IV-00001 Invoice Date: 10 Aug 2015 Invoice Doc Amount: 2,060.00 Invoice Details:

Tax Local Amount Local Tax Amount SubTotal SR 1,000.00 60.00 1,060.00 ZRL 1,000.00 0.00 1,000.00 Total 2,060.00 -

Payment OR Date: 20 Aug 2015 Knock-Off Amount: 200.00

-

Invoice Outstanding: 1,860.00

-

-

SQL Account

-

Past Invoice: Past Invoice No: IV-00001 Past Invoice Date: 10 Aug 2015 Past Invoice Total: 1,860.00

NOTE:User should key-in the total outstanding in the Past Invoice, eg. 2,060.00 - 200.00 = 1,860.00.

See example of past invoice in below screenshot.

-

Past GST Taxable Detail:

Tax Taxable Amount Local Tax Amount SubTotal SR 902.92 54.17 957.09 OR

Tax Taxable Amount Local Tax Amount SubTotal SR 902.92 54.17 957.09 ZRL 902.91 0.00 902.91 Total Outstanding 1,860.00 See example of past GST taxable in below screenshot.

-

Case 2: Bad debt relief claimed and partial recover in Old System; partial or fully recover in SQL Account

-

Old System

-

Invoice:

Invoice No: IV-00002 Invoice Date: 10 April 2015 Invoice Doc Amount: 2,060.00 Invoice Details:

Tax Local Amount Local Tax Amount SubTotal SR 1,000.00 60.00 1,060.00 ZRL 1,000.00 0.00 1,000.00 Total 2,060.00 -

Payment #1:

OR Date: 20 April 2015 Knock-Off Amount: 200.00 Bad Debt Relief detail from outstanding invoice:

Tax Local Amount Local Tax Amount AJP-BD 902.92 54.17 -

Payment #2:

OR Date: 01 Nov 2015 Knock-Off Amount: 400.00 Bad Debt Recover details:

Tax Local Amount Local Tax Amount AJS-BD 194.18 11.65 -

Invoice Outstanding: 1,460.00

-

-

SQL Account

-

Past Invoice:

Past Invoice No: IV-00002 Past Invoice Date: 10 April 2015 Past Invoice Total: 1,460.00

Note:User should key-in the total outstanding in the Past Invoice, eg. 2,060.00 - 200.00 - 400.00= 1,460.00.

See example of past invoice in below screenshot.

-

Past GST Taxable Detail:

Tax Taxable Amount Local Tax Amount SubTotal SL-AJP-BD 708.74 42.52 751.26

NOTE:User no need to key-in the payment #1 and payment #2 in SQL Account. Outstanding Taxable amount = 902.92 (Payment #1) - 194.18 (Payment #2) = 708.74 Bad debt relief not recover = 54.17 (Payment #1) - 11.65 (Payment #2) = 42.52 Any current payment knock-off to the above invoice will automatically treat as bad debt recover in next taxable period.

See example of past GST taxable in below screenshot.

-

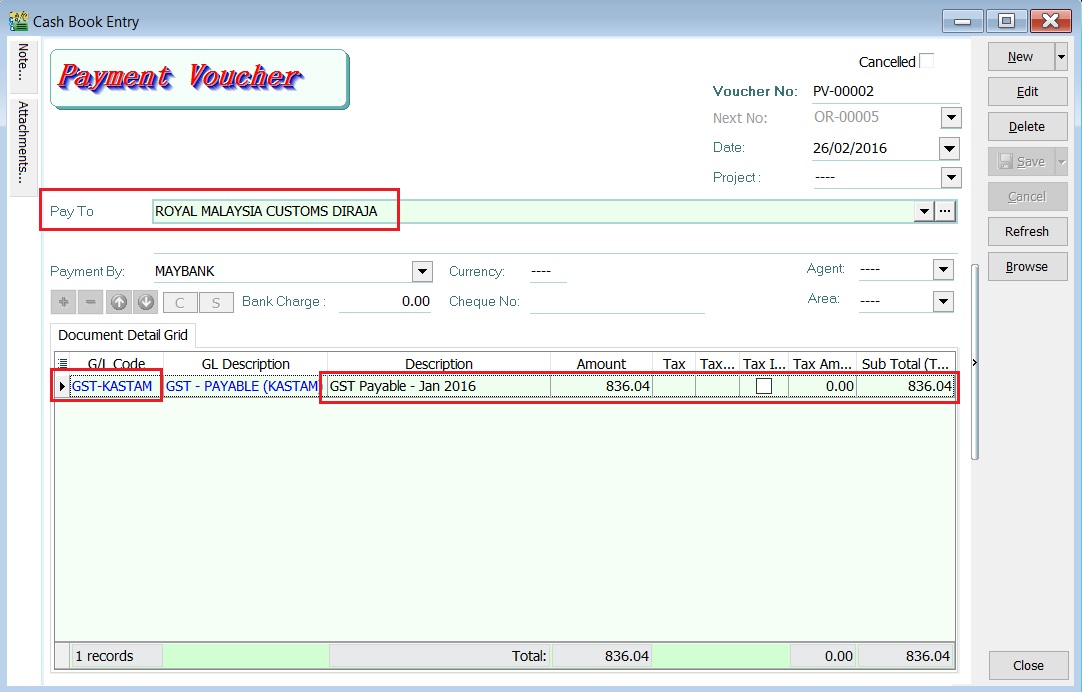

GST - Payment to RMCD

- Net GST Payable is the total GST amount to be paid to RMCD.

- Net GST Claimable is the total GST amount to be claimed or refund from RMCD.

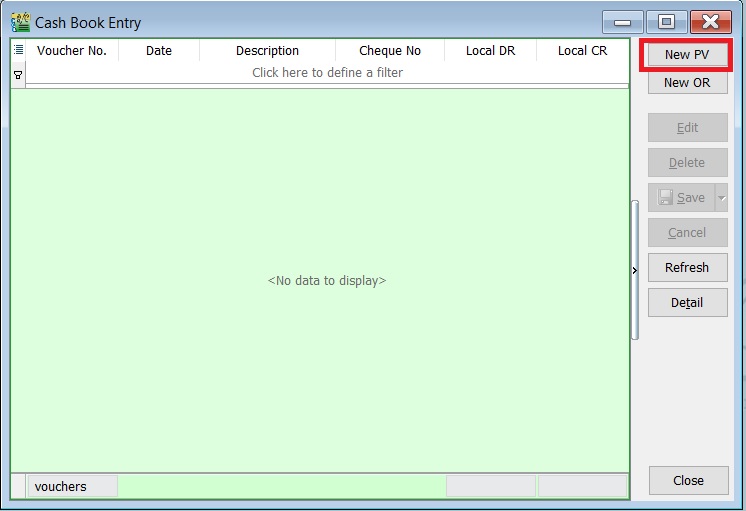

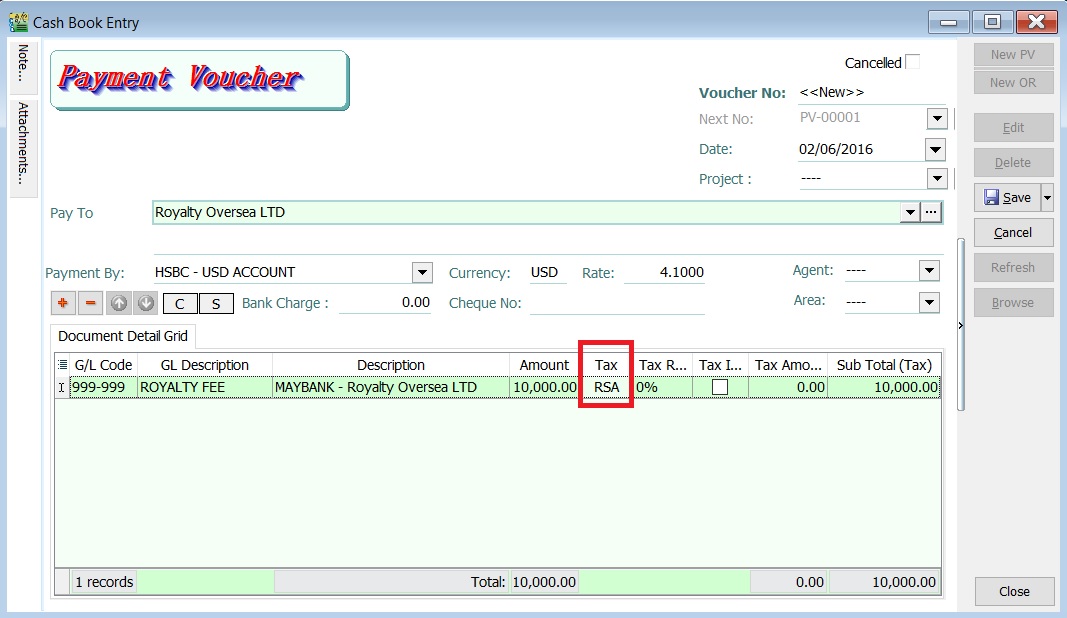

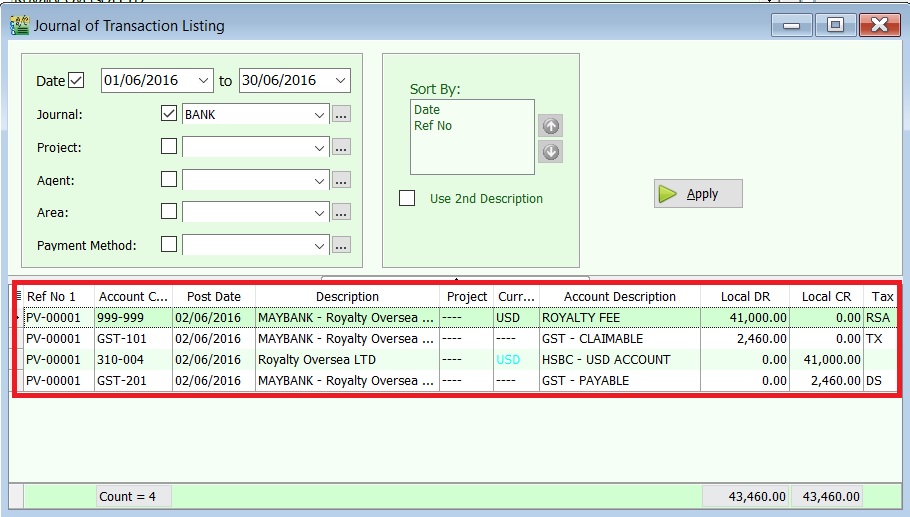

Payment to RMCD

-

Click on the New followed by selecting Payment Voucher.

-

Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Pay To field.

-

At the detail, select GL Code: GST-KASTAM.

-

Enter the description to describe the GST Payable for the period, eg. GST Payable - Jan 2016.

-

Based on the GST Returns, enter the GST amount payable (Rm836.04) into the Amount column.

-

Save it. See the screenshot below.

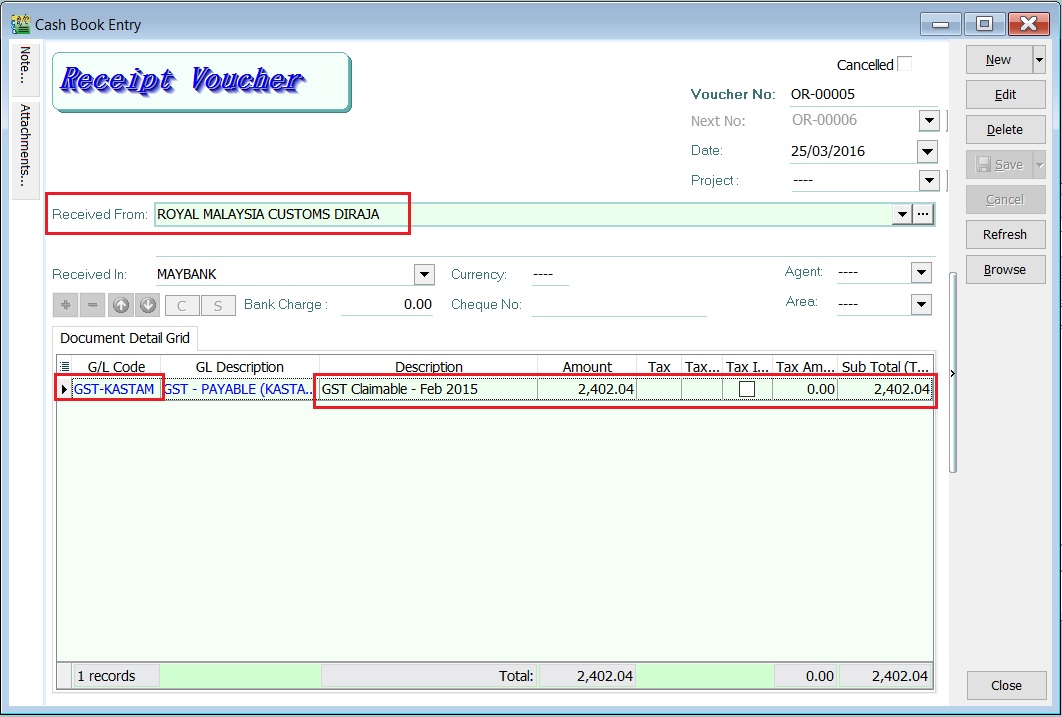

Refund From RMCD

-

Click on the New follow by select Official Receipt.

-

Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Received From field.

-

At the detail, select GL Code: GST-KASTAM.

-

Enter the description to describe the GST Claimable for the period, eg. GST Claimable - Feb 2016.

-

Based on the GST Returns, enter the GST amount claimable (Rm2,402.04) into the Amount column.

-

Save it. See the screenshot below.

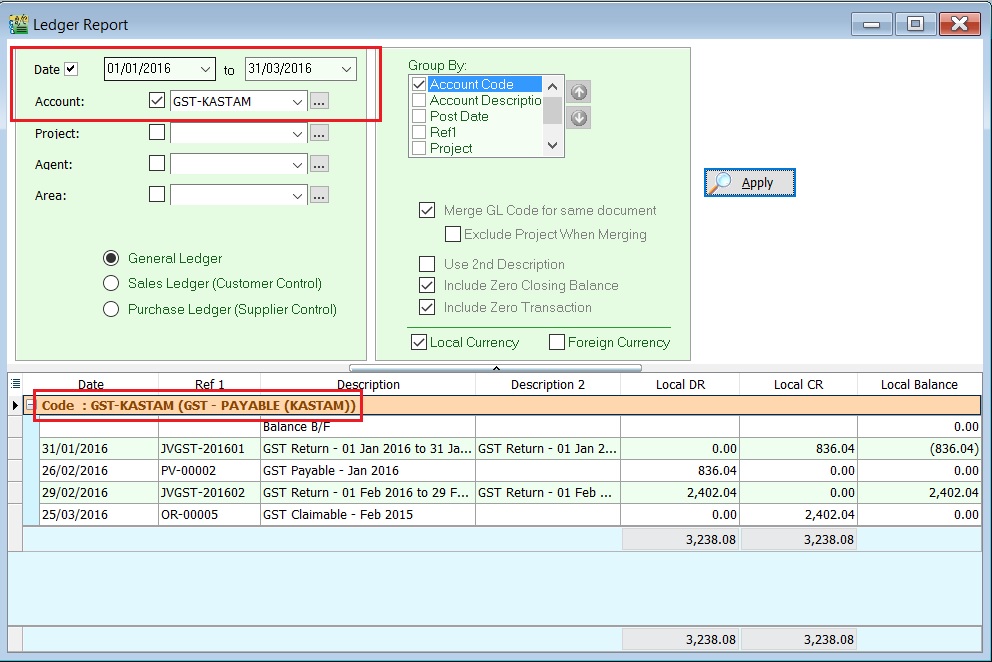

GST - Kastam Account Inquiry

-

Select the date range.

-

Select the GL Account code : GST-KASTAM.

-

Click Apply.

-

RMCD outstanding transactions will be display as below.

GST - GST-03 Amendment

For those company who might asked and self report to RMCD for the GST-03 amendment. It could be because of applying wrong tax code or others reasons. Therefore, this guide will explain the features to perform amendment on the particular GST-03 and re-submit via TAP website.

Notification On GST 03 Return Amendment

In accordance with Regulation 69 of the GST Regulation 2014, with effect from 23 August 2016, rules on return amendments are follows:

- There is no limit on return amendments until due date of submission of return.

- Amendment are allowed once within 30 days (for monthly taxable period) or 90 days (for quarterly taxable period) after last day of submission of return. Subsequent amendment are subject to approval by GST Officer.

- Amendment after the period stated in PARA 2 above are subject to approval by GST Officer.

- Amendment can be made through TAP but are subject to approval by GST Officer.

- Return amendments which are not approved by GST Officer is considered invalid and previous return made before the amendment will be accepted.

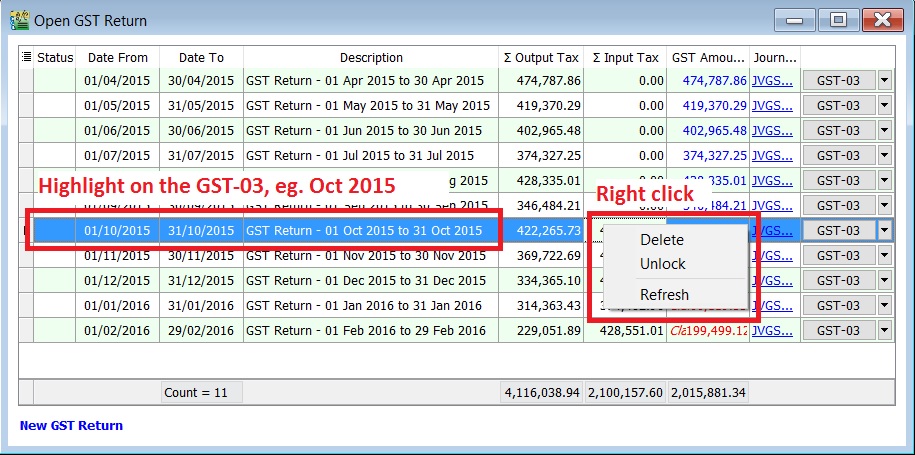

GST - 03 Amendment

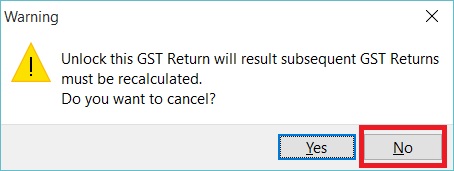

-

Highlight and right click on the GST-03 that you are required to resubmit as amendment.

-

Select Unlock.

-

Click on No to unlock this GST Return.

Important:

Important:Read the message before take further actions.

-

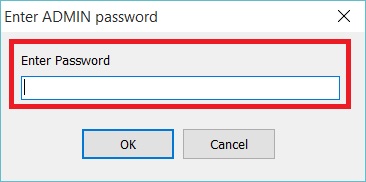

Enter the ADMIN password.

NOTE:

NOTE:ADMIN password only

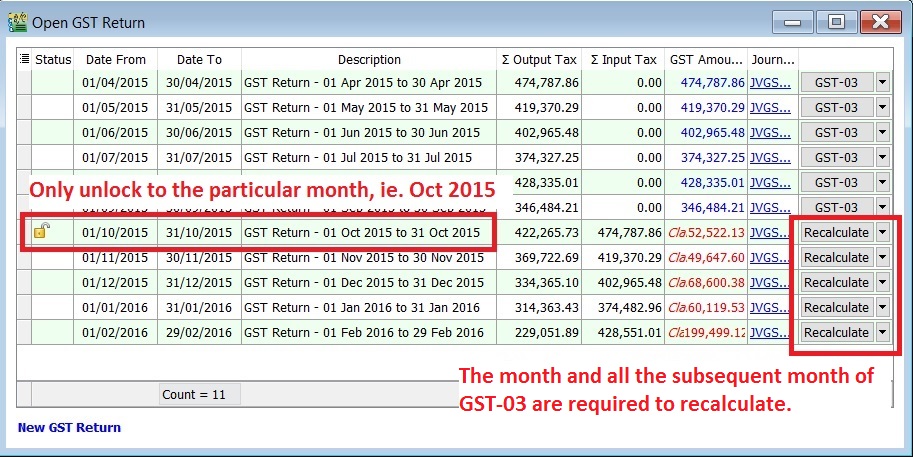

-

Status will added Unlock icon. It means users are allow to amend the documents for the month unlock, eg. the documents are able to amend in Oct 2015 only.

NOTE:

NOTE:- The month and all the subsequent month of GST-03 will converted to "Recalculate" action. It is depends on the amendment which might trigger the bad debt relief result changed.

- All the subsequent month of GST-03 are not allow to amend the documents (eg. invoice, credit note, supplied invoice, etc), unless you have Unlock it.

-

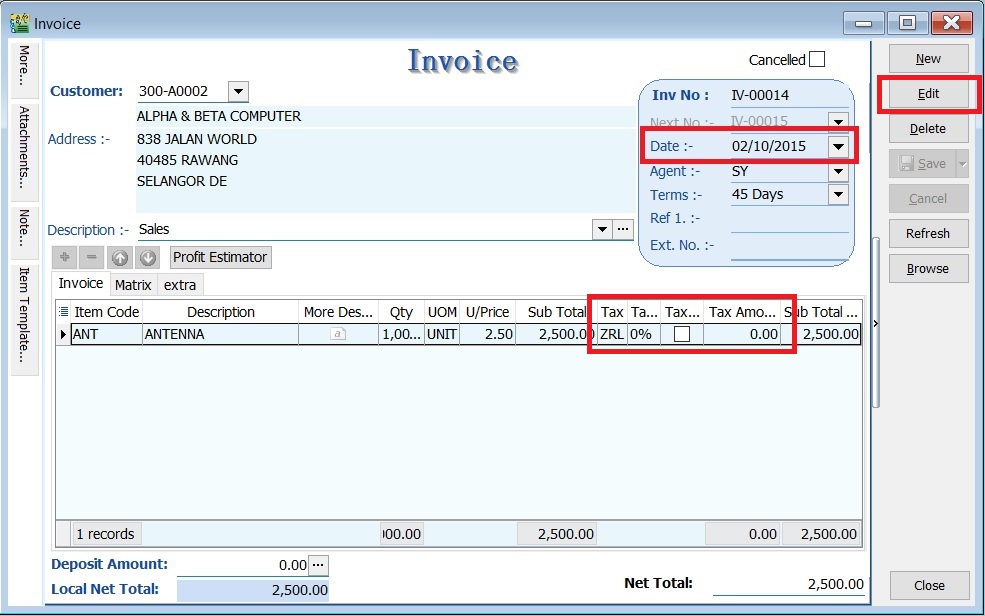

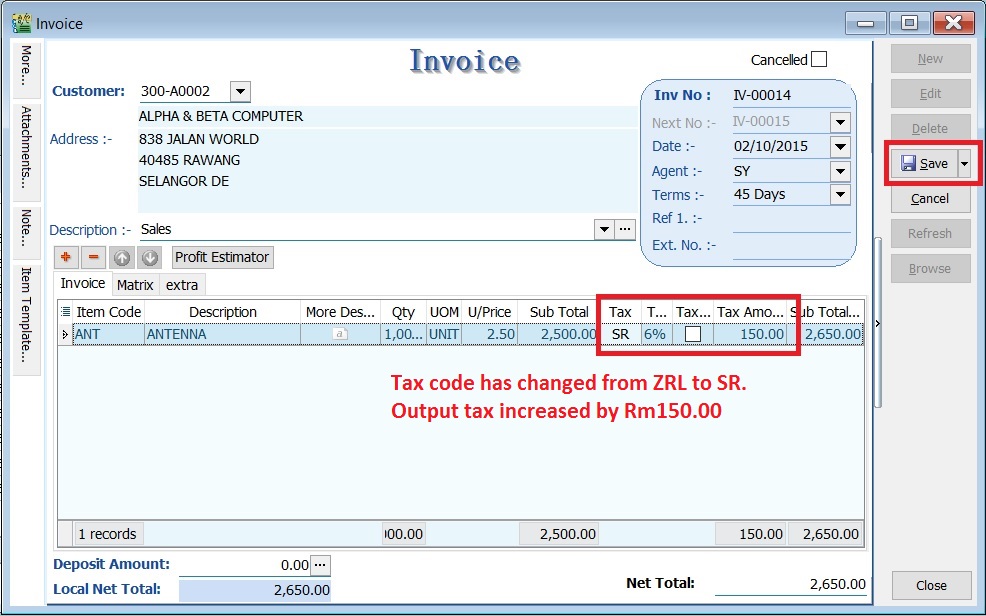

For example, to correct the tax code from ZRL to SR for the invoice amount Rm2,500.00.

-

Edit the invoice (eg. IV-00014 and date: 02 Oct 2015)

::: NOTE:

Unlock GST-03 is allow you to edit the documents only.

:::

-

Change the tax code from ZRL to SR.

-

It will will resulting the output tax increased by Rm150.00 (Rm2,500.00 X 6%).

-

-

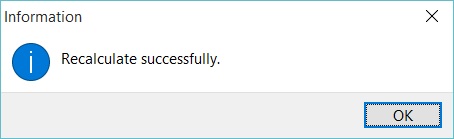

Run Recalculate for the GST-03 (eg. Oct 2015)

-

System will prompt Recalculate successfully.

-

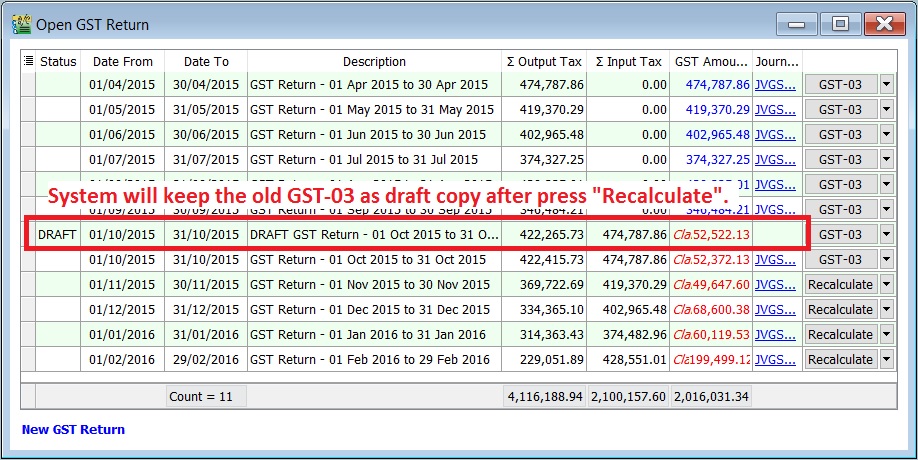

Press ok to proceed and a draft copy of GST-03 for Oct 2015 will create automatically. A previous GST-03 before perform any amendment to the taxable period will converted as DRAFT status.

-

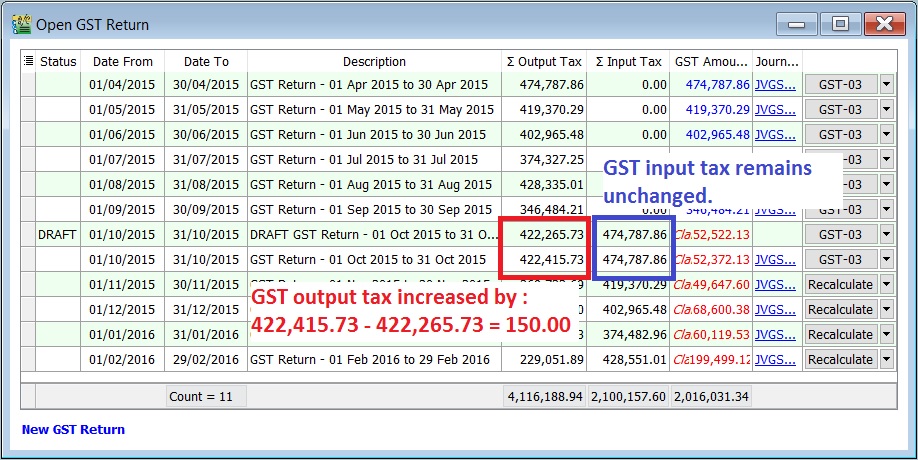

You can see the comparison in between the draft (from Recalculate) and the Final GST-03 for the amendment taxable period.

| Status | Taxable Period | Total Output Tax | Total Input Tax |

|---|---|---|---|

| 01 Oct - 31 Oct 2015 | 422,415.73 | 474,787.86 | |

| Draft | 01 Oct - 31 Oct 2015 | 422,265.73 | 474,787.86 |

| Increase/Decrease (-) | 150.00 | 0.00 |

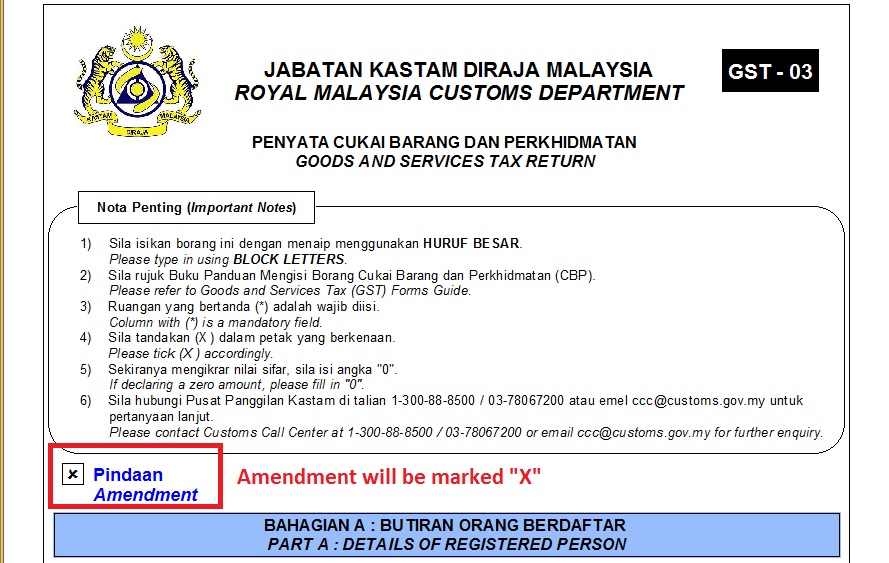

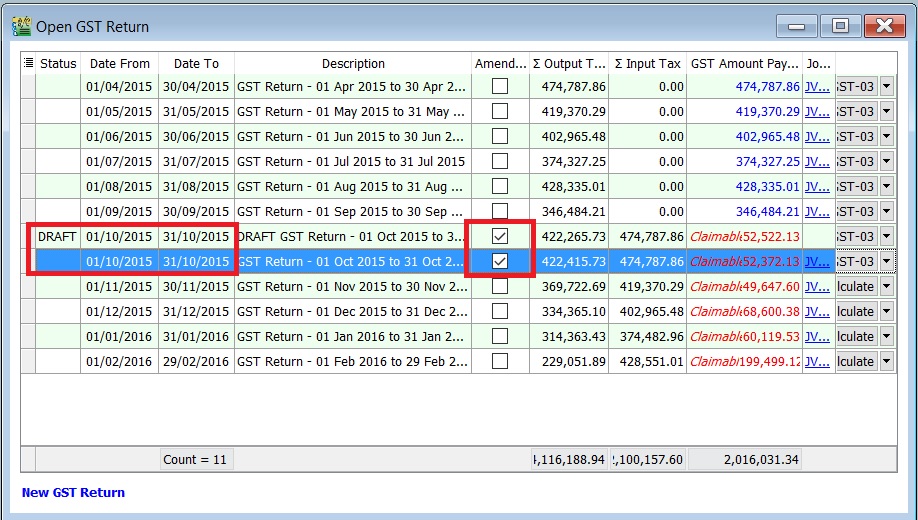

How to know the GST - 03 has performed amendment

-

You can find a cross marked (X) on the amendment column in the GST-03. See the screenshot below.

-

At the GST Returns, insert a grid column Amendment. Usually, you will found the ticked on the amendment column for both DRAFT and final GST-03.

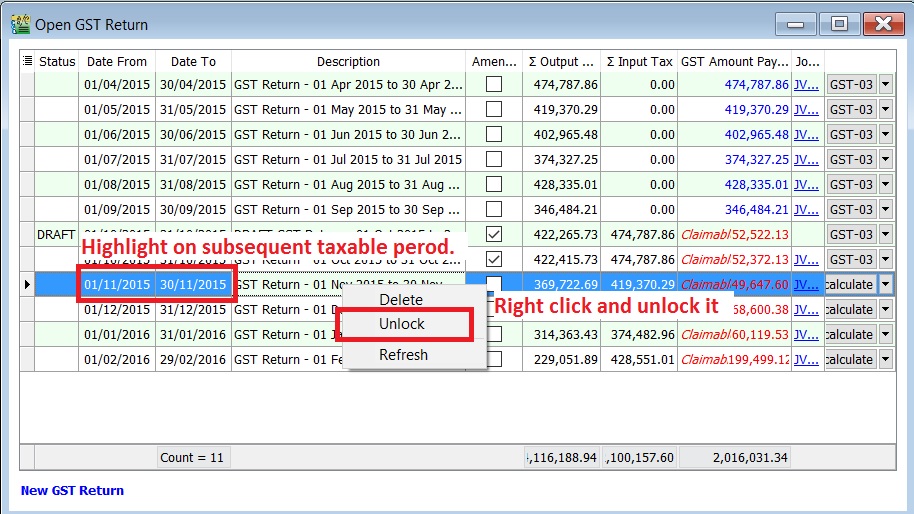

How to unlock the subsequent GST - 03 for amendment

-

Highlight on the subsequent GST-03, eg. for subsequent taxable period is 01 Nov - 30 Nov 2015.

-

Right and unlock it.

How to Avoid Costly GST Errors

This guide will help you to easily identify the common GST errors in GST Returns. To minimize GST amendment and incorrect GST Returns to RMCD. You may wish to take note the follow errors commonly made by businesses:

- Standard Rated Supply (5a) and Output Tax (5b)

- Standard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

- Local Zero-Rated Supplies

- Export Supplies

- Exempt Supplies

- Supplies Granted GST Relief

- Goods Imported Under Approved Trader Scheme and GST Suspended

- Capital Goods Acquired

- Bad Debt Relief

- Bad Debt Recovered

- Output tax value breakdown into Major Industries Code (MSIC Code)

- Other important info required in GAF

- GL Ledger vs GST-03

- Foreign currency exchange rate

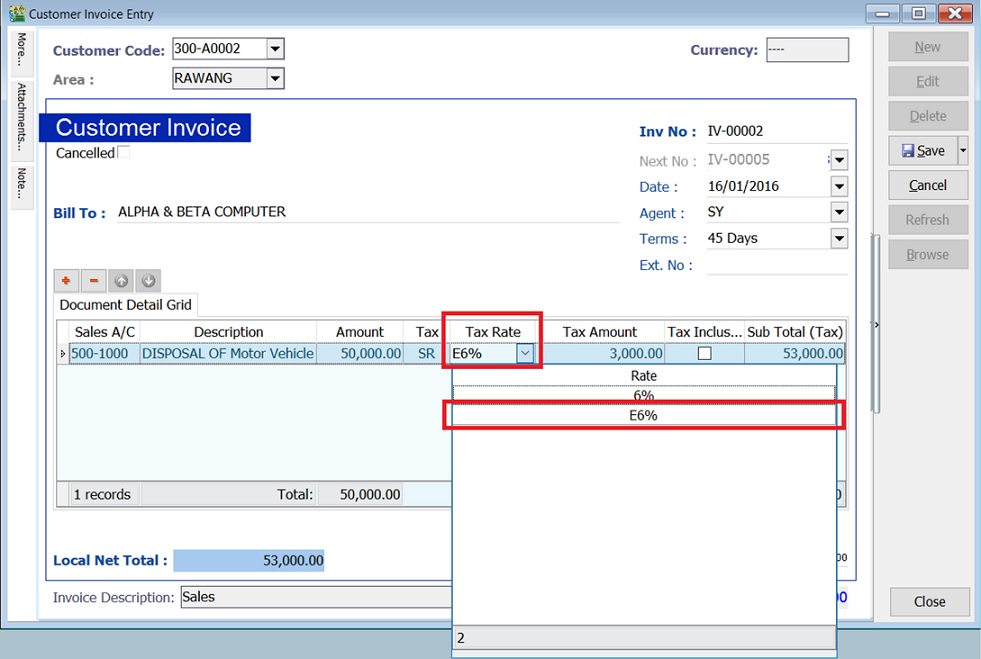

Standard Rate Supply (5a) and Output Tax (5b)

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 5a | Total Value of Standard Rated Supply | SR, DS |

| 5b | Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & others adjustments) | SR, DS, AJS |

- Sale or disposal of business assets

- Goods given free as gift.

- Inter-company transactions

- Margin Scheme

Standard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 6a | Standard Rate and Flat Rate Acquisitions | TX, TX-CG, TX-ES (DMR is fulfilled only), TX-IES (Total/Full amount), TX-RE, IM |

| 6b | Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments) | TX, TX-CG, TX-ES (DMR is fulfilled only), TX-IES (GST Claimable only based on IRR), TX-RE, IM, AJP |

Not all input tax claims are allowable. You can claim input tax on your purchases only if the below conditions are fulfilled.

-

Tax invoice / Simplified Tax Invoice / Custom K1 / Custom K9

- The buyer can use simplified tax invoice if the total amount GST payable is RM30 or less.

- if the total amount of GST payable is more than RM30, the buyer must request for a tax invoice with the name and address of the buyer.

- Tax invoice issued by approved person for Flat Rate Scheme.

- K1 form for imported goods

- K1 and K9 for goods removed from bonded warehouse

-

Supplies made outside Malaysia which would be taxable supplies if made in Malaysia.

-

To be eligible for input tax claim relating to goods that are exported, a registered person (exporter) must ensure that:-

- prescribed customs form for export (K2 / K8) must have an endorsement on Remarks column in Sistem Maklumat Kastam (SMK) – “A claim for input tax under the GST Act 2014 will be made”; and

- Customs Official Receipt.

-

Disregarded supplies (supplies within group, supplies made in warehouse, supplies between venture operator and venturers and supplies between toll manufacturer and overseas principal).

-

Directly attributable to taxable supplies (ie. standard rated supplies and zero rated supplies).

-

Must not be disallowed expenses (or known as Blocked Input Tax).

- Passenger motor cars (not more than 9 passengers including driver and unladen weight does not exceed 3,000 kg) including hiring of car

- Repair and maintenance for motor cars

- Family benefits

- Club subscription fee

- Medical and personal accident insurance

- Medical expenses

- Entertainment expenses for potential customer or others than employees.

-

Must be taxable purchases (ie. purchases made from GST registered suppliers)

Local Zero - Rated Supplies

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 10 | Total Value of Local Zero-Rated Supplies | ZRL, ZDA |

This refer to the following types according to GST (Zero Rate Supplies) Order 2014:-

-

Local supply of goods and services (ZRL):

- Zero-rated supply of goods of any of the descriptions as in Appendix (Zero-rated Supply) Order 2014 based on tariff code in such as milled-rice, fresh fruit, and live animals (cattle, buffalo, goat, sheep and swine),

- Medicaments and medical gases in the National Essential Medicines List issued by the Ministry of Health and approved by the Minister and put up in measured doses or in forms of packaging for retail sale,

- The supply of treated water by a person who is licensed under the Water Services Industry Act 2006 [Act 655] to domestic consumers irrespective of minimum or non-usage,

- The supply of raw materials and components made to a person who belongs in a country other than Malaysia for the treatment and processing of goods by any taxable person under the Approved Toll Manufacturer Scheme, and etc.

-

Supply of goods from Malaysia to Designated Area, ie. Pulau Langkawi, Labuan, & Pulau Tioman (ZDA)

Export Supplies

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 11 | Total Value of Export Supplies | ZRE |

This refer to the Supply of goods or services from Malaysia to Oversea according to GST (Zero Rate Supplies) Order 2014.

- Movement of goods is supported with Customs K2 form which must stated the following:- a. Supplier's name and address as the consignor. b. Recipient's name and address in overseas recipient as the consignee. c. Supply of services must attached with supporting documents such as invoice for an international services. Examples includes sales of air-tickets and international freight charges.

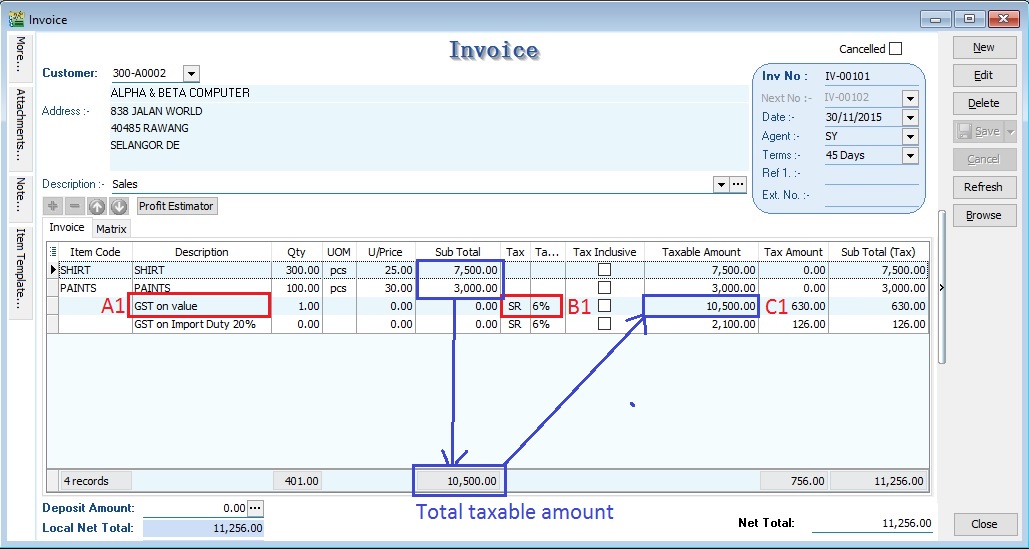

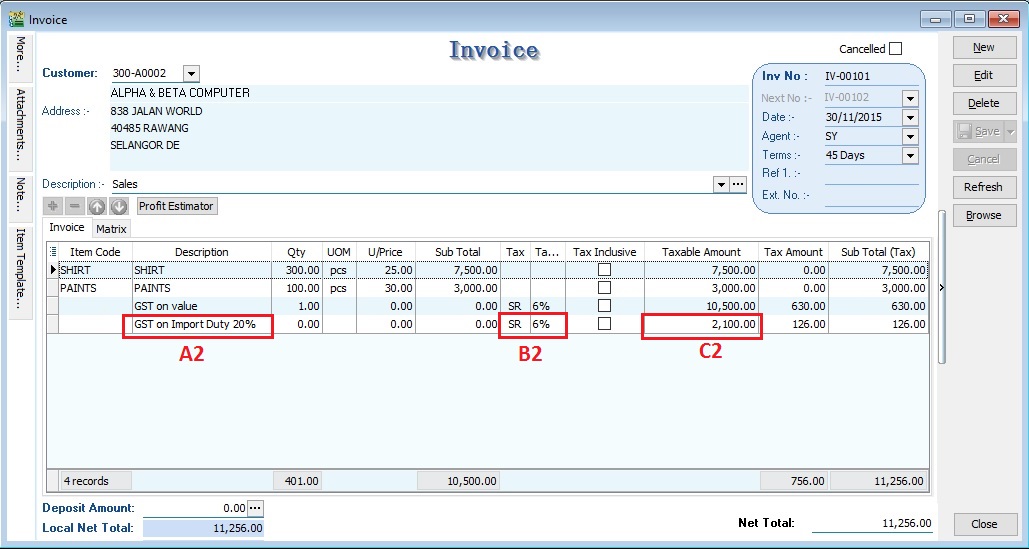

How to check the transactions correctly entered?

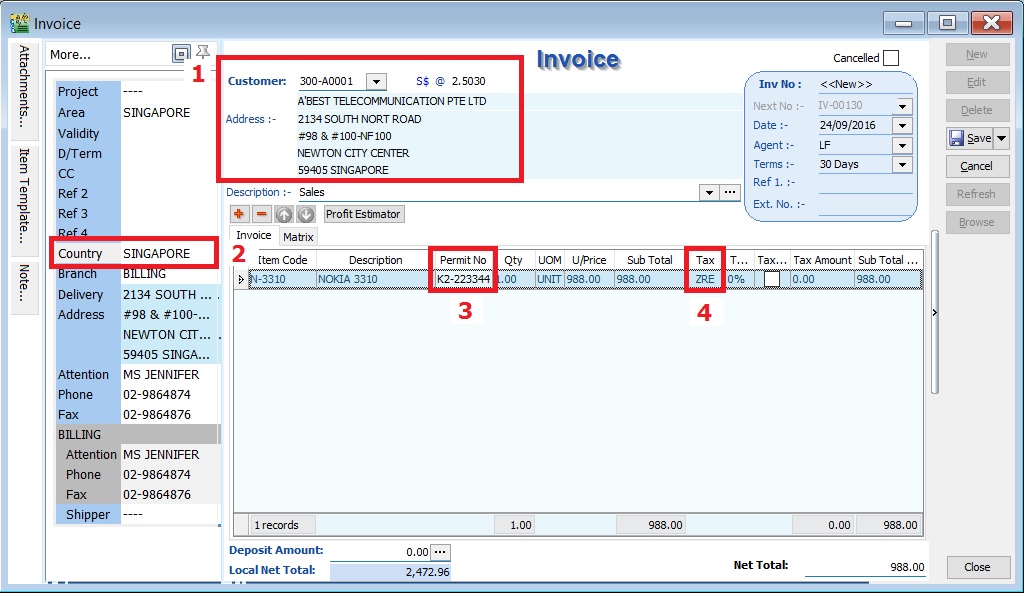

At the invoice entry, please ensure the following screenshot and steps are followed/entered correctly:-

- Customer name and address must be a foreigner company.

- Country to define the destination of goods deliver.

- Permit No to record the Custom K2 no for supporting document reference.

- Tax code must be ZRE.

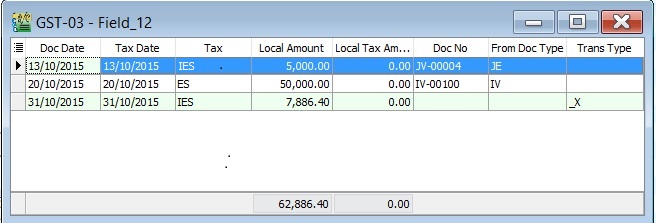

Exempted Supplies

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 12 | Total Value of Exempt Supplies | ES, IES |

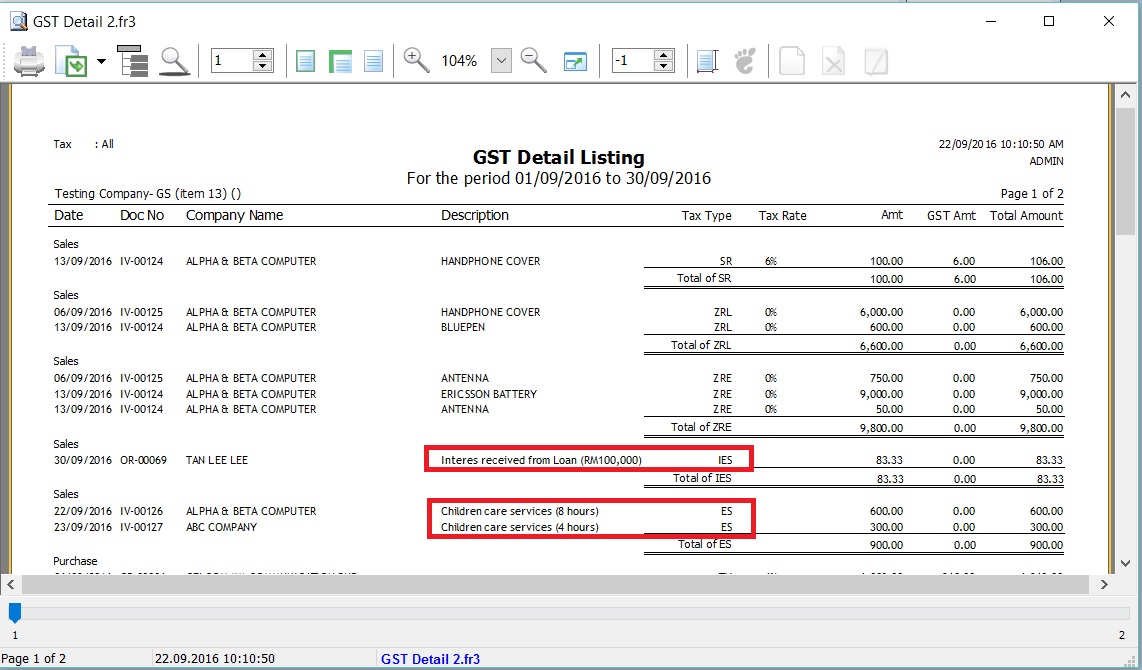

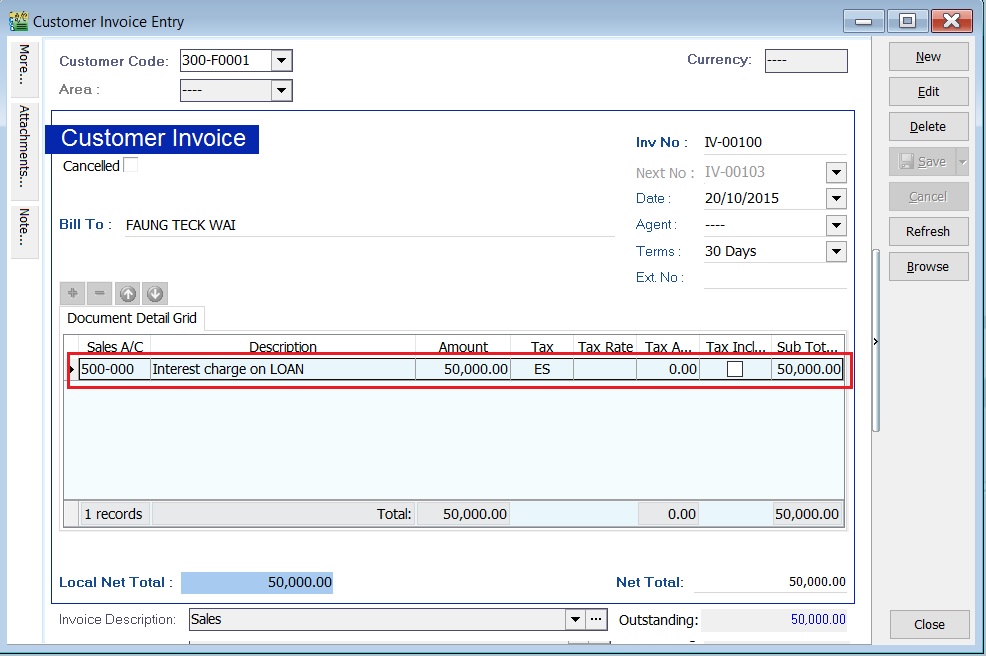

This refer to the following types according to GST (Exempt Supplies) Order 2014:-

-

Services (ES):-

- Private education

- Private health services

- Childcare services

- Domestic transportation of passengers for mass Public Transports (eg. by rail, ship, boat, ferry, express bus, stage bus, school bus, feeder bus, workers bus and taxi)

- Toll highway

-

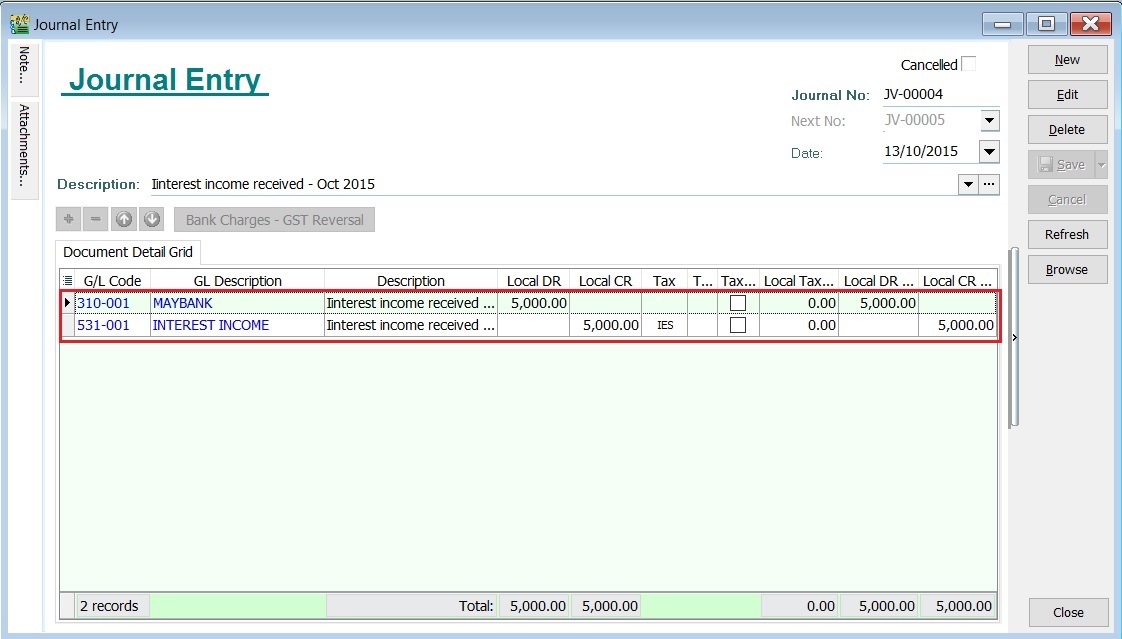

Financial Services (IES):-

- Interest income from deposits placed with a financial institution in Malaysia

- Interest received from loans provided to employees (factoring receivables)

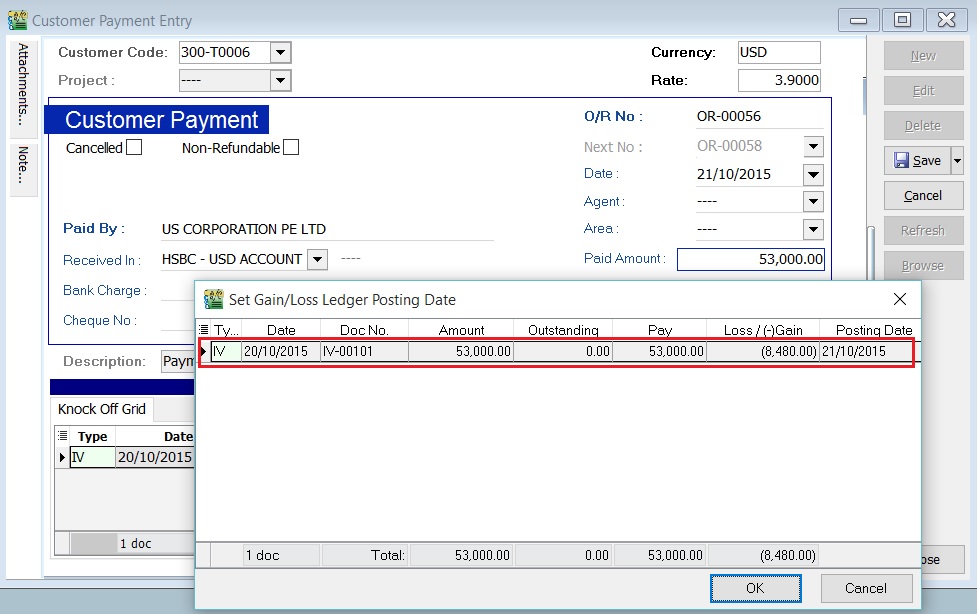

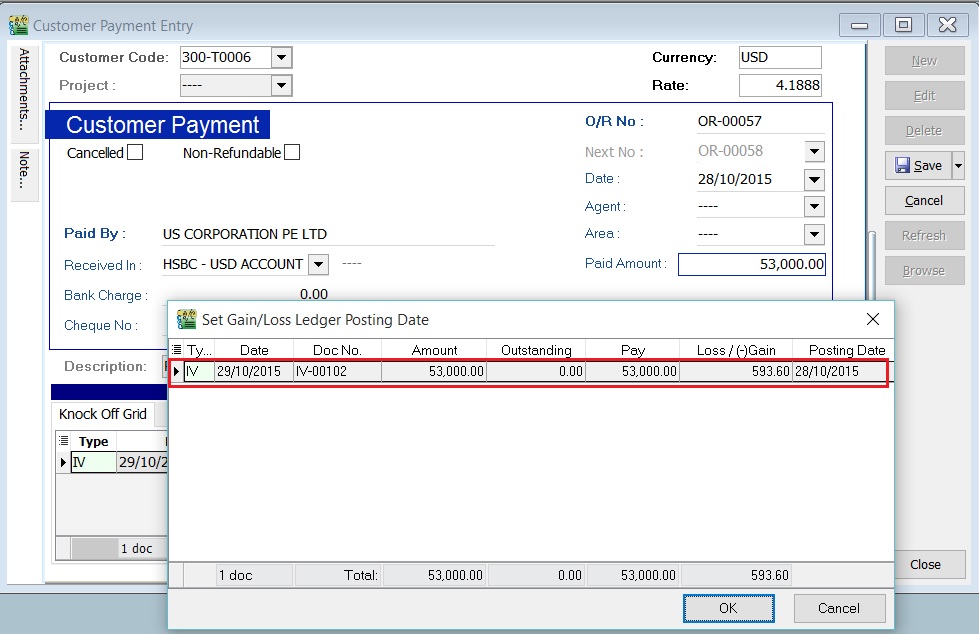

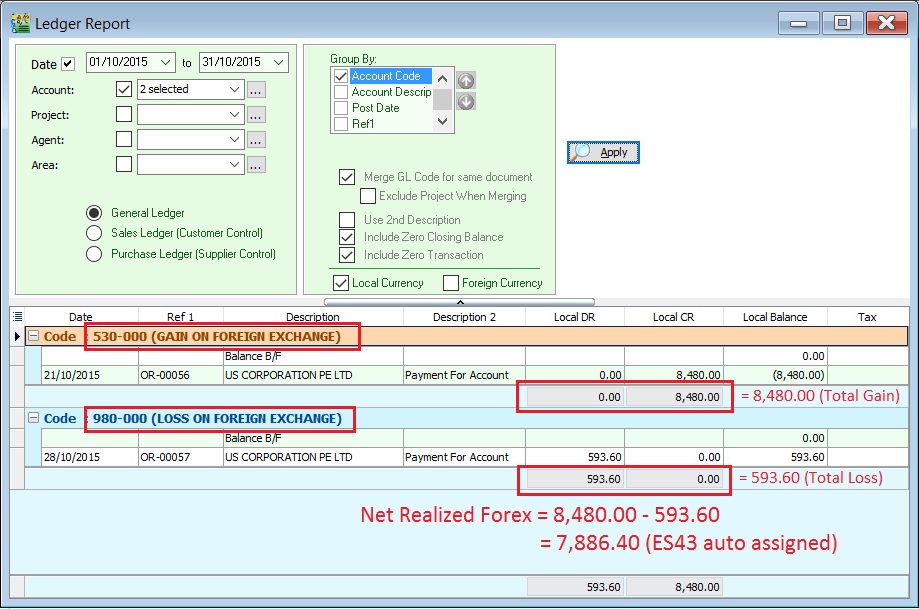

- Realized foreign exchange gains

-

Goods (ES):-

- Residential properties

- Land for agricultural use

- Land for general user (ie. burial ground, playground or religious building)

How to check the transactions correctly entered?

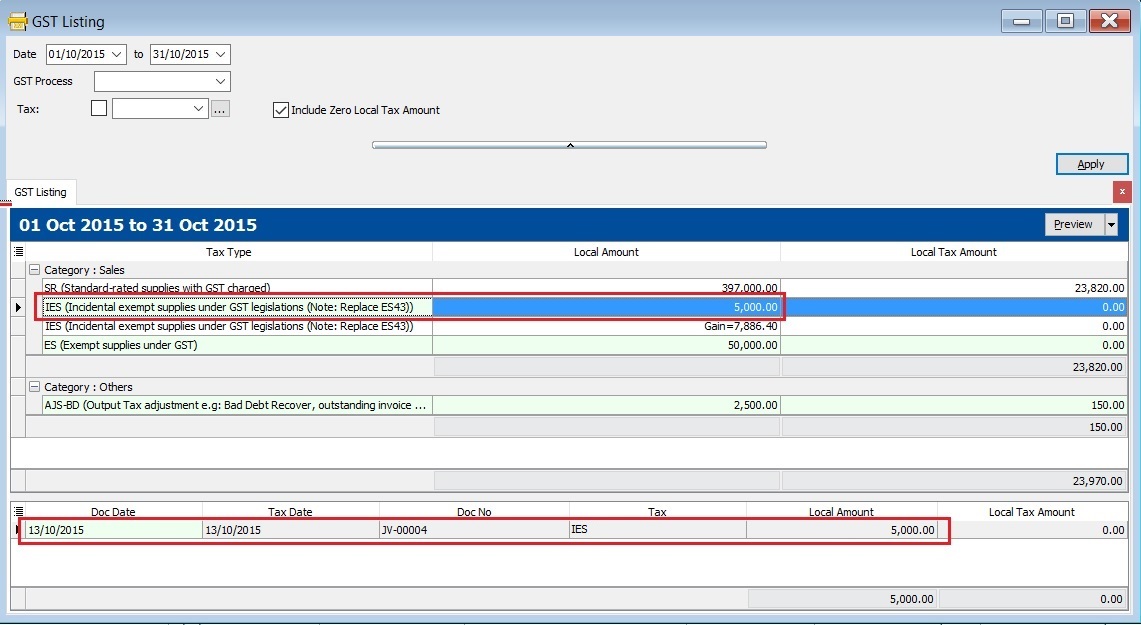

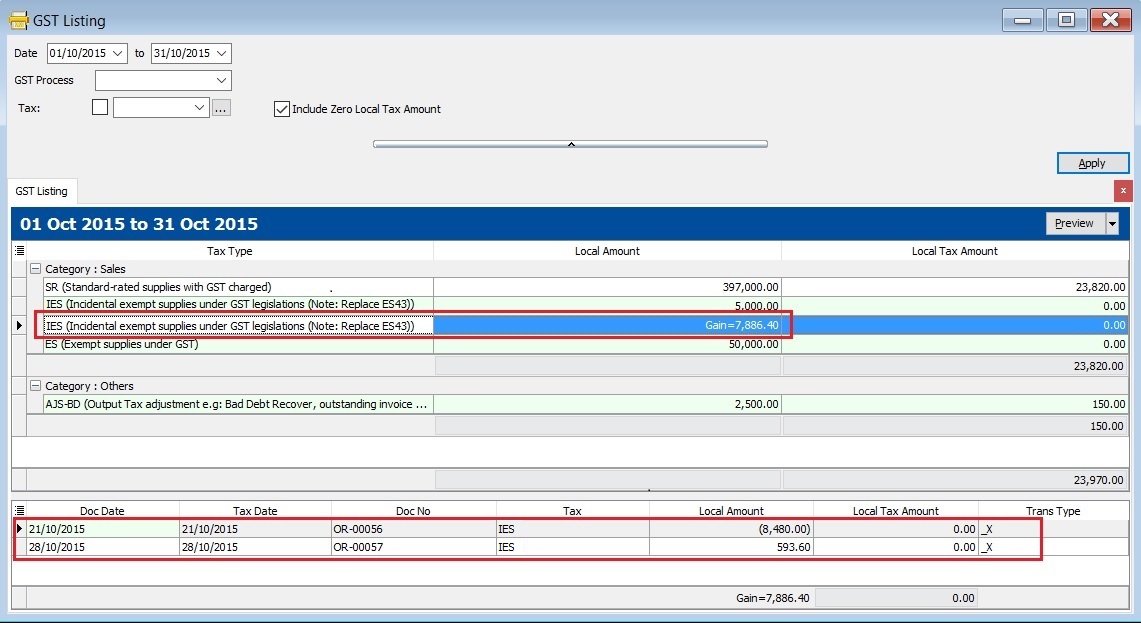

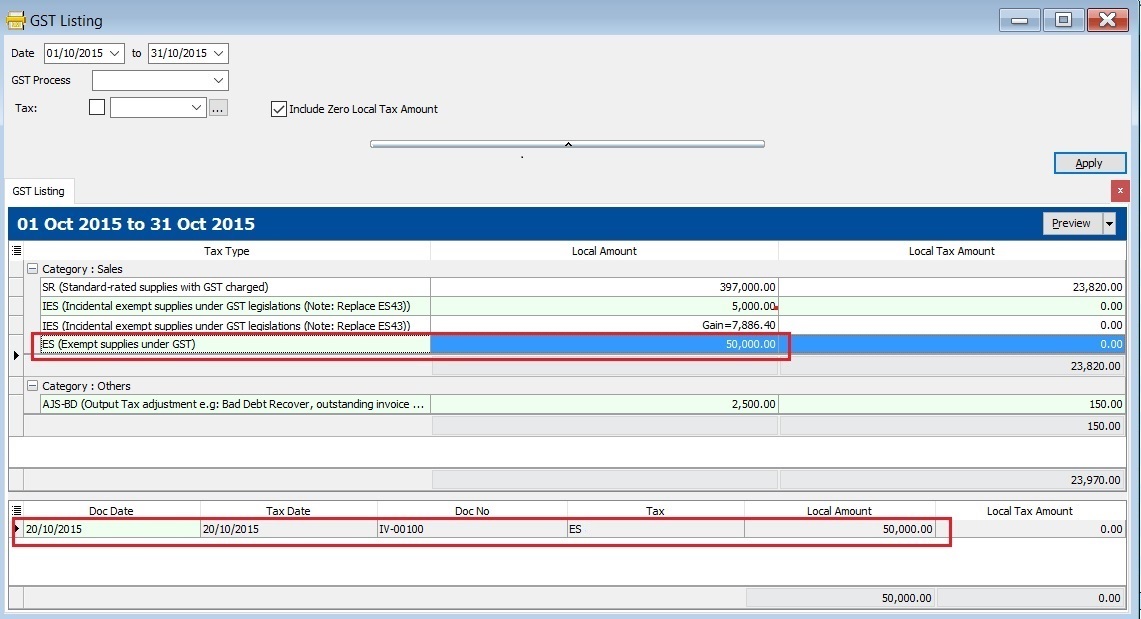

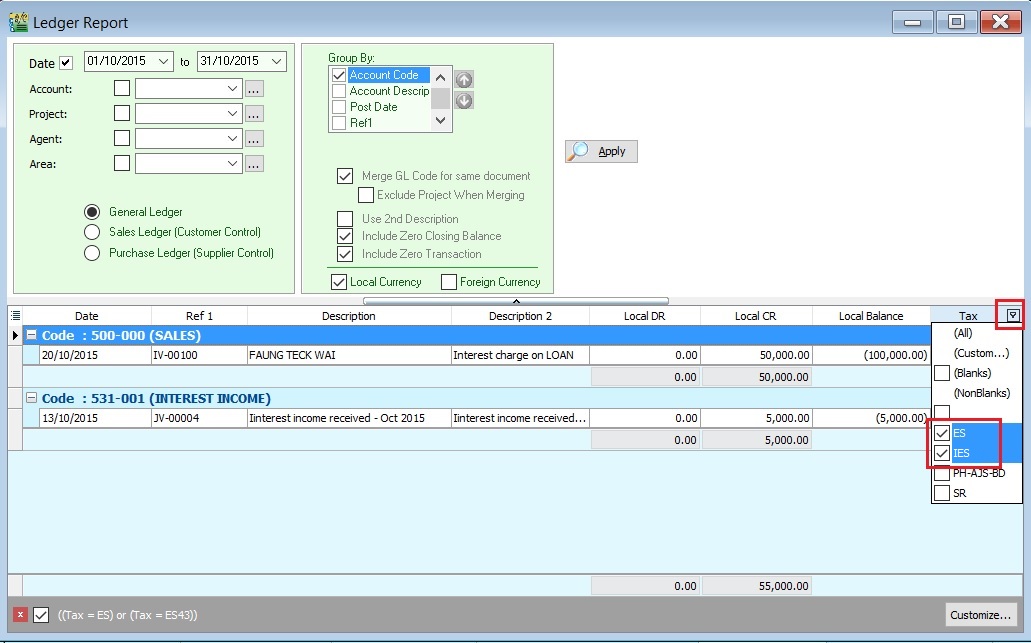

A. GST Listing

-

After GST Return processed, go to Print GST Listing....

-

Preview and select the report name GST Detail 2.

-

To ensure the document detail descriptions are clearly stated and map to the correct tax code.

B. GST-03

-

To quick do amendment before submit the GST-03 to RMCD. Click this link to learn more about the GST amendment.

-

Double click on the item 12 in GST-03.

-

Drill down the documents to open and correct it accordingly.

-

Lastly, you have to Recalculate the amended GST Return.

Supplies Grant GST Relief

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 13 | Total Value of Supplies Granted GST Relief | RS |

Goods Imported Under Approved Trader Scheme and GST Suspended

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 14 | Total Value of Goods Imported Under Approved Trader Scheme | IS |

| 15 | Total Value of GST Suspended under item 14 | IS x Tax Rate |

Capital Goods Acquired (Avoid Costly GST Error)

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 16 | Total Value of Capital Goods Acquired | TX-CG, TX, IM (Transaction GL Account related to Fixed Asset) |

Bad Debt Relief

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 17 | Total Value of Bad Debt Relief Inclusive Tax | AJP (AR only) |

Bad Debt Recovered

Mapping of GST Tax Code:

| GST-03 | Description | Tax Code |

|---|---|---|

| 18 | Total Value of Bad Debt Recovered Inclusive Tax | AJS (AR only) |

Output tax value breakdown into Major Industries Code (MSIC Code)

- This part usually require you to breakdown the total output tax reported in 5b according to your main business.

- You have to map to MSIC code.

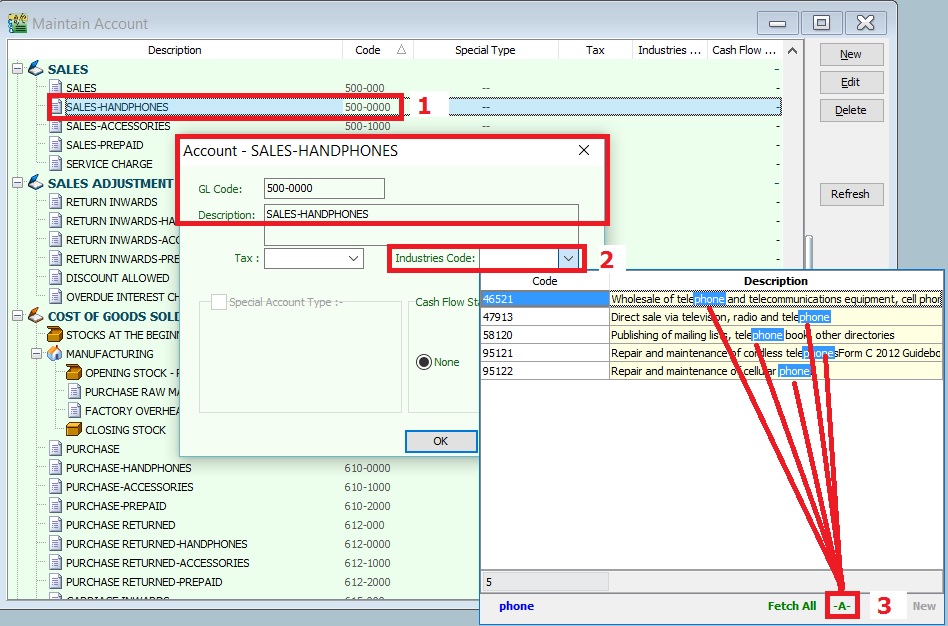

Where to set the MSIC Code?

-

Select and edit your main business supplies GL Account, eg. my main business is selling hand-phones.

-

Select an appropriate Industries Code.

-

You can change the search pattern to -A-. See screenshot below. So you can type-in the keywords, eg. Phone.

Other important info required in GAF

The GST Audit file is a way for taxpayers to submit information relevant to auditors in response to an audit request on information for auditing purposes. The information provided includes company identifications, names, supply & purchases, and general ledger transactions. There is also a footer record to ensure file integrity.

Record types are:-

| Record Type | Description | Where it update??? |

|---|---|---|

| C | Company | Company Profile |

| P | Purchase | Supplier Invoice (PI), Supplier Debit Note (SD), Supplier Credit Note (SC), Cash Book (PV), and Journal (JE) |

| S | Supply | Customer Invoice (IV), Customer Debit Note (DN), Customer Credit Note (CN), Cash Book (OR), Gift/Deemed Supply (GI), and Journal (JE) |

| L | Ledger | From the GL Ledger reports |

| F | Footer | GAF file integrity check |

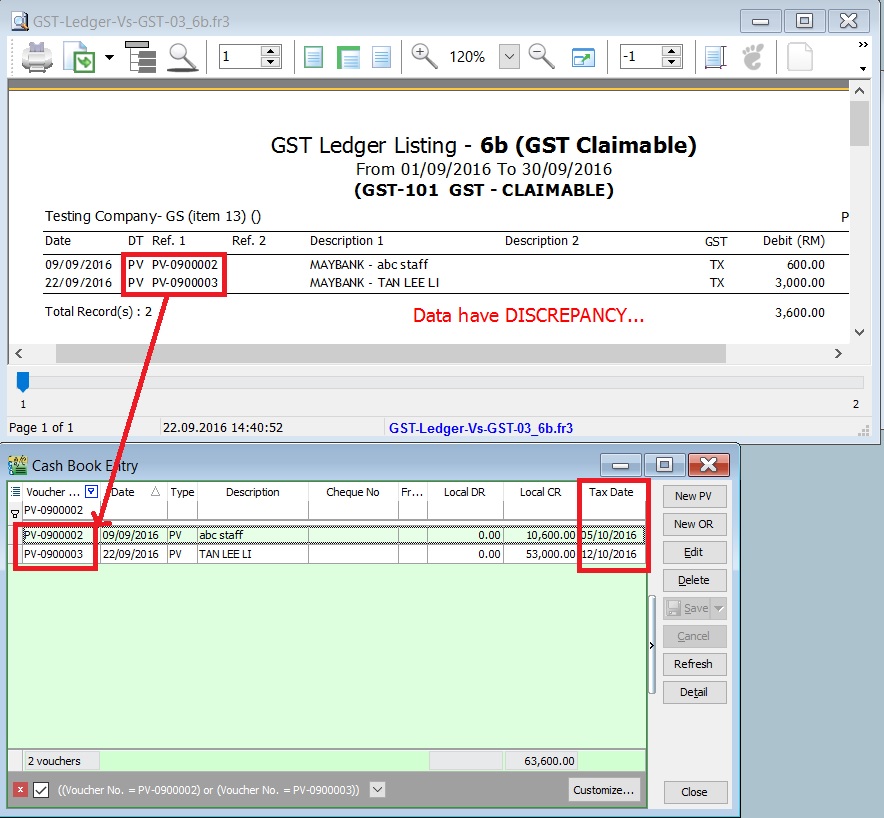

GL Ledger VS GST - 03

-

GST-Ledger-Vs-GST-03 is a very useful report to identify the unrealized human errors immediately. Possible errors may be due to documents had selected:-

- Wrong tax code or category

- Wrong account code

- Use Tax Date which is different from Document Date

- 5 Cents rounding had selected Tax Code.

-

It comprises of 2 reports:-

Report Name GL Acc Explanation 1. GST-Ledger-Vs-GST-03_5b GST-201 (GST - Payable) To reconcile the GST Payable account between the GL Ledger and GST-03 2. GST-Ledger-Vs-GST-03_6b GST-101 (GST - Claimable) To reconcile the GST Claimable account between the GL Ledger and GST-03 -

For example,

Supplier invoice date (15 Sept 2016) received in Oct 2016 and GST-03 Sept 2016 has submitted. Input tax will be claim in Oct 2016 by set the tax date (31 Oct 2016). In GL Ledger, the input tax will be posted in Sept 2016. However, this input tax will be appear in GT-03 Oct 2016. With this GST-Ledger-Vs-GST-03 report, you can very easy identify out the reasons. See the screenshot below.

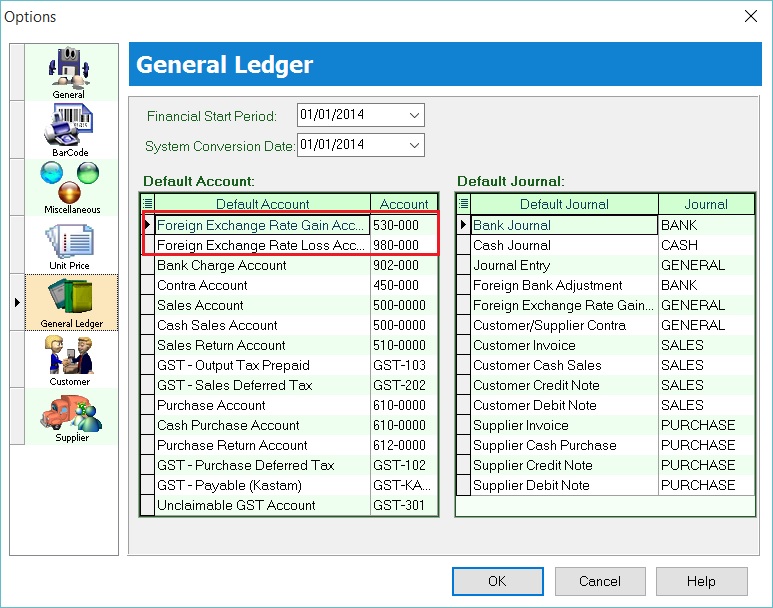

Foreign Currency Exchange Rate

- Always update the currency exchange rate at Tools | Maintain Currency.

- Critical cost on output tax if bill in foreign currency to local customer:

| Currency | Status | Exchange Rate | Amount | Local Amount | Output Tax |

|---|---|---|---|---|---|

| USD | Outdated | 3.8000 | 1,000.00 | 3,800.00 | 228.00 |

| USD | Actual | 4.3000 | 1,000.00 | 4,300.00 | 258.00 |

| Under declared | -30.00 |

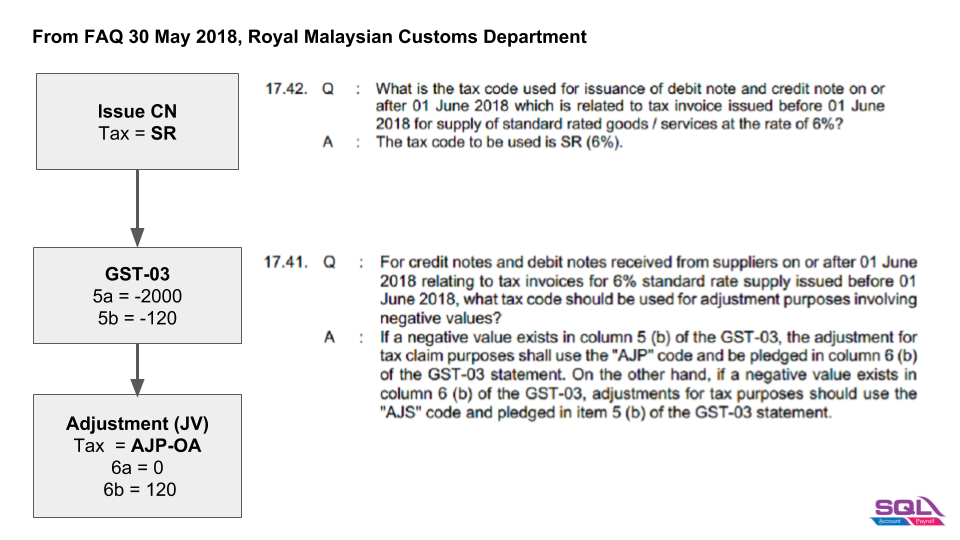

Adjustment to negative value in GST-03

- Negative value in 5a5b and 6a6b.

- TAP system not accept negative value.

Negative in 5a5b

-

Output Tax (Negative)

GST-03 Value 5a -2,000 5b -120 -

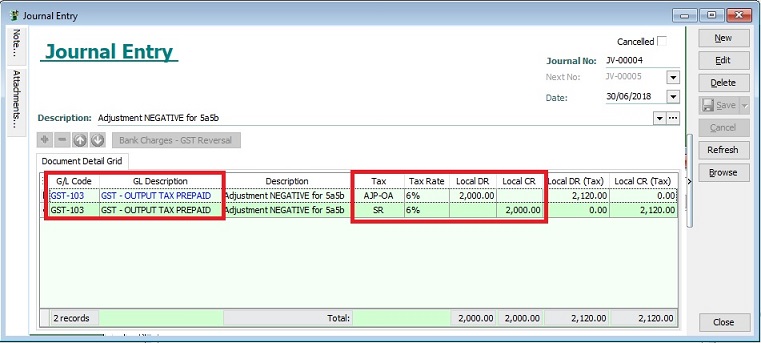

Journal Adjustment:

GL Code Tax Tax Rate Local DR Local CR Local DR(Tax) Local CR(Tax) GST-03 GST-103 AJP-OA 6% 2,000 2,120 6a = 0, 6b = 120 GST-103 SR 6% 2,000 2,120 5a = 0, 5b = 0

Negative in 6a6b

-

Input Tax (Negative)

Items Value 6a -1,000 6b -60 -

Journal Adjustment:

GL Code Tax Tax Rate Local DR Local CR Local DR(Tax) Local CR(Tax) GST-03 GST-103 TX 6% 1,000 1,060 6a = 0, 6b = 0 GST-103 AJS-OA 6% 1,000 1,060 5a = 0, 5b = 60

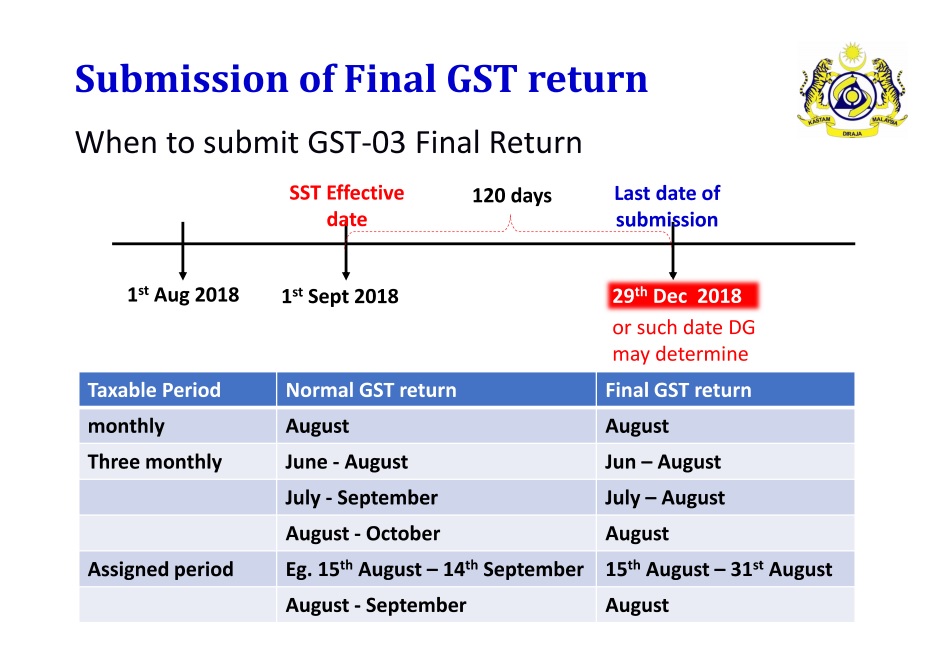

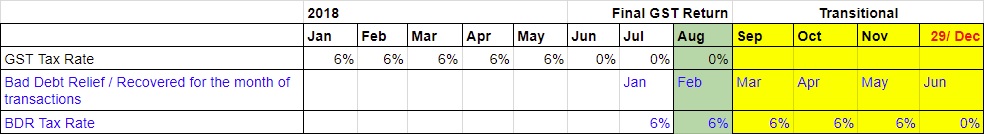

GST-Submission of Final GST Return

Pursuant to Section 6, Goods and Service Tax (Repeal) Act 2018, all GST Registrants are required to submit the GST-03 Return on the final taxable period (ie. 31 Aug 2018) and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days (29 December 2018) from 01 Sept 2018.

- Any input tax claimable from the purchase/supplier invoice received after 1 Sept 2018. It can be claim and must submit into the Final GST Returns (31 Aug 2018).

- Input tax claim will be subjected to verification and audit.

- Refund will be made within 6 years.

How to enter the input tax 6% claimable from Purchase / Supplier invoice after 1st September 2018

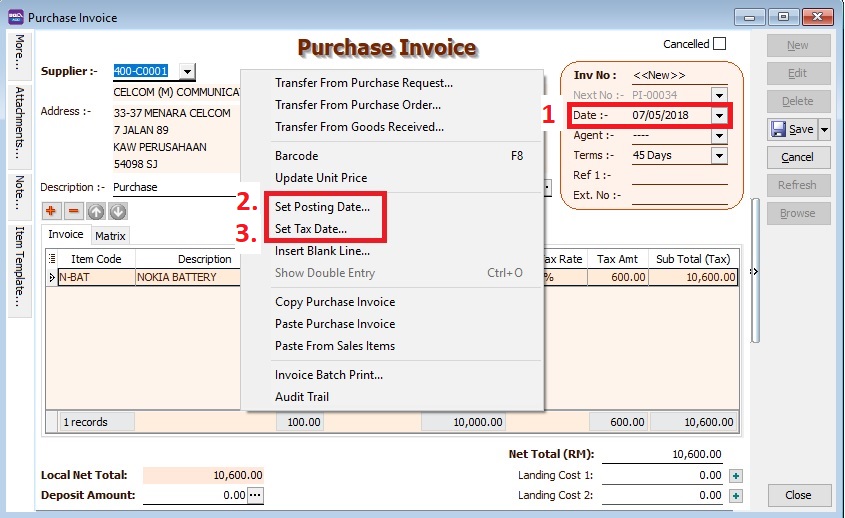

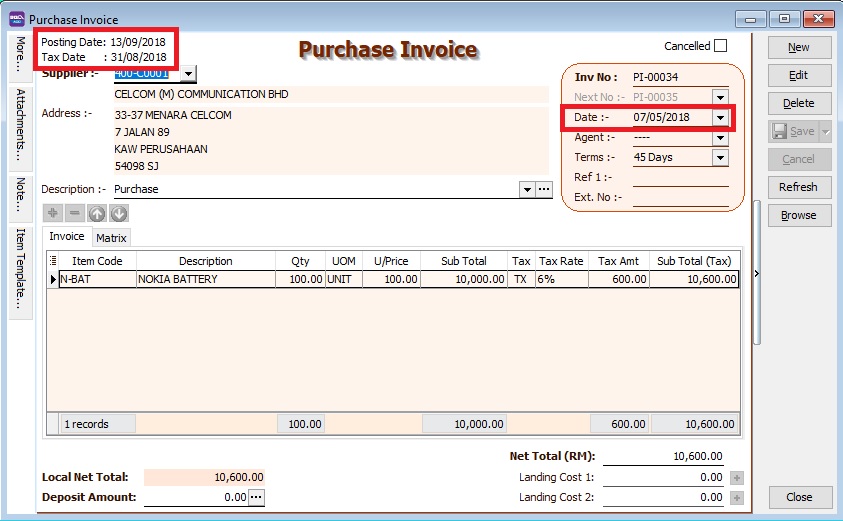

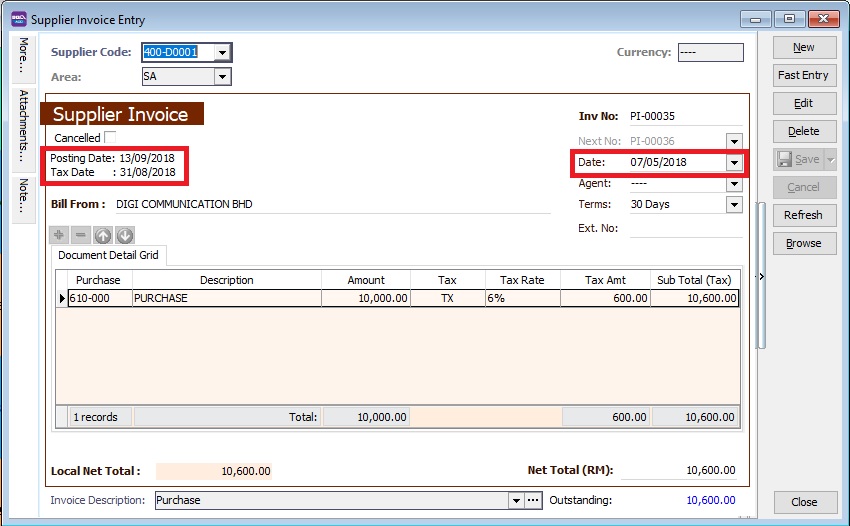

For example, on 13 SEPT 2018, my company has received a supplier tax invoice dated 07 MAY 2018 and amount inclusive GST is RM10,600.

Enter at Purchase Invoice

-

Set Date.... to record the original invoice date (eg. 07 MAY 2018).

-

Set Posting Date... to post this transaction into GL reporting as at 13 SEP 2018.

Note:To enable to set Posting Date, the Double Document Module is required.

-

Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

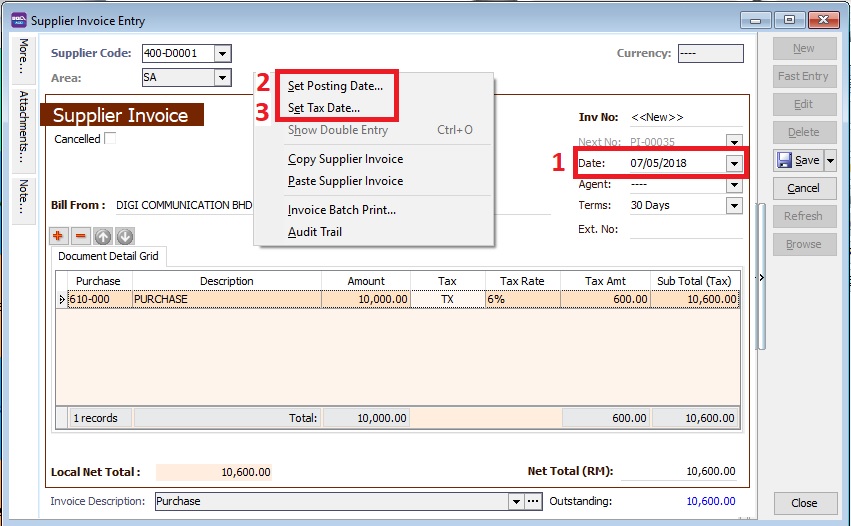

Enter at Supplier Invoice

-

Set Date.... to record the original invoice date (eg. 07 MAY 2018).

-

Set Posting Date... to post this transaction into GL reporting as 13 SEP 2018.

Note:To enable to set Posting Date, the Double Document Module is required.

-

Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

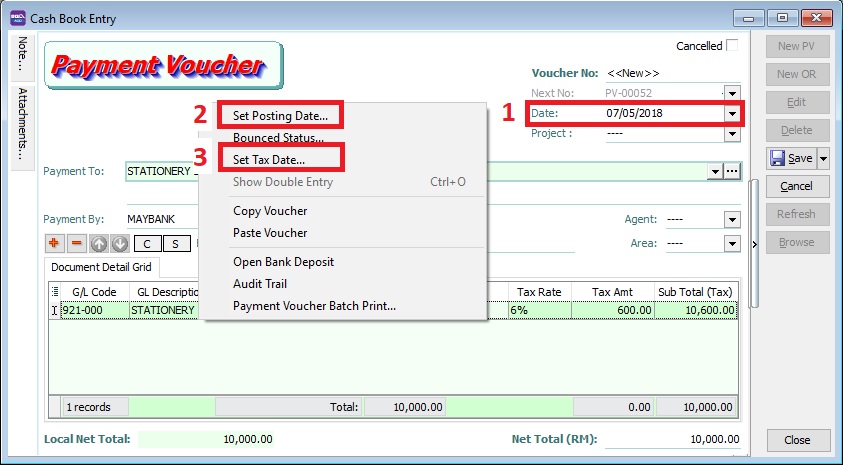

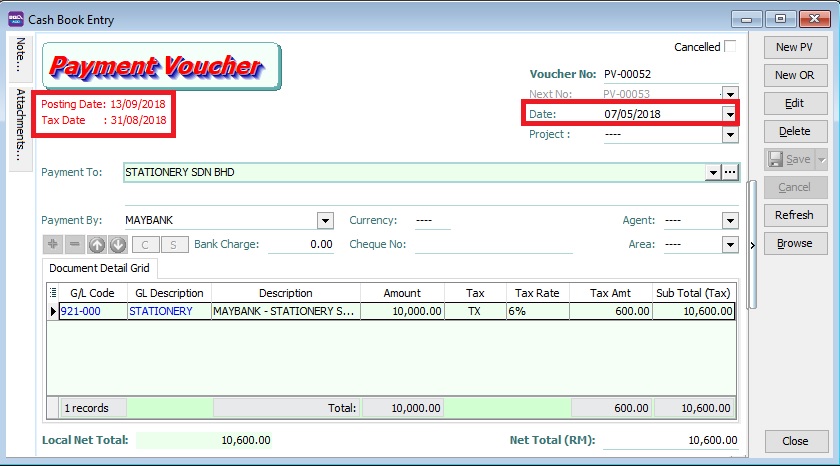

Enter at Cash Book (PV)

-

Set Date.... to record the original invoice date (eg. 07 MAY 2018).

-

Set Posting Date... to post this transaction into GL reporting as at 13 SEP 2018.

-

Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

Final GST Returns

Process GST Returns up to 31 AUG 2018.

| Items | Value |

|---|---|

| 6a | 10,000 |

| 6b | 600 |

- Final GST Returns until 31 AUG 2018.

- Last date of submission for the Final GST Returns is 29 DEC 2018

Transitional (from GST to SST)

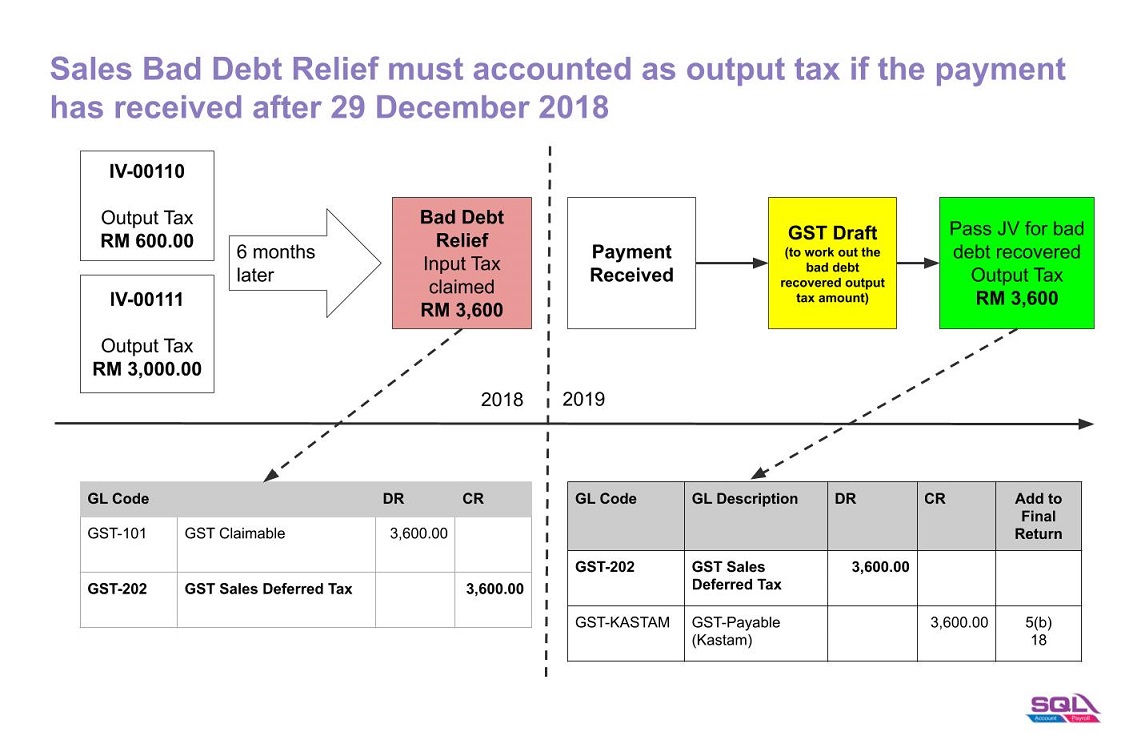

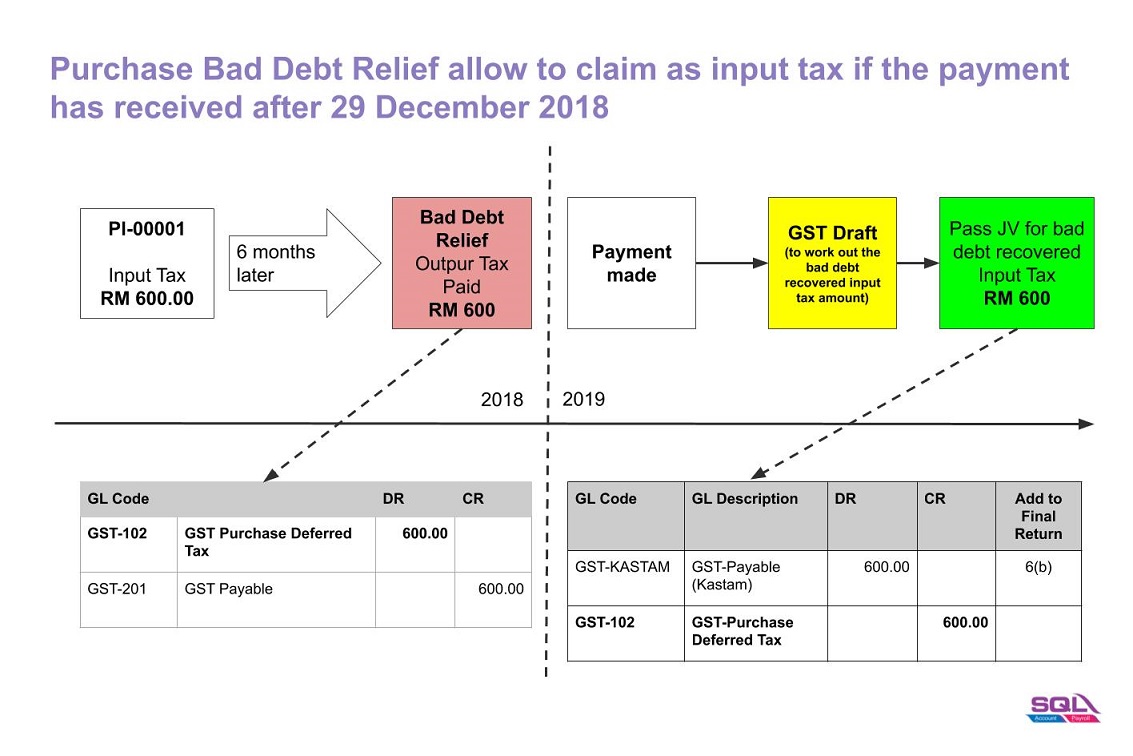

Bad Debt Relief / Recovered

- GST registered person is eligible to claim the bad debt relief even if it spans on or after 1 September 2018.

- Bad Debt Relief is allowed to be claimed within 120 days from the SST effective date (eg. 1 September 2018).

- Bad Debt Recovery made on or after 1 September 2018 must to be paid as output tax to RMCD within 120 days from the SST effective date by amending the Final GST Return.

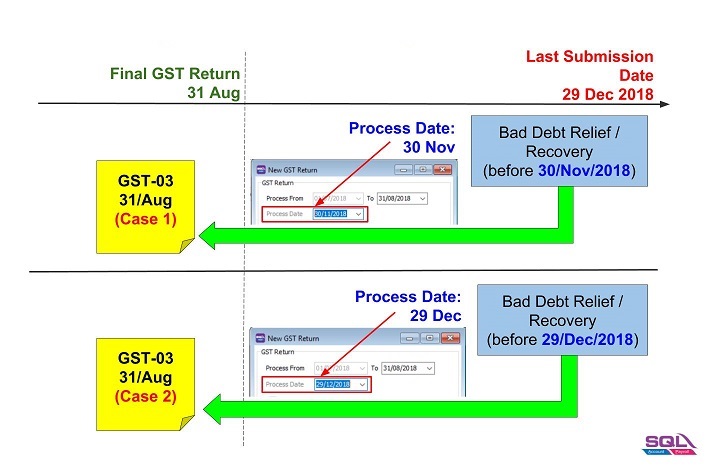

Final GST Return Processor

-

System will AUTO define the last taxable period (A), eg...

Process From Process To 01/07/2018 31/08/2018 -

Set the Process Date (B) as the date submit the Final GST return before 29 December 2018 (within 120 days from the SST effective date).

-

For example,

-

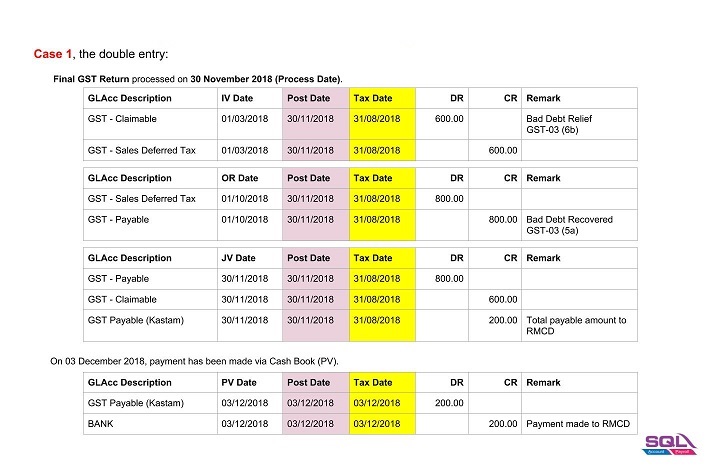

Double entry for Cases 1.

-

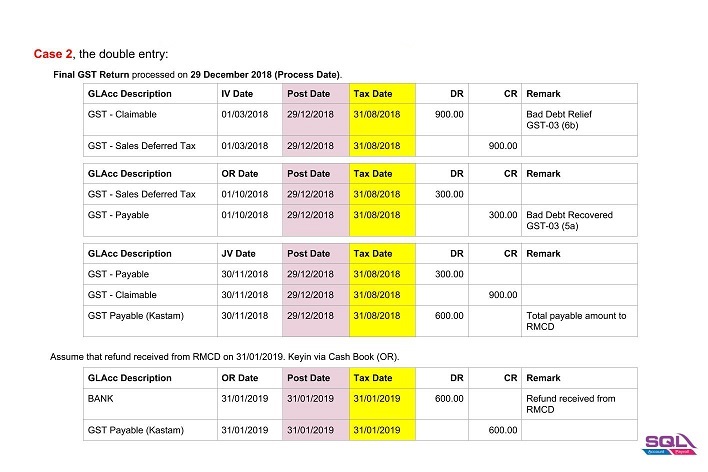

Double entry for Cases 2.

-

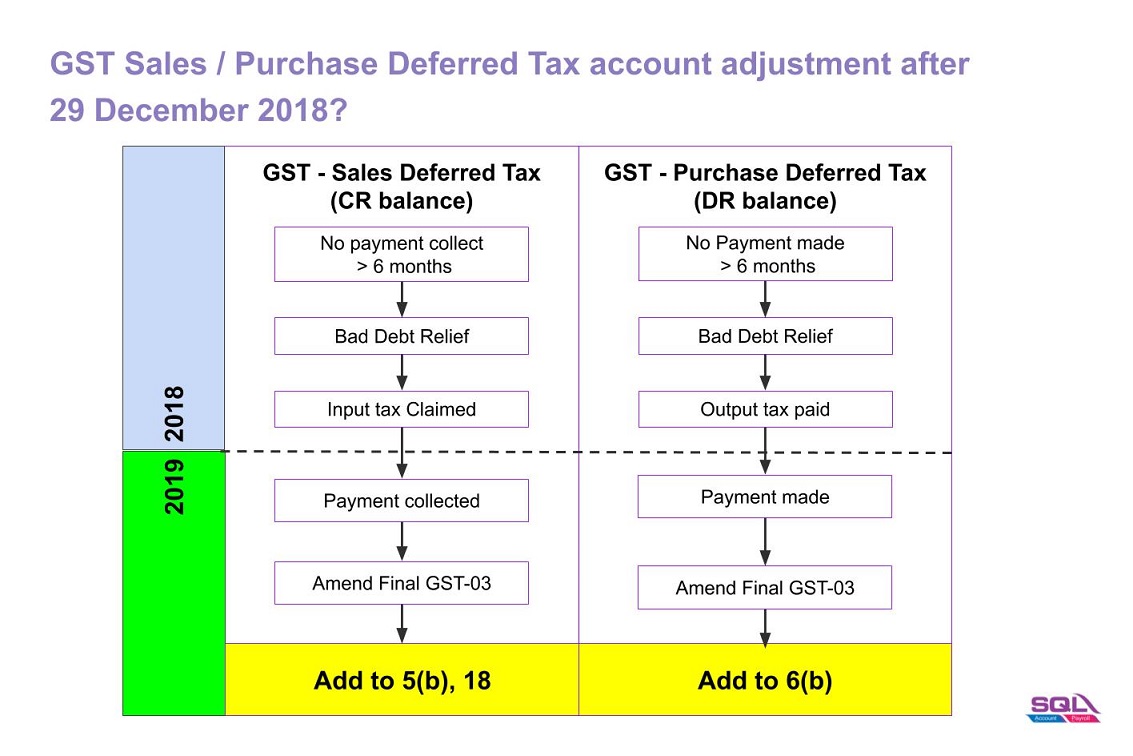

GST Sales/Purchase Deferred Tax Journal Adjustment

-

Double entry adjustment for the balance of GST Sales / Purchase Deferred Tax (Bad Debt Relief) AFTER 29 December 2018.

-

Add the adjustment amount into Final GST Return (amendment).

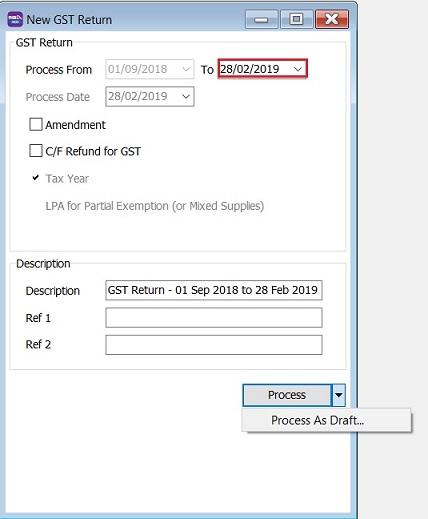

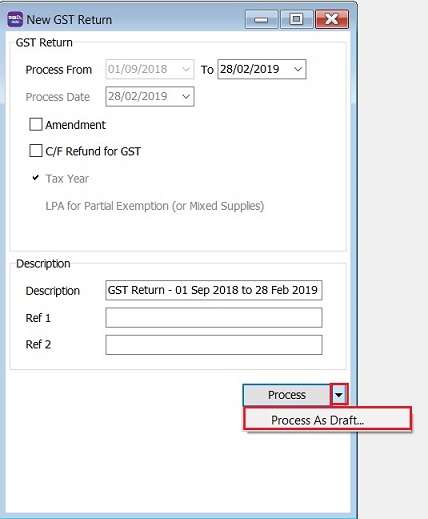

How to check the Sales / Purchase Bad Debt Recovered Amount after Final GST Returns

-

Select a date AFTER the Final GST Return Date, eg. 28/02/2019.

-

Choose Process As Draft.

-

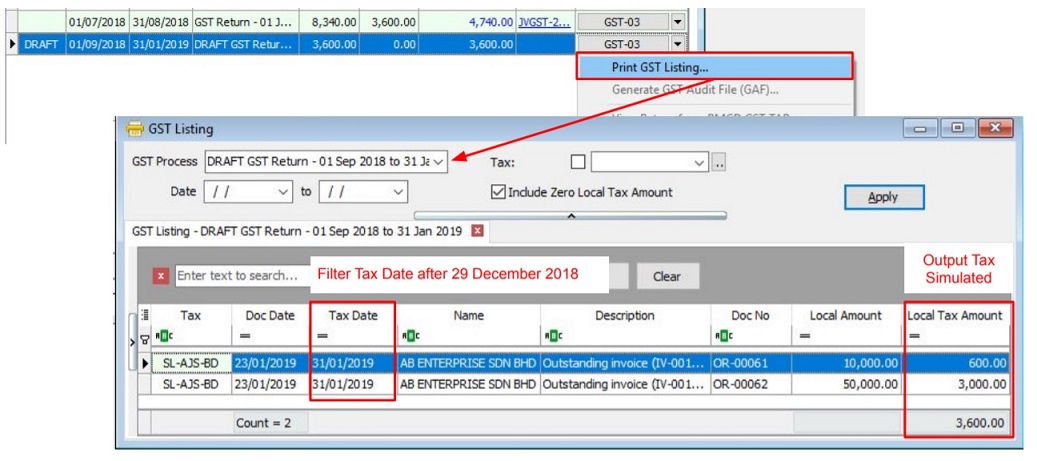

Click on GST Return Draft and print GST Listing.

-

Filter the Tax Date (ie. greater than or equal to 30 December 2018).

SL-AJS-BD : Sales Bad Debt Recovered (Output Tax). PH-AJP-BD : Purchase Bad Debt Recovered (Input Tax).

Adjustment for GST Sales Deferred Tax (SL-AJS-BD)

-

Based on the GST Listing (Draft), post the GST Bad Debt Recovered double entry using Journal Entry.

GL Code GL Description Local DR Local CR Add to Final GST-03 GST-202 GST - Sales Deferred Tax 3,600 GST-KASTAM GST - Payable (KASTAM) 3,600 5(b), 18 -

Amend the Final GST Return (Aug 2018) at TAP.

-

Add the amount into a. 5(b) b. 18

Adjustment for GST Purchase Deferred Tax (PH-AJP-BD)

-

Based on the GST Listing (Draft), post the GST Bad Debt Recovered double entry using Journal Entry.

GL Code GL Description Local DR Local CR Add to Final GST-03 GST-KASTAM GST - Payable (KASTAM) 600 6(b) GST-102 GST - Purchase Deferred Tax 600 -

Amend the Final GST Return (Aug 2018) at TAP.

-

Add the amount into a. 6(b)

Payment to RMCD (Tax Journal Adjustment)

Made payment to RMCD, use Cash Book Entry (PV).

| GL Code | GL Description | Local DR | Local CR |

|---|---|---|---|

| GST-KASTAM | GST - Payable (KASTAM) - Net Balance | 3,000 | |

| BANK | Bank Name | 3,000 |

GST Special Treatment

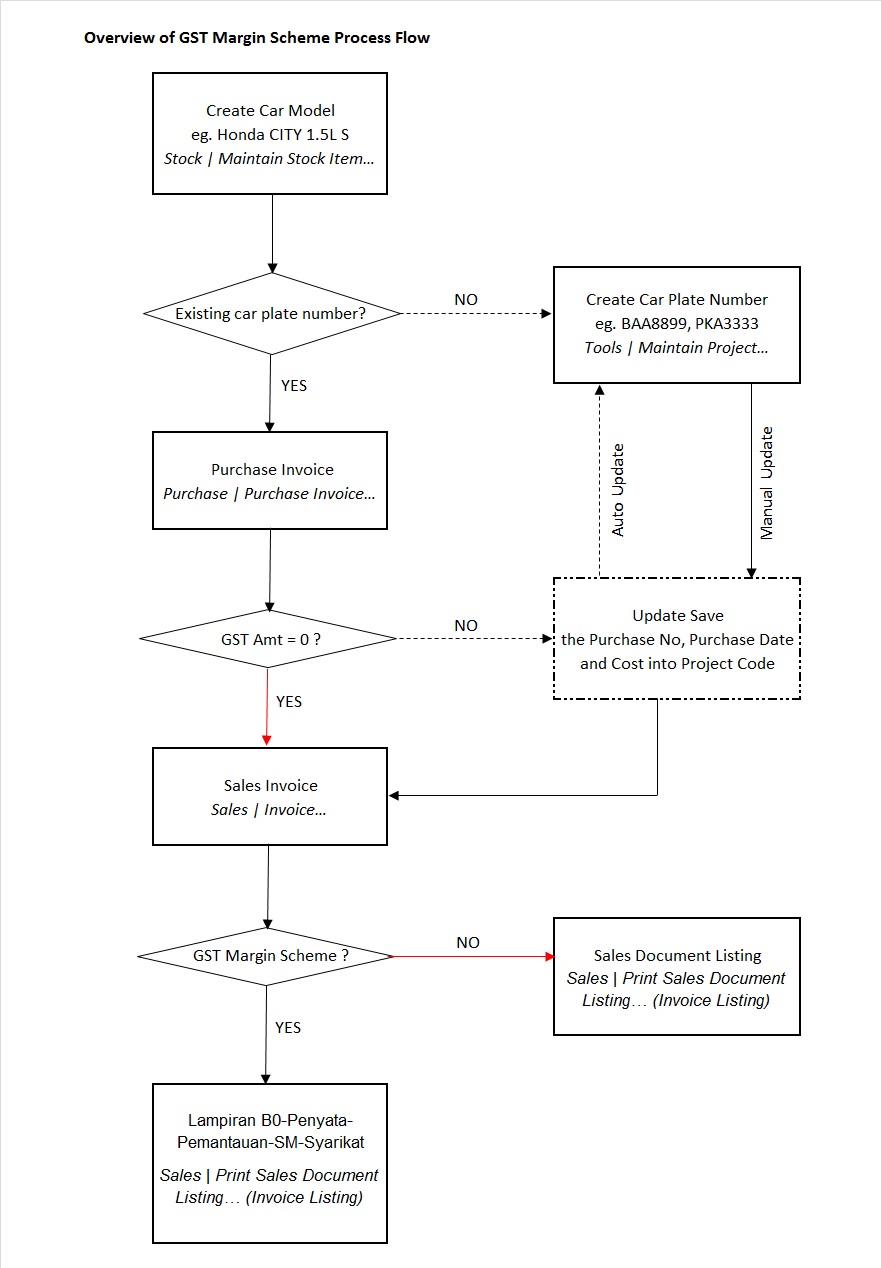

GST Margin Scheme

How To Start the New Margin Scheme with Special Database?

GST is normally due on the full value of goods sold. The margin scheme allows a GST Margin Scheme registered person (GST MS registered person) who meets all the conditions to calculate and charge GST on the margin i.e. the difference between the price at which the goods were obtained and the selling price. If no margin is made (because the purchase price exceeds the selling price) then no GST is charged and payable.

For the purpose of GST, margin under this scheme means the difference between selling price and purchase price. If there is any value being added to the eligible goods such as cost for repairing, this cost is part of the margin other than profit. In other words, the value added must be included in the selling price and not the purchase price.

Therefore, we have designed a database structure specially for business which has margin scheme involvement.

Modules Require

- SQL Accounting Basic (GST compliance)

- DIY field

- DIY script

- Project (use to record Car Plate number)

See below the overview of Margin Scheme process flow:

Setup Margin Scheme Database

Last Customization Update : 13 Sep 2016

- Get the NEW database structure for Margin Scheme (in backup format) from this link NEW COMPANY (For Margin Scheme)

- Restore this backup.

- Enter the user ID and password with “ADMIN” to login.

History New/Updates/Changes

Last Customization Update : 27 Nov 2015

- Move Cars Information to Maintain Project

- Auto Capture Initial Cost on Select Project

Last Customization Update : 20 Feb 2016

-

Empty item code (eg. repairs) will not update the Project - Purchase Details.

-

Run the SQL Accounting Diagnosis - DB Patch and apply the patch files can be download from Patch-Margin Scheme-20160220.zip

- Select the database file (eg.ACC-XXXXX.FDB).

- Drag the patch filename Patch-MarginScheme1.

- Click Execute.

- Repeat step 2 - 3 and apply with another patch filename Patch-MarginScheme-02-20160220.

Last Customization Update : 08 Mar 2016

-

Tax amount not equal to zero. Will prompt message "Cost will be tax excluded for GST Margin purpose" after save the purchase invoice.

-

Run the SQL Accounting Diagnosis - DB Patch and apply the patch files can be download from Patch-MarginScheme-20160308.zip

- Select the database file (eg.ACC-XXXXX.FDB).

- Unzip the patch file downloaded.

- Drag the patch filename DELETE_PHPI_OnAfterSave_08.03.2016.

- Click Execute.

- Repeat step 2 - 4 and apply with another patch filename UPDATE_PHPI_OnAfterSave_08.03.2016.

Last Customization Update : 08 Aug 2016

-

To remove the compulsory action to select project code other than Default Project (----).

-

Run the SQL Accounting Diagnosis - DB Patch and apply the patch files can be download from This Link here

- Select the database file (eg.ACC-XXXXX.FDB).

- Unzip the patch file downloaded.

- Drag the patch filename DELETE_SLIV_OnBeforerSave_2016.08.08.

- Click Execute.

Last Customization Update : 13 Sep 2016

-

Margin Scheme options added in Maintain Project. It is allowed to determine the car sold using GST margin scheme or GST standard calculation.

-

Run the SQL Accounting Diagnosis - DB Patch and apply the patch files can be download from This Link here

- Select the database file (eg.ACC-XXXXX.FDB).

- Unzip the patch file downloaded.

- Drag the patch filename DELETE_SLIV_OnGridColValChg_2016.09.13.

- Click Execute.

- Repeat step 2 - 4 and apply with another patch filename INSERT_SLIV_OnGridColValChg_2016.09.13.

-

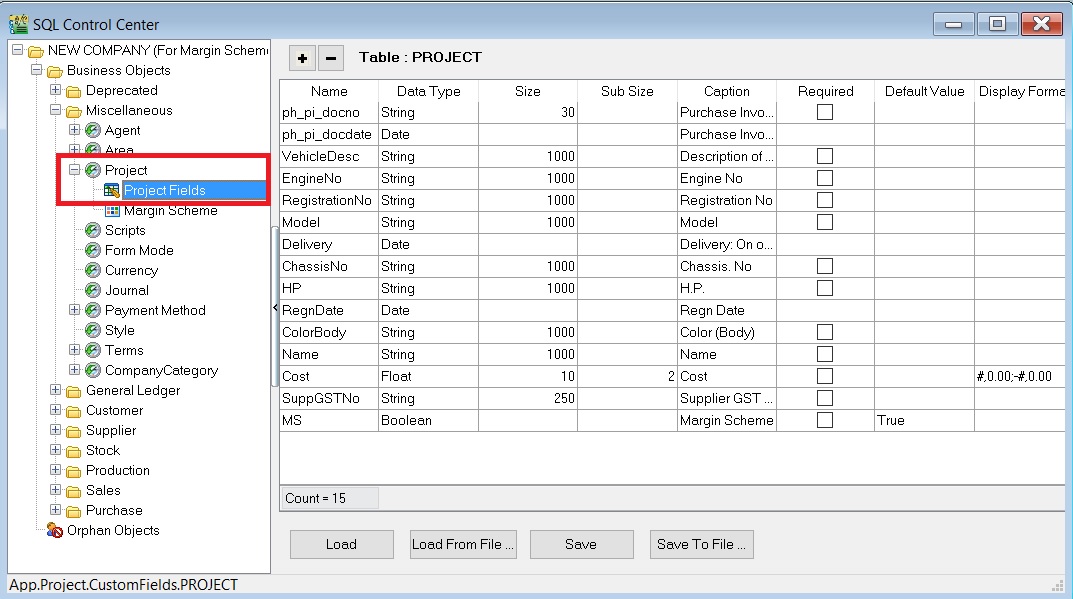

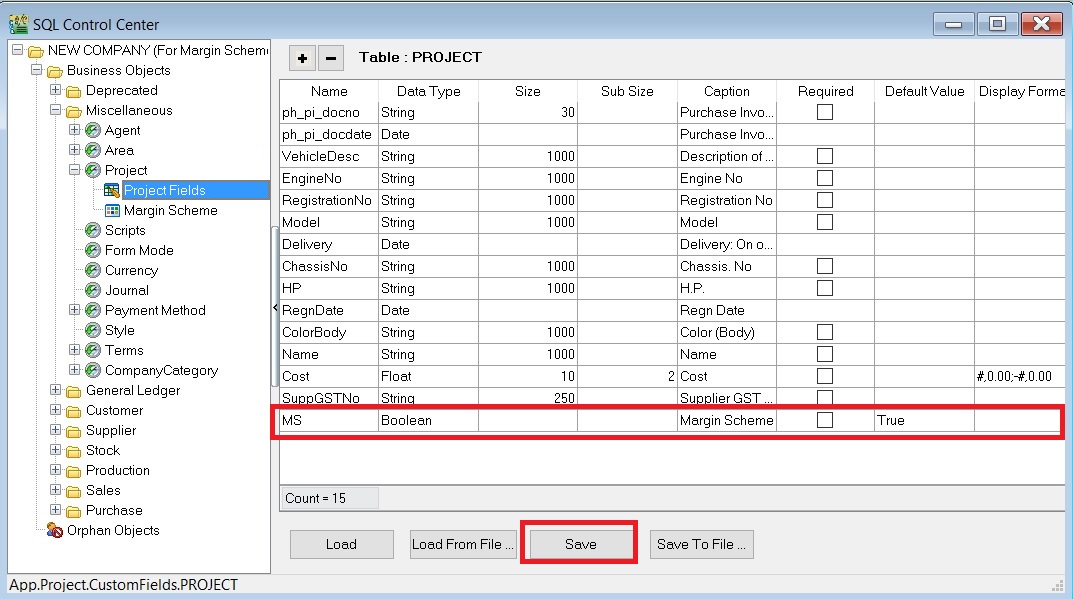

Add new field name MS in Maintain Project.

-

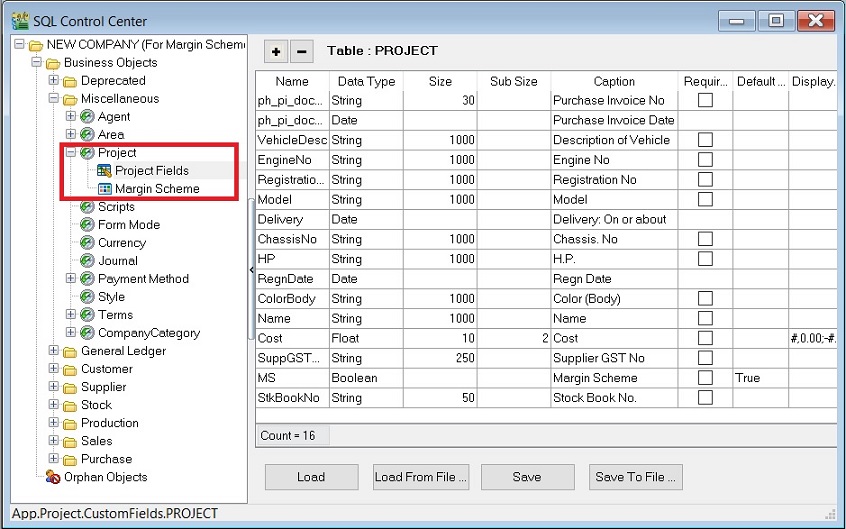

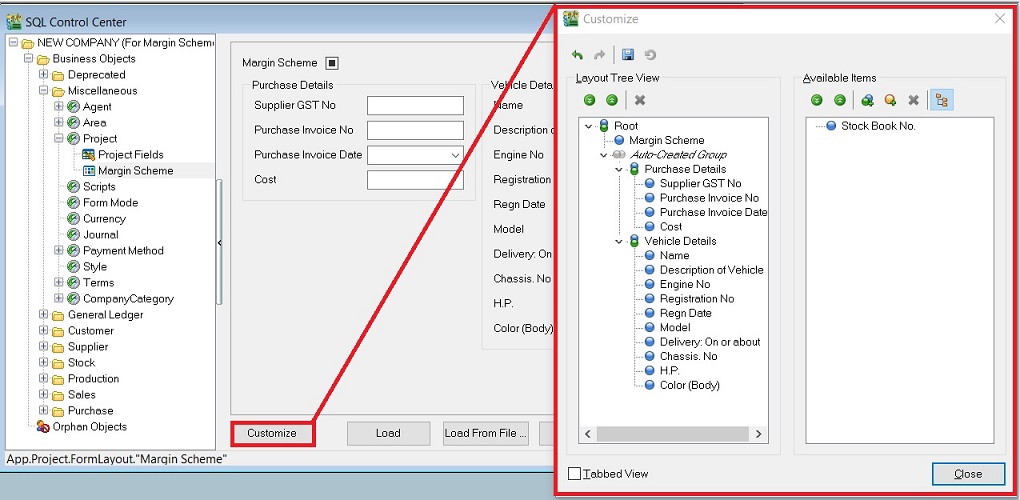

Go to Tools | DIY | SQL Control Center...

-

Browse to Business Objects | Miscellaneous | Project | Project Fields

-

Add new field name MS and the Data Type, Size, Sub Size, Caption, etc must follow the screenshot below. Click to Save button.

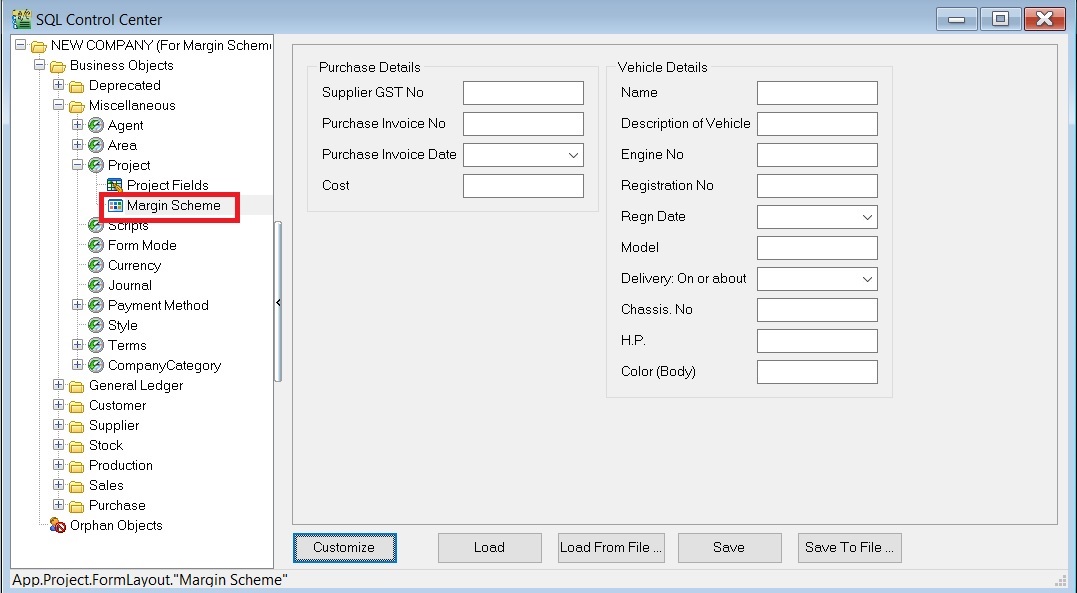

-

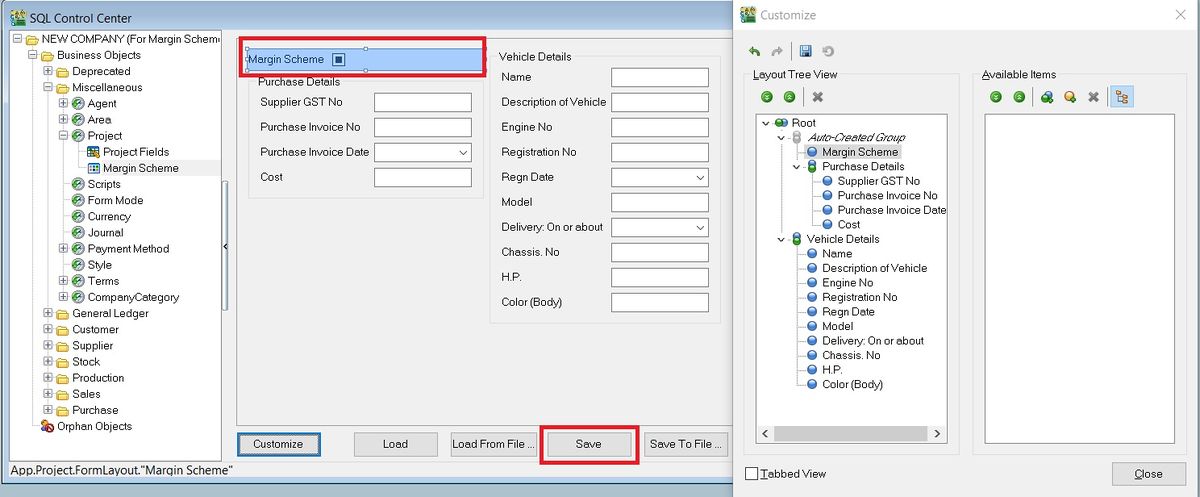

Next, click on the existing Margin Scheme form. See the screenshot below.

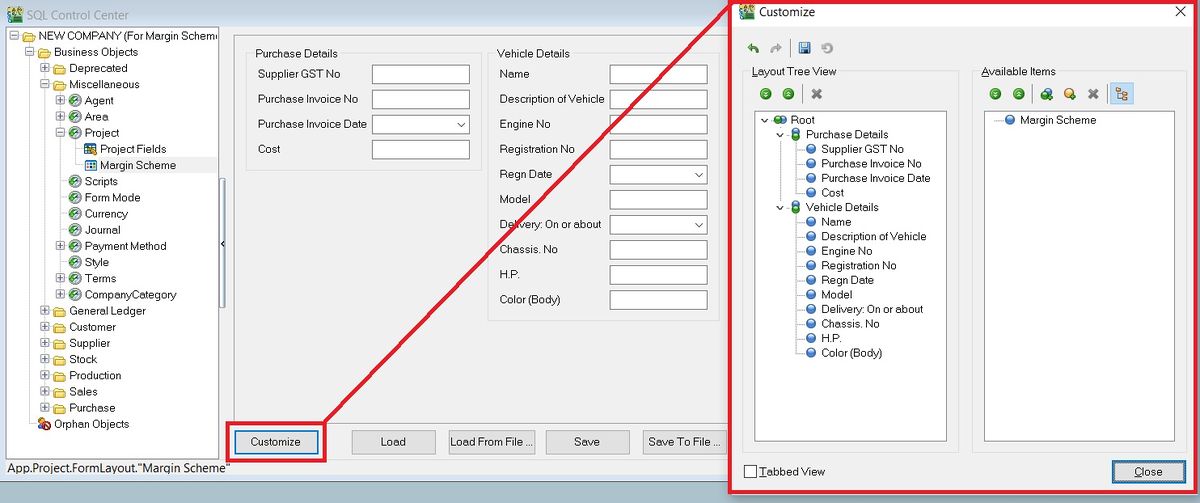

-

Click on Customize button.

-

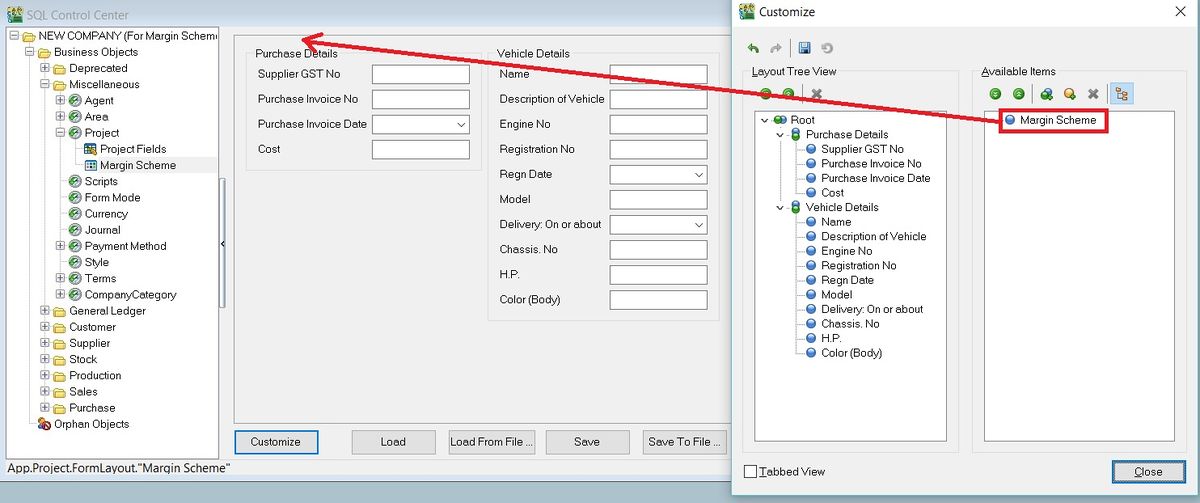

Drag the Margin Scheme from Available Item list and drop under Purchase Details. See screenshot below.

-

Lastly, click to Save button.

-

Patch files are applicable to old margin scheme database.

Last Customization Update : 09 Nov 2016

-

Added Stock Book Number into Maintain Project. It will auto update project Stock Book Number key-in at purchase invoice Ext. No.

-

Fixed the bug update project from Purchase Invoice on the First line only.

-

Run the SQL Accounting Diagnosis - DB Patch and apply the patch files can be download from This Link Here

- Select the database file (eg.ACC-XXXXX.FDB).

- Unzip the patch file downloaded.

- Drag the patch filename DELETE_PHPI_OnAfterSave_2016.11.09.

- Click Execute.

- Repeat step 2 - 4 and apply with another patch filename INSERT_PHPI_OnAfterSave_2016.11.09.

-

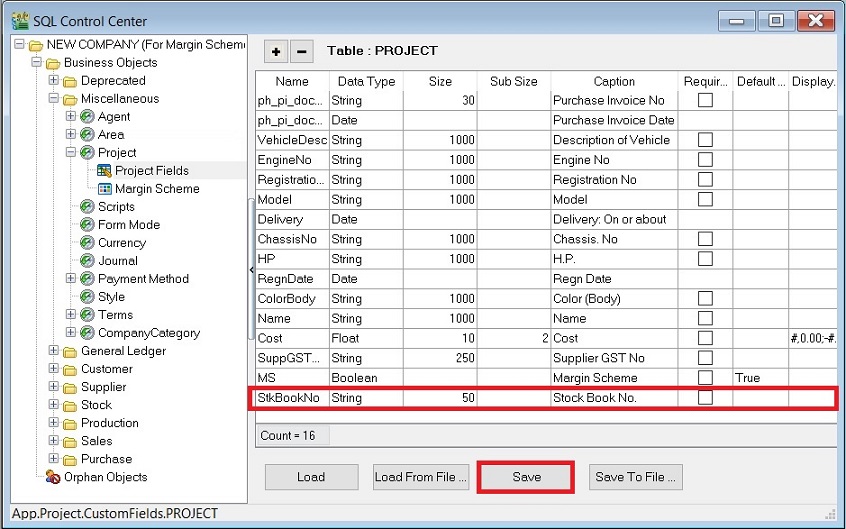

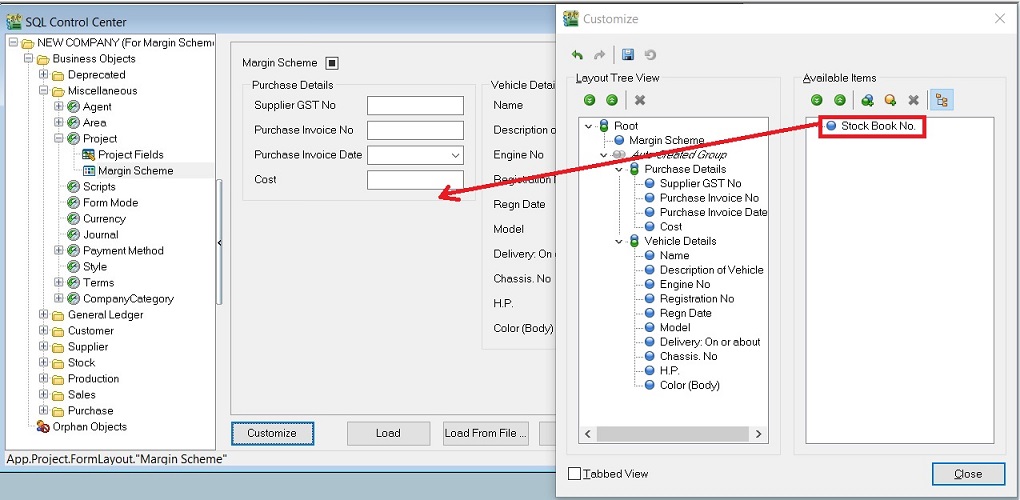

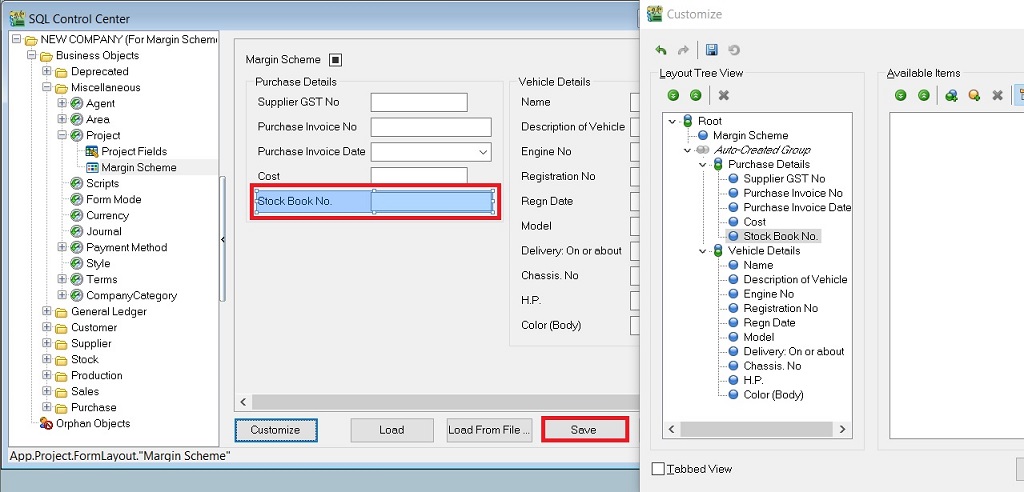

Add new field name StkBookNo in Maintain Project.

-

Go to Tools | DIY | SQL Control Center...

-

Browse to Business Objects | Miscellaneous | Project | Project Fields

-

Add new field name StkBookNo and the Data Type, Size, Sub Size, Caption, etc must follow the screenshot below. Click to Save button.

-

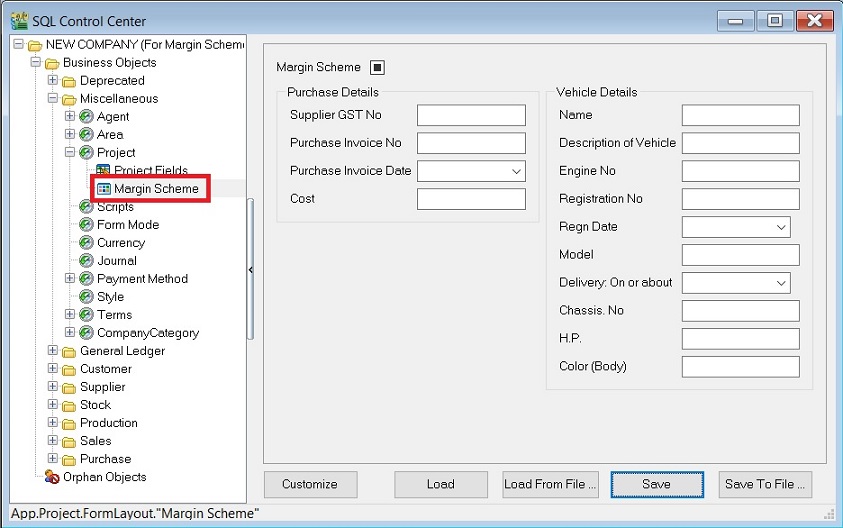

Next, click on the existing Margin Scheme form. See the screenshot below.

-

Click on Customize button.

-

Drag the Stock Book No from Available Item list and drop under Purchase Details. See screenshot below.

-

Lastly, click to Save button.

-

Patch files are applicable to old margin scheme database.

Setup Master Data (SMD)

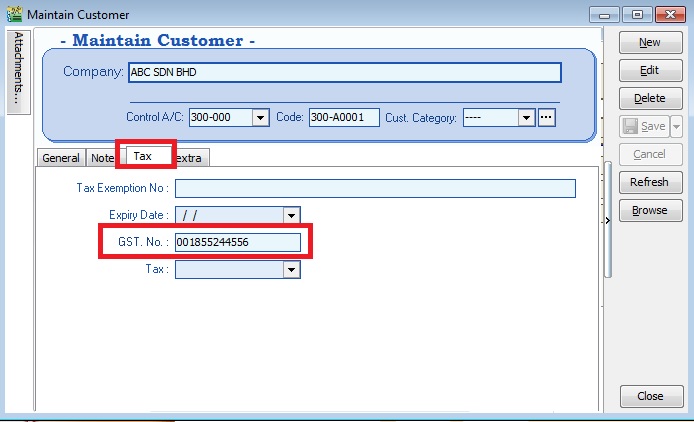

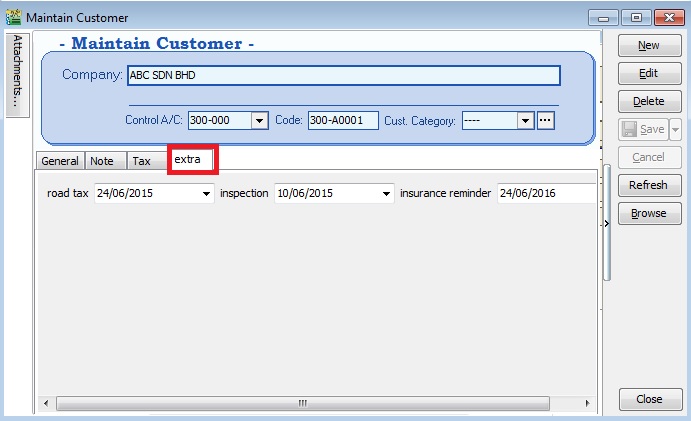

Maintain Customer (SMD)

-

Create new buyer name (eg. company name or person name).

-

Click on Tax tab to input the GST No (if applicable).

-

Click on extra tab. You can enter the road tax, inspection and insurance reminder date for reference.

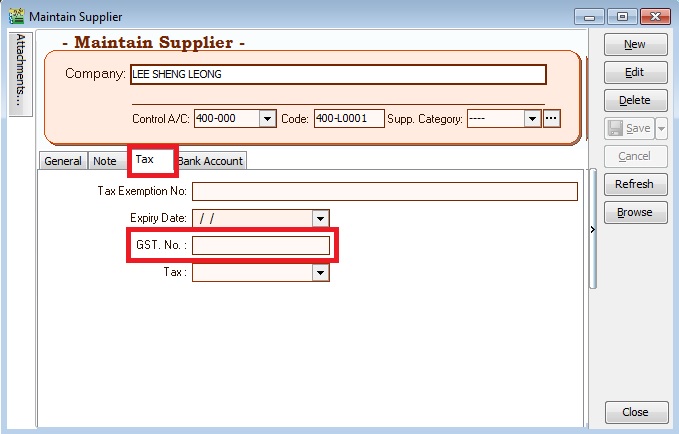

Maintain Supplier (SMD)

-

Create new seller name (eg. company name or person name).

-

Click on Tax tab to input the GST No (if applicable).

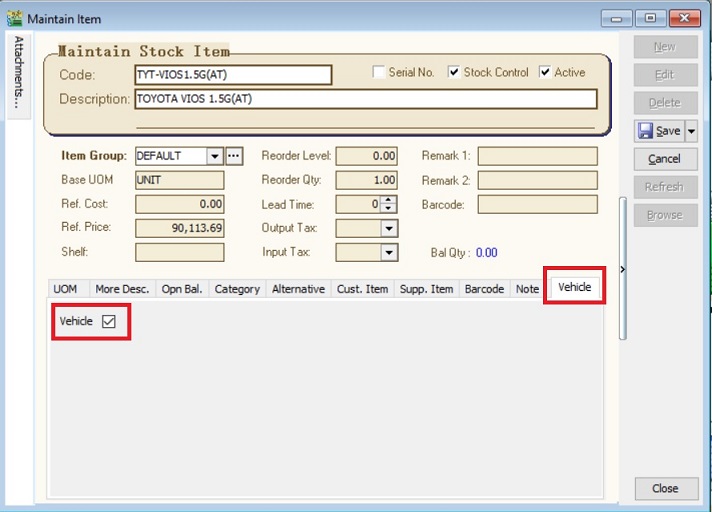

Maintain Stock Item (SMD)

-

Create the car model at Maintain Stock Item. For example, TOYOTA VIOS 1.5G(AT)

-

Click on Vehicle tab to define this item is a "Vehicle".

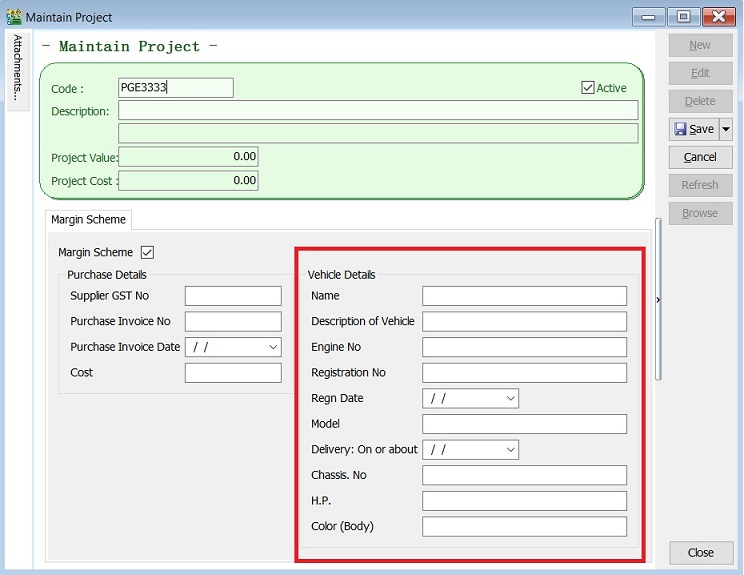

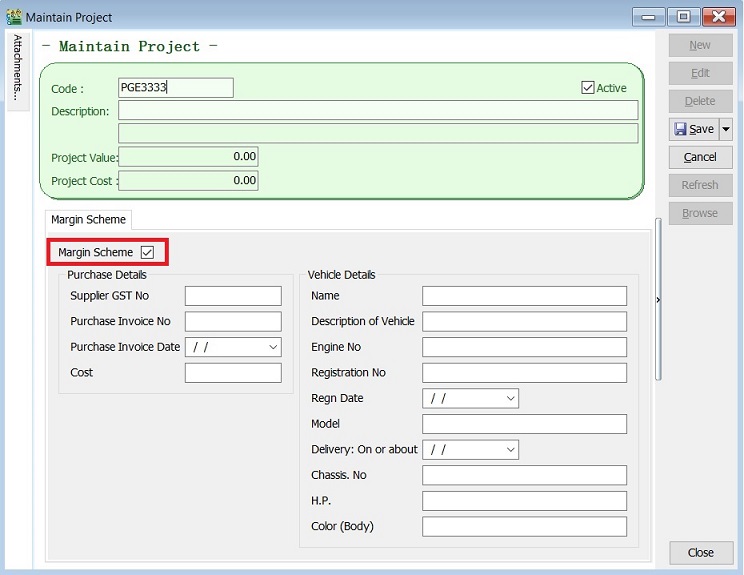

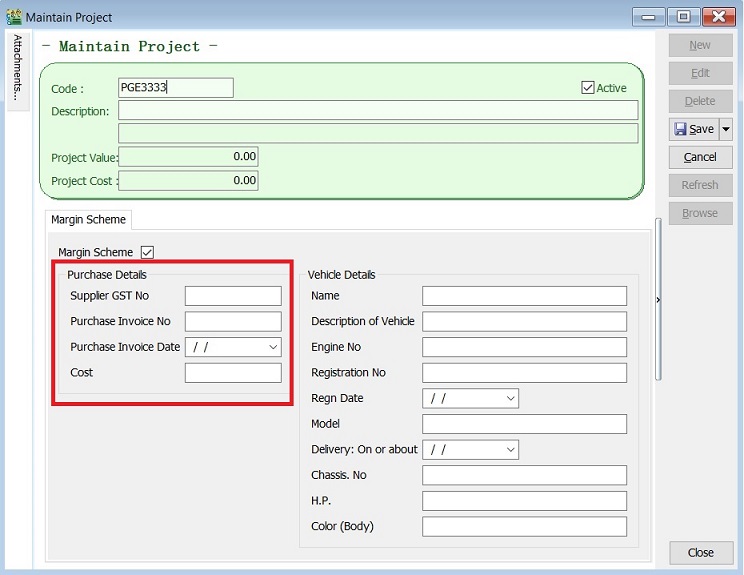

Maintain Project (SMD)

-

Create the second car plate number in Maintain Project.

-

Update the Vehicle detail.

-

Tick on Margin Scheme if it is a second hand car plate number.

-

Leave BLANK to Purchase Invoice Date, Purchase Invoice No and Cost. It will auto update when you are select the project code and save at the Purchase Invoice.

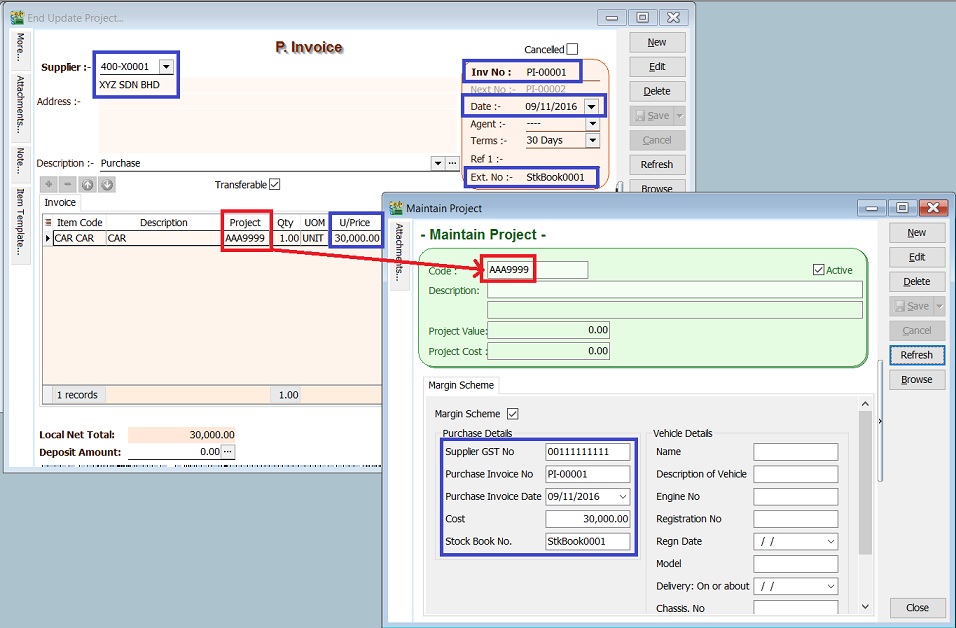

Record Purchase of Second Hand Car Value

-

Enter the purchase value of second car at Purchase Invoice. (eg. RM30,000 )

-

You must select the correct car plate number from Project. (eg. PGE3333, AAA9999)

-

Supplier GST No, Purchase invoice number, date and cost will be updated automatically after you have save the purchase invoice.

Project: Purchase Detail Update from Supplier GST No Maintain Supplier (GST No) Purchase Invoice No Purchase Invoice (Doc No) Purchase Invoice Date Purchase Invoice (Doc Date) Cost Purchase Invoice (Unit Price) Stock Book No. Purchase Invoice (Ext No)

-

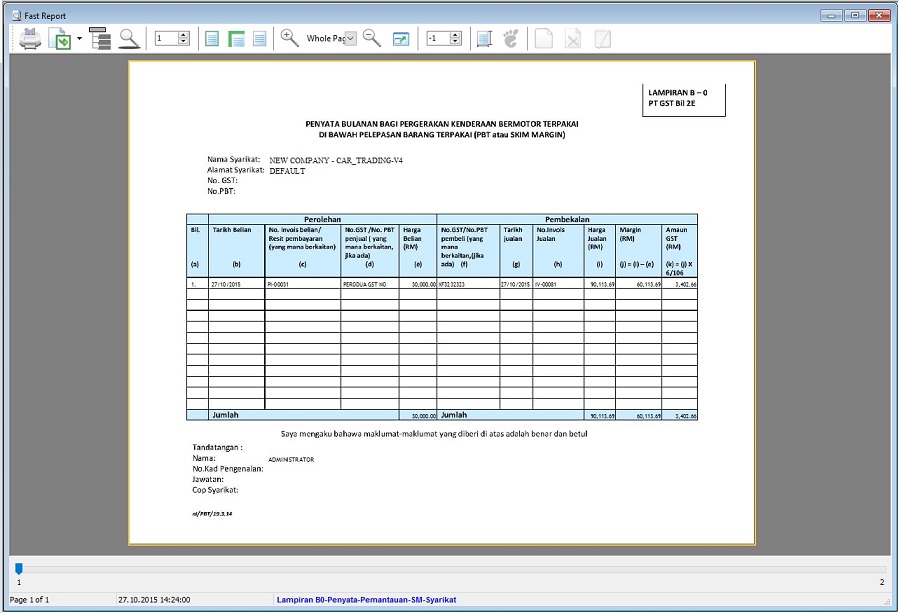

This information is required to show in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS).

-

Auto update to project purchase detail (Purchase No, Purchase Date and Cost) if tax amount is zero.

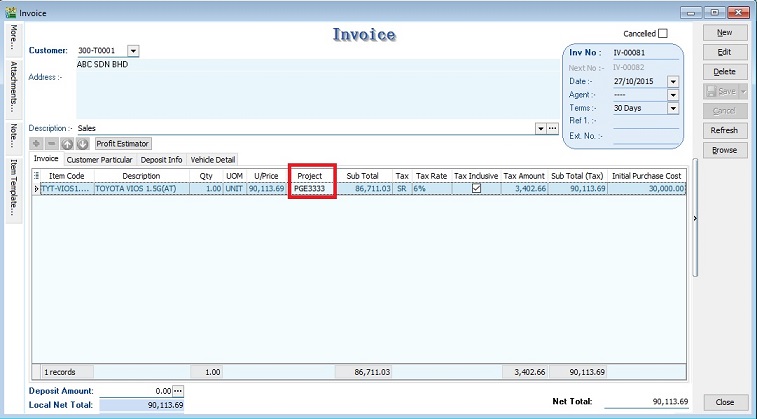

Record Sale of Second Hand Car Value

Margin Scheme Input

-

Enter the sale value of second car at Invoice. (eg.RM90,113.69)

-

You must select the correct car plate number from Project.(eg.PGE3333)

-

Initial Purchase Cost will auto upadate after select the project (car plate number).

-

Tax amount will be calculated based on Margin Scheme method.(See screenshot below)

- Sellng Price = 90,113.69

- Purchase Cost = 30,000.00

- Margin = 90,113.69 – 30,000.00 = 60,113.69

- Tax amount = 60,113.69 x 6/106 = 3,402.66

-

Invoice no, invoice date, selling price, margin, and margin tax amount will be shown in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS)

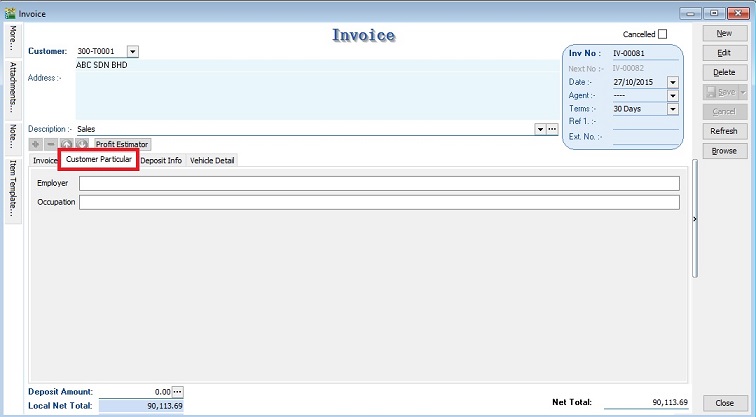

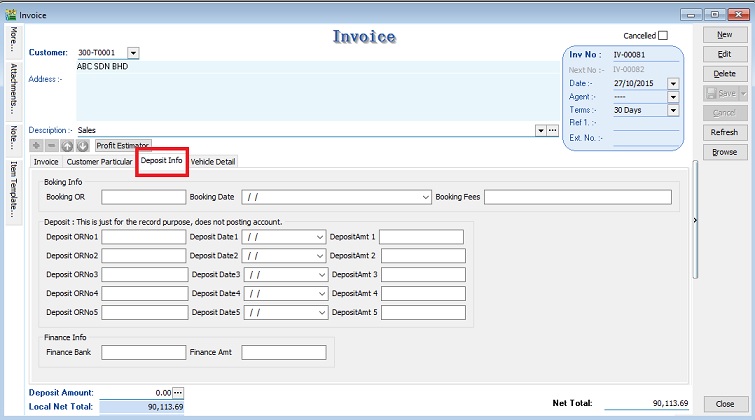

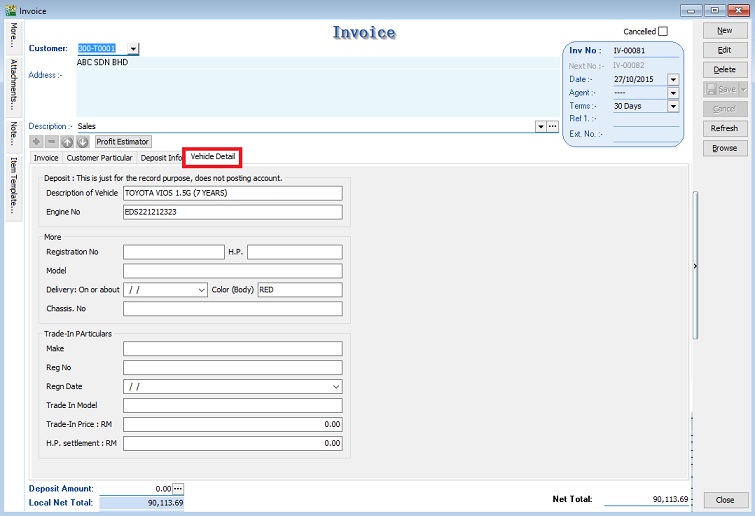

Other Information

-

Customer Particular tab.

-

Deposit Info (For record purpose, no posting to account).

-

Vehichle Detail (Auto retrieve from Vehicle Detail in Maintain Project).

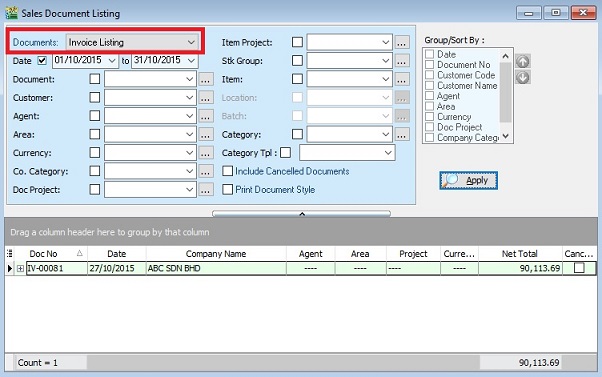

Print for Lampiran 07 (Lampiran B0-Penyata-Pemantauan-SM-Syarikat)

-

Select document to “Invoice Listing” and click APPLY.

-

Click on preview or print. Select the report name “Lampiran B0-Penyata-Pemantauan-SM-Syarikat”.

GST Treatment: Import Goods (IM)

IM - "Import of goods with GST incurred". It means there is an input tax claimable. Tax rate is 6%.

Purchase of goods from oversea supplier, the supplier invoice received will not incurred GST. However, the GST will be taken place when the goods are discharged out from the port to forwarder warehouse or direct to the buyer. Custom will incurred the GST on the total value stated in K1 form.

GST Importation of Goods (IM)

Tax Code for Importion of Goods

You can found the following tax code available in SQL Financial Accounting.

| Tax Code | Description | Tax Rate % |

|---|---|---|

| IM-0 | Import of goods with no GST incurred (for Foreign Supplier Account) | 0% |

| IM | Import of goods with GST incurred | 6% |

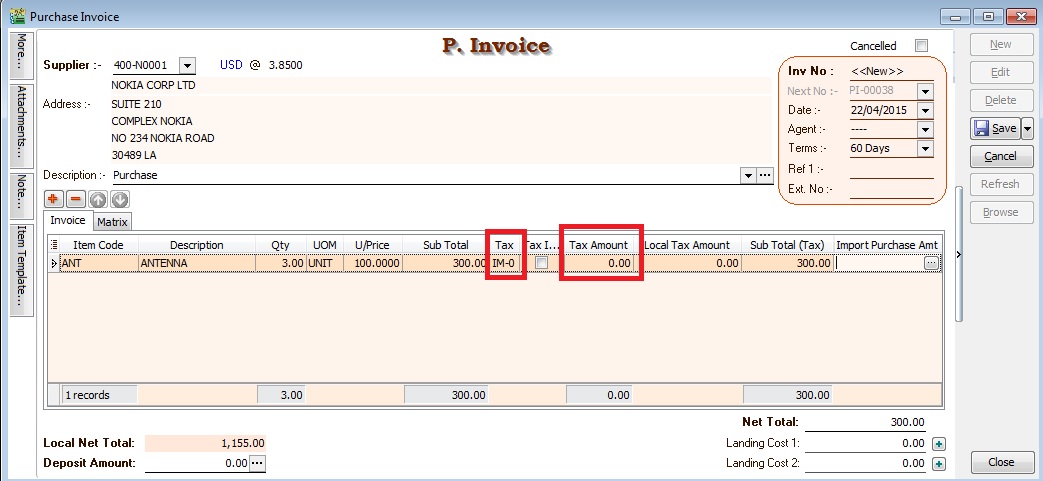

Oversea Supplier Invoice

-

Create the oversea supplier invoice at Purchase Invoice.

-

Select the tax code “IM-0”. Tax amount = 0.00

Received Forwarder Notification from K1 /Invoice

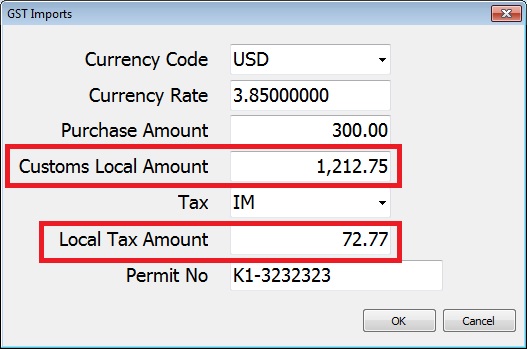

Let's say in the K1 form details:-

| Description | Amount (MYR) | Calculation |

|---|---|---|

| Goods Value (A) | 1,155.00 | USD300 × 3.8500 |

| Custom Duty (B) (5%) | 57.75 | RM1,155 × 5% |

| Total Taxable Amount (C) | 1,212.75 | A + B |

| GST - IM | 72.77 | C × 6% = RM1,212.75 × 6% |

Usually, the forwarder will invoice to the principal company for the following details:-

| Description | Net (MYR) | GST | Gross (MYR) |

|---|---|---|---|

| Est. Duties (Import &/ Excise Duty) | 57.75 | ||

| Est. GST Import (RM1,212.75 × 6%) | 72.77 | ||

| Est Duties + GST Import | 130.25 | 130.52 | |

| Duty Processing Fee | 100.00 | 6.00 | 106.00 |

| Total Payable | 236.52 |

GST Import can be calculated in different way. It might based on total weight (ie. weight x container) or total meter square (ie,meter square x container). For example, GST Import = 30,000m2 x 10 containers x 6% = RM18,000.00

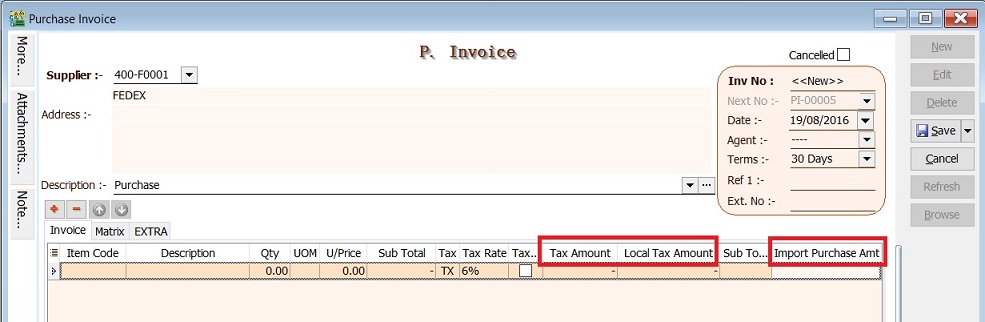

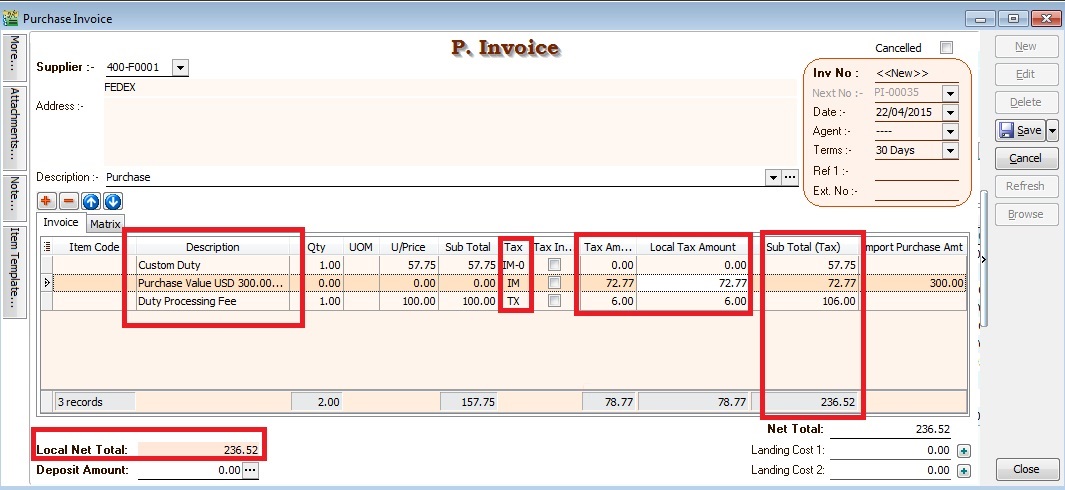

Forwarder Invoice Entry (Purchase Invoice)

-

Select the forwarder supplier code in Purchase Invoice.

-

Insert the following fields:-

- Tax Amount

- Local Tax Amount

- Import Purchase Amt (GST Import input)

- Import Curr.Code (for display only)

- Import Curr Rate (for display only)

-

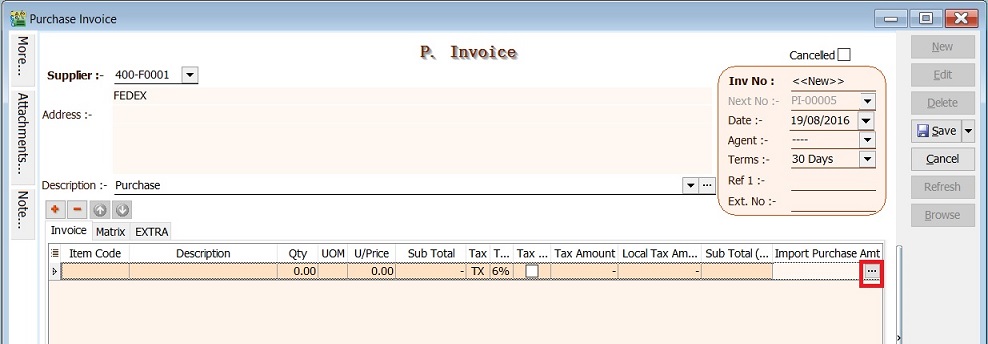

Click on the side button in the Import Purchase Amt column. See screenshot below.

-

You have to input the info according to 2.3. Received Forwarder Notification from K1 /Invoice example.

Field Name Input Value Explanation Currency Code USD Currency of the goods purchased Currency Rate 3.85 Follow K1 exchange rate Purchase Amount 300.00 Goods foreign value as stated in K1 Custom Local Amount 1,212.50 Follow K1 total taxable amount = Purchase Amount + Custom Duty + Excise Duty (if any) Tax IM 6% Import GST at 6% Tax Amount 72.77 = 1,212.75 × 6% Permit No K1-3232323 Key-in the K1 number

-

After press OK to exit the GST Import screen, the purchase invoice item description will be updated as “Purchase Value USD 300.00@3.8500 = RM 1,155.00, Permit No: K1-32323232” from the GST Import entered.

-

Below is the sample of Forwarder invoice entry.

In summary:

| Line # | Description | Sub Total | Tax | Tax Amount | Sub Total (Tax) |

|---|---|---|---|---|---|

| 1 | Est. Duties (Import &/ Excise Duty) | 57.75 | IM-0 | 0.00 | 57.75 |

| 2 | Est. GST Import (RM1,212.75 × 6%) | 0.00 | IM | 72.77 | 72.77 |

| 3 | Duty Processing Fee | 100.00 | TX | 6.00 | 106.00 |

| Total Payable | 236.52 |

Other Supporting Documents Related to Import

All imported goods, both dutiable or not, must be declared in the prescribed forms and be submitted to the customs station at the place of import. The prescribed forms are the following:

-

Customs Form no. 1 (K1): Declaration of goods imported

- Import for dutiable and non-dutiable goods.

-

Customs Form no. 2 (K2): Declaration of goods to be exported

- Export for dutiable and non-dutiable goods.

-

Customs Form no. 3 (K3): Application/ Permit to transport goods within the Federation/Malaysia

- Import & Export of dutiable and non-dutiable goods within Malysia

-

Customs Form no. 8 (K8): Application/ Permit to tranship/remove goods

- Declaration of duty not paid goods a. By rail - Pasir Gudang declared K8 to rail the containers from Pasir Gudang to Port Klang without paying the duty. Port Klang declared K1 to clear the containers by paying duty. (Dutiable cargo) b. Transhipment - From one port tranship from another port. K8 can move container from westport to northport and vice versa without paying duty.

-

Customs Form no. 9 (K9): Requisition/ Permit to remove dutiable goods from customs control

- Clear dutiable cargo slowly out from bonded warehouse. K8 declares for the container truck into bonded warehouse and K9 clears the cargo partial by partial out from the warehouse probably due to high duty charges.

Supporting documents for the declaration forms are as follows:

- Delivery order

- Packing list

- Original invoice

- Bill of lading

- Certificate of origin

- Import licenses which may be required by a proper officer of customs

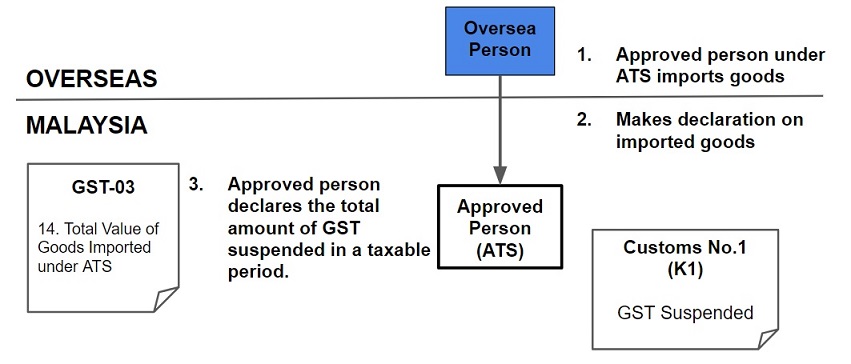

GST Treatment: ATS

Approved Trader Scheme (ATS) is a special schemes are introduced to relieve GST payment on importation of goods.

Section 71 under ATS,

- ATS participants are allowed to suspend GST on the importation of goods.

- Goods imported is used in the course or furtherance of business.

- The amount of GST suspended needs to be declared in the GST return (for the taxable period to which the suspension relates).

Persons eligible for ATS

- Companies located within Free Industries Zone (FIZ)

- Licensed Manufacturing Warehouse (LMW)

- International Procurement Centre (IPC)

- Regional Distribution Centre (RDC)

- Toll manufacturers under ATMS

- Jewellery manufacturers under AJS

- Companies with turnover above RM25 million and at least 80% of their supplies made are zero-rated; or

- Any other person approved by the Minister.

ATS

Tax Code for ATS

| Tax Code | Description | Tax Rate % |

|---|---|---|

| IS | Imports under special scheme with no GST incurred. This refers to goods imported under the Approved Trader Scheme (ATS) and Approved Toll Manufacturer Scheme (ATMS), where GST is suspended when the trader imports the non-dutiable goods into Malaysia. These two schemes are designed to ease the cash flow of ATS and ATMS traders, who have significant imports. | 0% |

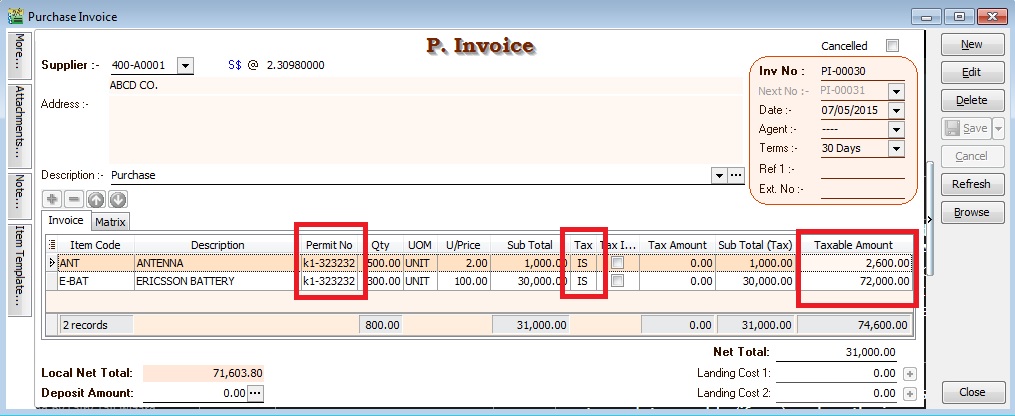

Purchase Invoice For ATS

-

Create the oversea supplier invoice at Purchase Invoice.

-

You are required to key-in the Import Declaration No. (eg. K1 or K9) into Permit No column. This import declaration no will be appear in GAF file.

-

Select the tax code = IS. Tax amount = 0.00

-

Taxable Amount (local value) should entered as:

GST Value = Customs Value (CIF) + any customs duty paid + any excise duty paid

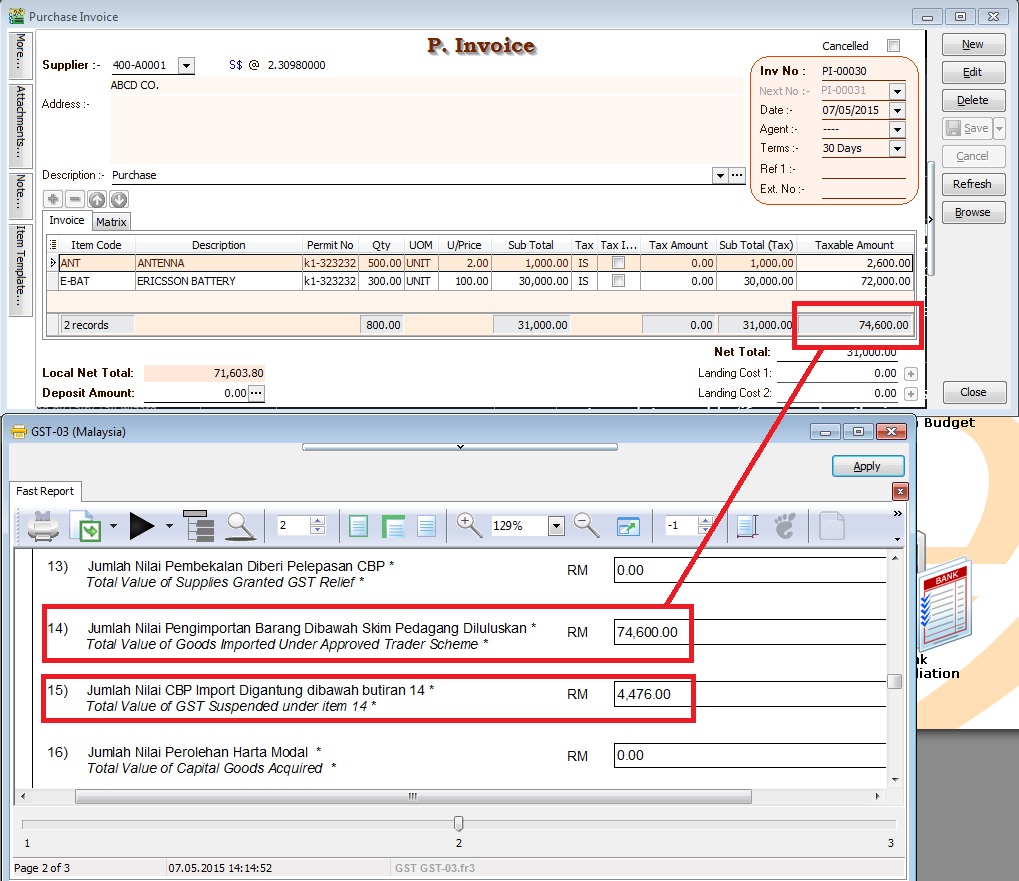

GST Return Process

-

Process the month GST Return.

-

GST03 item no 14 will be fill-up with the Taxable Amount from the purchase invoice item with tax code “IS”.

-

GST03 Item no 15 = Taxable Amount (local value) x 6%

-

For example, below screenshot:-

GST03 Item no 15 = 74,600.00 x 6% = 4,476.00

GST Treatment: Non-Refundable Deposit

How to enter the non-refundable deposit accounted to Standard Rated (SR) and Zero Rated(ZRL & ZRE) to reflect in GST-03 submission?

This guide will help you out. All non-refundable deposit amount are inclusive tax.

| Type of supplies | Tax Rate | GST-03 |

|---|---|---|

| Standard Rated (SR) | 6% | 1. Total Value of Standard Rated Supply (5a) |

| 2. Total Output Tax (5b) | ||

| Zero Rated (ZRL & ZRE) | 0% | 1. Total Value of Local Zero Rated Supplies |

| 2. Total Value of Export Supplies |

Customer Payment

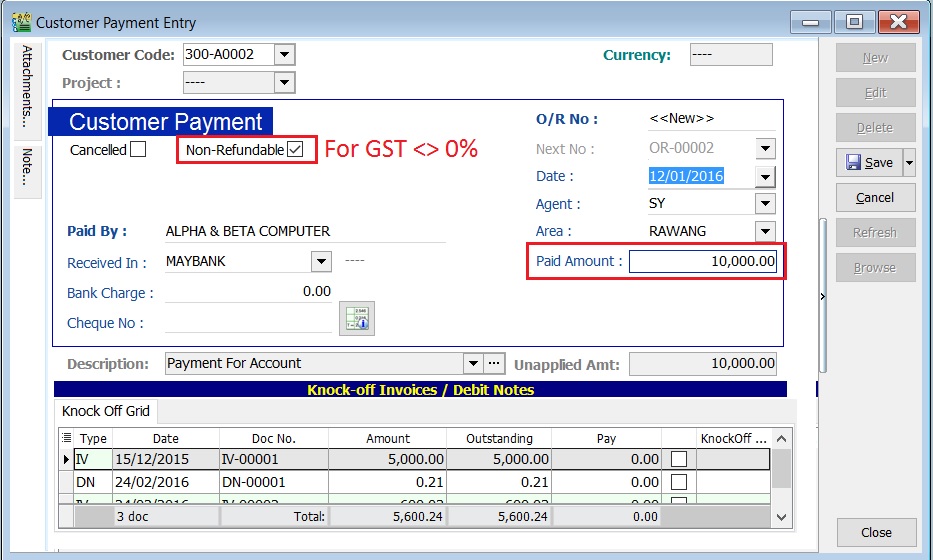

Non-Refundable (SR)

-

Create New Customer Payment.

-

Enter the Paid Amount, eg. Rm10,000.00

-

Tick Non-Refundable for GST not equal to 0%.

-

See the screenshot below.

-

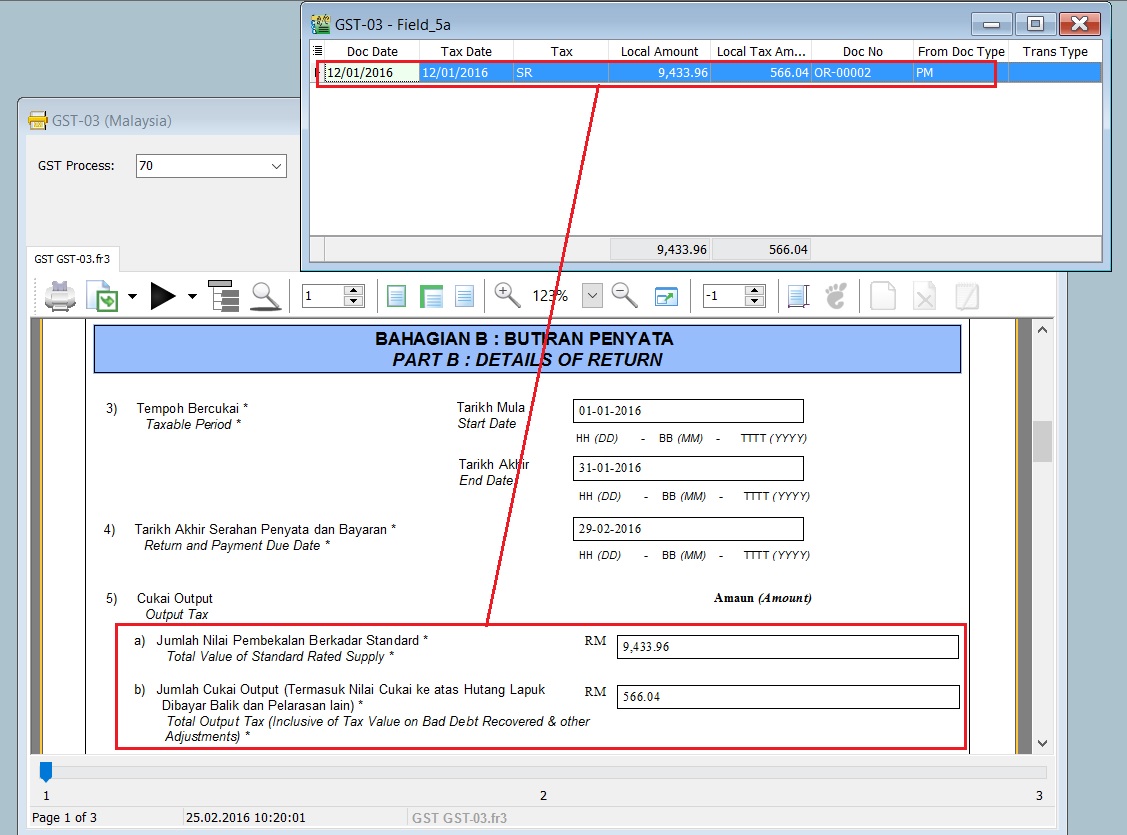

Process GST Returns (GST | New GST Returns...).

-

Print the GST-03.

GST-03 results:-

GST-03 Item Description Local Amount 5a Total Value of Standard Rated Supply 9,433.96 5b Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) 566.04 -

See the GST-03 screenshot below.

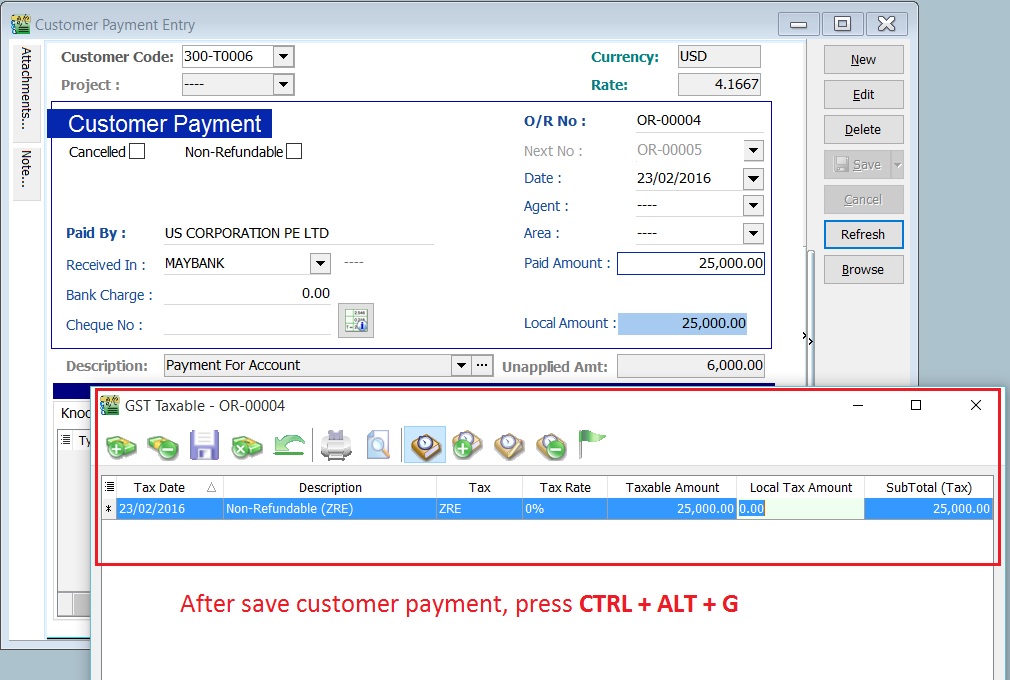

Non-Refundable (ZR)

-

Create New Customer Payment.

-