SST

SST Setup and Information

SST Introduction

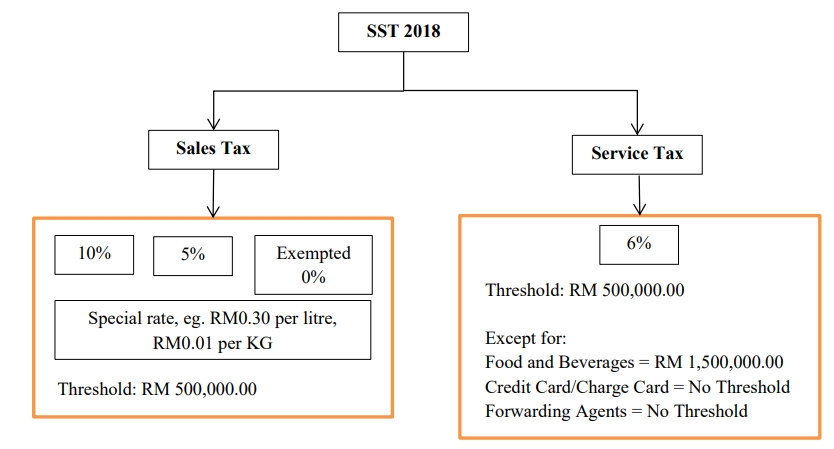

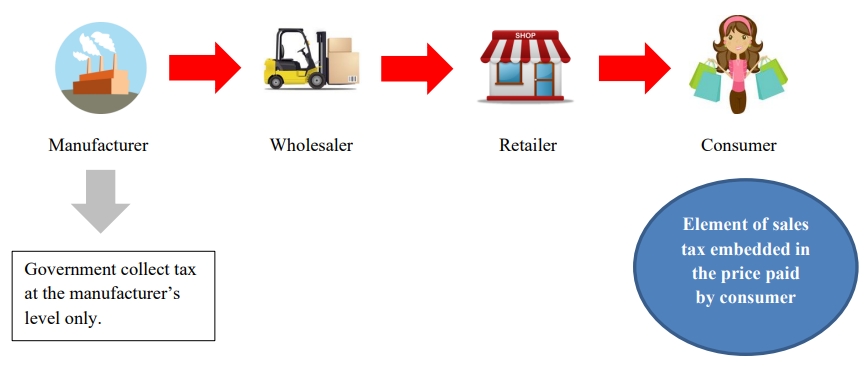

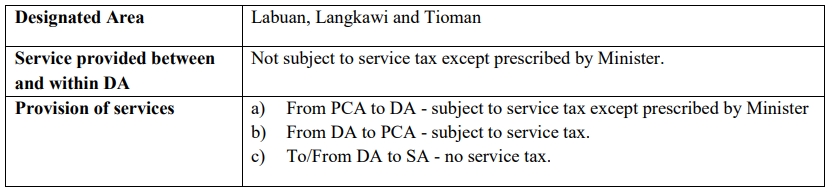

Introduced in September 2018, SST replaced the former 6% Goods and Services Tax (GST) system. SST consists of two parts: Sales Tax and Service Tax. Sales Tax is a single-stage tax applied to all taxable goods manufactured in or imported into Malaysia; while Service Tax is a single-stage tax imposed on taxable services provided in Malaysia by a registered business. Certain designated areas in Malaysia such as Langkawi Island, Tioman Island, and the Federal Territory of Labuan, are exempt from Service Tax.

Sales and Service Tax 2018 Model and Scope

Sales and Service Tax model are structured as below:

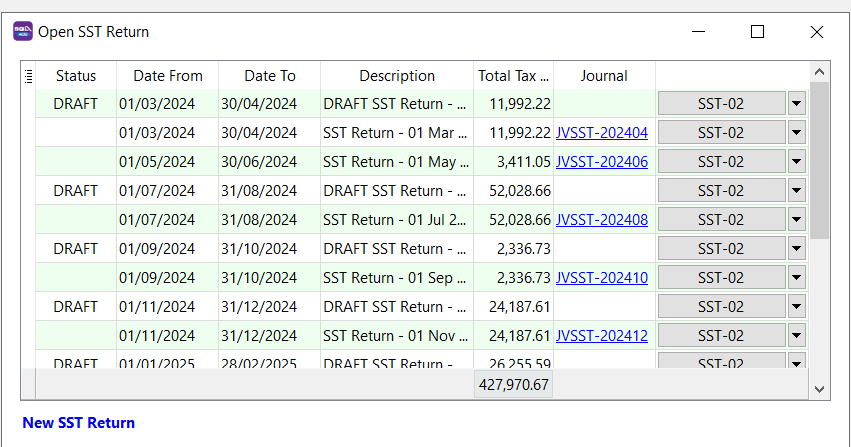

Open SST Return

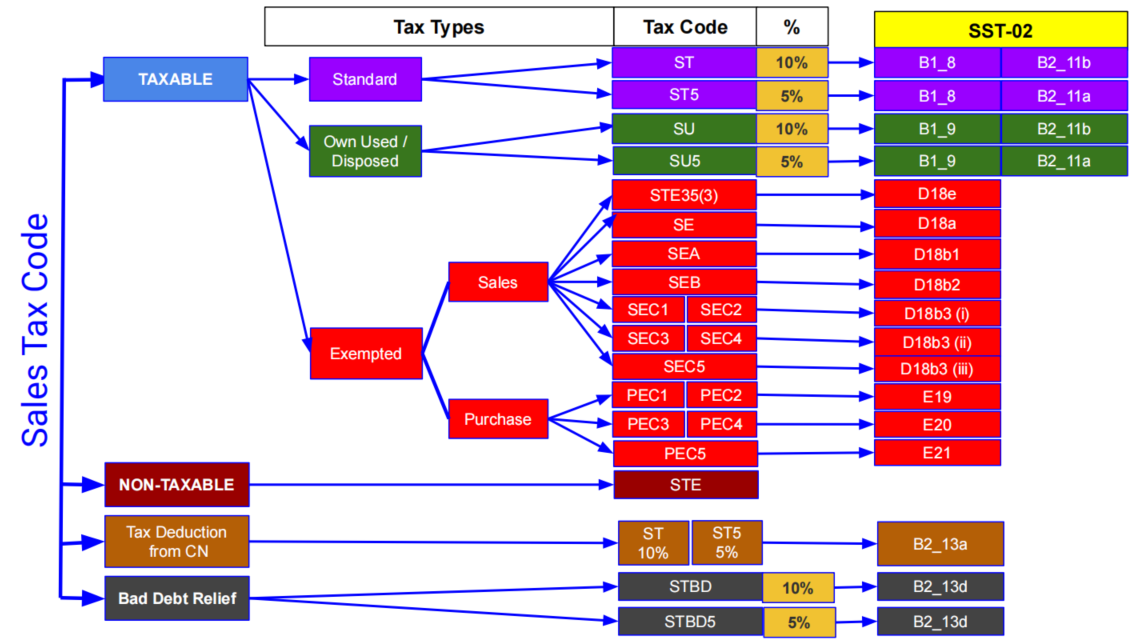

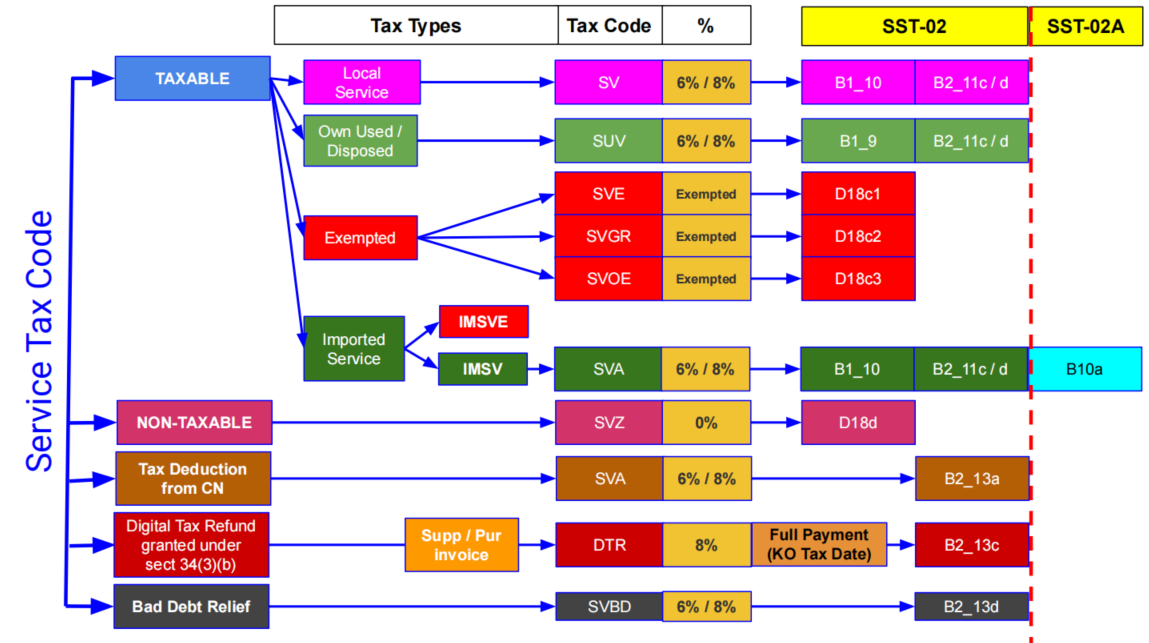

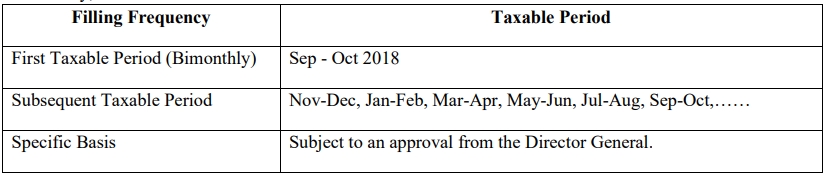

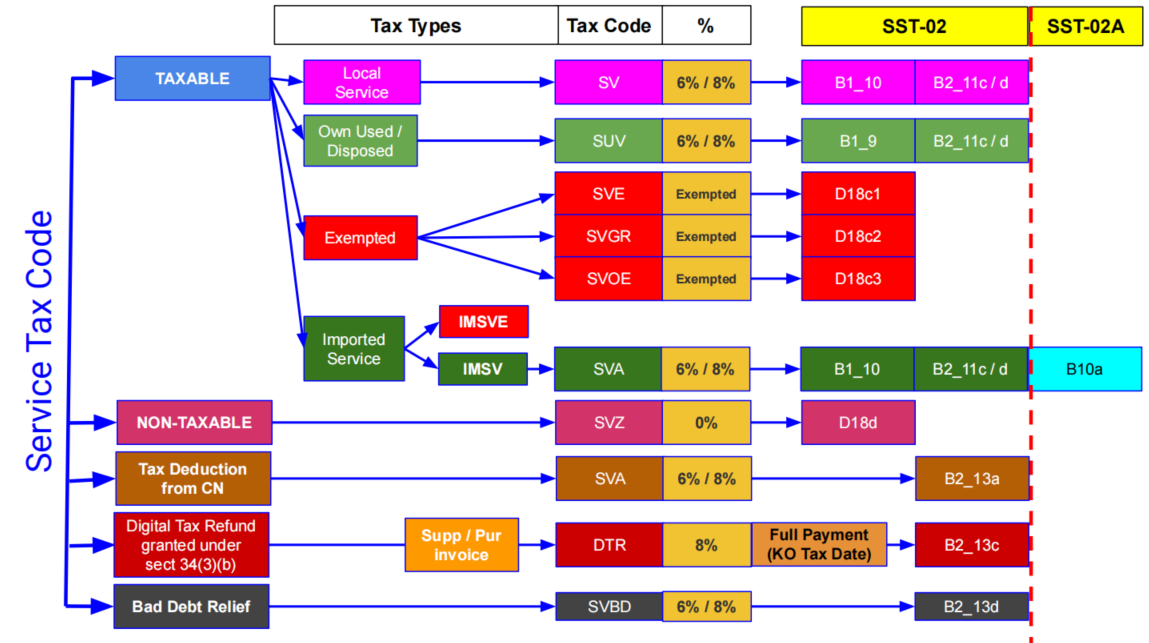

Tax code and SST-02 mapping

SST tax code structures and mapping to SST-02:

Example of SST-02

Follow the steps to process SST-02 in SQL Account : Youtube

-

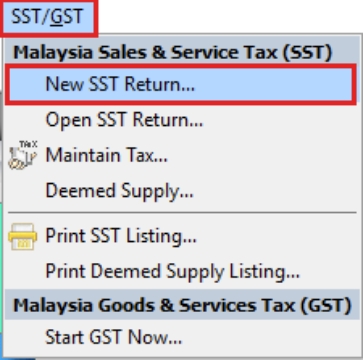

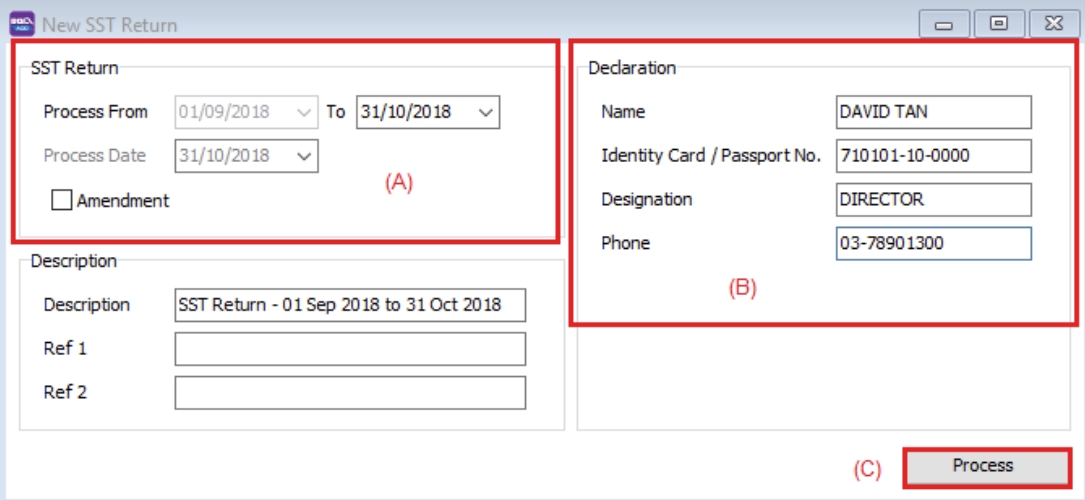

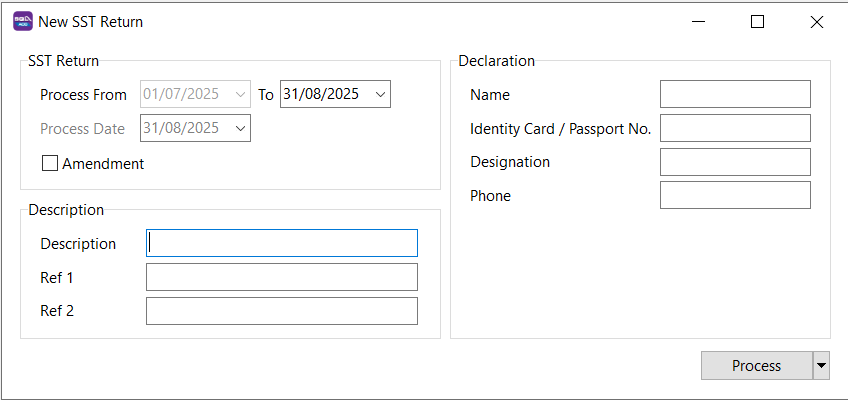

Process SST Return from SST | New SST Return

-

Enter your taxable period

-

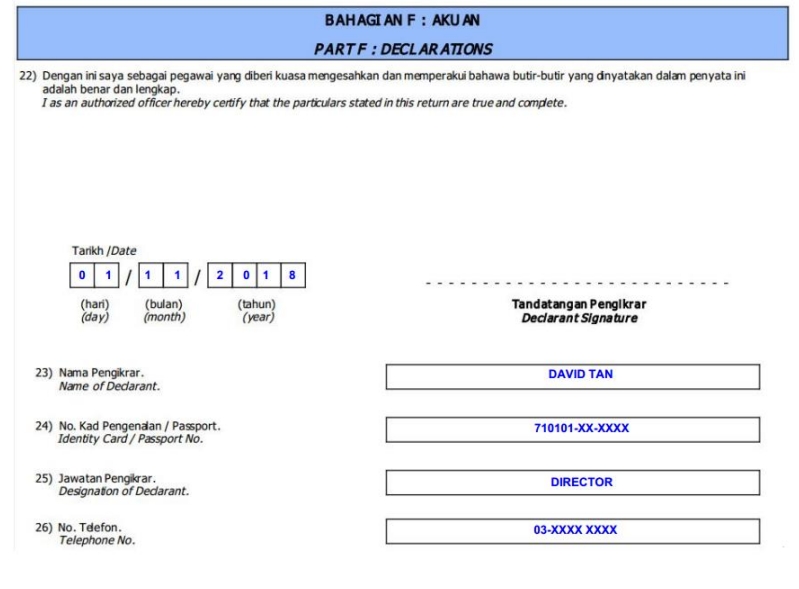

Key in declaration, which will appear in Part F of the SST02 form. This declaration only needs to be entered once, as it will automatically appear in subsequent returns.

-

click Process

-

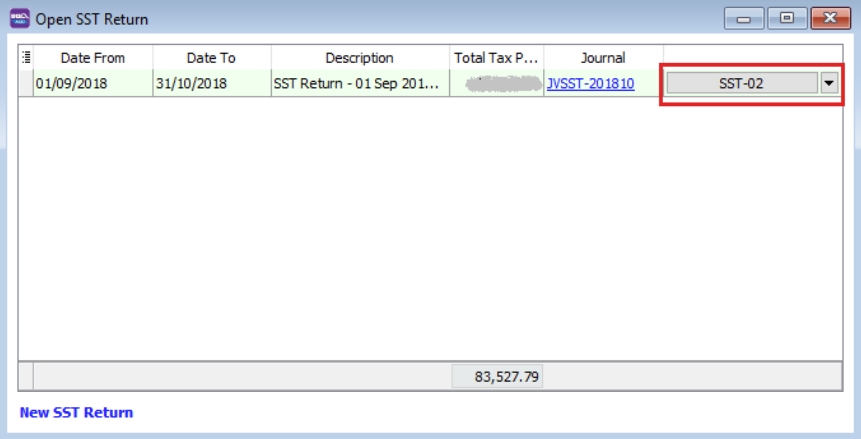

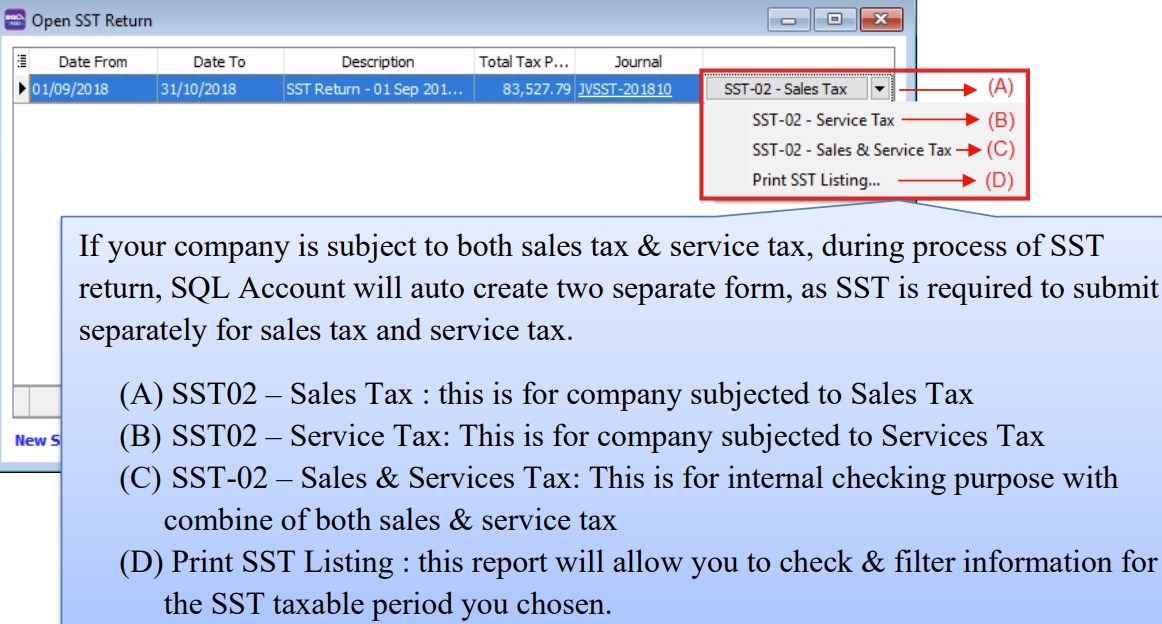

click SST-02

Understand SST02 27 Column : Video

-

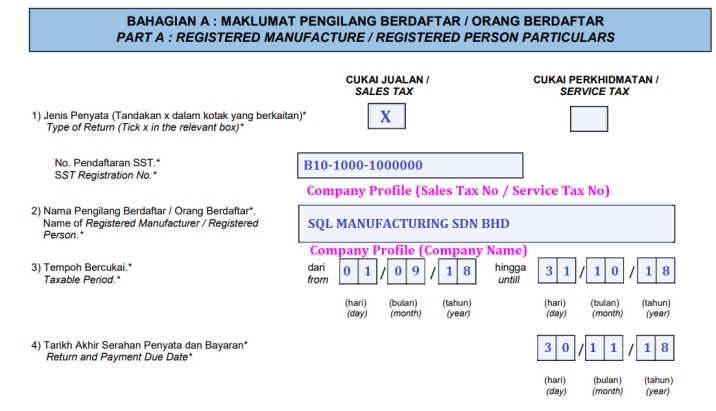

Part A

-

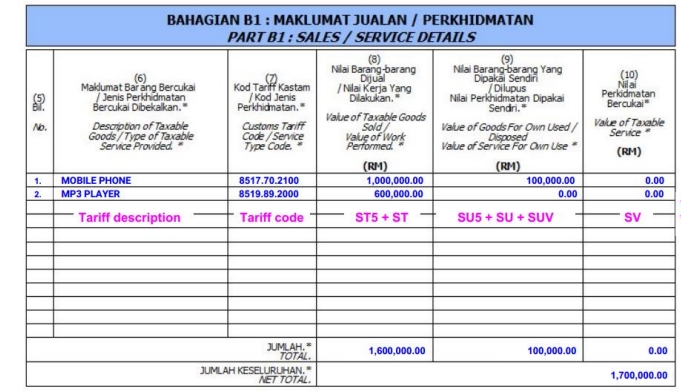

Part B1

-

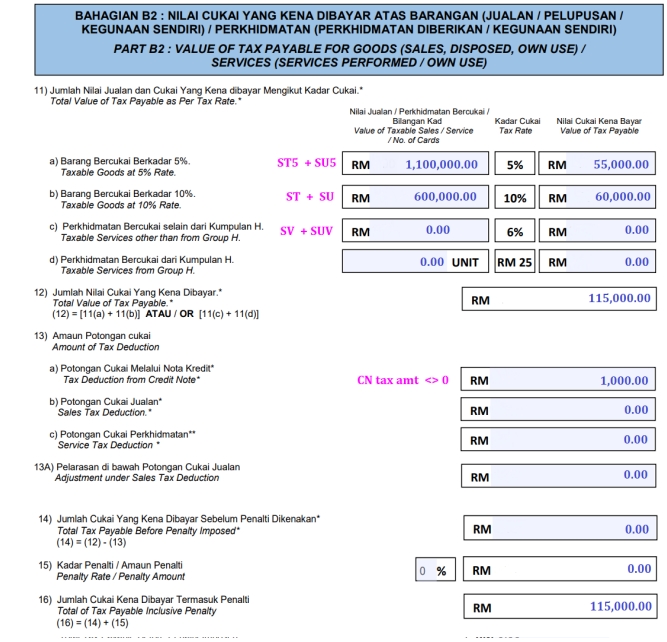

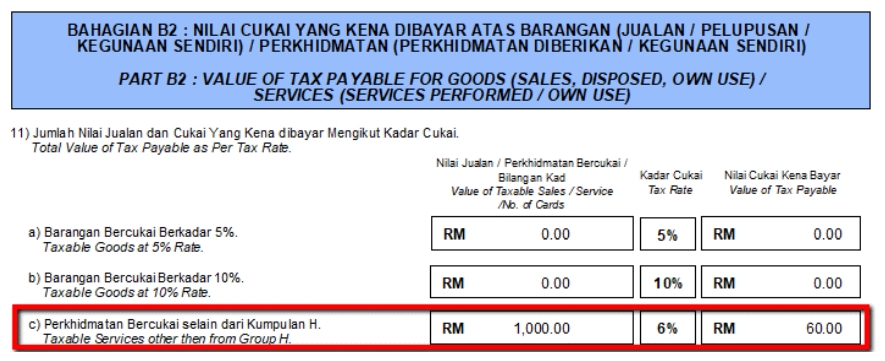

Part B2

-

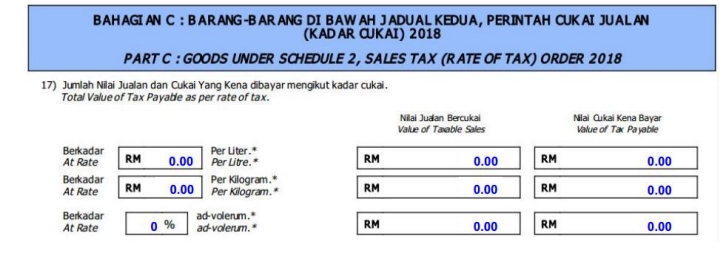

Part C

-

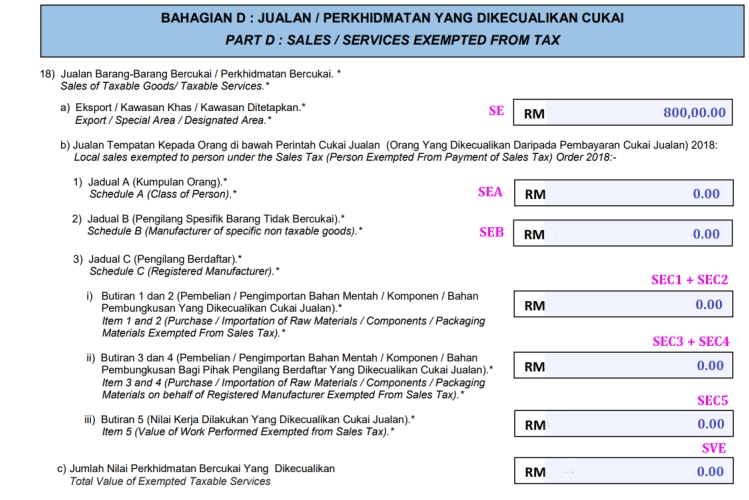

Part D

-

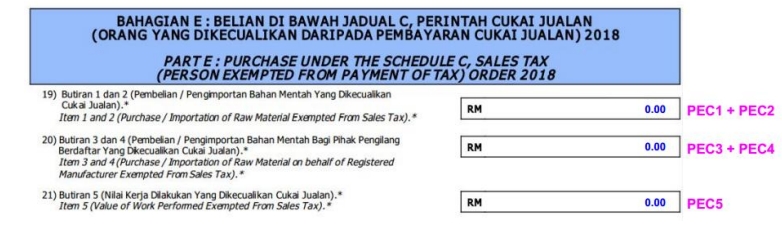

Part E

-

Part F

-

Part G

New SST Return

To process and close the SST returns period. You can generate the SST-02.

| Field Name | Field Type | Explanation |

|---|---|---|

| Process From to | Date | SST Taxable Period, e.g., every 2 months. |

| Process Date | Date | Date to process the SST Return. |

| Amendment | Boolean | Ticked. In SST-02, the "Amendment" checkbox will be marked X. |

| C/F Refund for SST | Boolean | Ticked. In SST-02, the Item 9 "Do you choose to carry forward refund for SST?" will be marked X in Yes checkbox. |

| Description | String | SST Return - Process From Date to Date (by default). |

| Ref 1 | String | Key-in any reference no. |

| Ref 2 | String | Key-in any reference no. |

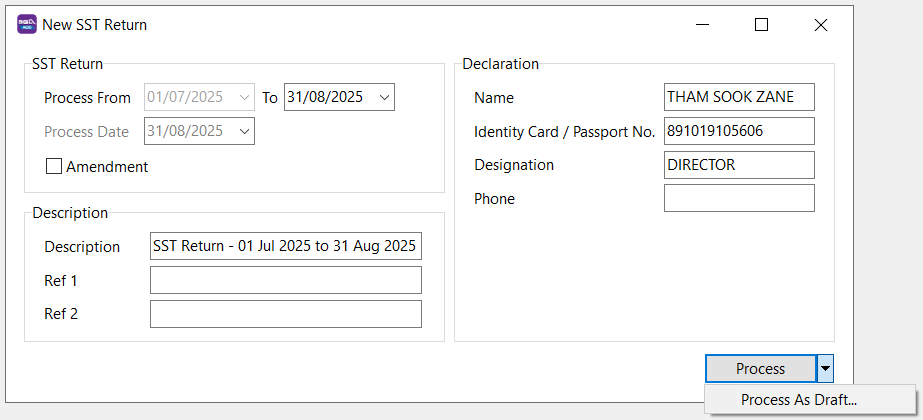

Draft SST Return

You can draft the SST-02 before final submission by processing it as draft.

-

Click on the arrow key down at the Process button (Y).

-

See below screenshot.

-

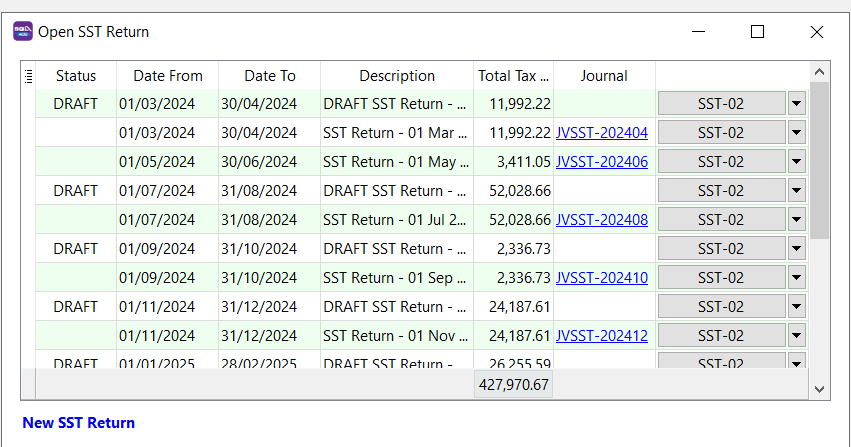

DRAFT Status showed for the SST Returns period.

You still can amend the documents where the DRAFT SST return has generated. You may create multiple drafts before finalizing the SST return for the period.

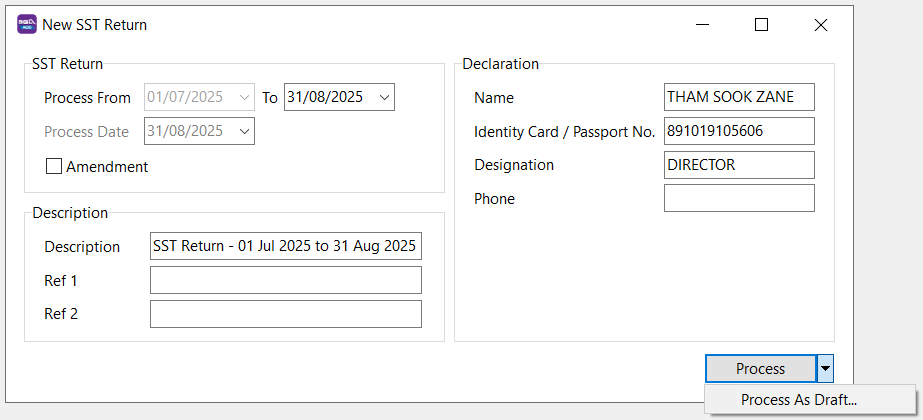

Final SST Return

-

Click on the Process button.

-

See below screenshot.

-

Final SST Return will no longer display "DRAFT" in the status column.

Once the SST return is finalized, you cannot amend the documents.

Posting

-

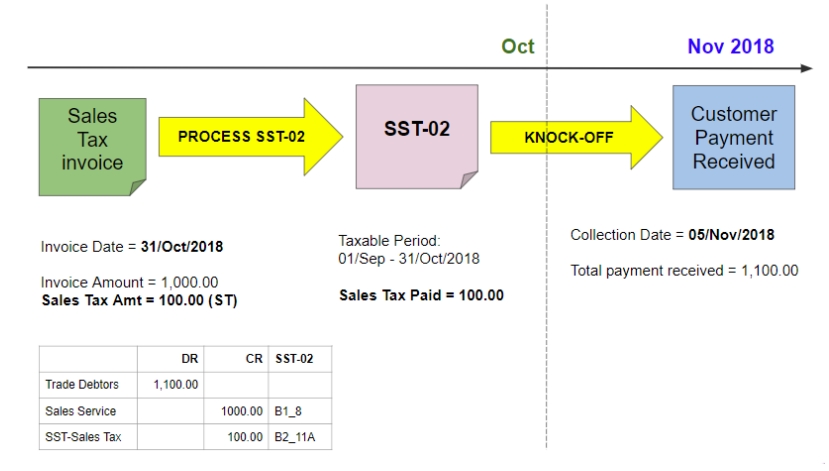

Sales Tax (Accrual Basis)

-

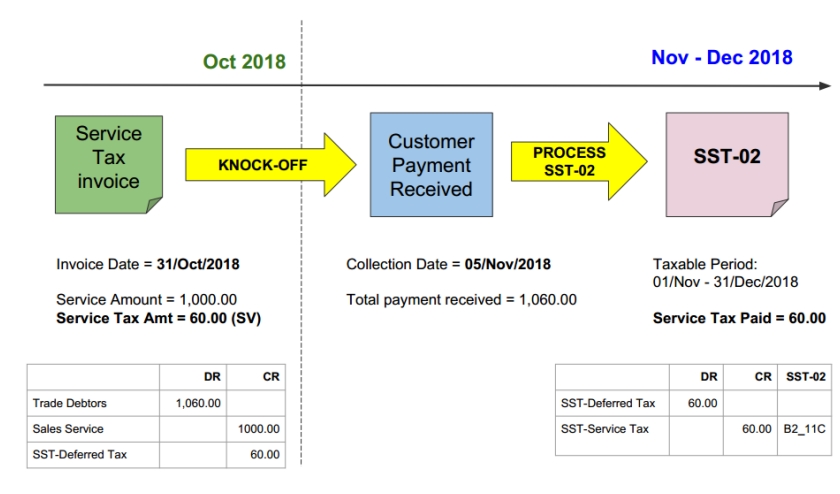

Service Tax (Payment Basis)

In SST 2.0, the service tax is due and payable when payment is received for any taxable service.

-

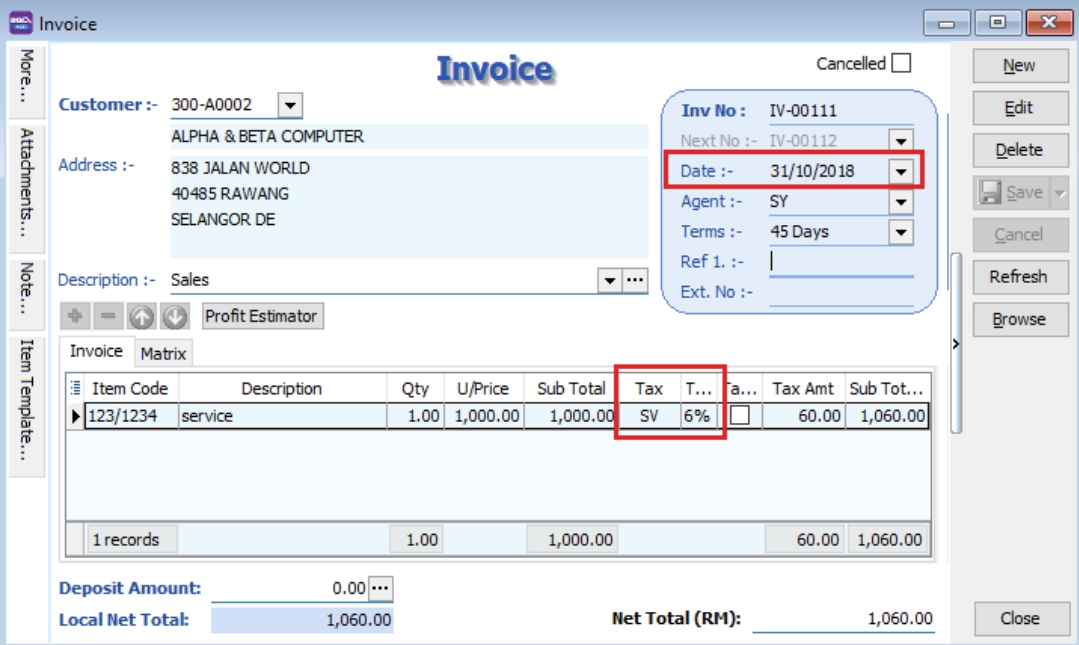

Issue sales invoice with service tax 6%, date 31/10/2018, Amount RM 1,000.00 & Tax Amount RM 60.00.

-

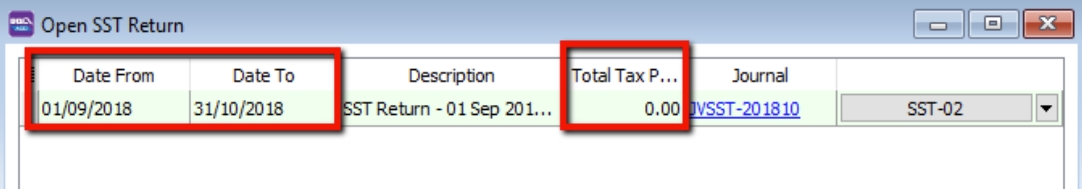

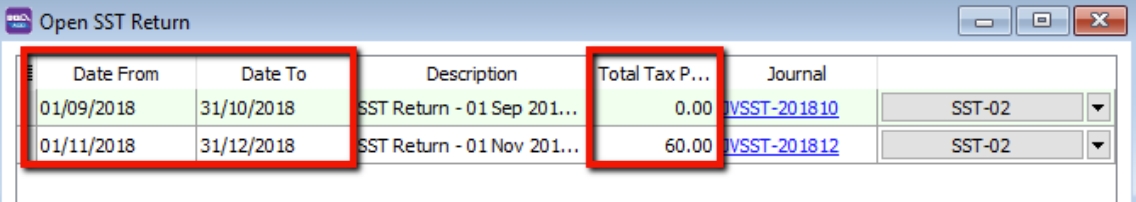

Process SST Return for the period 01/09/2018 to 31/10/2018. Total Tax Payable is RM 0 because no payment was received for the invoices issued.

-

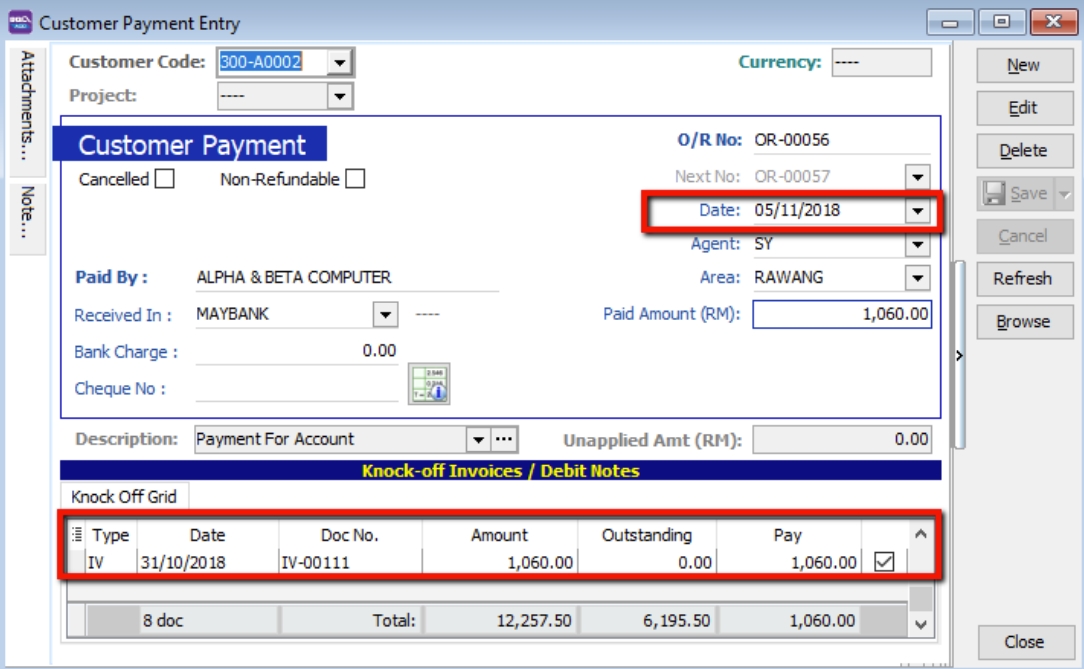

Payment is received on 05/11/2018, knocked-off on IV-00111.

-

Process the second cycle of taxable period. The tax payable will be recorded as payment is received.

-

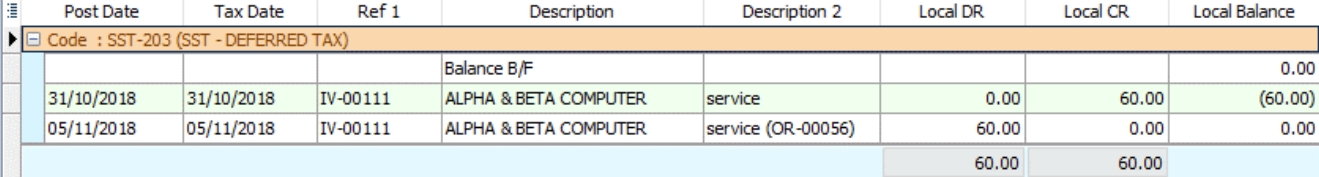

SQL Account will auto Credit to SST- Deferred Tax account during invoice issue but no payment. Once payment is received, a Debit will be auto reversed at SST-Deferred Tax Account.

-

The taxable amount of RM 1,000.00 and the tax amount of RM 60.00 will also be recorded in SST-02 Part B2, item 11c.

-

Sales Tax Legislation (SaTL)

Act (SaTL)

- Sales Tax 2018

Regulations (SaTL)

-

Sales Tax Regulations 2018

-

Sales Tax (Customs Ruling) Regulations 2018

-

Sales Tax (Determination of Sale Value of Taxable Goods) Regulations 2018

-

Sales Tax (Compounding of Offences) Regulations 2018

Order (SaTL)

-

Appointment of Date of Coming into Operation

-

Sales Tax (Person Exempted From Payment Of Tax) Order 2018

-

Sales Tax (Imposition Of Tax In Respect Of Designated Area) Order 2018

-

Sales Tax (Imposition Of Tax In Respect Of Special Area) Order 2018

-

Sales Tax (Exemption From Registration) Order 2018

-

Sales Tax (Goods Exempted From Tax) Order 2018

-

Sales Tax (Rates Of Tax) Order 2018

-

Sales Tax (Total Sale Value Of Taxable Goods) Orders 2018

Scope and Charge (SaTL)

Sales Tax is a tax charged and levied -

-

on taxable goods manufactured in Malaysia by a taxable person and sold, used or disposed by him;

-

on taxable goods imported into Malaysia

Definition of:

-

Goods means all kind of movable property.

-

Taxable goods means goods of a class or kind not exempted from sales tax; i.e goods which are not listed in Sales Tax (Goods Exempted From Sales Tax) Order 2018.

-

Sales includes barter, disposal of goods with a right of purchase or on terms providing that the seller retains an interest in the goods, and delivery of goods under any conditions as to future payment.

Sales Tax is not charged on-

-

Goods listed under Sales Tax (Goods Exempted From Sales Tax) Order 2018;

-

Certain manufacturing activities are exempted by Minister of Finance through Sales Tax (Exemption from Registration) Order 2018.

Malaysia excludes designated area (DA) and special area (SA).

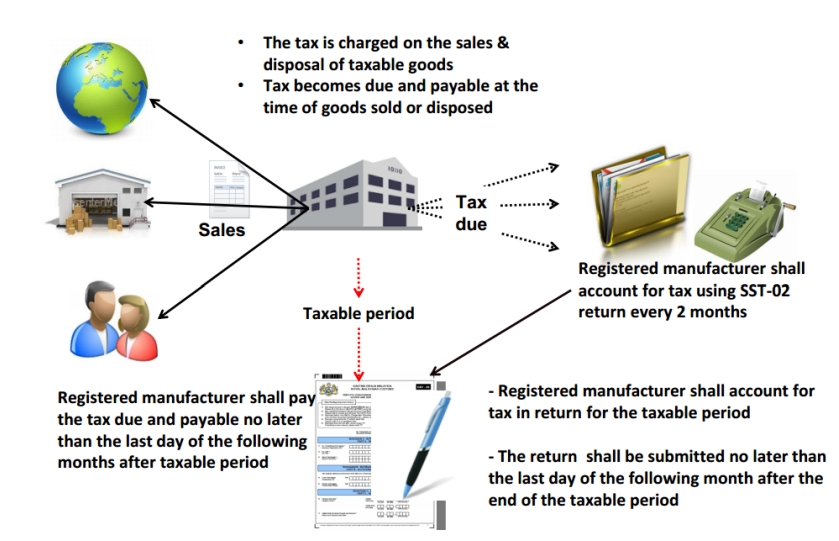

Sales Tax Mechanism

Overview of Sales Tax flow chart:-

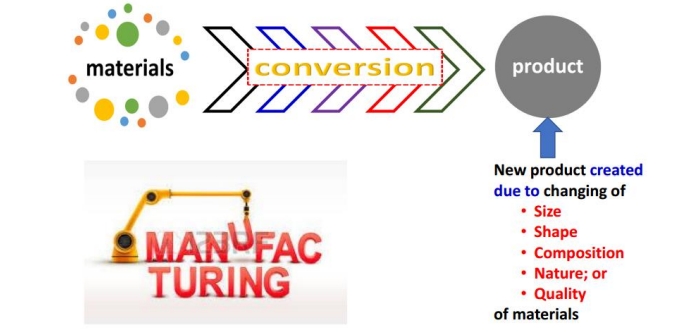

Meaning of Manufacture

Manufacture defines as a conversion of materials by manual or mechanical means into a new product by changing the following:

-

size

-

shape

-

composition

-

nature

-

quality

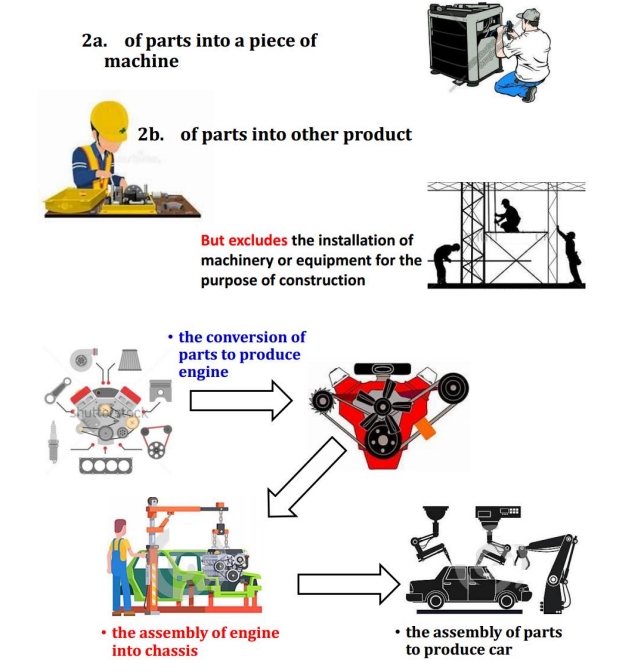

of such materials and includes the assembly of parts into a piece of machinery or other products.

However, manufacture does not include the installation of machinery or equipment for the purpose of construction.

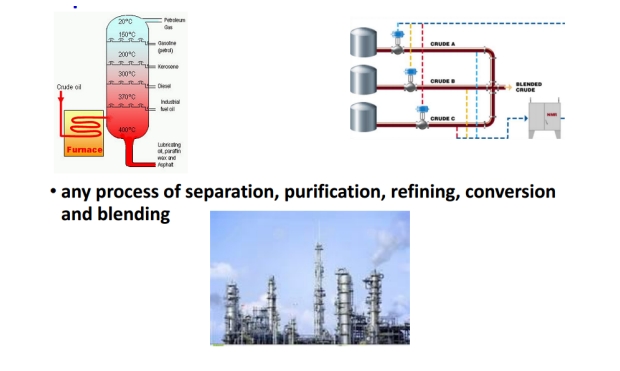

In relation to petroleum, any process of:-

-

separation

-

purification

-

conversion

-

refining

-

Blending

For goods other than petroleum

-

By conversion

-

The assembly

-

For petroleum

Meaning of Taxable Person (SaTL)

Taxable person is a person who manufacturing taxable goods and is:

-

Liable to be registered

-

Reached sales threshold

-

Manufacturer - RM 500,000.00

-

Sub-contractor - RM 500,000.00

-

-

-

Registered under Sales Tax Legislation

-

Mandatorily registered

-

Voluntarily registered

-

Sales Tax Registration

Liability To Register

Manufactures of taxable goods are required to register when the sales value of taxable goods exceeds RM 500,000 over a 12 months period.

Manufacturers who carry out sub-contract work on taxable goods where the VALUE of work performed exceeds RM500,000 for 12 months period.

Taxable goods belong to:

-

Registered manufacturer;

-

Non-registered manufacturer

-

Manufacturer in special area (FIZ and LMW)

Registered Person will known as Registered Manufacturers.

Voluntary Registration

Conditions are:

- Sales value of taxable goods below threshold (ie. < RM 500,000).

- Person who are exempted from registration

Determination of Turnover

Manufacturers should calculate the sales value of taxable goods for a period of 12 months using the following methods:

-

Historical Method

The total value of taxable goods in that month and the 11 months immediately preceding the month;

-

Future Method

The total value of taxable goods in that month and the 11 months immediately succeeding the month.

Exemption from Registration

-

Manufacturer of non taxable goods. (Not eligible for voluntary registration).

-

Manufacturer below threshold (ie. < RM 500,000).

-

Sub-contractor manufacturer below threshold.

-

Manufacturing activities that have been exempted from registration. E.g :

-

Tailoring

-

Installation incorporation of goods into building

-

Transitional Registration (Sales)

Manufacturer liable for registration must register before September 1, 2018. The registration commencement date is September 1, 2018.

-

Automatic Registration

-

Manufacturers who are GST Registered Persons which have been identified and fulfilled the required criteria will be registered automatically as Registered Manufacturer under Sales Tax.

-

Registered Manufacturer need to charge tax beginning 1 September 2018.

-

-

Person Not Registered Automatically

- GST registered person who fulfilled the required criteria to be registered but were not registered by 1 September 2018 need to apply for registration within 30 days from the commencement date.

Taxable vs Exempted Goods

Taxable Goods

Taxable goods refer to goods of a class or kind not exempted from sales tax.

In another words, goods which are not listed in Sales Tax (Goods Exempted From Sales Tax) Order 2018.

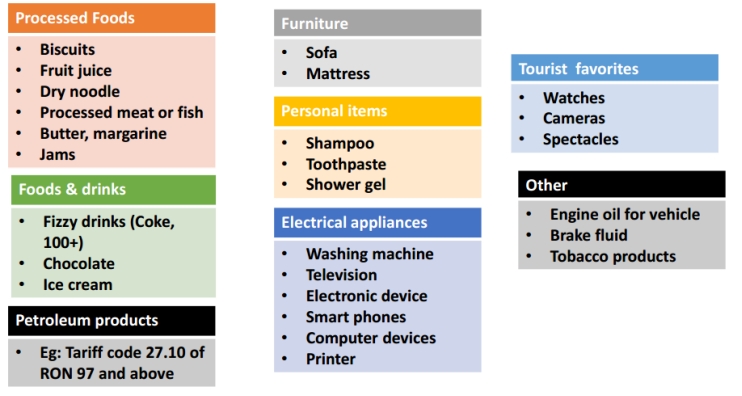

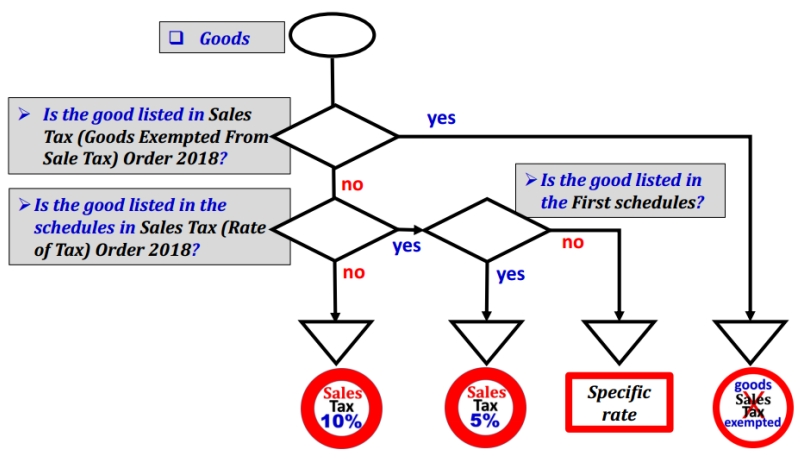

Example of taxable goods include:

It is chargeable with a tax rate of

-

10% - standard sales tax rate

-

5% - reduced sales tax rate

- First Schedule in the Sales Tax (Rate of Tax) Order 2018

-

Specific rate - for petroleum product (eg. RM0.30 per litre)

- Second Schedule in the Sales Tax (Rate of Tax) Order 2018

How to determine the rate of sales tax for goods?

Exempted Goods

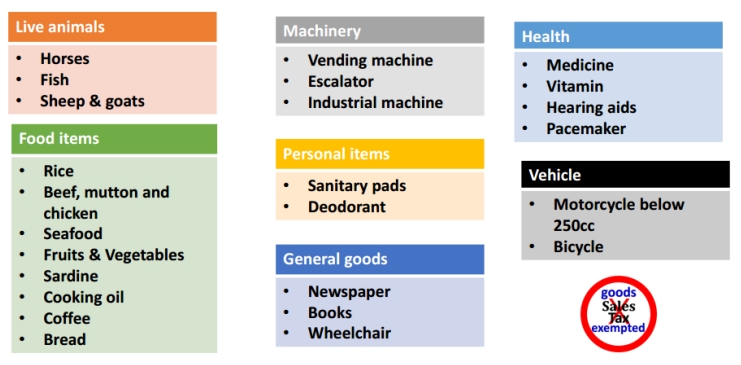

Exempted goods refer to goods of a class or kind that are exempted from sales tax, as listed in the Sales Tax (Goods Exempted From Sales Tax) Order 2018.

Example of exempted goods are:

Value of Taxable Goods

Refer to Sales Tax (Rules of Valuation) Regulation 2018, value of taxable goods that:

-

sold by taxable person

-

manufactured and used by the manufacturer for other purpose than as materials in manufacturing; or

-

disposed by manufacturer.

For goods belongs to another manufacturer is known as sub-contract work.

- Sale value of the goods = Amount of the work performed and charged by sub-contractor.

The sale value of the goods shall be determined on the basis of the transactions value of the goods as the primary basis of valuation.

Transaction value of the goods,

-

The actual price the goods are sold, without any conditions or restrictions imposed to purchaser.

-

Purchaser is not required to give parts of proceed on subsequent sale to the manufacturer.

-

Purchaser and manufacturer are not related or if related the relationship did not influence the price.

Responsibility of Registered Manufacturer

Exemption and Facilities

Goods Exemption from Sales Tax

Goods refer to Sales Tax (Goods Exempted From Sales Tax) Order 2018.

- E.g. live animals, unprocessed food, vegetables, medicines, machinery, chemicals, etc.

Person Exempted from Sales Tax

Person refer to Sales Tax (Person Exempted From Sales Tax) Order 2018.

-

Schedule A: Class of person, e.g. Ruler of States, Federal or State Government Department, Local Authority, Inland Clearance Depot, Duty Free Shop.

-

Schedule B: Manufacturer of specific non-taxable goods, e.g. any manufacturer of

-

Controlled goods under Control of Supplies Act 1961

-

Pharmaceuticals products

-

Solely manufacture milk products

-

Solely manufacture of exempted goods for export to import/purchase raw materials, components and packaging materials.

- Schedule C: Registered Manufacturer, exemption of tax on the acquisition of raw materials, components, packaging to be used in manufacturing of taxable goods (previously known as CJ5, CJ5A, CJ5B).

-

Field Exempted from Sales Tax

Manufacturing activities exempted from registration regardless of turnover.

- E.g. tailor, jeweller, optician, engraving, vanishing table top, etc.

Special Rules

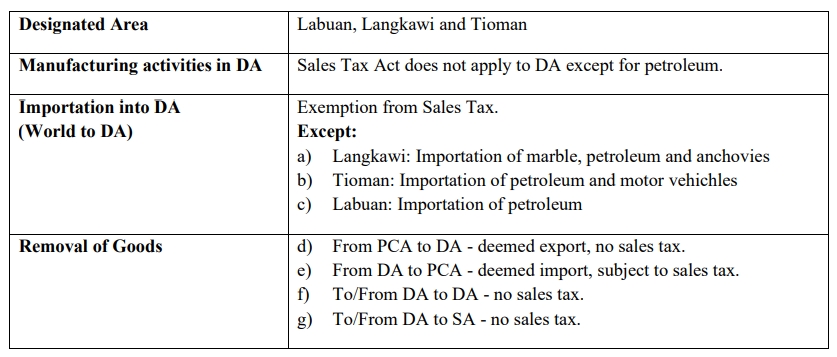

Treatment in Designated Area for Sales (DA)

SA = Special Area, e.g. Free Zone (FZ), Licensed Warehouse, Licensed Manufacturing Warehouse (LMW) and Joint Development Area (JDA).

PCA = Principal Customs Area

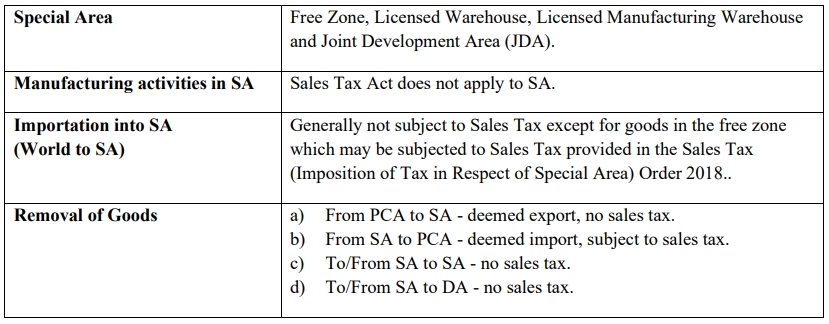

Treatment in Special Area for Sales (SA)

Accounting of Tax

Invoices

Issuance of Invoice:

-

Mandatory for registered manufacturer who sell taxable goods.

-

Hard copy or electronically.

-

Containing prescribed particulars.

-

Bahasa Melayu or English.

Prescribed particulars are:

-

The invoice serial number;

-

The date of the invoice;

-

The name, address and identification number of the registered manufacturer (Sales Tax Number);

-

The name and address of the person to whom the taxable goods is sold;

-

Description and quantity of the goods;

-

Any discount offered;

-

For each description, distinguish the type of goods, quantity and amount payable excluding tax;

-

The total amount payable excluding tax, the rate of tax and the total tax chargeable shown as a separate amount or total amount payable inclusive of total of tax chargeable;

-

Any amount expressed in a currency other than ringgit shall also be expressed in ringgit at the selling rate of exchange prevailing in Malaysia at the time of sale.

-

Credit Note & Debit Note usage

A credit note is allowed to issue by registered manufacturer under the situation where the goods are returned by the purchaser due to :

-

Wrong quantity, poor or defective quality or uncontracted goods, provided that the goods have not been subsequently sold or disposed of by the purchaser.

-

Discount given in respect of goods sold and which are freely available to all who are willing to conduct business.

A debit note is allowed to issue by registered manufacturer under the situation where there is an additional of sales tax to be paid for any price adjustment.

Both credit note and debit note shall contains the following particulars:

-

The word “credit note” or “debit note” in a prominent place.

-

The serial number and date of issue.

-

The name, address and Sales Tax identification number of the supplier.

-

The name and address of the customer.

-

The reason for issuance.

-

Description which identifies the description of goods, the quantity and amount for which CN or DN is given.

-

The total amount excluding tax.

-

The rate and amount of tax.

-

The number and date of the original invoice.

If changes related to amount of tax payable:

-

Adjustment in the return for the taxable period in which the credit note or debit note is issued.

-

Adjustment in the return for the last taxable for person who has ceased to be a taxable person.

If deduction for taxable period exceeds the amount of sales tax payable, the balance is to be carried forward to the next taxable period. Refund is not allowed on balance carried forward if taxable person has ceased to carry on business.

Accounting Basis and Taxable Period Information

Accounting Basis Information

Sales Tax is based on accrual basis and it is required to be accounted at the time when the goods are sold, disposed or first used.

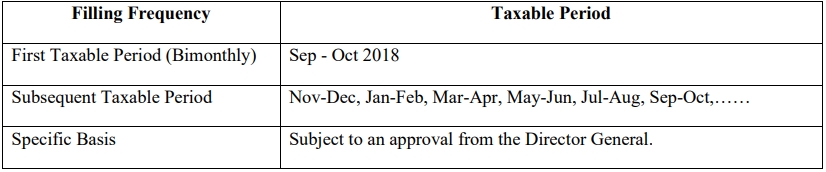

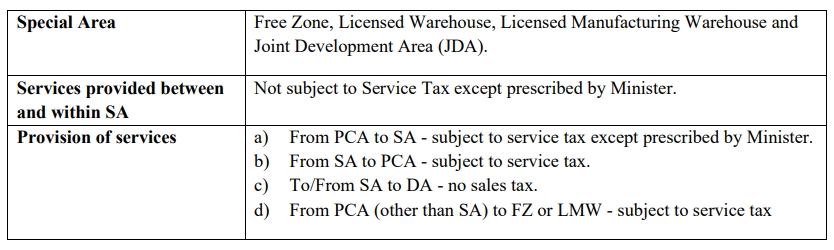

Taxable Period Information

Regular interval period where a taxable person accounts and remits sales tax to Government. Default taxable period for the registered manufacturer to be bimonthly (2 months) period.

Registered manufacturer may apply for taxable period other than the default taxable period.

In summary,

Furnishing Sales Tax (SST-02) Return & Payment of Tax

Registered manufacturer has to declare SST return every 2 months according to the taxable period.

-

Sales tax return has to be submitted not later than the last day of the following month after the taxable period ended.

-

Sales tax return has to be submitted regardless of whether there is any tax to be paid or not.

-

Sales tax return has to be submitted electronically or by cheque, bank draft and posted to SST Processing Centre.

Payment for tax due and payable declared in SST-02. Failure to submit return is an offence.

Miscellaneous (Remission, Refund of Overpaid Tax, Drawback. Penalty)

Remission

The Minister may remit the whole or any part of sale tax due and payable.

Director General may remit the whole or any part of:

-

Surcharge

-

Penalty

-

Fee

-

Other money payable under the Act

Refund of overpaid tax

Any person who has overpaid or erroneously paid of sales tax, penalty, surcharge, fee; or If any person who has paid sales tax and then exemption or remission of sales tax is granted by Minister.

Claim to be made in form JKDM No. 2 within one year from the date of over payment or erroneously payment; or entitlement of refund.

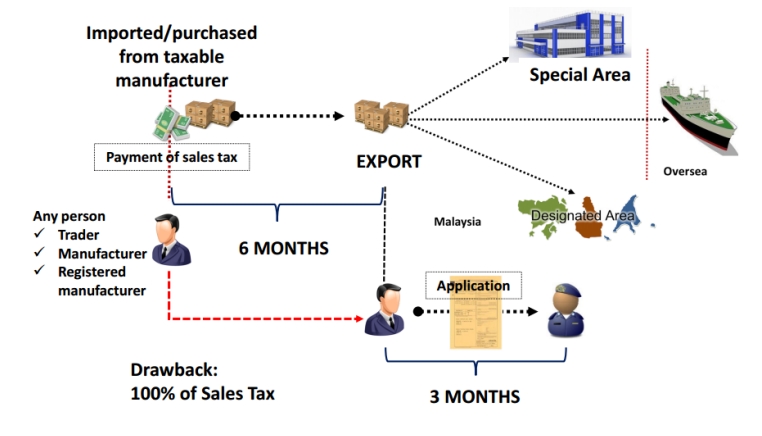

Drawback

Director General may allow a drawback of the full amount of sales tax paid by a person for taxable goods that are subsequently exported. This does not apply to petroleum.

Conditions:

-

Goods must be exported within six months from Sales Tax paid on import or date of invoice issued.

-

Application made within three months from the date of export in JKDM Form no. 2

-

Other conditions with regards to documentation and declaration.

Submission to sales tax office at applicants’ place of business.

Illustration:

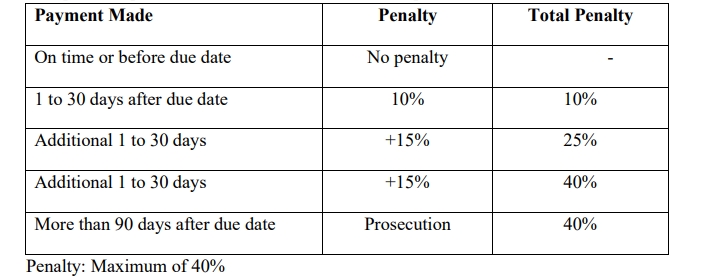

Penalty for late payment of tax

Late payment penalty on the amount of sales tax not paid as shown in the table below.

Other penalty for offences

Evasion of sales tax:

-

1st offence - either or both

-

Fine

-

Minimum 10x Sales Tax Amount

-

Maximum 20x Sales Tax Amount

-

-

Imprisonment not exceeding 5 years

-

-

2nd offence - either or both

-

Fine

-

Minimum 20x Sales Tax Amount

-

Maximum 40x Sales Tax Amount

-

-

Imprisonment not exceeding 7 years

-

Service Tax Legislation (SeTL)

Act (SeTL)

- Service Tax 2018

Regulations (SeTL)

-

Service Tax Regulations 2018

-

Service Tax (Customs Ruling) Regulations 2018

-

Service Tax (Compounding of Offences) Regulations 2018

Order (SeTL)

-

Appointment of Date of Coming into Operation

-

Appointment of Effective Date for Charging and Levying of Service Tax

-

Service Tax (Imposition Of Tax For Taxable Service in Respect of Designated Areas and Special Areas) Order 2018

-

Service Tax (Rates Of Tax) Order 2018

Scope and Charge (SeTL)

Service tax is charged on:

-

any provision of taxable services;

-

made in the course or furtherance of any business;

-

by a taxable person; and

-

In Malaysia

Service tax is not chargeable on:

-

Imported services

-

Exported services

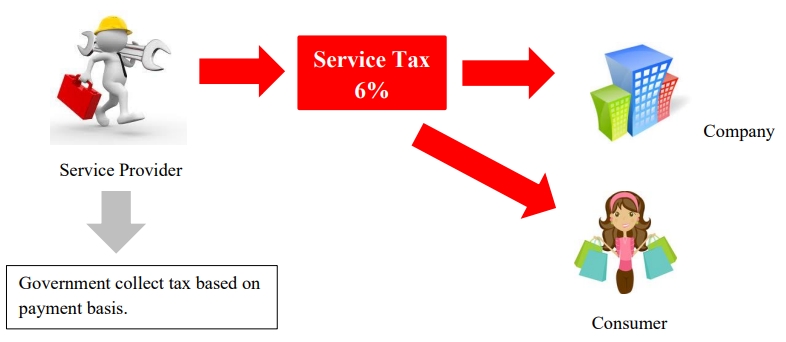

Service Tax Mechanism

Overview of Service Tax flow chart:-

Meaning of Taxable Person (SeTL)

A service provider who is liable to be registered or registered under the Service Tax Act 2018. The service provider provides taxable services in the course or furtherance of business in Malaysia.

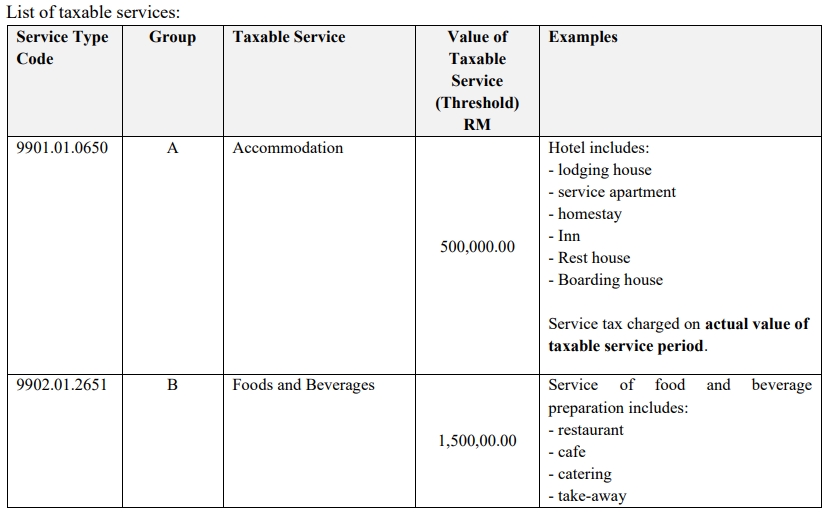

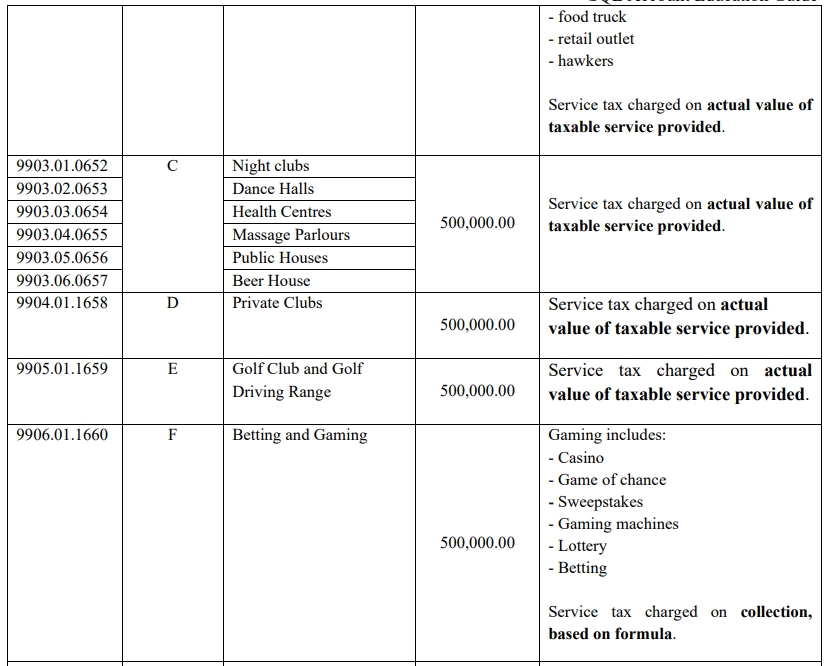

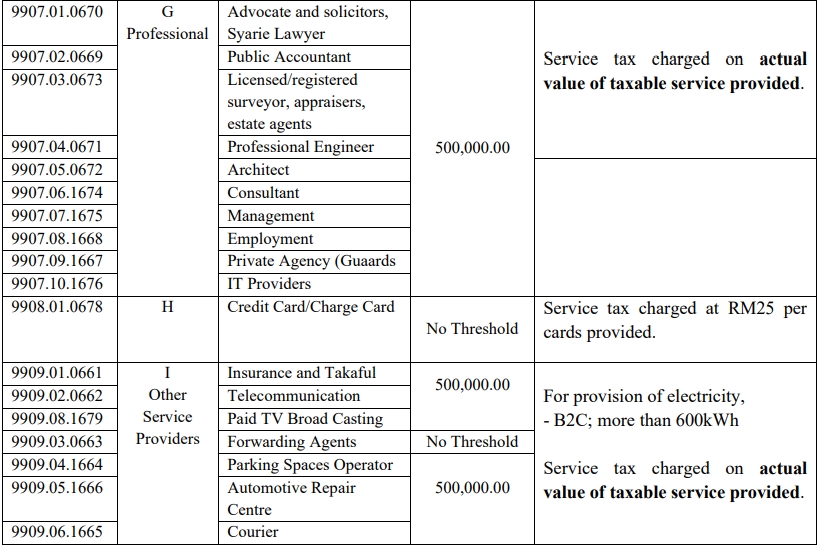

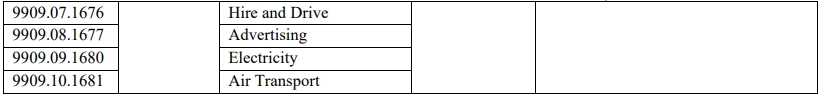

Taxable Service

Value of taxable service provided by a service provider for a period of 12 months that exceed a threshold of RM 500,000 is liable to be registered. Except the following taxable service group:

-

Food and Beverages (exceed RM 1,500,000)

-

Credit card / charge card (no threshold)

Rate of Services

All taxable services are fixed charged at a rate of 6%, except the provision of credit card/charge card services are charged at a specific rate of tax of RM25 is imposed upon issuance of principal or supplementary card and every subsequent year or part thereof.

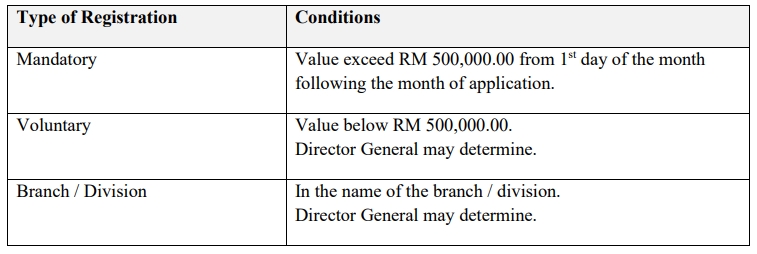

Service Tax Registration

Types of Registration list

Determination of Taxable Turnover

Service provider should calculate the value of taxable services provided for a period of 12 months using the following method:

-

Historical Method

The total value of taxable supplies in that month and the 11 months immediately preceding the month.

-

Future Method

The total value of taxable supplies in that month and the 11 months immediately succeeding the month.

Transitional Registration (Service)

Any person liable to register must do so before September 1, 2018. The registration commencement date is 1 September 2018.

-

Automatic Registration

- Service provider who is a GST Registrant which have been identified and fulfilled the required criteria will be registered automatically as a registered person.

-

Person Not Registered Automatically

- Service provider who is a GST Registered person that fulfilled the required criteria to be registered but was not registered by 1 September 2018 need to apply for registration within 30 days from the commencement date.

Contra System Facility

Registered person is allowed to deduct service tax in his return for any cancellation and termination of services or any other reasons such as reducing premiums or discounts.

Special rules for specific areas

Treatment in Designated Area for Service (DA)

-

SA = Special Area, e.g. Free Zone (FZ), Licensed Warehouse, Licensed Manufacturing Warehouse (LMW) and Joint Development Area (JDA).

-

PCA = Principal Customs Area

Treatment in Special Area for Service (SA)

Accounting

Issuance of Invoice

-

Mandatory for registered person who provides any taxable services..

-

Hard copy or electronically.

-

Containing prescribed particulars.

-

Bahasa Melayu or English.

Prescribed particulars are:

-

The invoice serial number;

-

The date of the invoice;

-

The name, address and identification number of the registered person (Service Tax Number);

-

The name and address of the person to whom the taxable service is provided;

-

Description of service provided;

-

Any discount offered;

-

For each description, distinguish the type of service and amount payable excluding tax;

-

The total amount payable excluding tax, the rate of tax and the total tax chargeable shown as a separate amount or total amount payable inclusive of total of tax chargeable;

-

Any amount expressed in a currency other than ringgit shall also be expressed in ringgit at the selling rate of exchange prevailing in Malaysia at the time of sale.

-

Credit Note & Debit Note

Both credit note and debit note are allowed to issue by registered person. It shall contain the prescribed particular and make an adjustment in their SST-02 return.

Accounting Basis and Taxable Period

Accounting Basis

Service Tax is based on payment basis and it is required to be accounted at the time when the payment has received. On the day following period of twelve months when any whole or part of the payment is not received from the date of the invoice for the taxable service provided.

Taxable Period

Regular interval period where a taxable person accounts and remits service tax to Government. Default taxable period for the registered person to be bimonthly (2 months) period.

Registered person may apply for taxable period other than the default taxable period.

In summary,

Furnishing Service Tax (SST-02) Return & Payment of Tax

Registered person has to declare service tax return every 2 months according to the taxable period.

-

Service Tax return has to be submitted not later than the last day of the following month after the taxable period ended.

-

Service Tax return has to be submitted regardless of whether there is any tax to be paid or not.

-

Service Tax return has to be submitted electronically or by cheque, bank draft and posted to SST Processing Centre.

Payment for tax due and payable declared in SST-02. Failure to submit return is an offence.

SST-Tax Code

Explain the importance and usage of SST Tax Code reflect to SST-02.

SST Tax Code

SST tax code mapping to SST-02.

Sales Tax Code

-

Standard

No Tax Code Description Tax Rate SST-02 01 ST Sales Tax 10% charged to the taxable goods based on accrual/billing basis 10% B1_8, B2_11B 02 ST5 Sales Tax 5% charged to the taxable goods based on accrual/billing basis 5% B1_8, B2_11A -

Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 01 SU Goods Own Used/Disposed deemed taxable and charged at 10% based on accrual/billing basis 10% B1_9, B2_11B 02 SU5 Goods Own Used/Disposed deemed taxable and charged at 5% based on accrual/billing basis 5% B1_9, B2_11A -

Sales - Exempted

No Tax Code Description Tax Rate SST-02 01 STE Sales Tax Exempted on goods as prescribed in the Sales Tax (Goods Exempted From Tax) Order 2018 02 SE Sales Tax Exempted to Export, Special Area (SA), e.g. Free Zone, LMW and Designated Area (DA), e.g. Langkawi, Tioman, Labuan D18_A 03 SEA Sales Tax Exempted-Schedule A (Class of Person), e.g. Government, Local Authority Dept, etc. Detail refer to Schedule A in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 D18_B1 04 SEB Sales Tax Exempted-Schedule B (Manufacturer of specific non-taxable goods), e.g. control products, medical. Detail refer to Schedule B in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 D18_B2 05 SEC1 Sales Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer D18_B3 (i) 06 SEC2 Sales Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products D18_B3 (i) 07 SEC3 Sales Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer D18_B3 (ii) 08 SEC4 Sales Tax Exempted-Sch C (Item 4) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETROLEUM products D18_B3 (ii) 09 SEC5 Sales Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcontractor to a reg. manufacturer after completion of subcontract work D18_B3 (iii) -

Purchase - Exempted

No Tax Code Description Tax Rate SST-02 01 PEC1 Purchase Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer E19 02 PEC2 Purchase Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products E19 03 PEC3 Purchase Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer E20 04 PEC4 Purchase Tax Exempted-Sch C (Item 4) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETROLEUM products E20 05 PEC5 Purchase Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcontractor to a reg. manufacturer after completion of subcontract work E21

Service Tax Code

-

Standard

No Tax Code Description Tax Rate SST-02 01 SV Service Tax 6% charged to the taxable services based on payment basis 6% B1_10, B2_11C 02 SVA Service Tax 6% charged to the taxable service based on accrual/billing basis. It is used in IMSV tax code to report in SST-02A 6% B1_10, B2_11C -

Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 01 SUV Service Own Used charged at 6% on accrual/billing basis 6% B1_9, B2_11C -

Service Exempted

Applicable to same service provider under:

- Group G to Group G (all except Employment and Guards protection service provider).

- Group I to Group I (ie. advertising service provider).

No Tax Code Description Tax Rate SST-02 01 SVE Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 D18C -

Imported Service

- For non-Service Tax Registered must declare using SST-02A.

- For Service Tax Registered must declare using SS-02.

No Tax Code Description Input Tax Output Tax SST-02 SST-02A (for imported service) 01 IMSV Imported Service Tax, any company in Malaysia who acquire the taxable service from company outside Malaysia. Non-SST & Sales Tax reg. must report in SST-02A. Service tax reg. remains report in SST-02 PSV (6%) SVA (6%) B1_10 B2_11C B10a 02 IMSVE Imported Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 PSVE SVE D18C

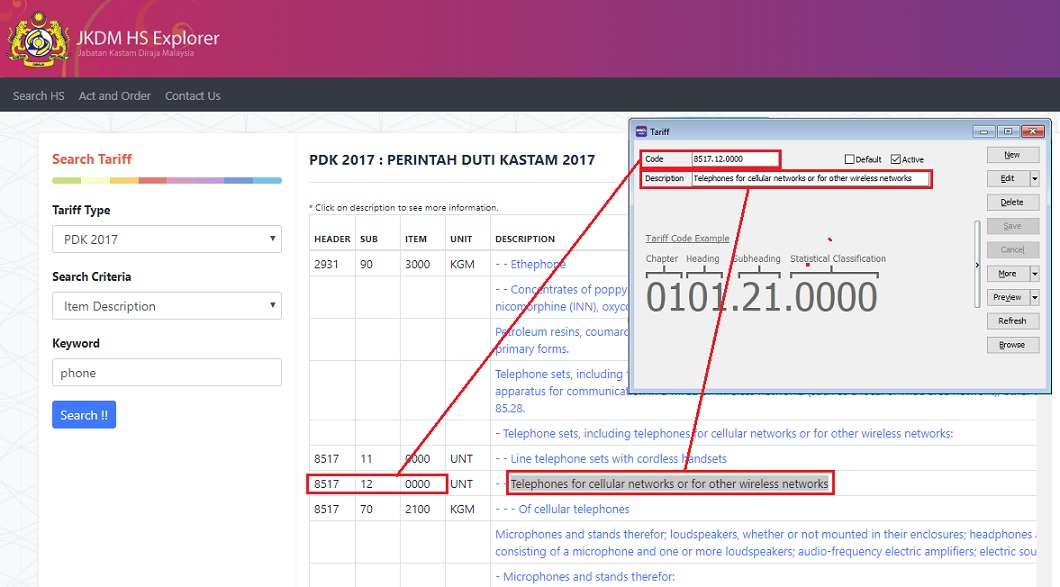

SST-Tariff Code

- Tariff classification is a complex yet extremely important aspect of cross-border trading.

- Goods imported from or to Malaysia are classified by the Harmonized Tariff Schedule (HTS) or commonly referred to as HS Codes.

- The codes, created by World Customs Organization (WCO), categorize up to 5,000 commodity

- HS Codes are made of 6-digit numbers that are recognized internationally, though different countries can extend the numbers by two or four digits to define commodities at a more detailed level.

- Click this link here to search the tariff code list from Kastam system.

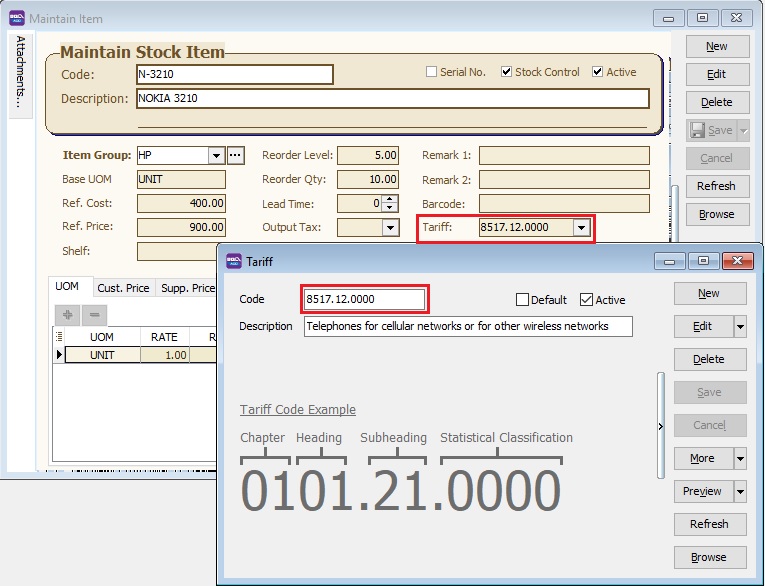

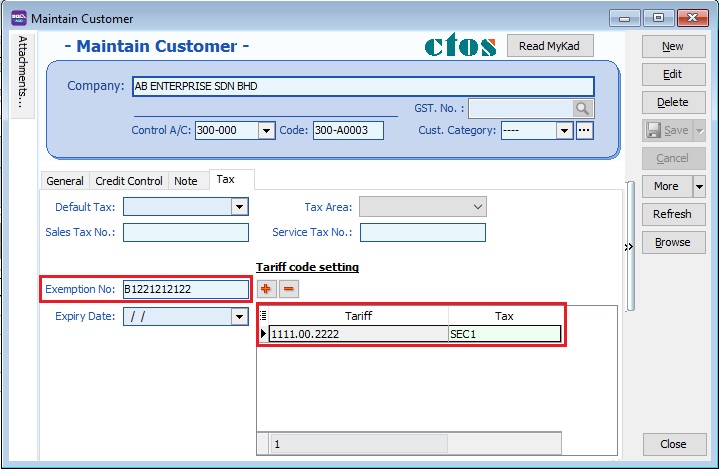

Quick Setup for Tariff Code

-

Create the tariff code applicable to your product at Maintain Tariff.

-

Pick a tariff code for an items at Maintain Stock Item.

-

For exemption certificate case (under Schedule A, B, C), a tariff and tax code (SEA, SEB, SEC1, SEC2, SEC3, SEC4, SEC5) should set in Maintain Customer and Maintain Supplier (Tariff code setting under Tax Tab).

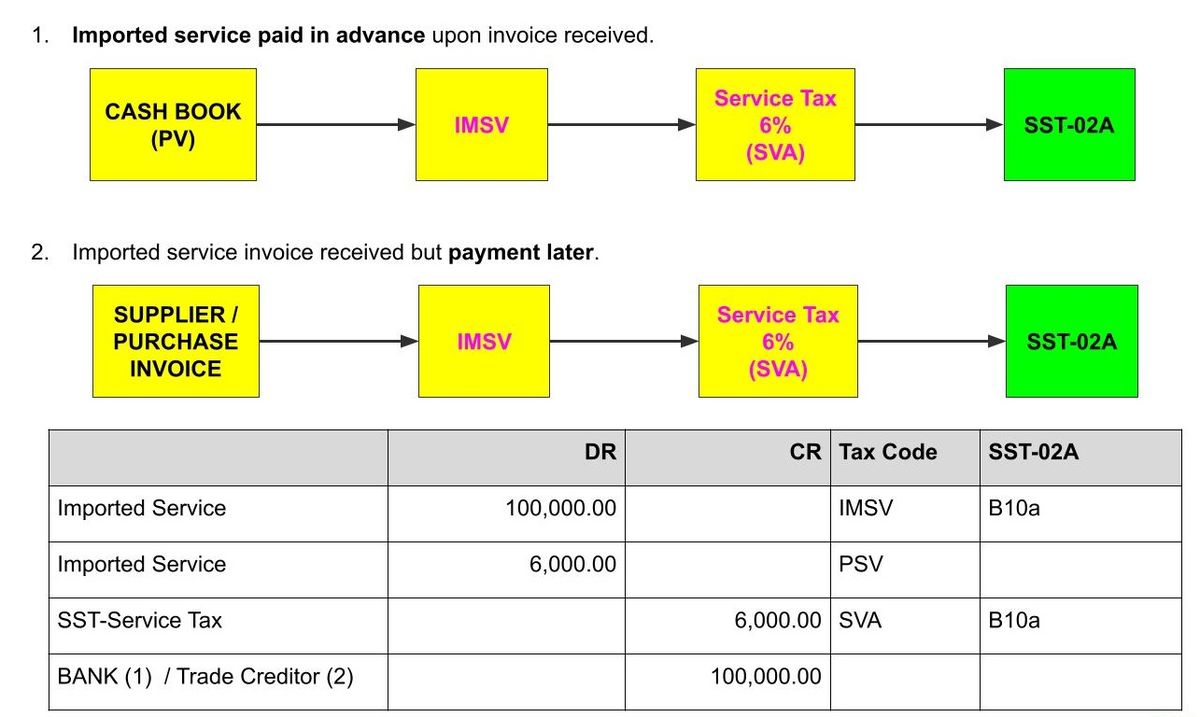

SST-Imported Service (SST-02A)

Imported Service Tax (IMSV)

Purchase service from oversea by any companies in Malaysia and it is subject to imported service tax 6%.

- for Service Tax registered ONLY, declare together with other service tax in SST-02

- for non-SST registered, declare imported service in SST-02A

- for Sales Tax registered ONLY, declare imported service in SST-02A

- Enter at Cash Book Entry (PV) or at Supplier/Purchase Invoice. See the illustration below.

- use Tax code : IMSV

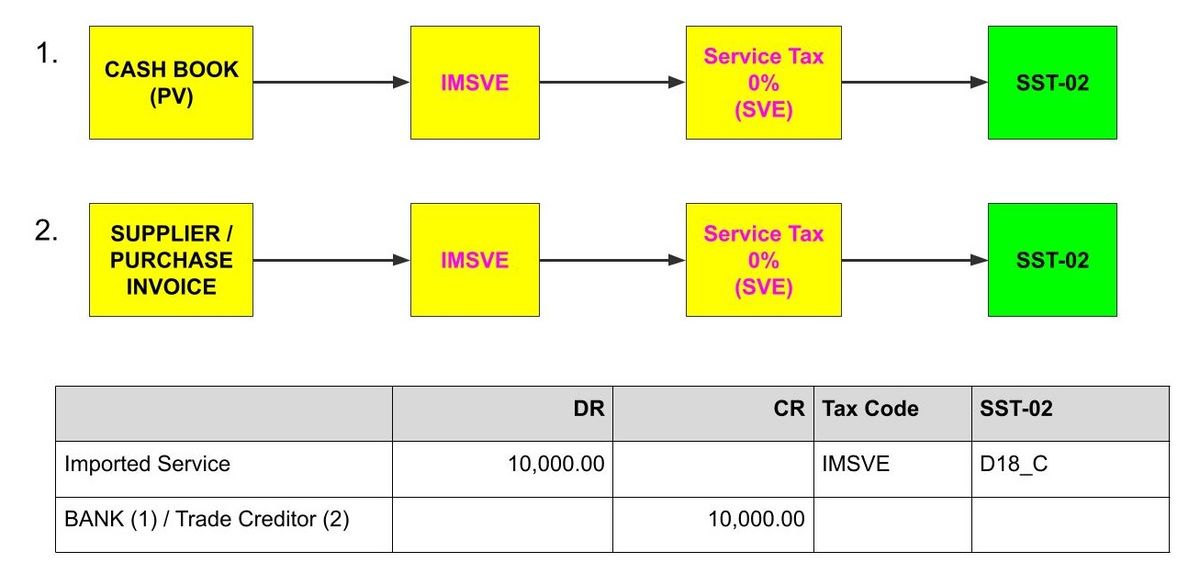

Imported Service Tax Exempted (IMSVE)

Any company in Malaysia who acquires taxable services of Group G item (a), (b), (c), (d), (e), (f), (g), (h) and (i) from any company within the same group of companies outside Malaysia. It is Exempted.

- Need to declare in SST-02

- Enter at Cash Book Entry (PV) or at Supplier/Purchase Invoice. See the illustration below.

- use Tax code : IMSVE

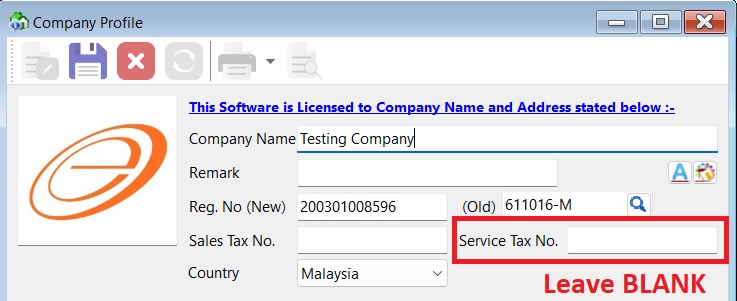

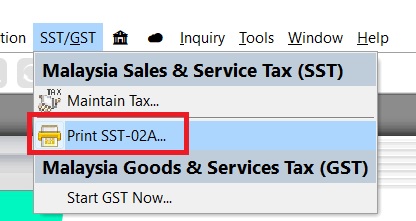

How to get print SST-02A

-

Go to File | Company Profile...

-

Make sure the Service Tax No field is BLANK.

Note:

Note:For Service Tax Registered company, it is declare together with other service tax in SST-02

-

Save it.

-

Logout and login again.

-

Go to menu : SST/GST | Print SST-02A...

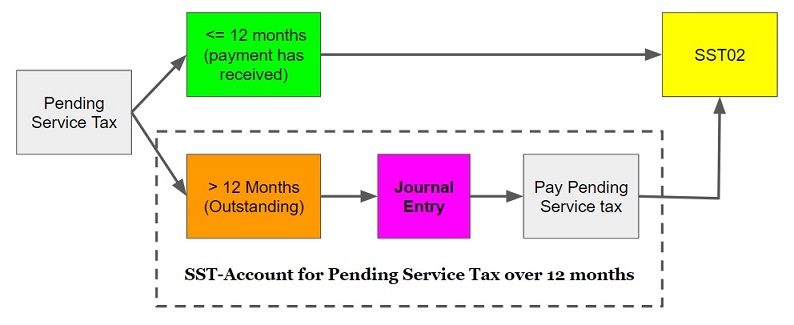

SST-Account for Pending Service Tax over 12 months

Service Tax required to be accounted if on the day following period of 12 month when any whole or part of the payment is not received from the date of the invoice for the taxable service provided.

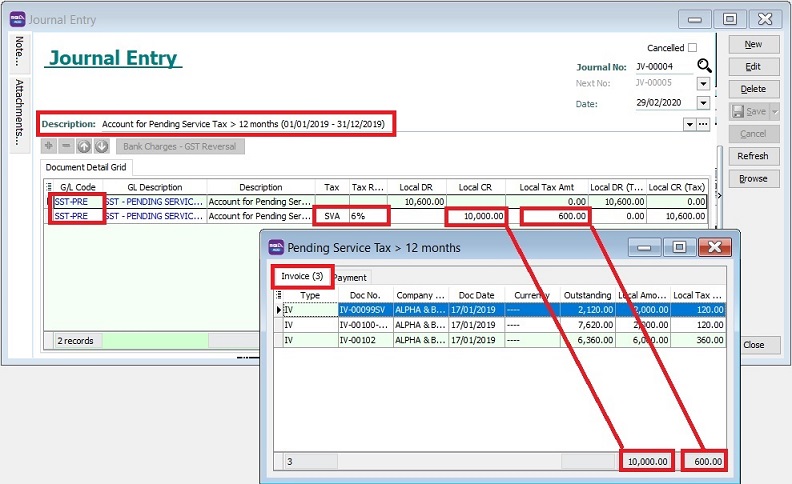

Journal Entry Adjustment

[Invoice] Pending Service Tax To Be Paid

-

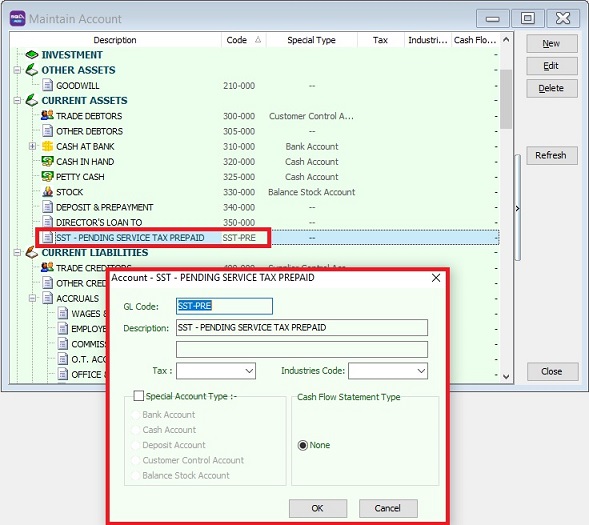

For first time, create the following GL Account.

GL Acc Description Account Type SST-PRE SST - PENDING SERVICE TAX PREPAID CURRENT ASSETS -

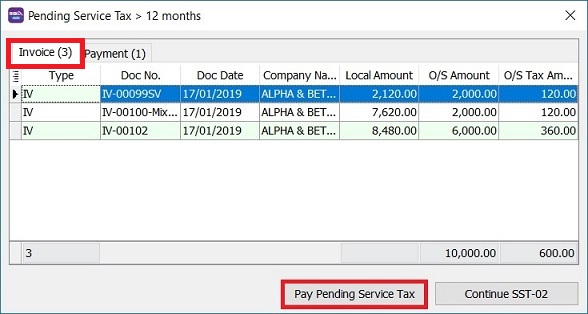

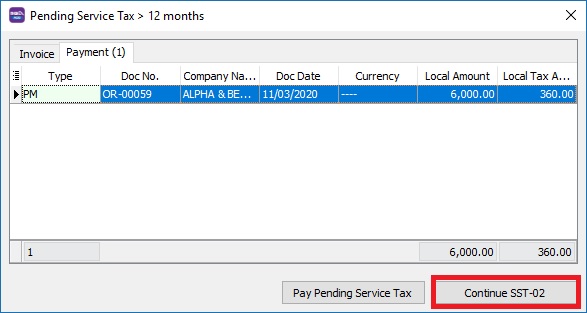

Process SST Return, system will prompt the Pending Service Tax > 12 months if have found the outstanding service invoices has over 12 months.

-

Follow the Service Tax rules, click Pay Pending Service Tax button.

-

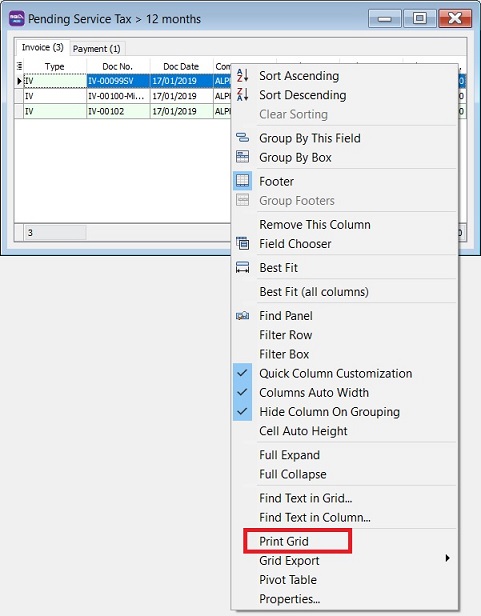

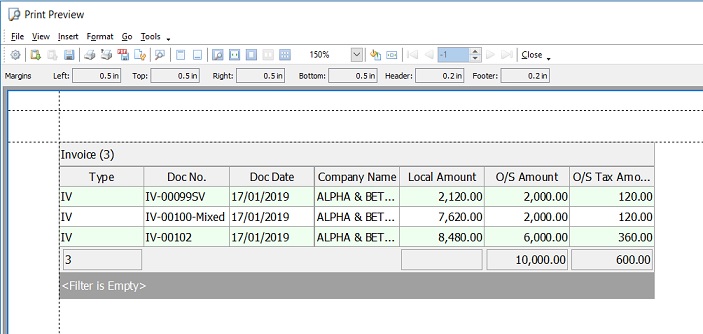

Right click on the grid column, select Print Grid.

-

Print out the list of outstanding service invoices for record purpose.

-

Post the journal entry and follow the double entry below to account the service tax pending over 12 months to be paid.

GL Code GL Description Tax Local DR Local CR Tax Amount Local DR (Tax) Local CR (Tax) SST-PRE SST - PENDING SERVICE TAX PREPAID 10,600.00 10,600.00 SST-PRE SST - PENDING SERVICE TAX PREPAID SVA 10,000.00 600.00 10,600.00 NOTE:For partial payment, should refer to Outstanding Amount instead of Local Amount.

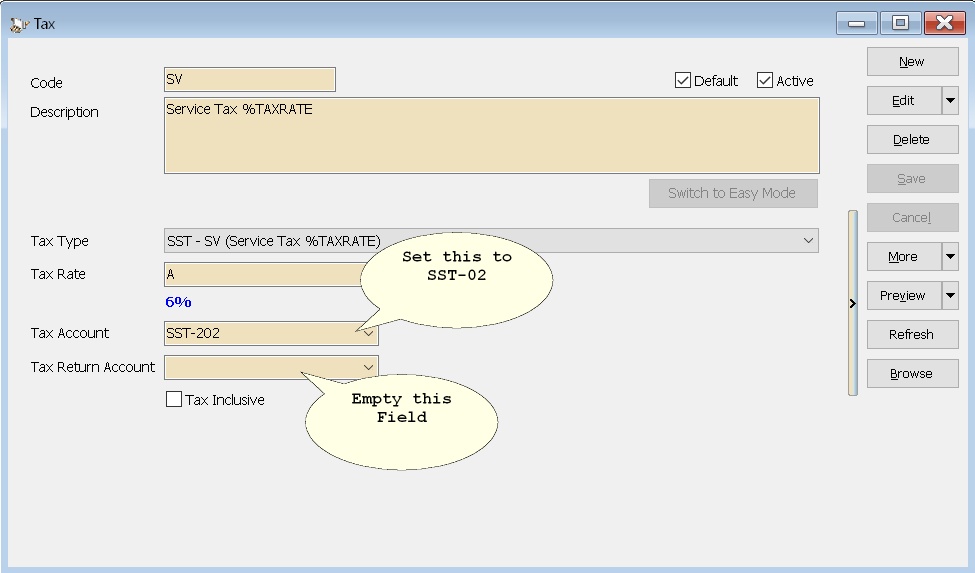

Active the tax code : SVA

- Go to SST/GST | Maintain Tax.

- Look for tax code: SVA or SV.

- Edit and tick Active.

- Save it.

-

Next, go to New SST Return. Click Process.

-

At this time, click Continue SST-02.

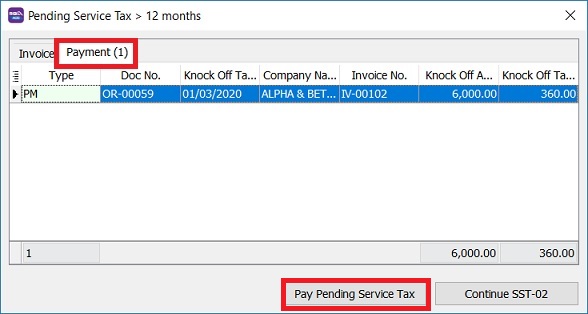

[Payment] Recovery from Payment for Pending Service Tax Prepaid

-

Under the payment tab, system will list out the prepayment service invoice which has been paid when process SST return.

-

If you have follow the Service Tax rules, click Pay Pending Service Tax button.

-

Right click on the grid column, select Print Grid.

-

Print out the list of the prepayment service invoice which has been paid for record purpose.

-

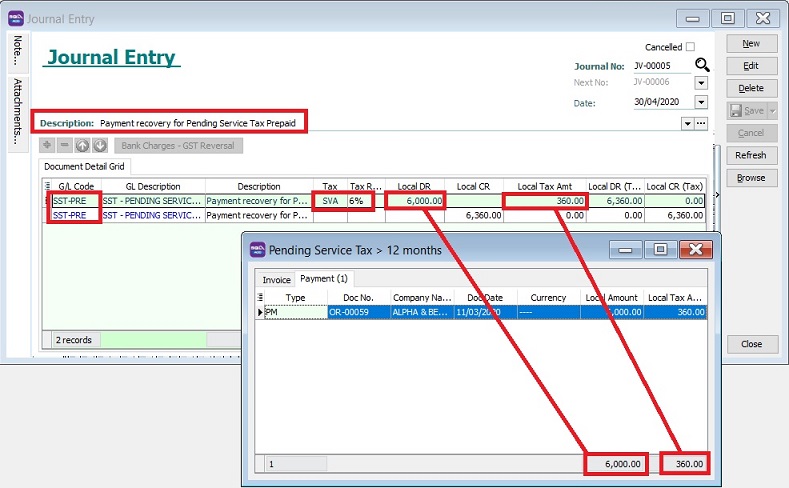

Post the journal entry and follow the double entry below to recover the service has been paid.

GL Code GL Description Tax Local DR Local CR Tax Amount Local DR (Tax) Local CR (Tax) SST-PRE SST - PENDING SERVICE TAX PREPAID SVA 6,000.00 360.00 6,360.00 SST-PRE SST - PENDING SERVICE TAX PREPAID 6,360.00 6,360.00 -

Next, go to New SST Return. Click Process.

-

At this time, click Continue SST-02.

SST FAQ

1.Can I Change the Service Tax Type to Accrual Basis?

Solution:

By Default System will use as Payment Basis for Service Tax Type To change to Accrual Basis(i.e. Pay Kastam even no payment), Just Set as below

2.Why does my SST-02 report preview show no value even though the screen display an amount?

Solution:

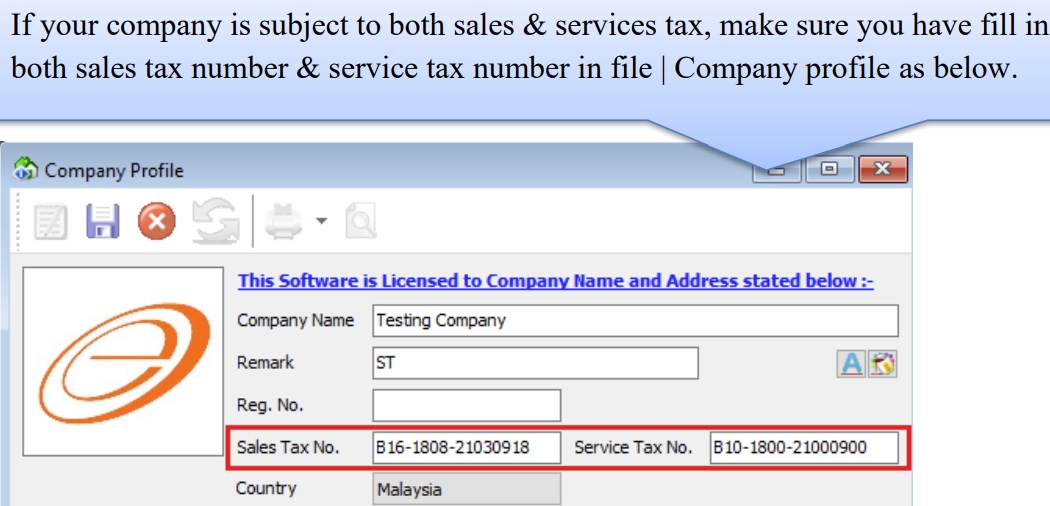

Make sure you have entered your Service Tax and/or Sales Tax No. in File | Company Profile

3.Why does the tax code (ST5) used in my sales invoices not appear in SST-02, but it shows up in the SST-02 listing?

Solution:

Make sure you have entered your Sales Tax no instead of Service Tax no in File | Company Profile

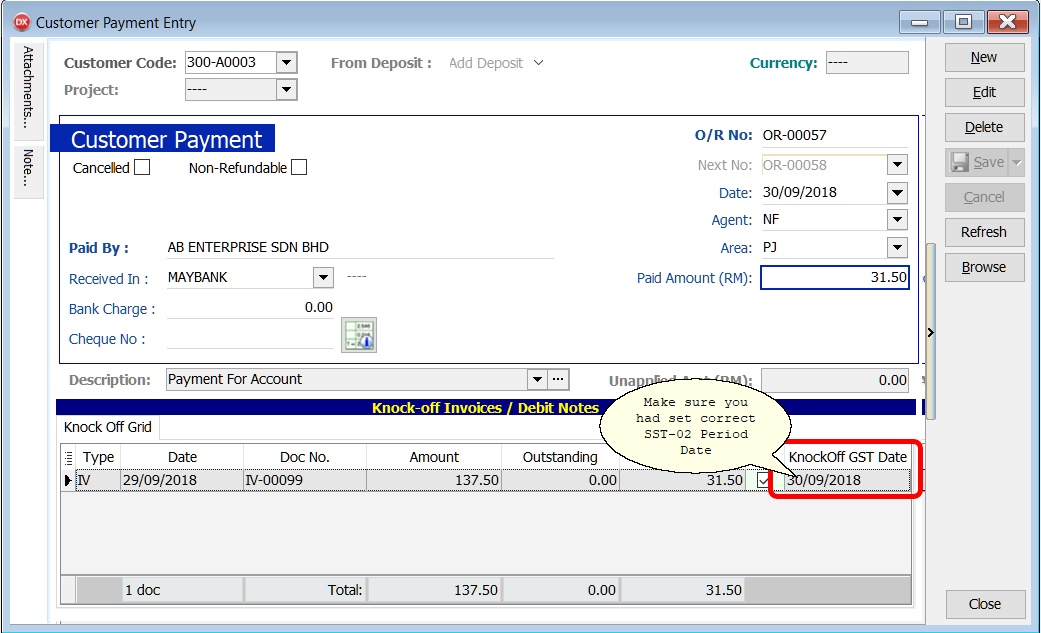

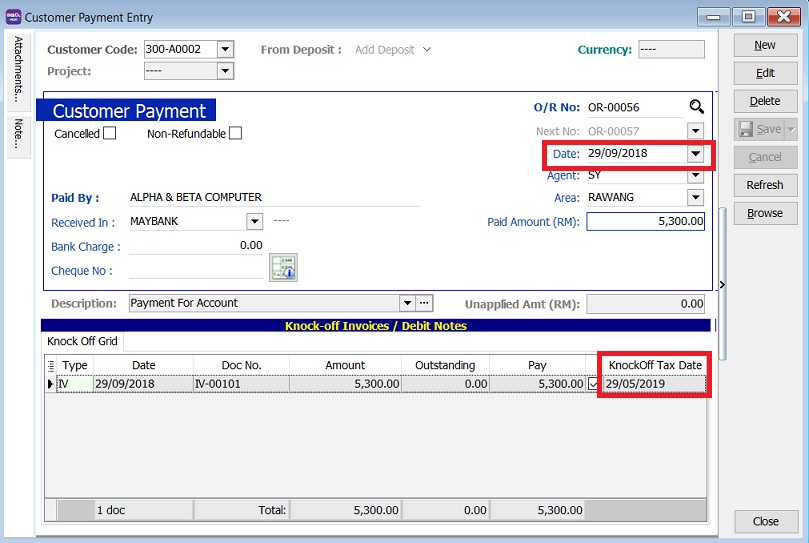

4.Why Some Service Tax Transaction not shown in SST-02 even the document is fully paid?

Solution:

Make sure you had select correct Knock Off Date in the Customer Payment

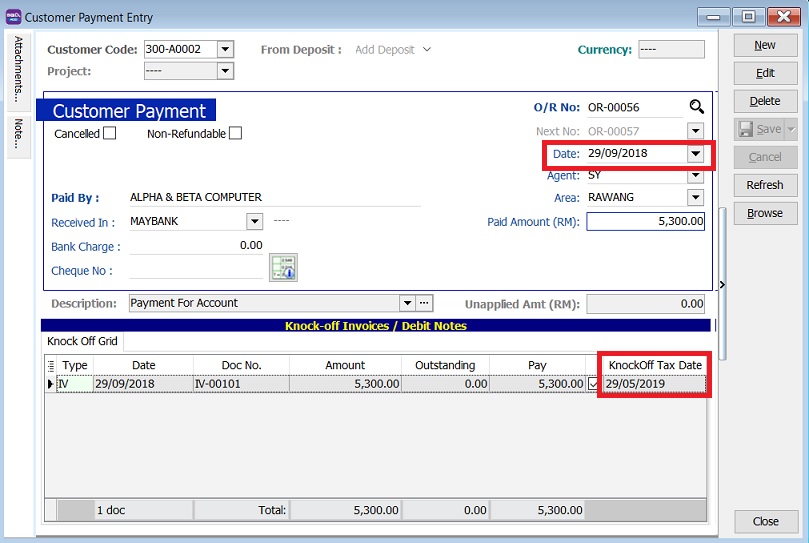

5.Why does the service invoice that was knocked off (paid) in Sept 2018 not appear in SST-02 for the period Sept–Oct 2018?

Issue:

Knock-off tax date will follow the customer payment date if user has tick on an invoice. Change the customer payment date (eg. from 29/05/2019 to 29/09/2018), the knock-off date will remains unchanged.

Solution:

Change the Knock-off Tax Date (follow the payment date)

6.Can I mix sales tax and service tax in a single invoice?

Issue:

Can I mixed the sales and service tax code in single document?

Solution:

- Customs officer has recommended the company should raise the invoice, debit note and credit note separately for sales and service invoice.

- Indicate the sales and service tax registration no on the invoice letter head separately as well.

- This is to ease the Customs audit operation purpose.

Sales tax and service tax having different accounting basis as explained below.

-

SALES TAX

- Billing / accrual basis

- Sales Tax required to be accounted at the time when the goods are sold, disposed or first used

-

SERVICE TAX

- Payment basis

- Service Tax required to be accounted at the time when the payments is received.

- On the day following period of twelve month when any whole or part of the payment is not received from the date of the invoice for the taxable service provided

7.What circumstances to use tax code SV and SVA for Credit Note?

Issue:

Service tax is based on payment basis.

Solution:

There will be 2 cases of service tax where credit note has taken in place:

-

Unpaid service tax

- Cancellation of service before any payment.

- use tax code: SV (follow the invoice tax code, eg. SV)

- system will auto reverse the unpaid service tax amount in the SST - Deferred Tax (SST-203).

-

Paid service tax

- Cancellation of service after payment and service tax has been paid to RMCD.

- Adjustment tax deduction for refund of service tax approved by RMCD.

- use tax code: SVA

- system will reduce the service tax payable to RMCD

8.What is Digital Service Tax

New service tax effectively come into operation on 1 January 2020.

Characteristics

- delivered or subscribed over the internet or other electronic network

- delivered through information technology medium (human eye cannot see and touch)

- minimal or no human intervention (eg. automation, click to subscribe and consume)

Scope on Digital Service

- Software, application & video games

- music, e-book and film

- advertisement and online platform

- search engine and social network (facebook)

- database and hosting (eg. website hosting, online data, file sharing, cloud storage)

- internet based telecommunication (eg. VOIP)

- Online training

- Subscription to online newspapers

- payment process services (paypal)

Taxable Person

-

Foreign Service Provider (FSP)

- any person who is outside Malaysia providing any digital service to a consumer directly

- any person who is outside Malaysia operating an online platform for buying and selling goods

- providing services (whether or not such person provides any digital services) who makes transactions for provision of digital services on behalf of any person

-

Threshold exceeds RM500,000 (historical or future 12 months)

Accounting Basis

- Default is Payment basis (same to service tax)

- Accrual Basis (billing) must apply to DG upon registration

Exchange Rate

- Can use any exchange rate to calculate tax payable

Taxable Period

- Three months (quarterly)

Returns Form

- Digital Service Return DST-02

Exemption

- No exemption announced

Claim Refund

- Digital service tax overpaid allowed to claim refund.

- Need fill-in JKDM-2

9.What invoice format should I use for service tax exempted services?

Issue:

What invoice format can be use for service tax exempted

Solution:

- Download the invoice format by click to Sales Invoice 8 SST 1 (Exempted Taxable Service)

- Go to Tools | Report Designer...

- Click import the invoice format file.

10.What is the double entry for service tax invoice and CN issued using SV tax code?

Issue:

How should the double entry be recorded for a service tax invoice and credit note issued under the SV tax code?

Solution:

-

Full Service Tax Invoice issue

GL Acc Description Tax DR CR 300-A0001 Customer ABC 1060.00 500-000 Service Sales SV 1000.00 SST-203 SST - Deferred Tax SV 60.00 -

Partial Payment knock-off with invoice

GL Acc Description Tax DR CR 330-000 BANK 530.00 300-A0001 Customer ABC 530.00 System auto reverse the SST-Deferred Tax after knock-off

GL Acc Description Tax DR CR SST-203 SST - Deferred Tax 30.00 SST-202 SST - Service Tax 30.00 -

Reduce/cancel the partly of the service amount. Issue CN using tax code: SV

GL Acc Description Tax DR CR 500-000 Service Sales SV 500.00 SST-203 SST - Deferred Tax SV 30.00 300-A0001 Customer ABC 530.00

Conclusion:

SST Deferred Tax account = ZERO if the Full Service Tax Invoice (eg. SV only) outstanding is ZERO.

SST Deferred Tax account <> ZERO if the service tax invoice has mixed tax type (eg. ST, SV and empty tax code).