GST Bounce Cheque

Scenario

- Invoice Date Jan 2016

- Bad Debts Relief - Jul 2016 to Sep 2016

- Payment Dec 2016

- Bad Debts Recover - Oct 2016 to Dec 2016

- Payment Bounce - Jan 2017 <--- Should do Adjustment on Bounce GST Period (before process GST-03)

- Bad Debts Relief(after Adjustment) - Jan 2017 to Mar 2017

- Replace New Cheque - Apr 2017

- Bad Debts Recover - Apr 2017 to Jun 2017

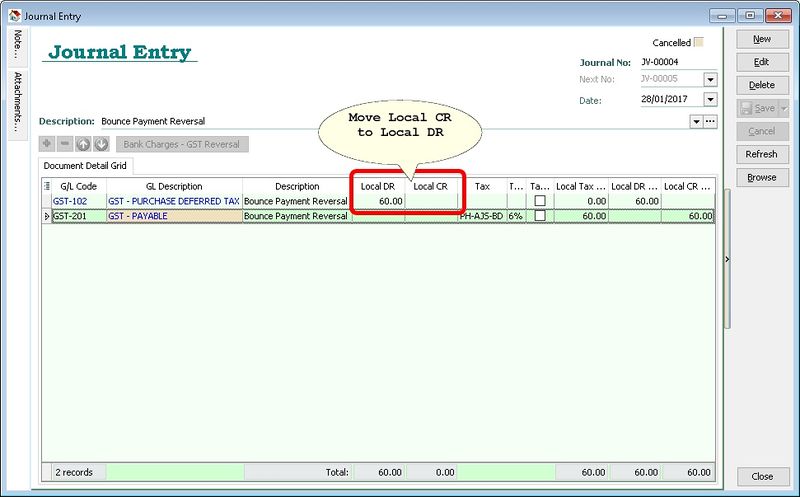

Solution

By using the GL Journal Voucher - Bank Charges - GST Reversal button

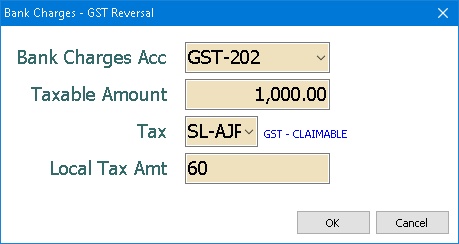

Customer Side

At GST Period Jan 2017:

- DR GST-101 - GST - CLAIMABLE --> (SL-AJP-BD)

- CR GST-202 - GST - SALES DEFERRED TAX

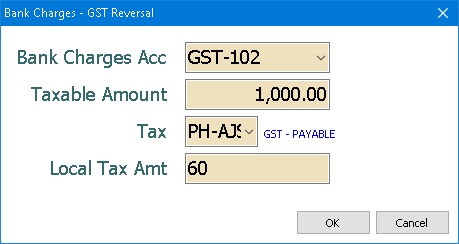

Supplier Side

For GST Period January 2017:

- Debit: GST-102 - GST - PURCHASE DEFERRED TAX

- Credit: GST-201 - GST - PAYABLE → (PH-AJS-BD)